Trades

besomebodyfx

quiz results and explanations

You are here to know the correct answers to the quiz right?

Cool, let’s start…

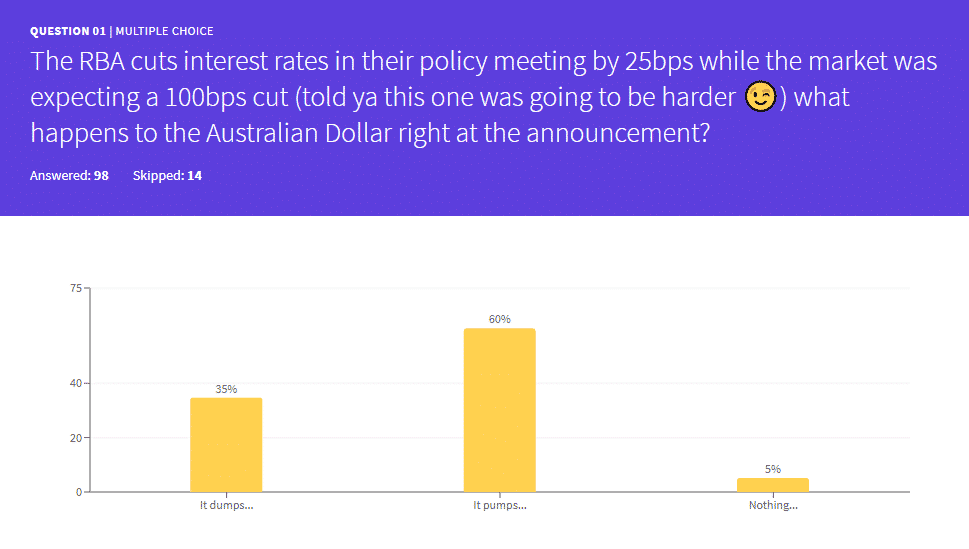

The first question was about market pricing…

So in a hypothetical event (RBA rate decision) the market heads into the rate decision expecting a 100bps rate cut which is of course a negative for the Australian Dollar (in simple, cuts are negative while hikes are positive for a currency).

BUT the market is more complex and the RBA did cut rates BUT only a small 25bps cut, which would have been a negative if only the market wasn’t pricing a 100bps cut, so in simple the RBA underdelivered in this case hence it was a HUGE relief for the Australian Dollar which would have rallied on the back of it, so the correct answer here is “it pumps“.

The concept of what’s priced in and what not is extremely important in trading, why?

Take for instance the recent huge unemployment numbers that we are seeing, you may look at the data release and say “woahhh 16% UnemPloyMent rate in the US that’s HUUUGEE the DOllAr is going to dUmP…”

But instead the Dollar it’s not moving, the data is release, it’s a crazy number but the market moves just a few pips, why? because it was EXPECTED and PRICED IN, so everybody already knew that the unemployment rate was going to be awful hence the marked already did its thing weeks in advance.

It’s always important to know what’s priced into the market and what not, makes sense?

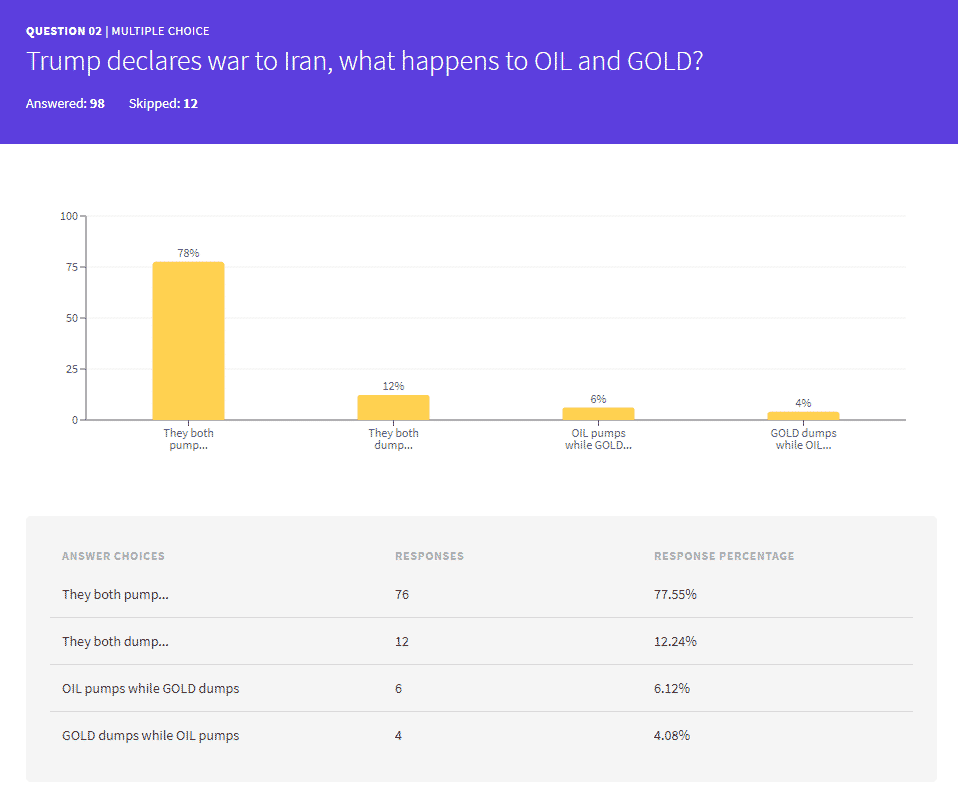

This is pretty basic, anything that creates tensions in the middle east hence putting OIL production at risk is POSITIVE for OIL, and at the same time anything that creates tensions in the world is GOLD POSITIVE so the correct answer here is “they both pump“.

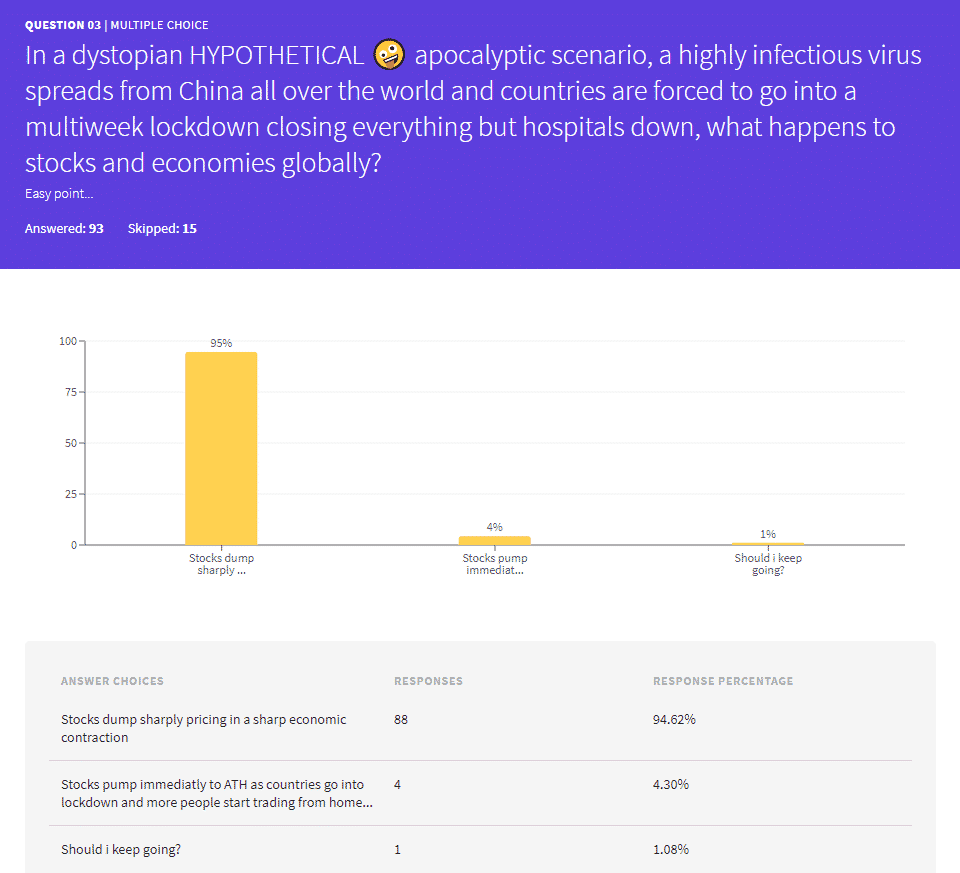

Should i even comment on this? ☝️

Next…

And this one made the most kills, 10Y T Notes and GOLD are extremely correlated, if one pumps the other does too and if for some reason one is moving while the other isn’t then it’s time to squeeze your brain and find the reason to understand which one is lagging who, because you may have a great trading opportunity.

So the correct answer here is “They are positively correlated” so if T Notes pump then GOLD pumps too.

And for the smart lads that thought two different assets don’t affect each other, it’s time to learn that currencies and some commodities are all interconnected with the bond market.

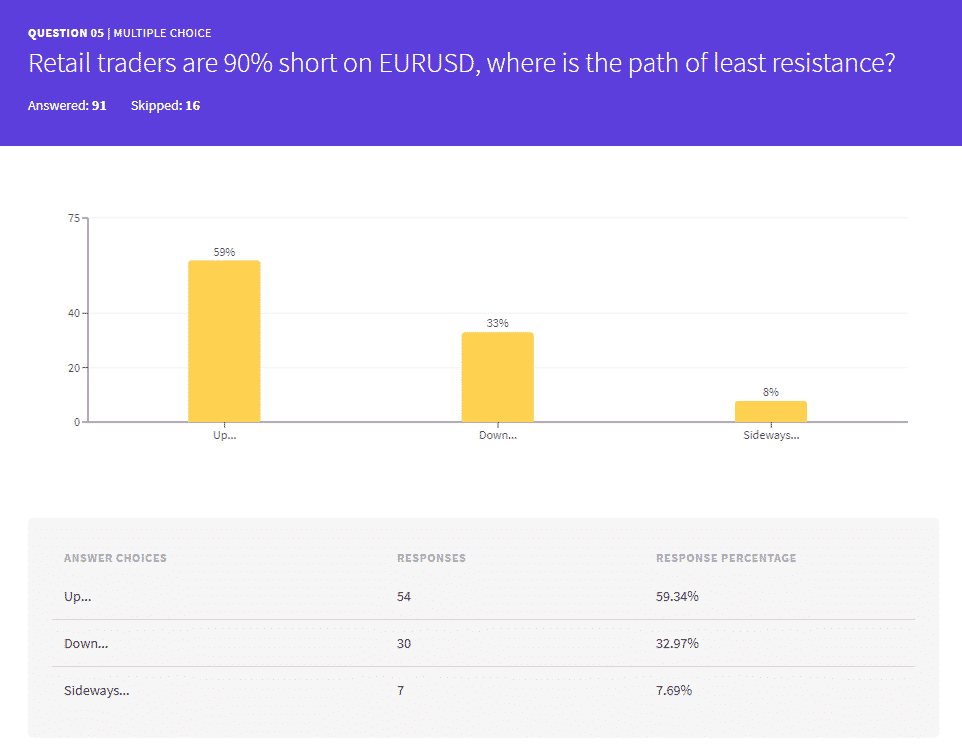

I wonder if the traders that answered down ever read one of our public analysis?

It’s literally almost a cornerstone concept of our analysis…

A contrarian approach to retails…

If retails are short the path of least resistance is UP…

Why? because most of the time you are trying to pick tops and bottoms in trending markets genious!

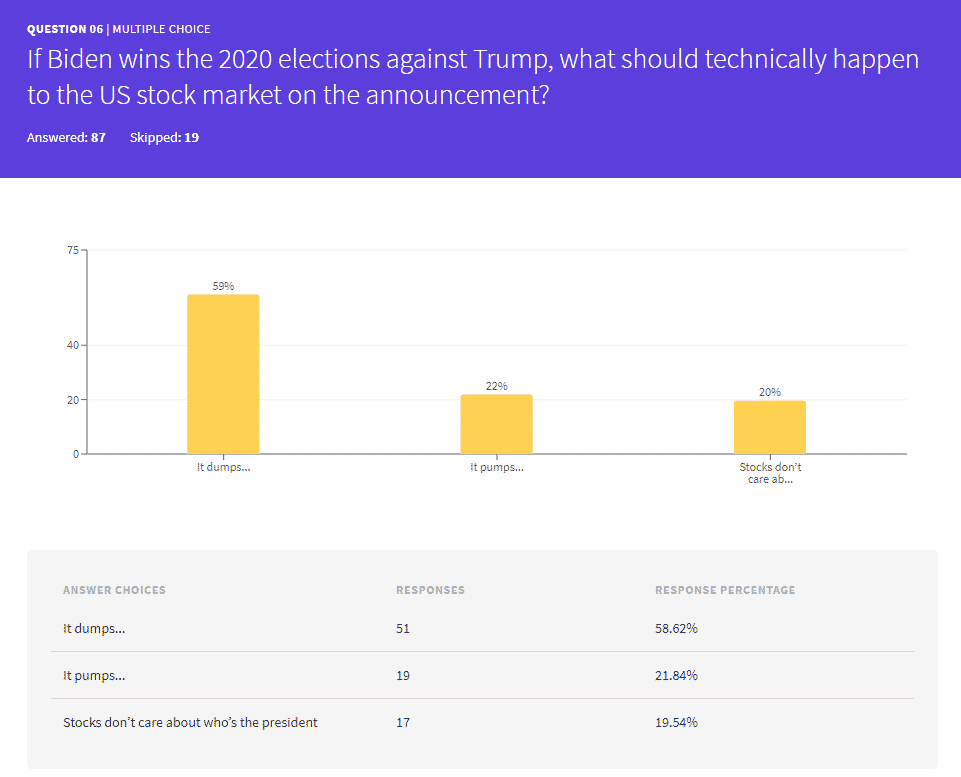

This could be a heated subject but the consensus is clear, if Biden wins the elections the stock market should react negatively at least in the short term…

The thinking behind this is that if a Democrat wins the White House, the party is virtually certain to win both houses of Congress due to next year’s Senate math, and, in turn, that could likely result in the unwinding of fiscal and regulatory policies that contributed to the current economic expansion.

And yes hate it or love him Trump is actually GOOD for the stock market:

This of course before the COVID19 hit the world economy, but that’s what we call an exogenous (something that has an external cause or origin) black swan event, and at this rate i wouldn’t even be surprised if we get back to ATH before November’s elections…

Next…

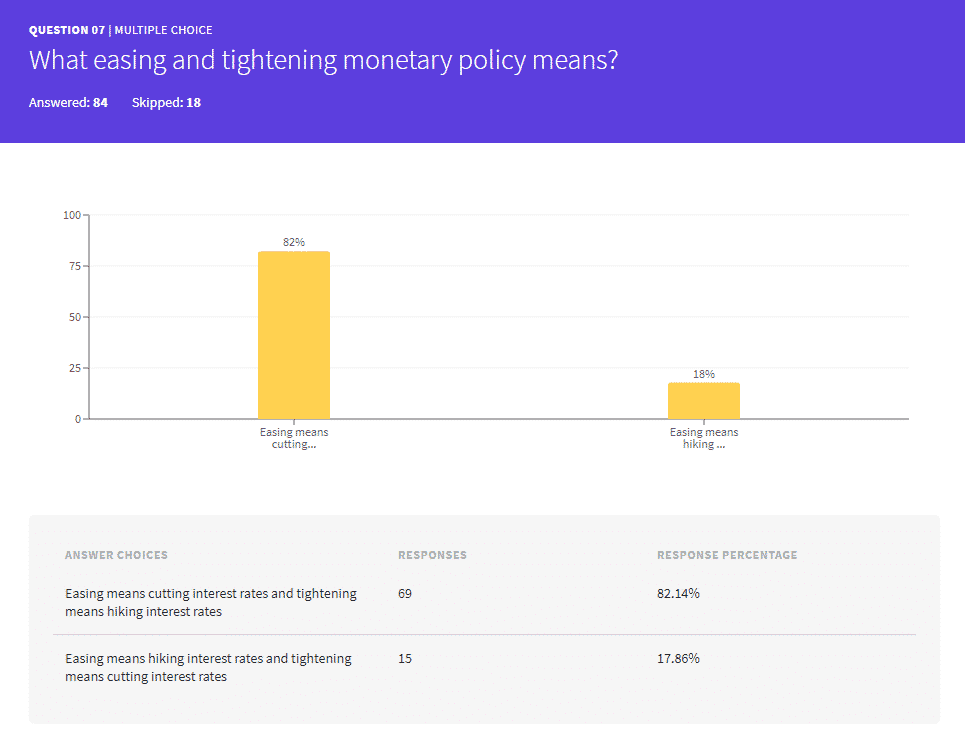

The correct answer here is “Easing means cutting interest rates and tightening means hiking interest rates”

This one looks more like confusion between the term hawkish and dovish…

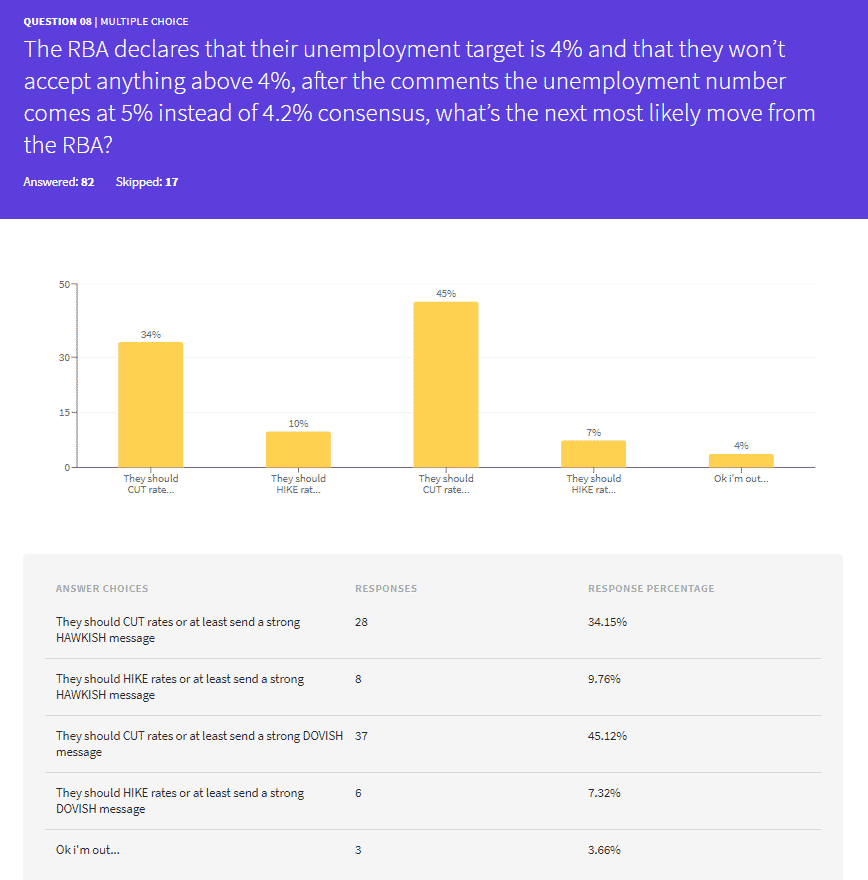

Most of you agree that at least they should CUT rates which is correct, in this hypothetical scenario the RBA sets an acceptable level for the Unemployment rate and if it goes above that they are prepared to act (prepared to act means prepared to cut rates in this case), unemployment goes wayyy above their level and the next logical move (as specified by the RBA itself with the “prepared to act”) is to indeed CUT rates or at least send a DOVISH message.

Why Dovish message and not hawkish one?

Don’t forget an hawkish central bank is a bank looking to hike rates and optimist about future outlook, while a dovish central bank is a bank looking to cut rates and with a negative outlook on their economy, so correct answer is “CUT or at least send DOVISH message”.

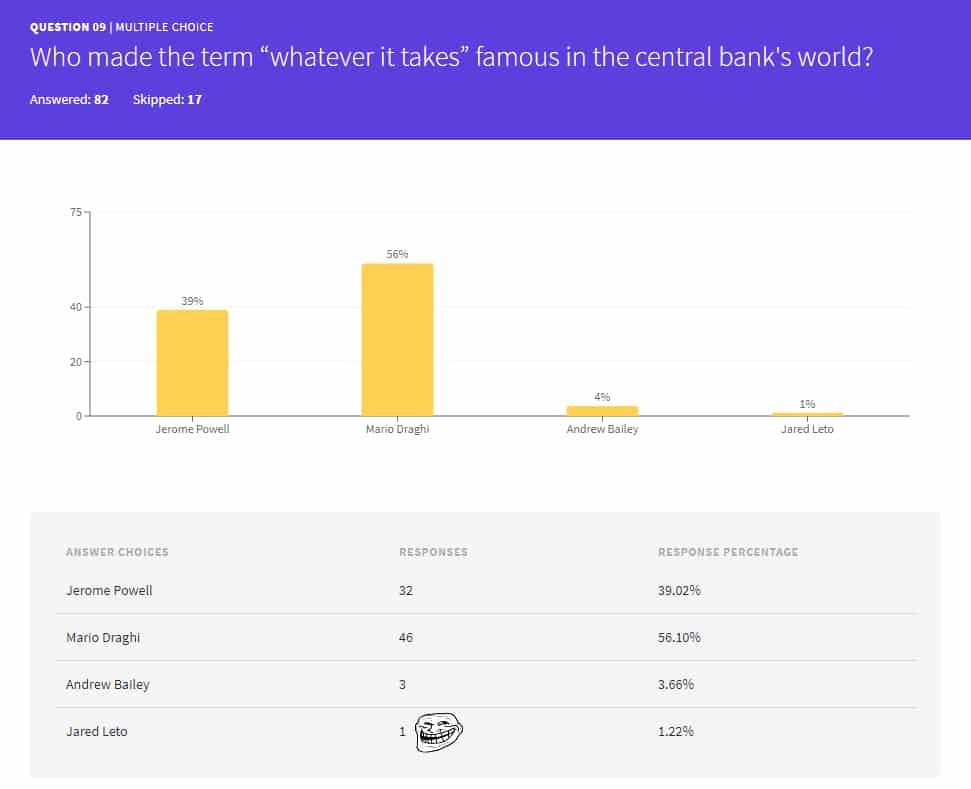

MARIO DRAGHI! ![]()

![]()

MARIO DRAGHI! ![]()

![]()

I’m Draghi’s fan did you notice?

For your interest, this is Jared Leto:

Yeah definitely not a central banker…

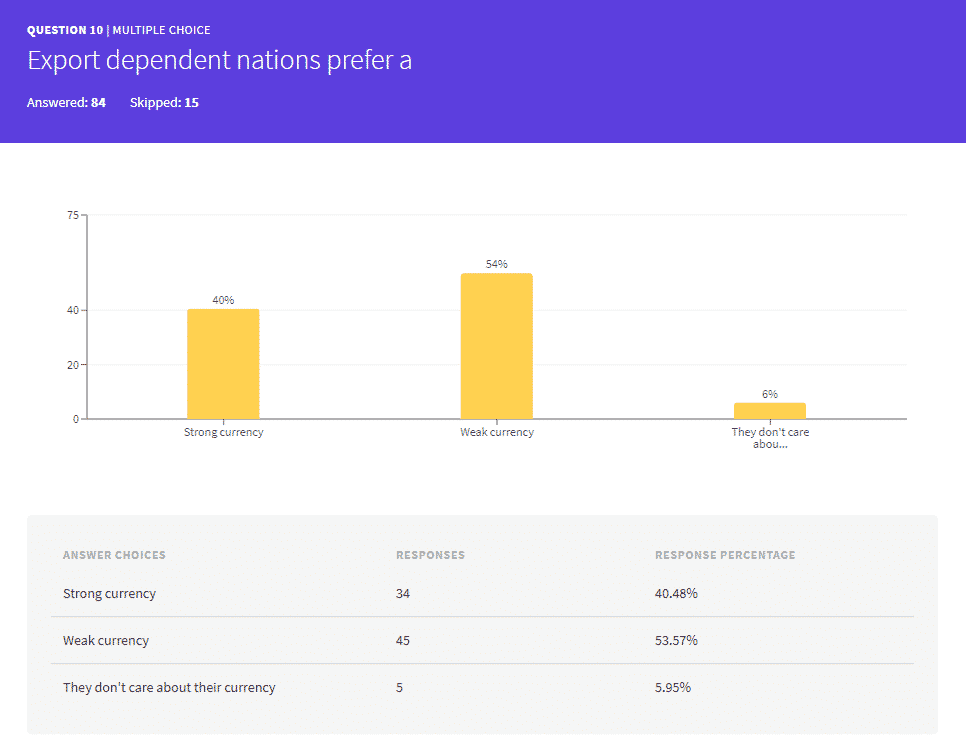

Now last question:

This question looks taken straight out of a school test…

And i will let Google answer this one:

Yes the correct answer is a “weak currency“, and the RBNZ is a great example of this, it’s in their mandate to keep the NZD relatively weak to help their exports hence support the economy.

And that’s it…

We had only 2 traders that scored 100 on the quiz, the first one won a free month in the Private Network so congratz, while the second can whistle for it ‘cos he got too late…