Trades

BESOMEBODYFX

Trading quiz results and answer explanations...

It’s sunday and it’s f1 race day so let’s make it quick 😉

The first 4 questions are the most boring ones but bear until the OIL questions, those will maybe teach you something…

Anyway let’s begin, and let’s be quick because as i said in a few hours there is the Mugello F1 race

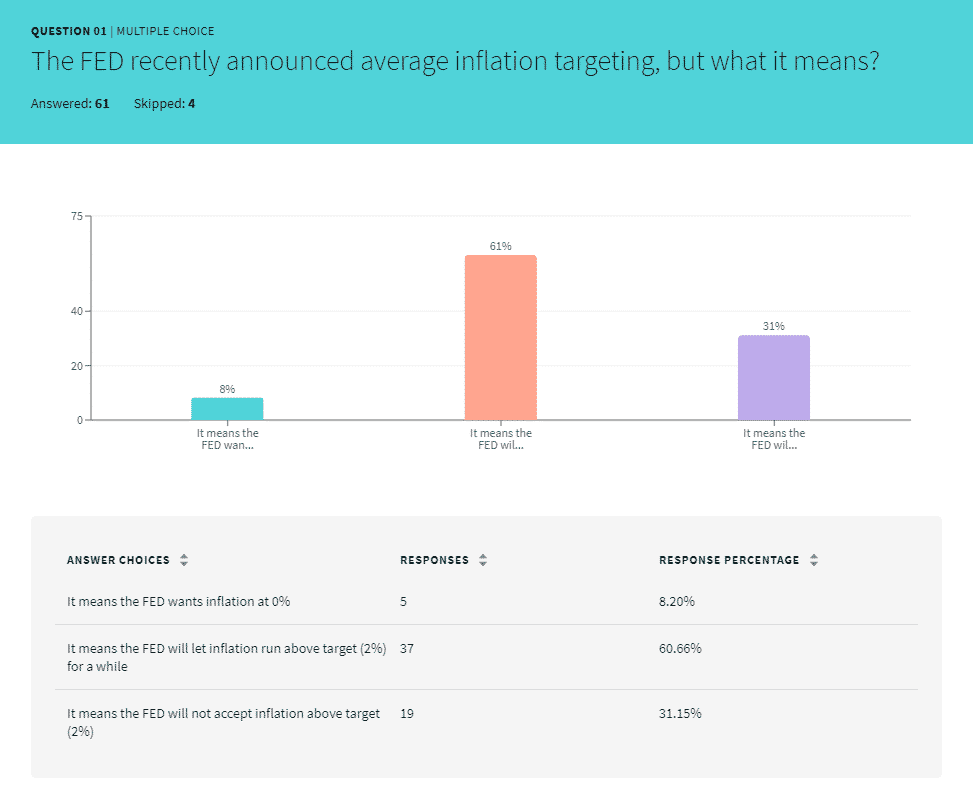

Average inflation targeting…

It’s the hot topic at the moment…

So the majority answered correctly here but I see there has been some confusion between letting inflation above 2% or not accepting it above.

The not accepting it above would have been a very hawkish message from the FED but what’s happening now is the exact opposite, the FED is sending a clear dovish message saying that they will let inflation run ABOVE 2% for some time.

What does this mean?

Central banks controls inflation with monetary policy, they tighten monetary policy to reduce inflation and ease it to stimulate inflation, so the average inflation targeting means that they will accept inflation to run above target for a while before hiking interest rates (tightening monetary policy)

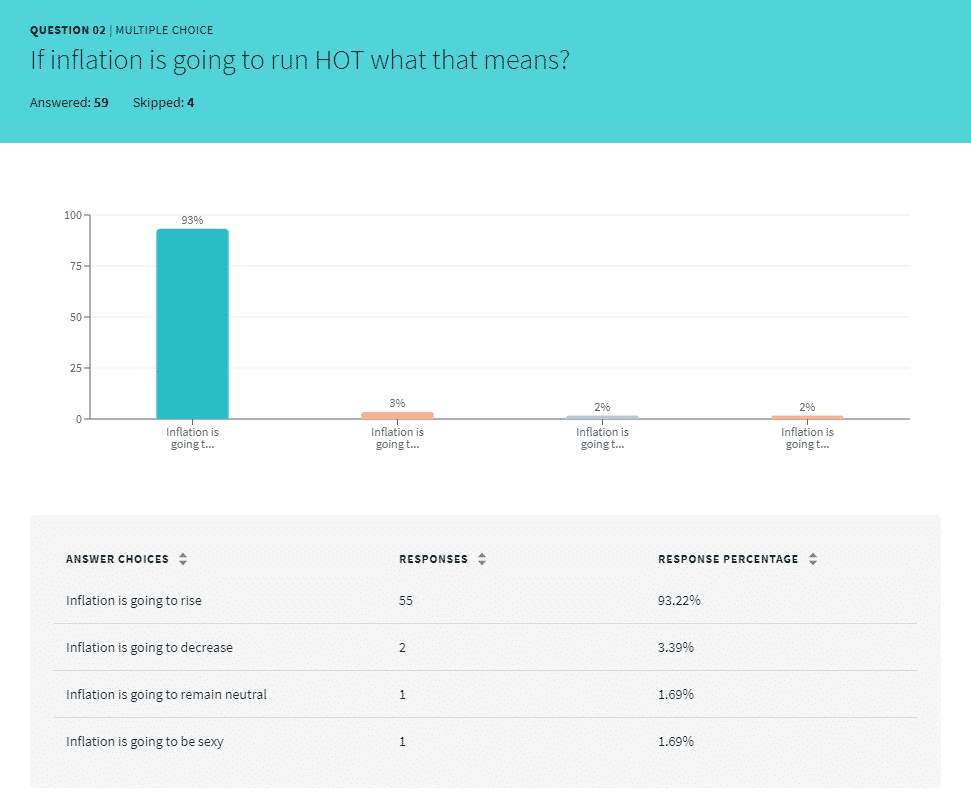

This question is related to the average inflation targeting, with that they will let inflation run “HOT” which of course means they will let inflation rise above their targets.

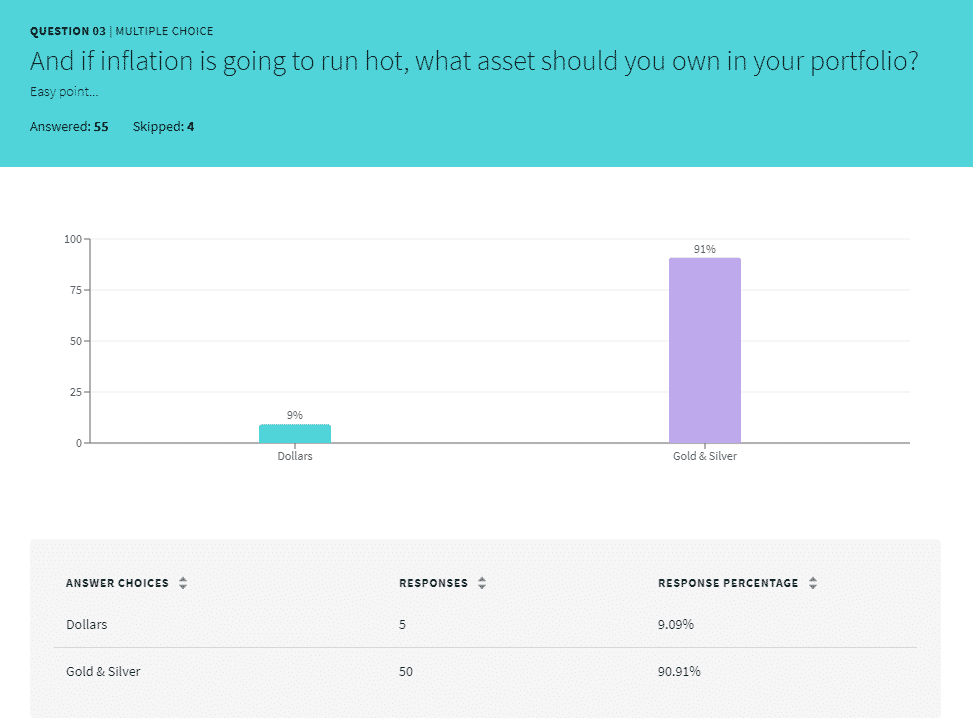

This above is a textbook question…

There is one asset par excellence that is known as the “hedge against inflation”, that of course is GOLD, so if inflation is expected to run hot GOLD & SILVER are the asset to own.

And to be precise, there are many other assets that do well in an inflationary period but definitely not the Dollar.

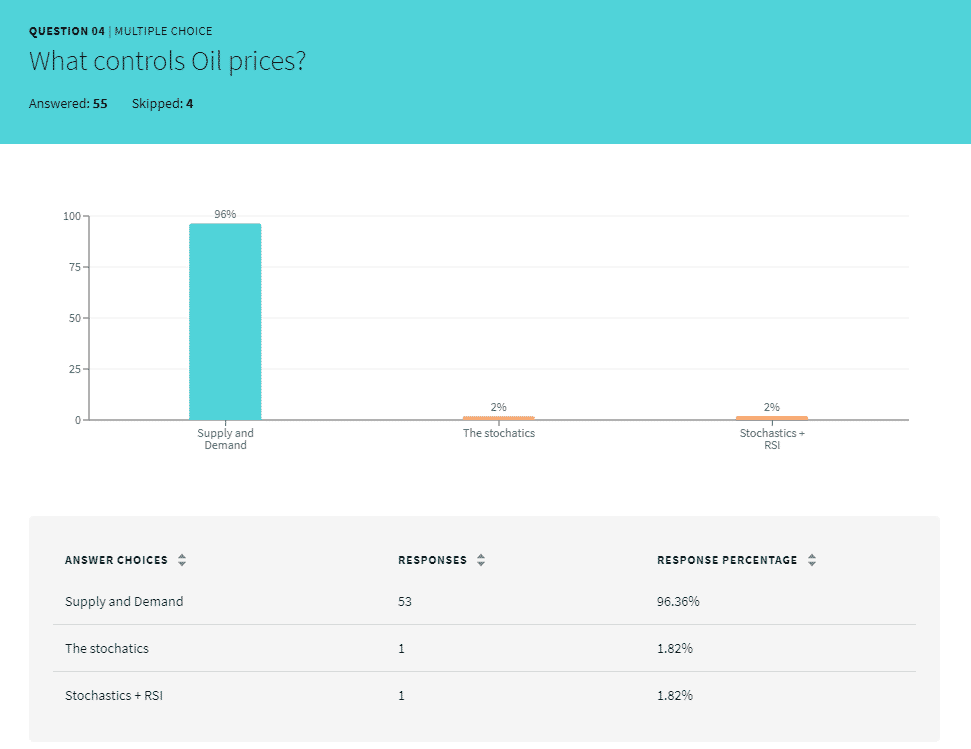

I hope this above doesn’t need explanations…

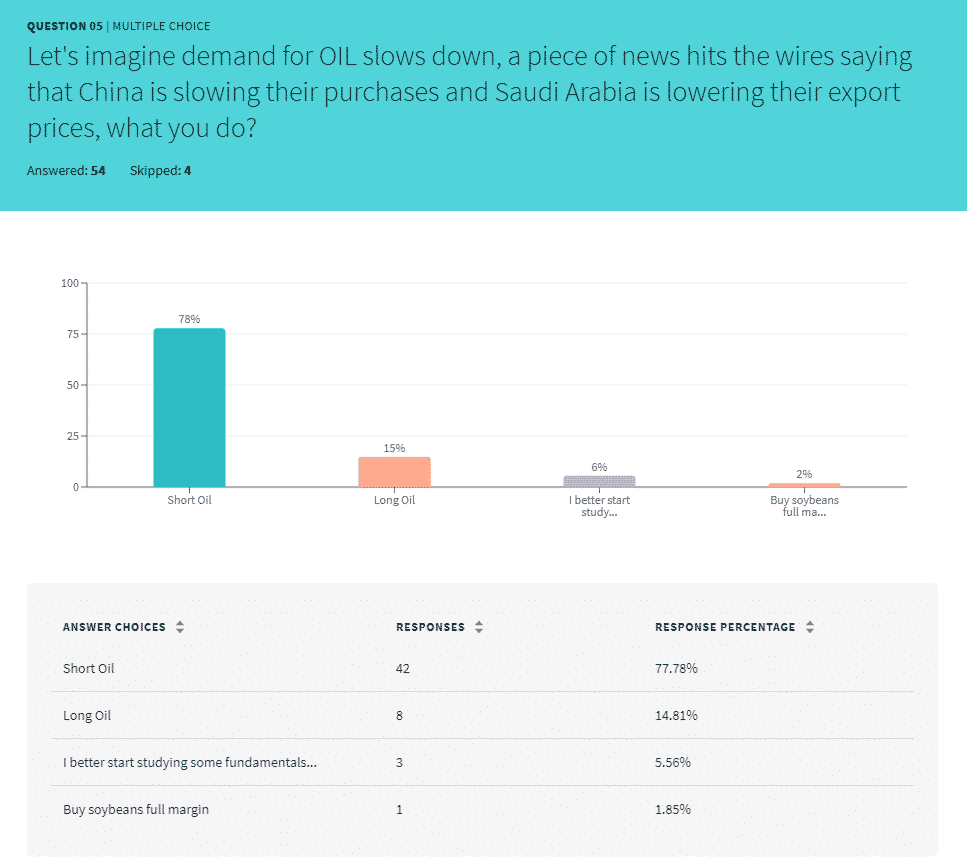

Supply and demand controls Oil prices, but i wonder how many answered it thinking about the supply and demand zones on the charts…

Here we are NOT talking about the supply and demand taught on Youtube or in your favorite guru overpriced technical analysis course, here we are talking about the real supply and demand, meaning exports, imports, airlines demand, countries demand, countries production and so on…

What people call supply and demand on the chart are simple zones of buying and selling interest, useful sometimes yes, but not what supply and demand is.

And here indeed we go deeper on what happens when demand for an asset changes and unsurprisingly of course, if demand is decreasing and supply doesn’t decrease along with the demand then prices fall.

And let me show you a real and very recent example:

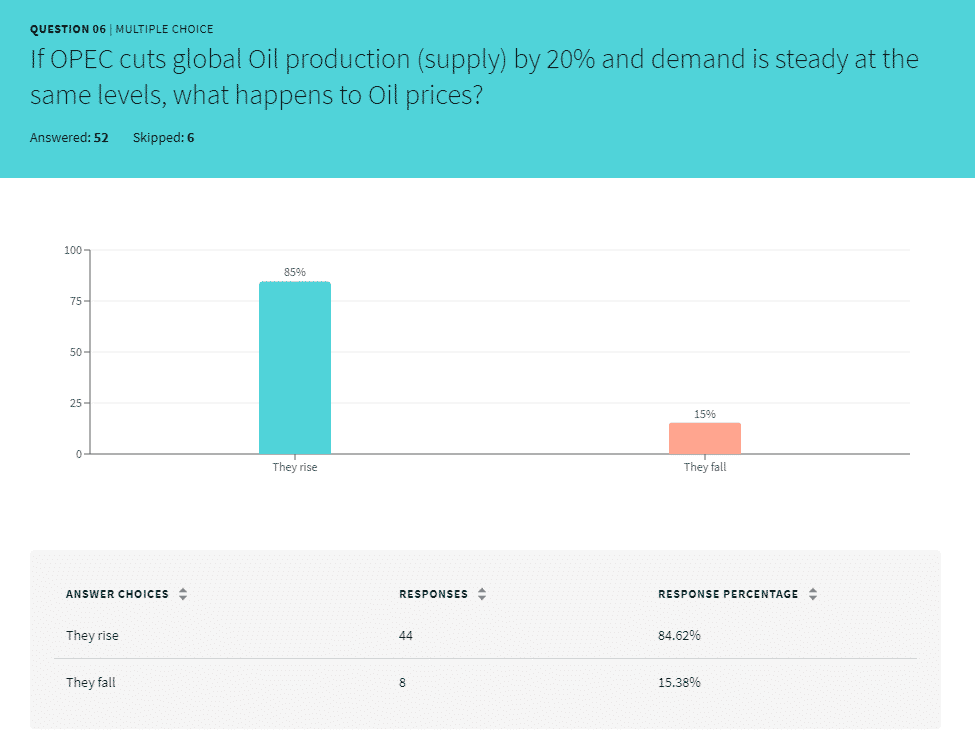

So we talked about the demand but what happens if the supply is changed, well if you reduce the supply of an asset and the demand is unchanged then there is less available in the market then price increases.

This is truly the basics of supply and demand and indeed fortunately most of you are getting it right, good job 😉

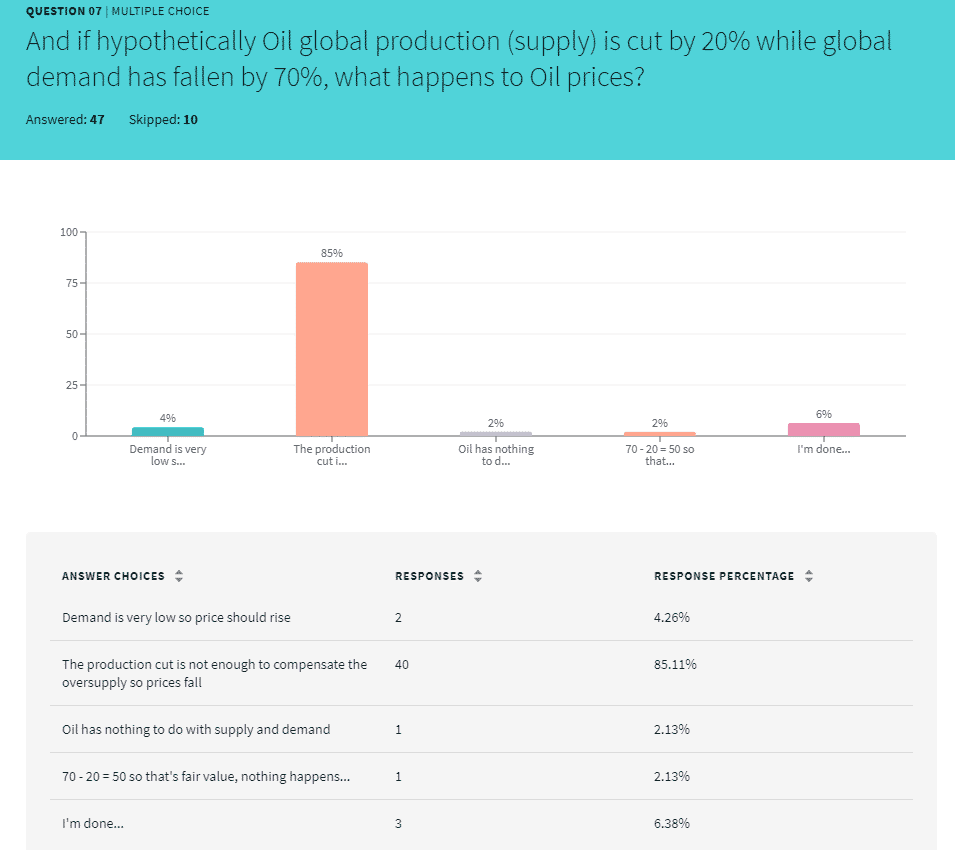

Here is my favorite one, and i’m very happy to see that many of you get these concepts pretty well.

So what happens if supply is cut but demand has slowed down more than the supply cut?

Well the cut is not enough to compensate to the slowdown in demand, so the market begins to be flooded with OVERSUPPLY and prices need to decrease to be “attractive”

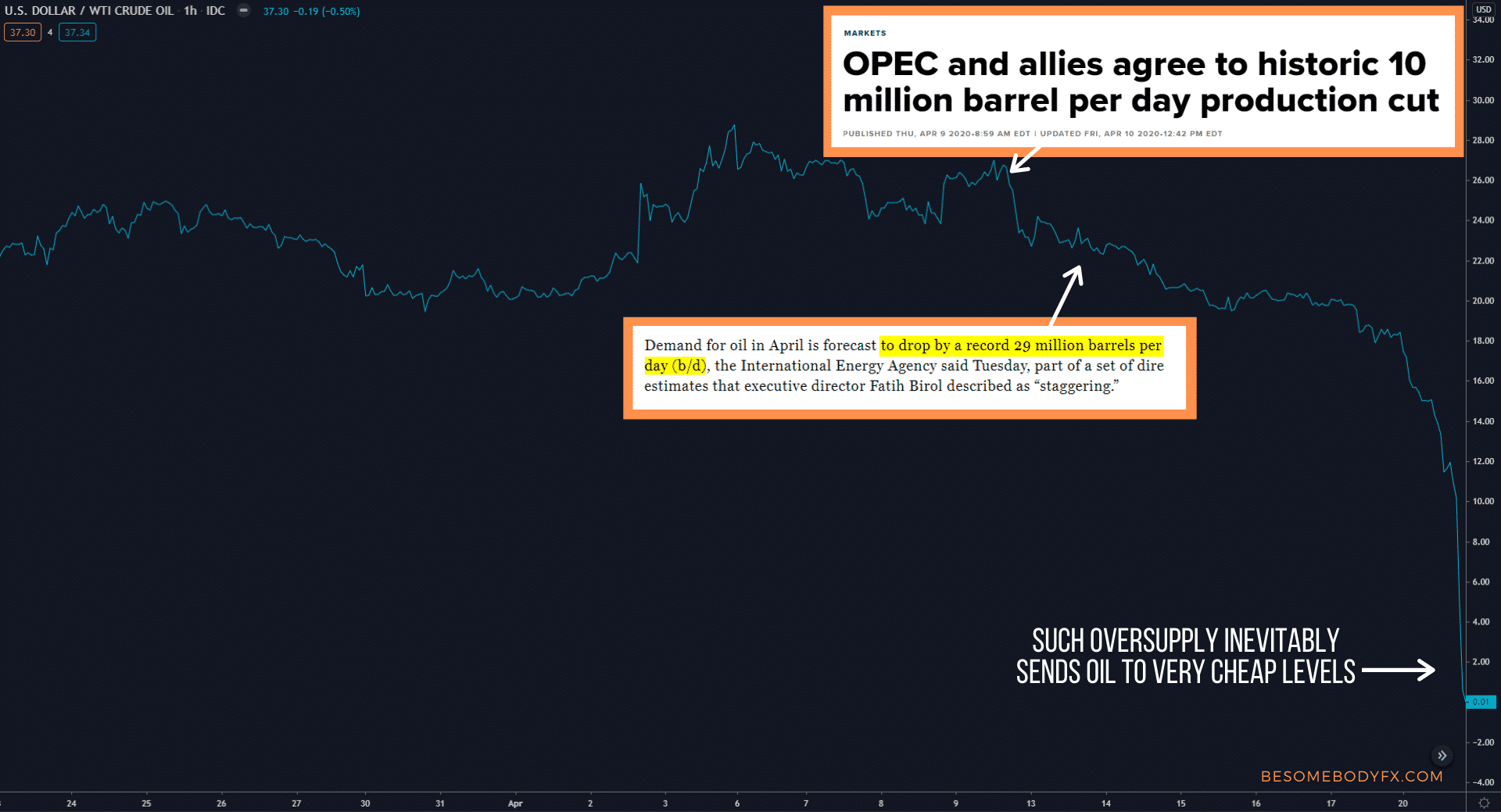

We saw this in March, when OPEC was trying to find an agreement to cut supply and after long negotiations, they agreed to cut 10 Million barrels per day, but this was right before the global pandemic and during the Chinese lockdown where flights were already stopping and travels were slowing down, demand was so low that the OPEC cut was not enough to compensate with the oversupply, storages began to fill with unsold OIL barrels and that inevitably led OIL to levels unseen before:

This above is the true example of why CONTEXT is sooo important in trading.

A 10 Million barrel per day cut in a world where demand has slowed by more than 29 Million barrel per day…

Some simple math of course brings us to a staggering oversupply of 19 Million barrel per day that didn’t know where to go and where to be stored.

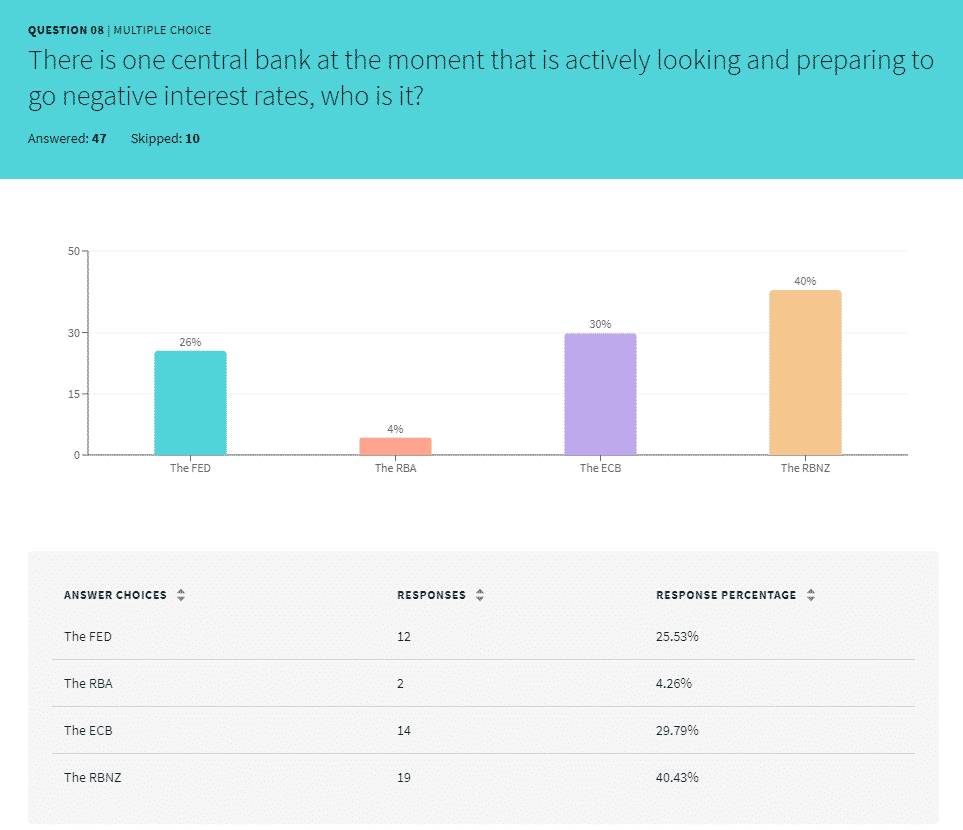

A bit of confusion here guys…

This is something that we have been closely tracking in the Private Network for the past 5 months.

The central bank looking to go negative rates right now is the RBNZ.

But hey, this doesn’t mean that you can go outhere and short the NZD everywhere, remember the word CONTEXT, the right pair to buy here begins with an A and ends with a D

Oh and by the way, the ECB has negative rates since June 2014… ![]() Where did those 14 votes come from?

Where did those 14 votes come from?

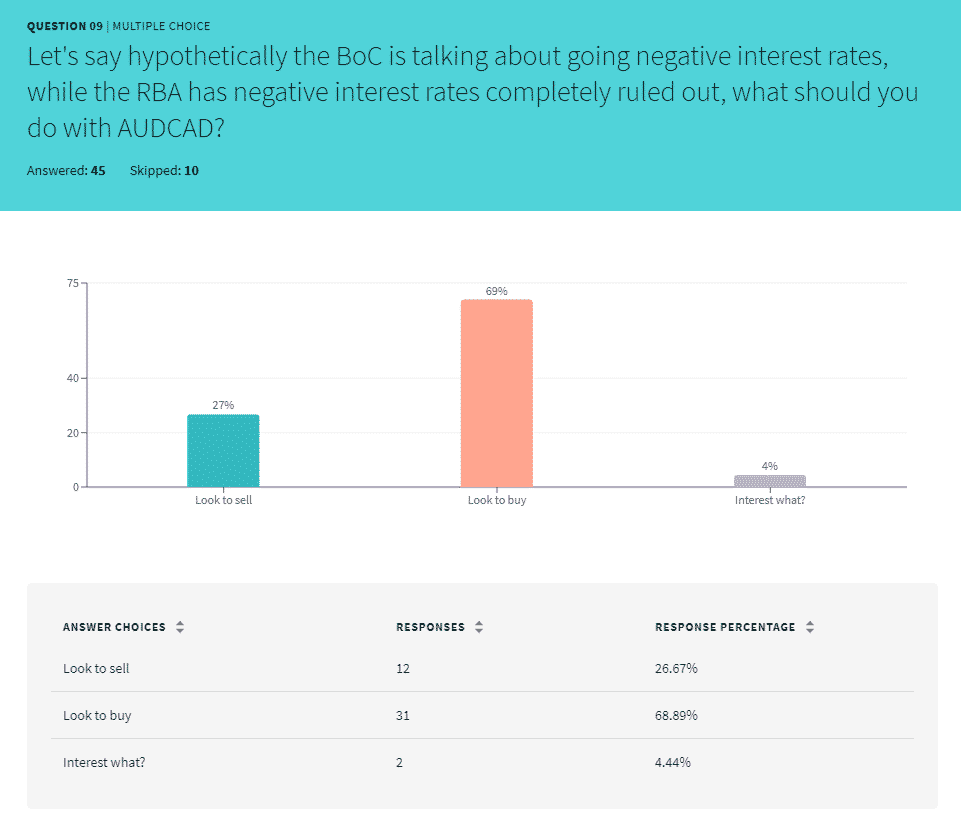

So what happens when one central bank is more dovish then another?

We here we are looking at a monetary policy divergence, where central bank X is dovish while central bank Y is neutral, this inevitably leads to the depreciation of central bank X currency against central bank Y currency, so the correct answer is indeed “look to buy”.

This is exactly what’s happening with the pair that begins with A and ends with D 😉

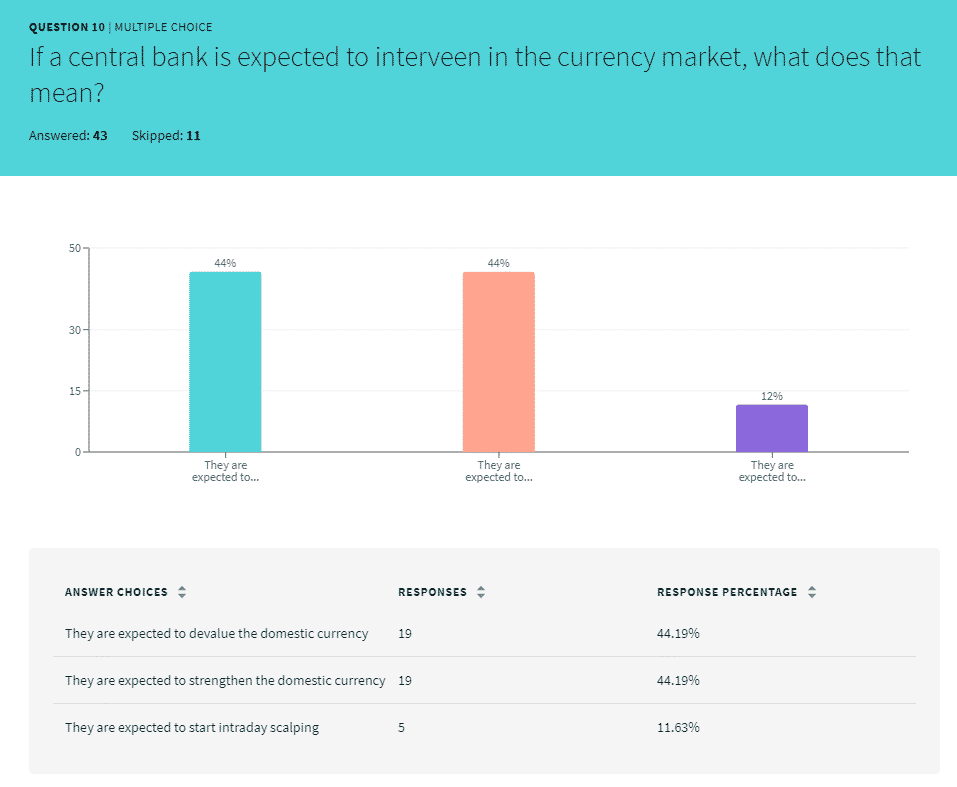

This is an interesting one, people are a little confused on what “currency intervention” means.

And we have been talking recently about it with the ECB meeting where the market was scared about a possible ECB intervention…

But then, what “intervention” means?

When a central bank intervenes in the market it’s to devaluate their currency, a strong domestic currency is not in the interest of central banks so when they intervene is to stop their currency from appreciating too much as that would put pressure on exports and inflation.

And that is it…

It definitely was the easiest quiz we have ever prepared and you can see it from the % of correct answers.

I hope you enjoyed it and found this educational, If you want to delve deeper in our trading style, check the BeSomebodyFX Private Network, you will have professional macro traders telling you exactly what they are doing with their own money each step of the way, so that you are increasing the probability of being successful and so that you can learn along the way.

Have a good Sunday and a good week.

And enjoy the race for all the F1 fans out there like me, Mugello what a great track.