Trades

BESOMEBODYFX

TRADING MACRO FUNDAMENTALS

How to start learning macro fundamentals trading? let’s see an example of a macro trading framework

Now, the second most asked question is “how do I get started with macros?” “what trading macro fundamentals is about?“

In the previous post we have discussed the average global macro fund framework, but we haven’t really discussed anything practical to trading.

So here we are…

Let’s talk about some practical macroeconomics theories to get you started in the right direction…

What we are going to illustrate here is a very simple, yet very powerful, macro concept that you can use in your trading to gauge the long term directions of ANY asset.

Now, if you have ever gone around the web trying to study economic indicators and the impact they have on FX or any market, you can think about all that, and throw it away…

Really… you DON’T need to keep track of dozens of economic indicators for each country…

Great… So let me show you something practical.

For this specific example we are going to take one leading indicator and ONE only.

Not dozens of indicators, nothing too complext, just one simple graph:

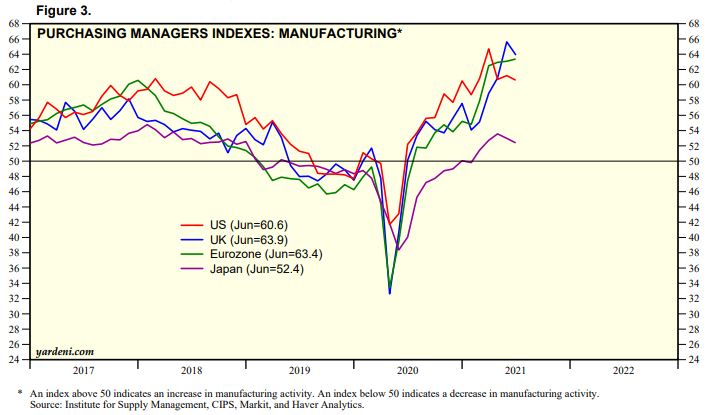

Among the most powerful leading indicators we have Purchasing Managers’ Index, or shorter, PMIs.

Which you can see in the chart above.

Looks good. but how do you actually read it? rising is good and falling is bad for the currency?

No, FORGET that…

That’s your average trading guru on Youtube trying to sound smart with newbies.

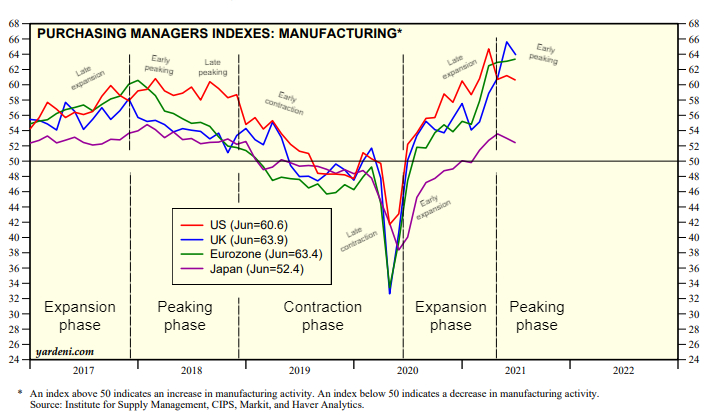

The reality is, with PMIs and almost any indicator as a whole what matters is understanding the cycles:

Right click the image and select “open in image in a new window to zoom in“

Looks good…

But it’s still just theory…

How do you generate a possible trade from this?

that’s A GOOD question, AND HERE’S THE GOOD answer:

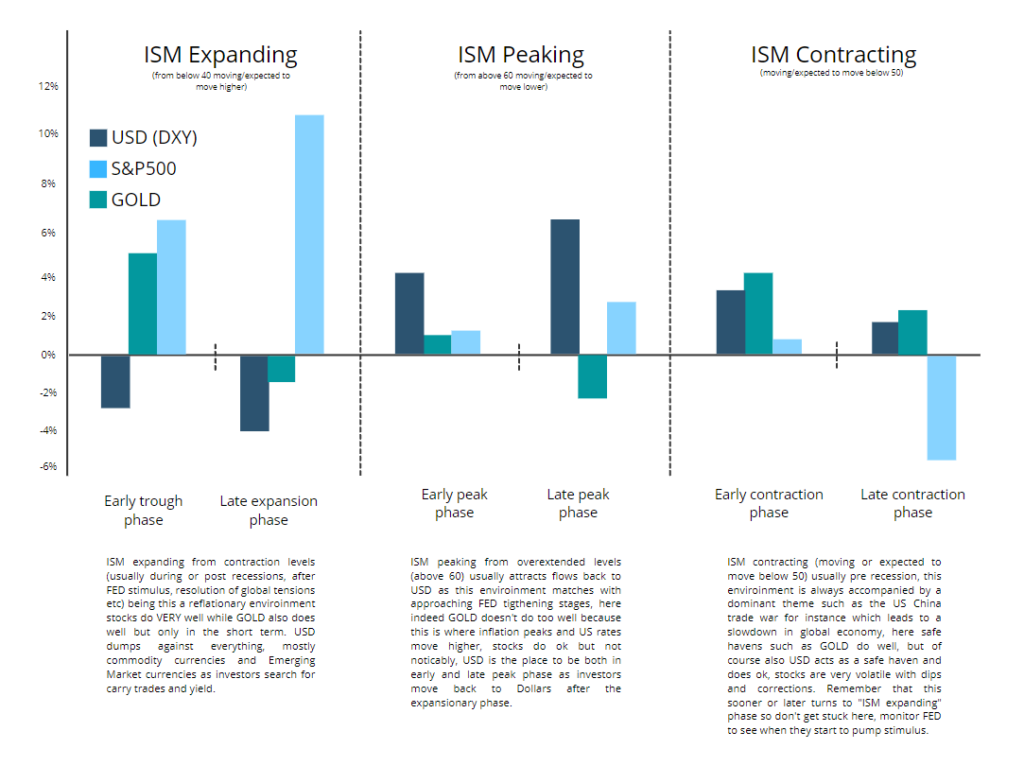

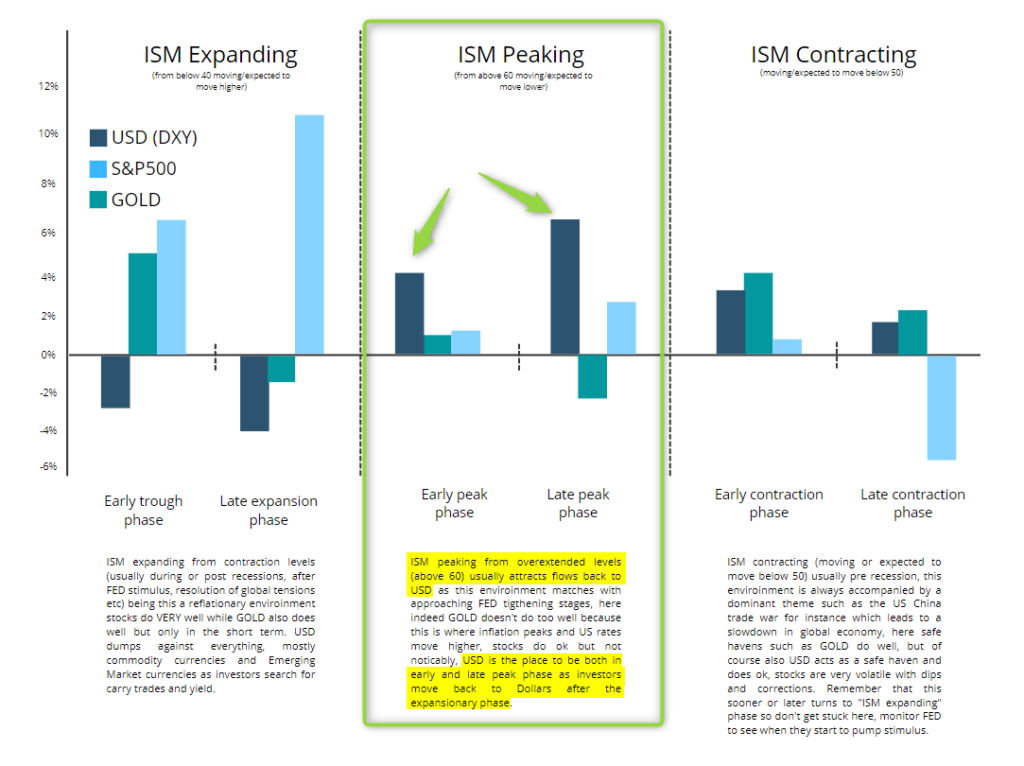

With PMIs we can differentiate between 3 phases of the ISM cycle…

The expansion phase, the peak phase, and the contraction phase.

Each phase creates a specific macro environment that generates specific returns for different assets.

For the sake of the example I’m going to illustrate the three most popular ones, DXY (USD) S&P500 and GOLD in this table:

But let’s actually see a chart…

Here’s EURUSD and how it behaves with the various PMIs tops and bottoms:

Now, let’s get even more practical…

Would it be pretty useful to know the FX, commodities, and indices trends for the next 3 to 6 months, wouldn’t it?

Yes it would… So let me show you exactly how.

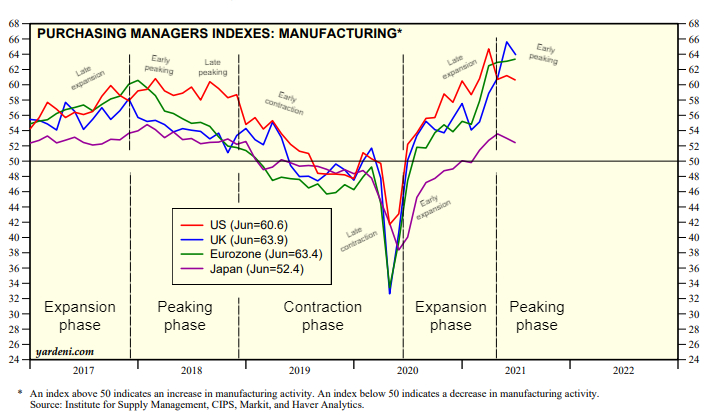

Let’s take for instance, the recent global PMIs chart:

As of June 2021 (chart above) global PMIs are peaking, that’s pretty clear just by undertanding how the cycles work, after an expansion, the peaking phase naturally, sooner or later, comes.

And anyway…

We know given the current macro context that they should continue to move gradually lower going forward.

What’s the trade in this environment?

That’s all…

And because of that, we understand that this specific macro context favors USD longs.

Thus we know that in July and August 2021 the “favorite” trades will be to be long Dollars, period.

Then in a couple of months the environment may change back to expansion or whatever, we don’t know that YET.

But we know that, for the time being, PMIs are in an “early peaking” phase and based on that specific macro environment you know exactly what trades will be favorite.

To Conclude…

We are making it sound easier than it is here…

But if understand this type of thinking you will be ahead of 90% of traders out there that trade randomly without any idea of what’s happening in the markets on a macro level.

Now, don’t forget:

“The market doesn’t move in a straight line, pullbacks in macro trends are natural, periods of counter trend flows are perfectly normal. Use them to your advantage to get the best entries for your trades.”

Hopefully I delivered a point here, now certainly we have ultra oversimplified here. We could have gone into more details but talking about these subjects in a simple post wouldn’t be impactful enough for one to understand how important and powerful they are.

The best way to learn and PROPERLY understand these macro theories is to experience it with the right people on your side that guide you and educate you on what’s happening in the markets at every moment in time.

Cheers,

Jay from the BeSomebodyFX Team