Trades

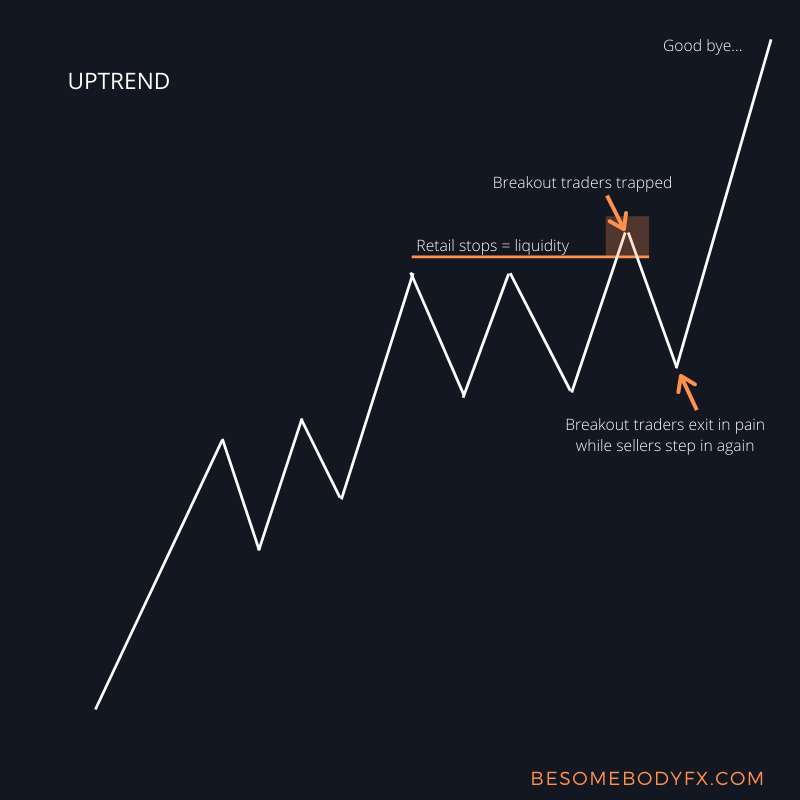

BESOMEBODYFX

HOW DO INSTITUTIONS TRADE?

INTRODUCTION TO the average INSTITUTIONAL TRADING FRAMEWORK…

One of the most asked question in the trading field out there is “how do institutions trade?” “How does an institutional trading strategy look like?”

It feels like one of those top trading secret, it feels like it’s a hidden method that only the elite can know…

Well, it’s not that big of a secret at all, most actually make their framework public so that investors and people interested in working with them can know exactly how they generate returns.

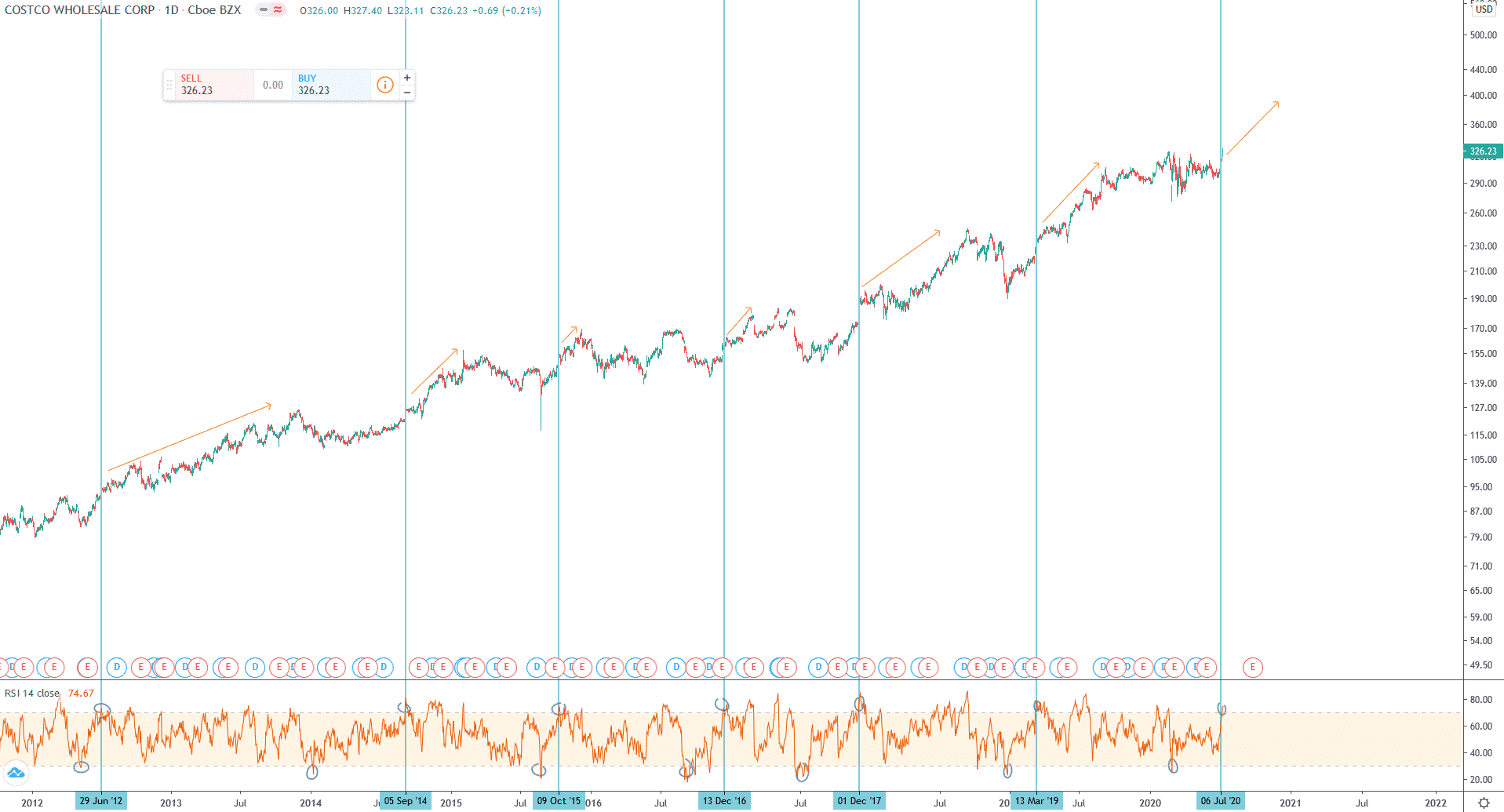

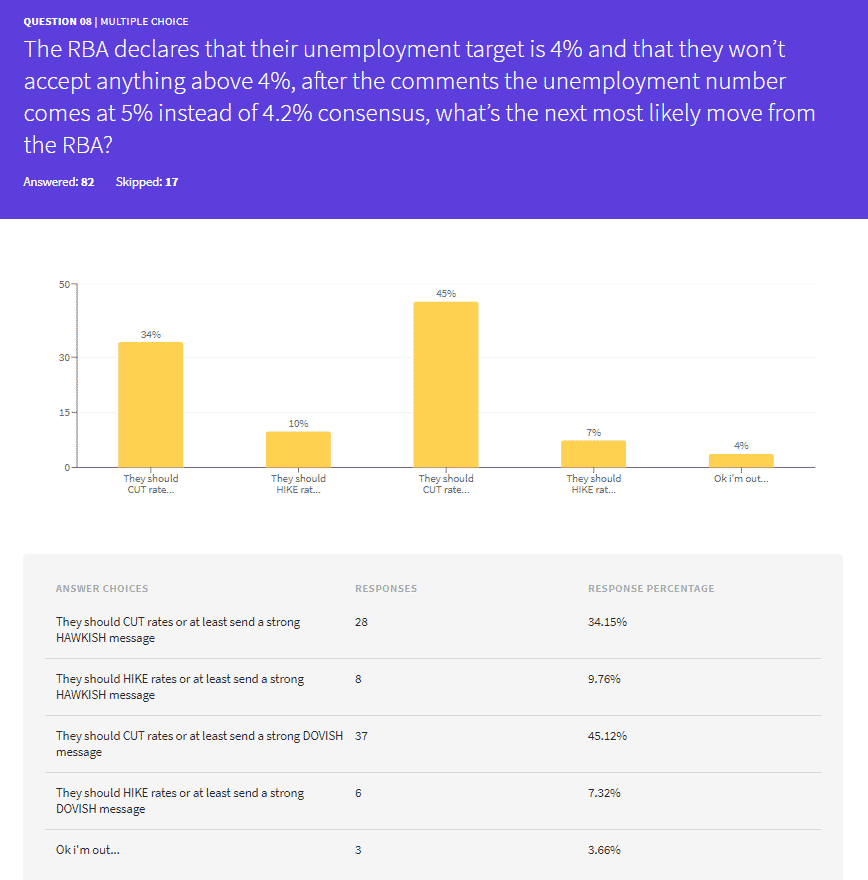

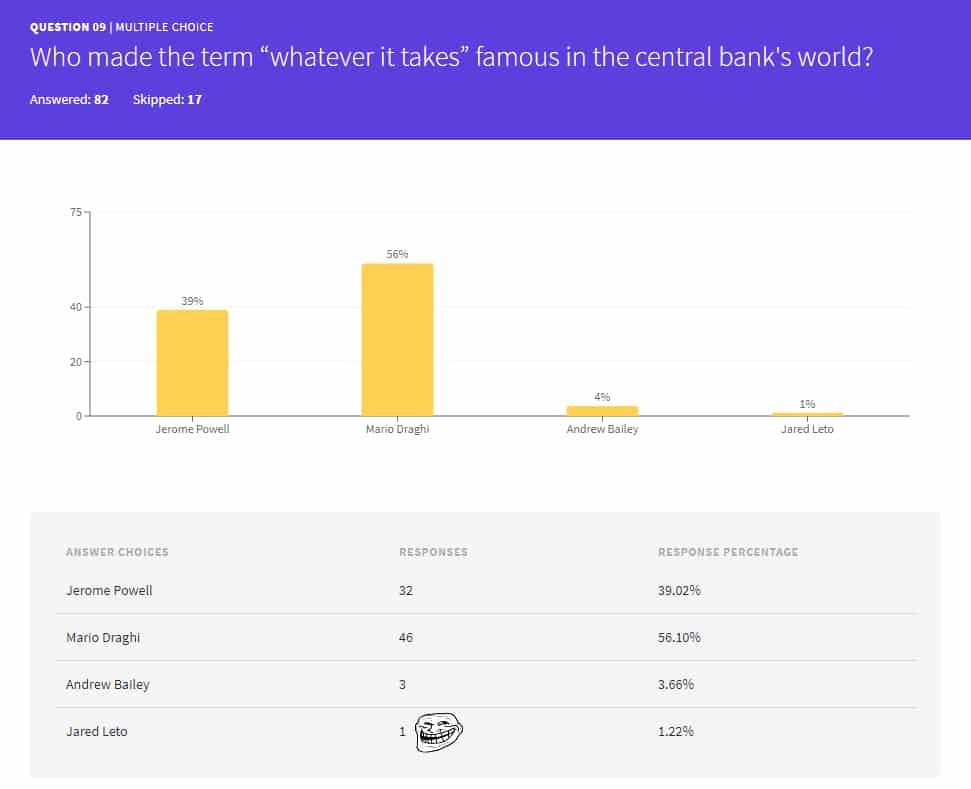

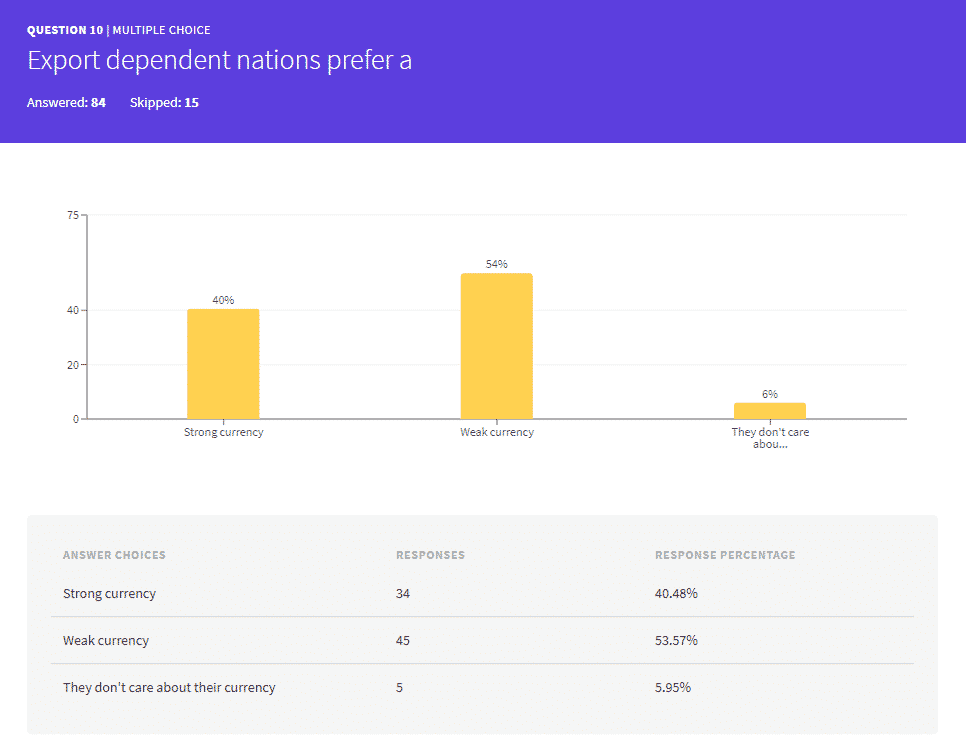

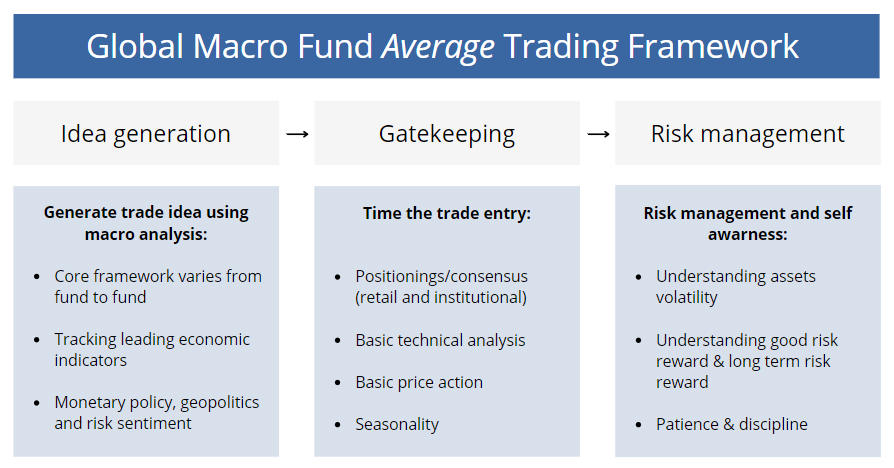

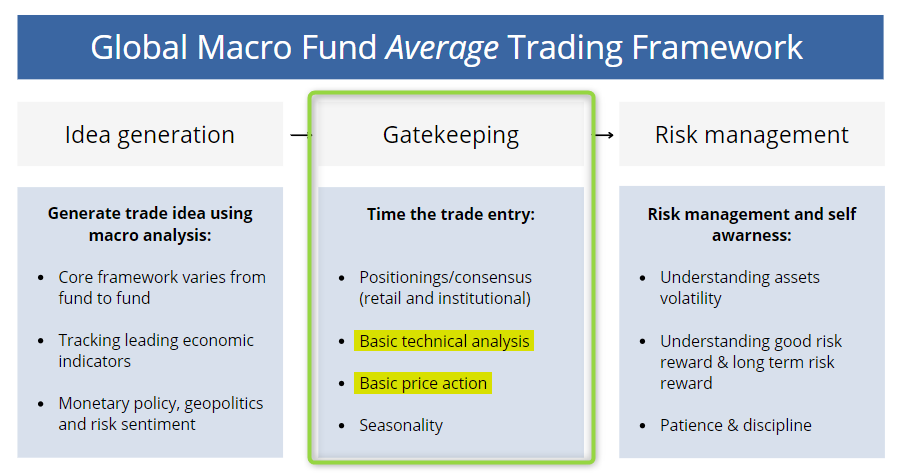

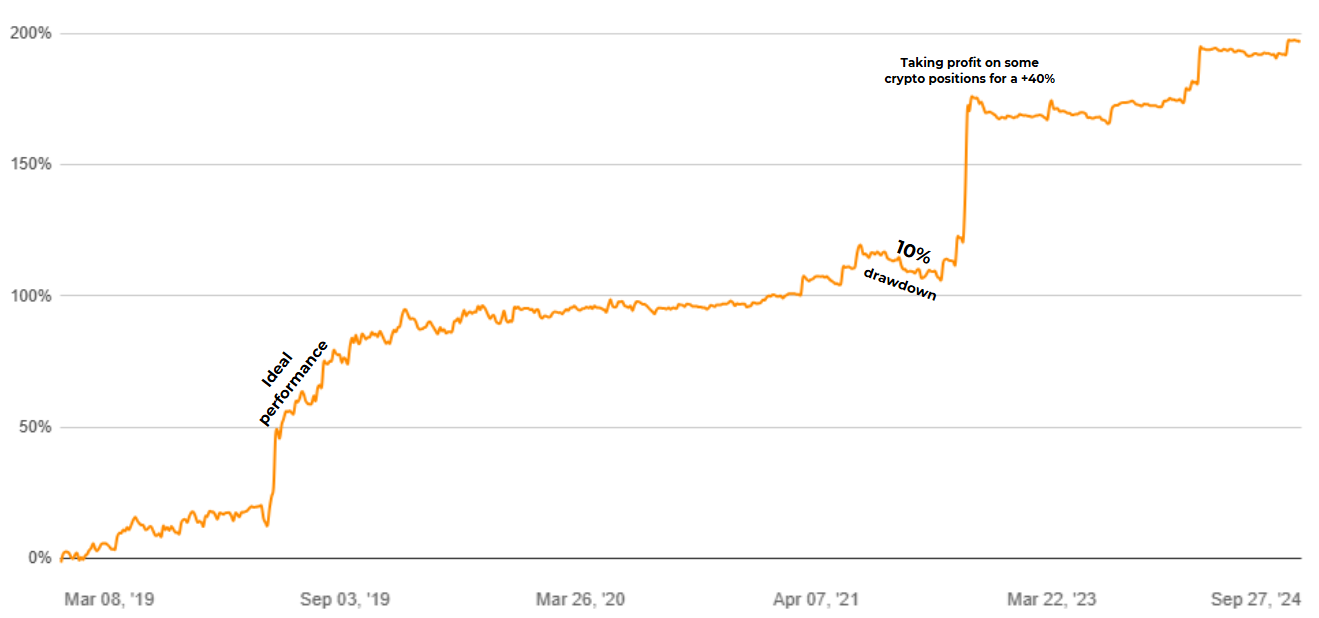

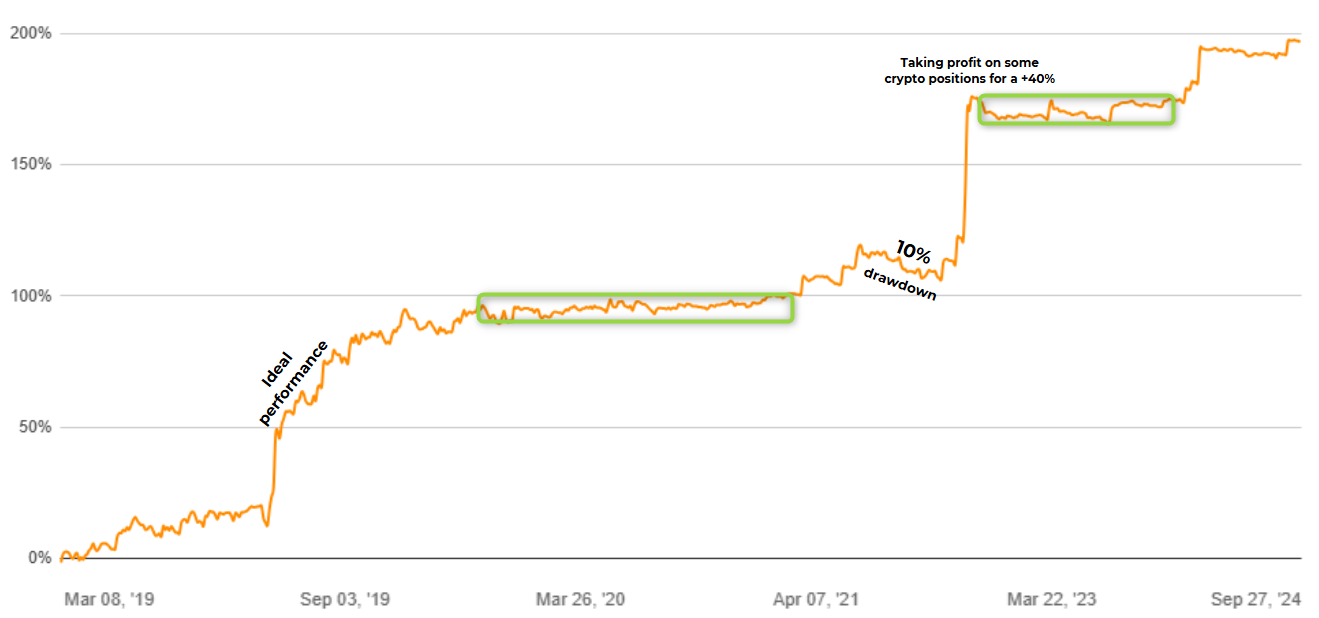

For instance, here’s how the usual global macro fund trading framework looks like:

If you come from a retail education, if you come from the average Youtube trading guru you will find the model above absolute nonsense…

And that’s a good point…

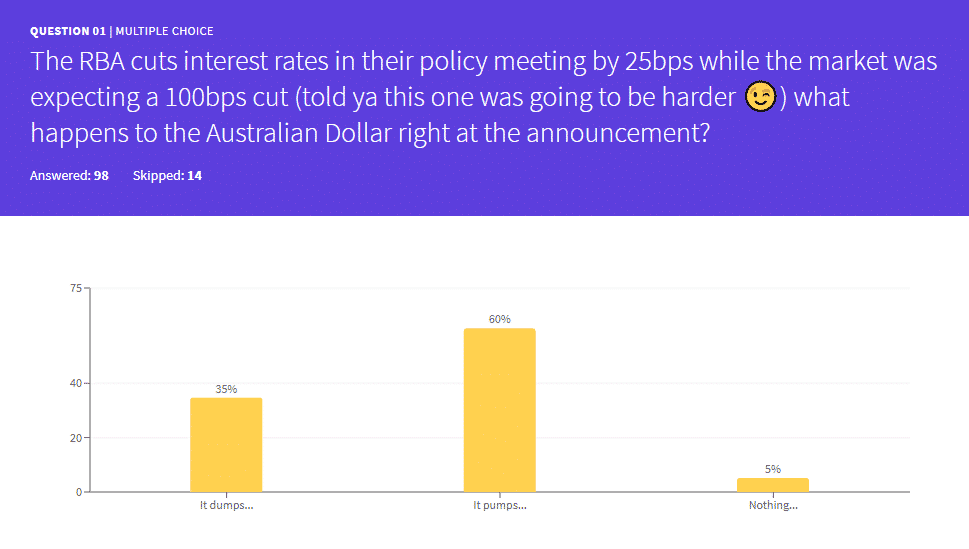

How many traders do you think use that type of trading approach? Maybe 10% or so?

Right, how many use the “Youtube guru” trading approach, meaning only technical analysis and indicators? at least 90% right?

Yes, ever heard of the fact that 90% of traders can’t trade profitably and only 10% do?

Can you spot the pattern here?

The 90% is all fed with the same type of information and education that doesn’t work UNLESS applied only in a complete and more defined framework similar to the one above. So let’s talk about that…

TO MAKE IT SIMPLE, There is ONE core difference between an improvised retail trader and a professional institutional trader.

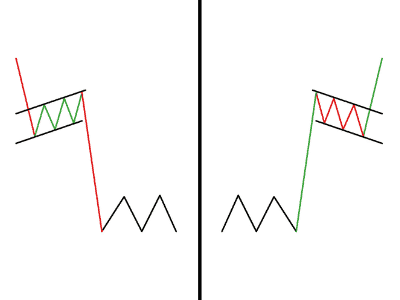

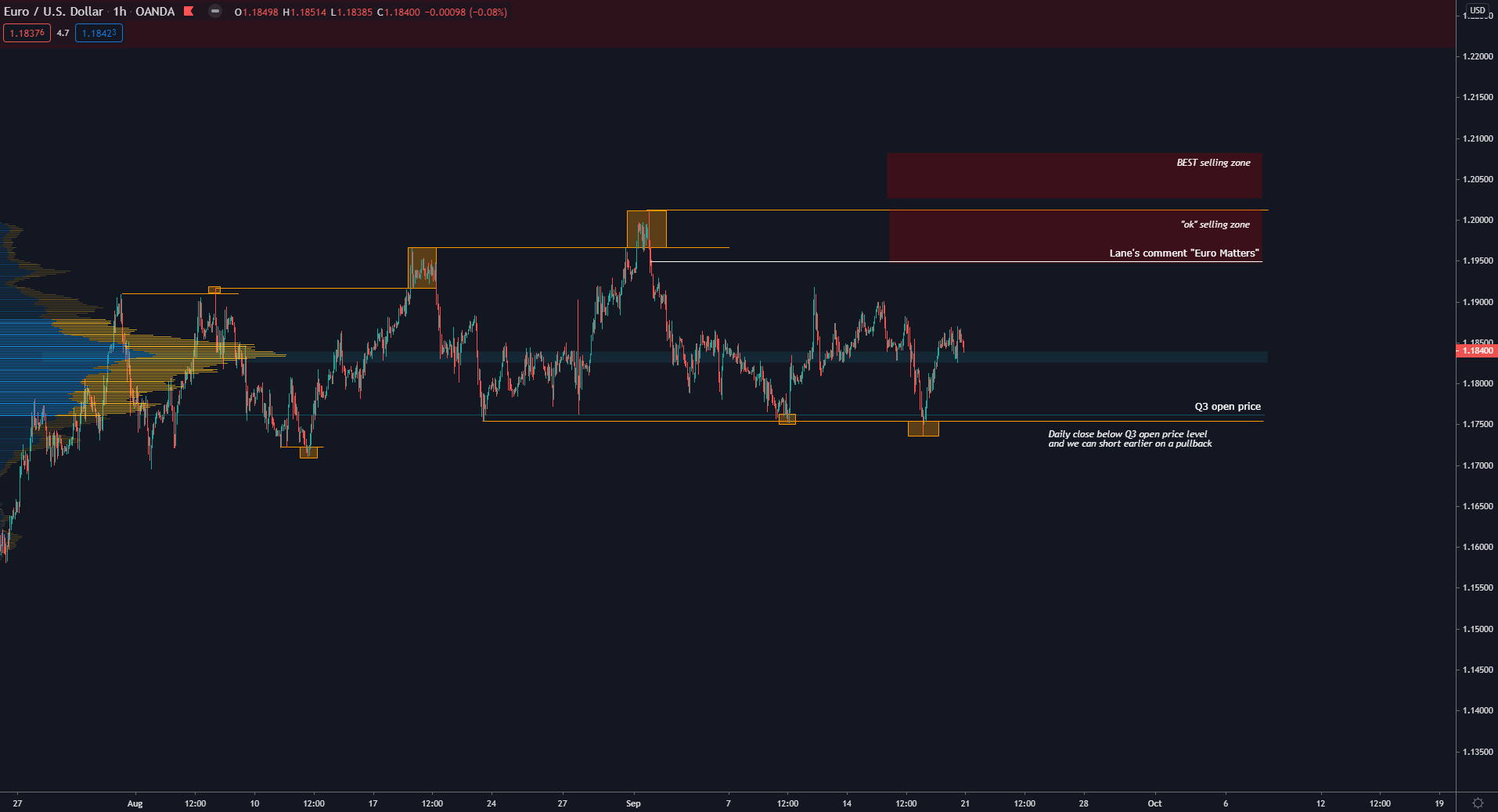

Usually the average retail generates his trade ideas from the chart (technical analysis) and then eventually looks for some random fundamental to support his trade:

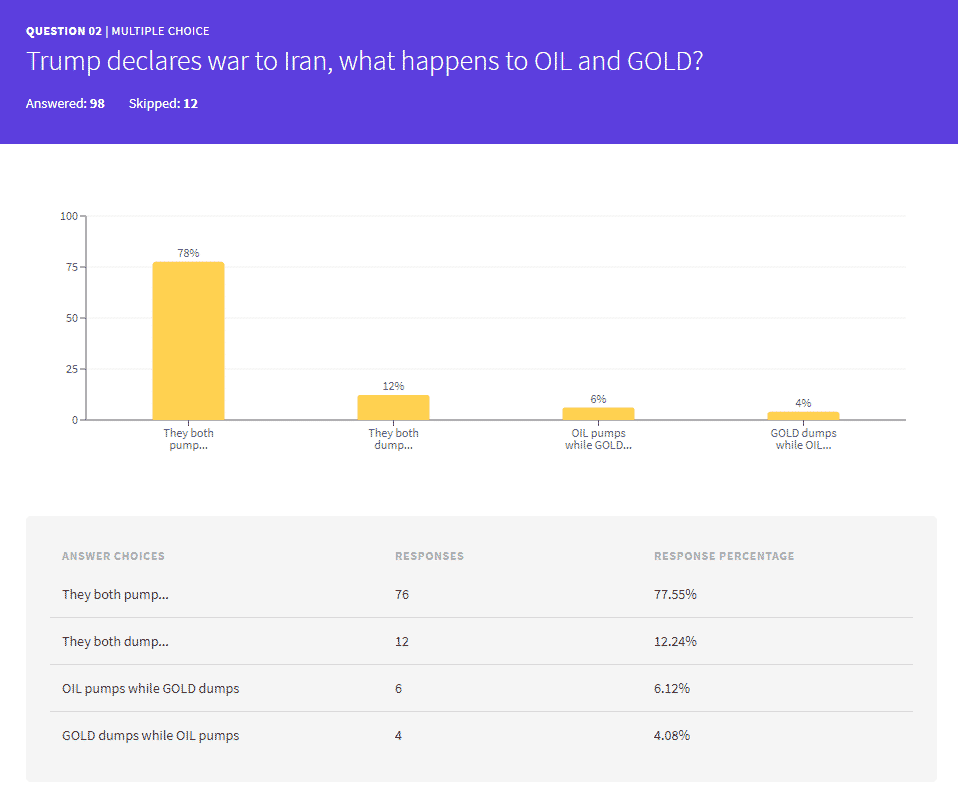

Meanwhile, the professional trader generates his trades ideas OUTSIDE the chart (macro fundamentals) and then uses the chart (technical analysis) to confirm his idea and time his entry:

That’s the core difference between a retail and an institutional trader, not a secret approach, not a special indicator, just the correct way to see the market. In other words, a specific framework that answers your questions about where the market is going, something like this.

Now let me tell you a little secret…

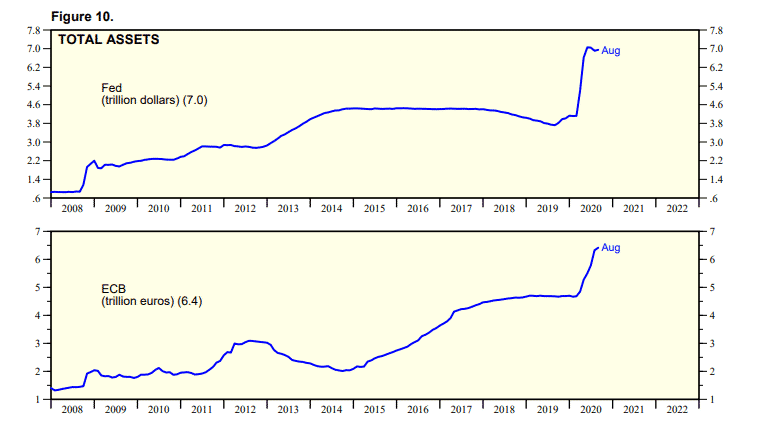

Hedge funds that don’t use technical analysis tend to underperform the ones that do use technical analysis to complement their macro researches.

Yes, you read right… Global macro hedge funds that only trade on macros tend to underperform global macro hedge funds that also apply some technical analysis.

But why is that?

Let me show you again the average global macro fund framework:

A professional “institutional” trading framework has technical analysis in it. Because it helps you time your macro idea, enter at a good price, get a good risk reward, and in addition eventually even filter what could be a misplaced trade idea.

In other words, technical analysis has a role, and it’s quite an important one, but it only comes in the gatekeeping phase. Technical analysis is NOT used to generate trade ideas, a professional institution/trader doesn’t look at a chart and says:

“This looks bullish, look it’s sitting at support, let me buy some…”

That’s the fallacy of the retail industry…

And it’s the fault of the laziness of the average Instagram and Youtube trading guru that knows technical analysis is easier for a newbie to understand than macro fundamentals. Hence to get his views and clicks he goes for the technical content.

And there you have a crowd of uneducated technical retail traders thinking the “smart money concept” taught on Youtube is how banks and institutions trade. Don’t be that retail, walk outside the box and trade professionally.

Cheers,

Jay from the BeSomebodyFX Team

.

.