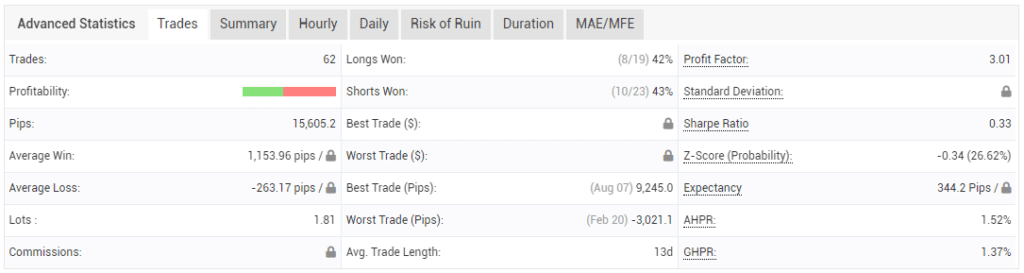

Trades

BESOMEBODYFX

CRYPTO GLOBAL MACRO Q2 2022

FED tigthening, 50bps rate hikes, quantitative tightening, global growth slowing down, it all matters for the crypto market

A crypto global macro update? That’s a new one, isn’t it?

Yes, it’s time we start discussing some crypto too, we have always done it in private with the Private Network members, but I feel it’s time to do some public discussions on the field as well.

We’ll do these crypto global macro updates at the start of every quarter, and ideally it will have everything you need to make some solid longer term decisions for your crypto portfolio.

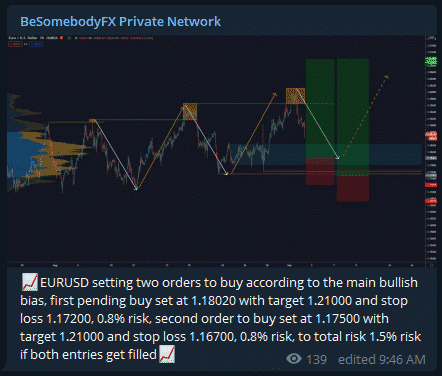

We won’t be going into the very details of our positionings in crypto because our exact trade details with frequent updates are exclusive for the Private Network members, but you will get the important context.

If reading isn’t your thing you can jump straight to the bottom of this page where we’ll do a brief summary, but you will miss out on some educational and informational stuff, just saying.

Anyhow…

It’s an extremely interesting time for classic markets and crypto because the current macro conditions are setting up the stage for some (more) volatility.

Geopolitical tensions, inflation getting slightly out of control, a FED ready to do “whatever it takes” and recession talks already populating some institutional notes.

Wait, does all this matter for crypto?

Oh, yes…

BTC is the future, no doubt… but speculatively speaking it’s just an extremely high beta asset, in other words, a more volatile S&P500.

The FED drives the boat… in crypto, too.

So now comes the point…

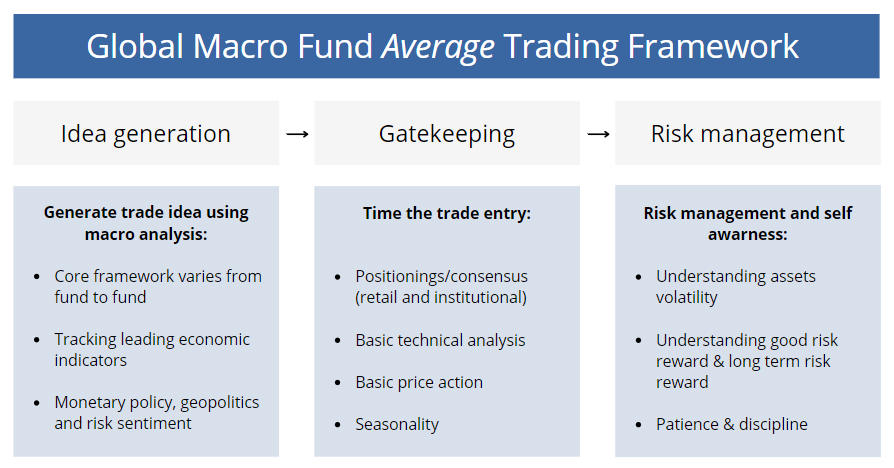

Where are we at with the FED’s monetary policy cycle?

I know you know already, or at least you SHOULD know, but let’s do a brief recap anyway:

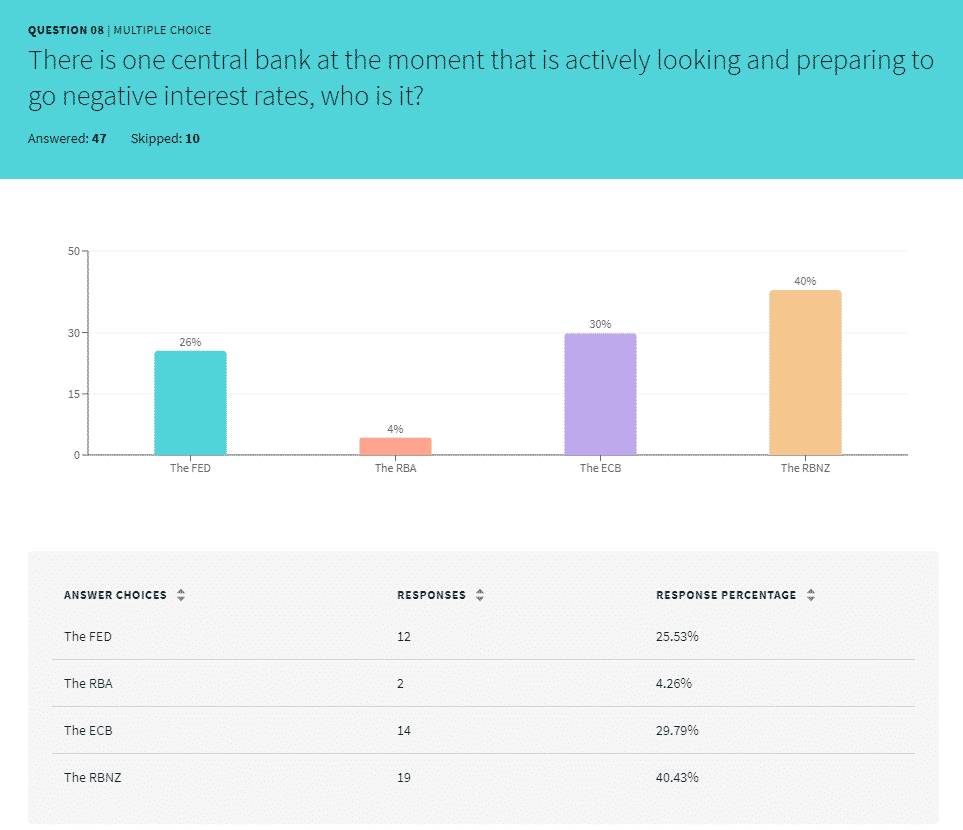

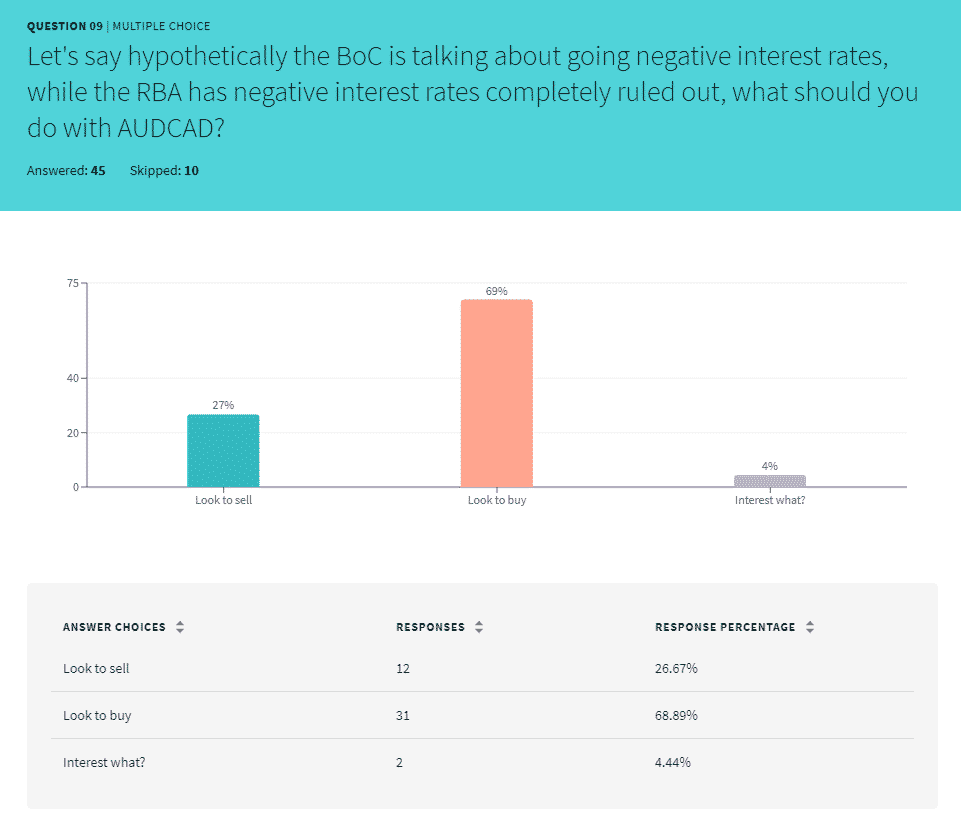

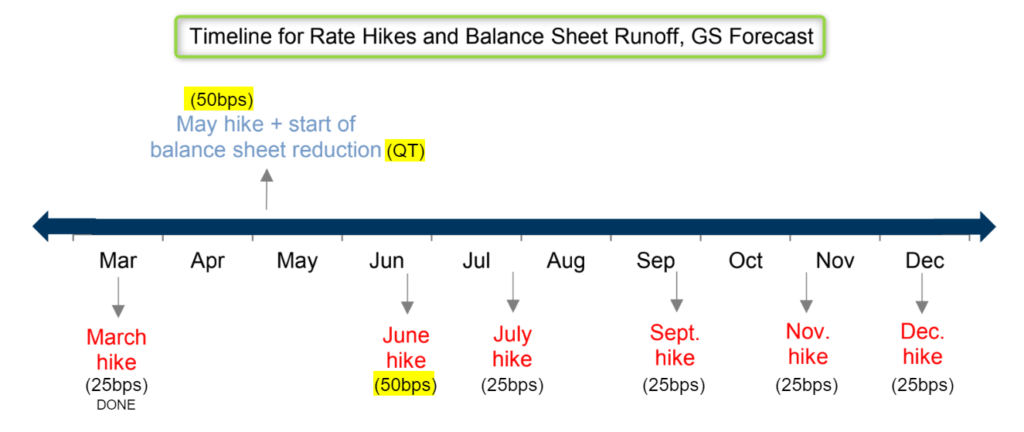

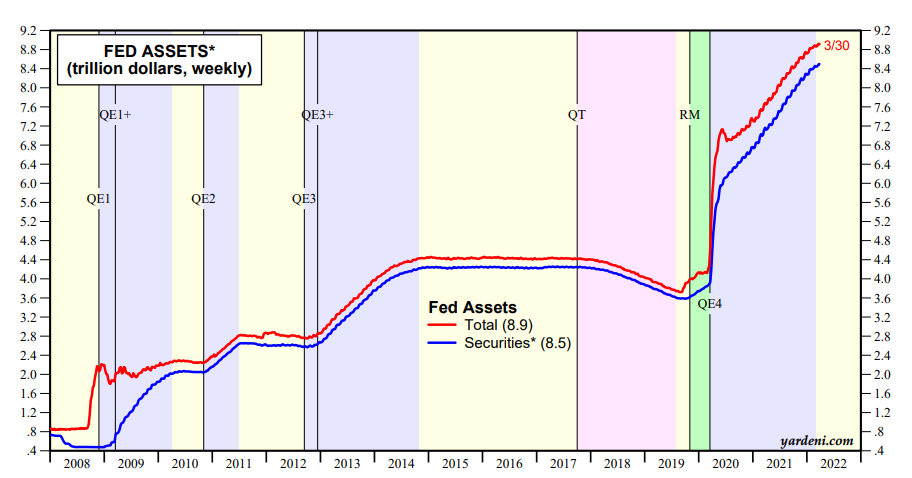

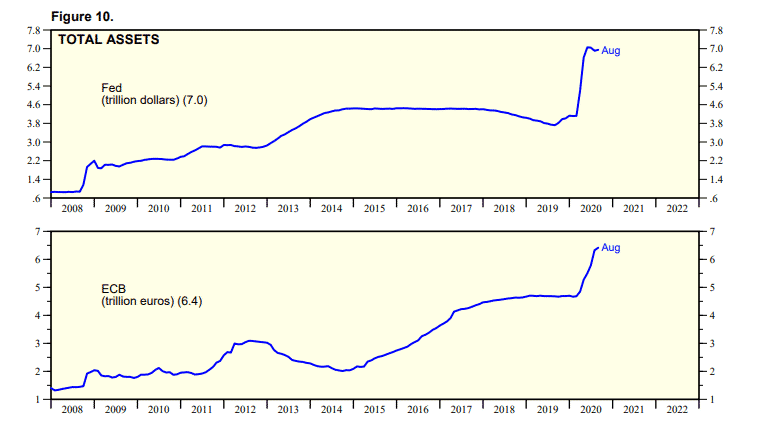

The FED is raising interest rates, is expected to raise rates faster (50bps) and is expected to start quantitative tightening in May.

Wait… what is quantitative tightening? See HERE.

And is it us just fantasizing about the FED’s monetary policy moves going forward?

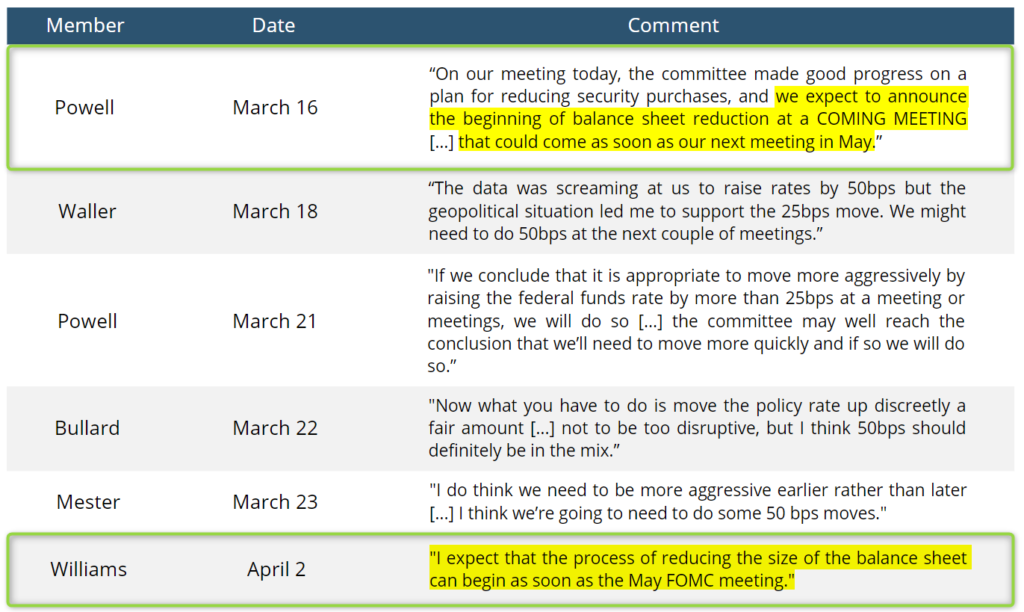

No, we listen to the FED’s committee:

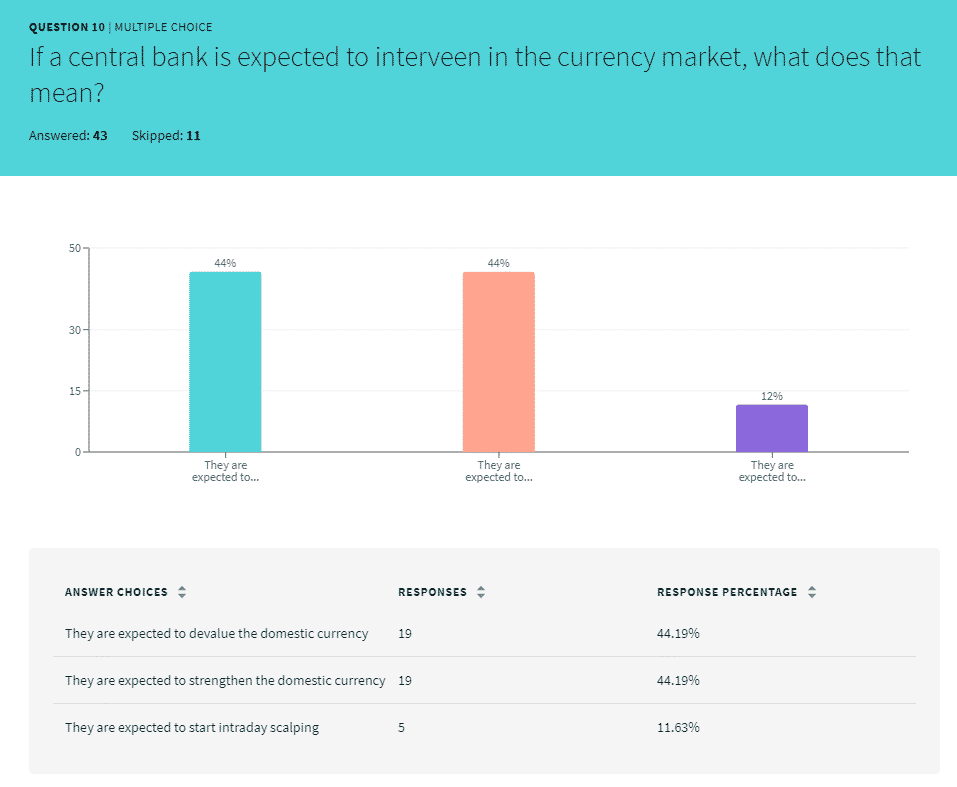

That’s called forward guidance.

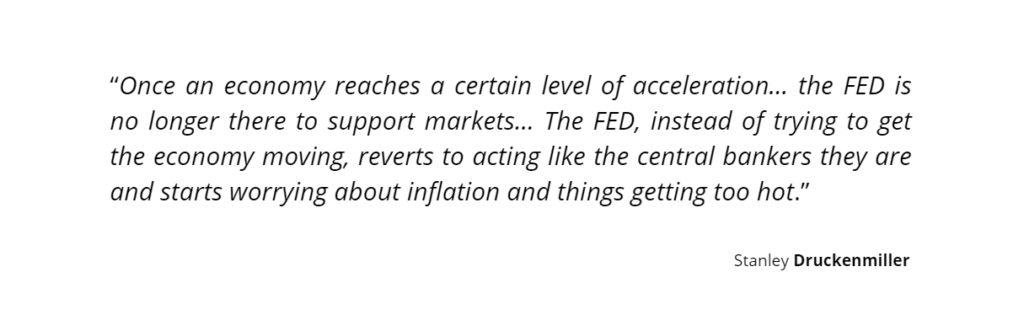

The most important power of CBs is forward guidance, their talking, their managing of expectations.

CBs are big tanks, so it takes a while for them to move. Hence before they can act pragmatically, they act verbally.

But wasn’t this a CRYPTO global macro article? So why we talking central banks?

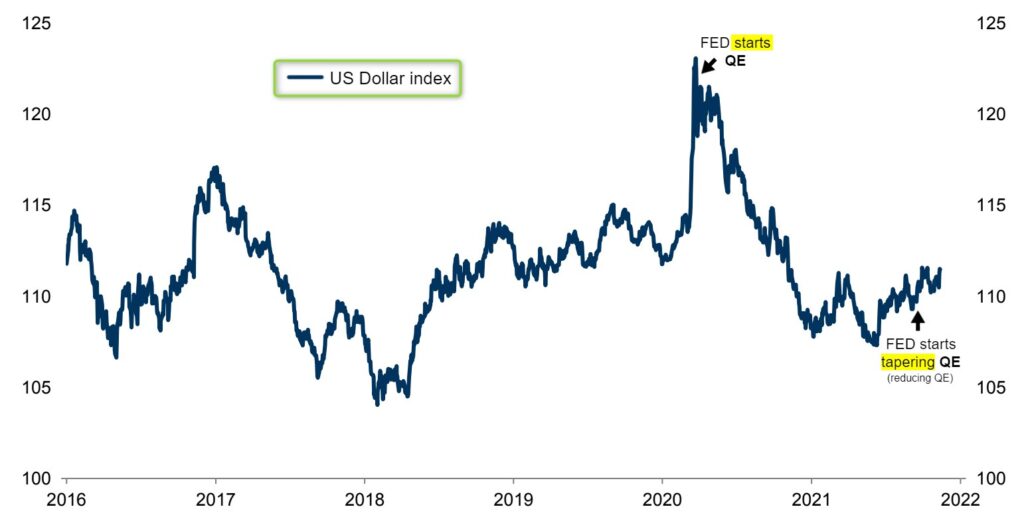

Anything that moves and that can be traded is influenced by central banks’ monetary policy. If you are buying BTC at any given price and any given moment just because “crypto is the future” you are doing it wrong…

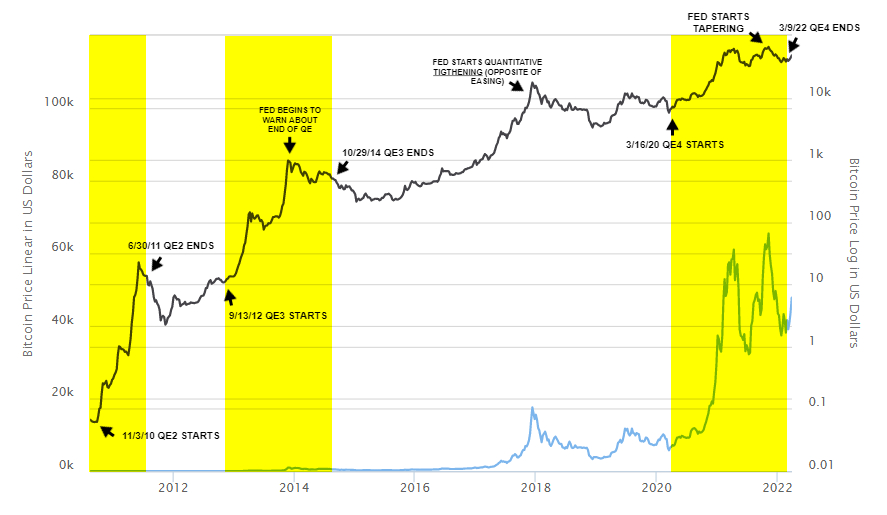

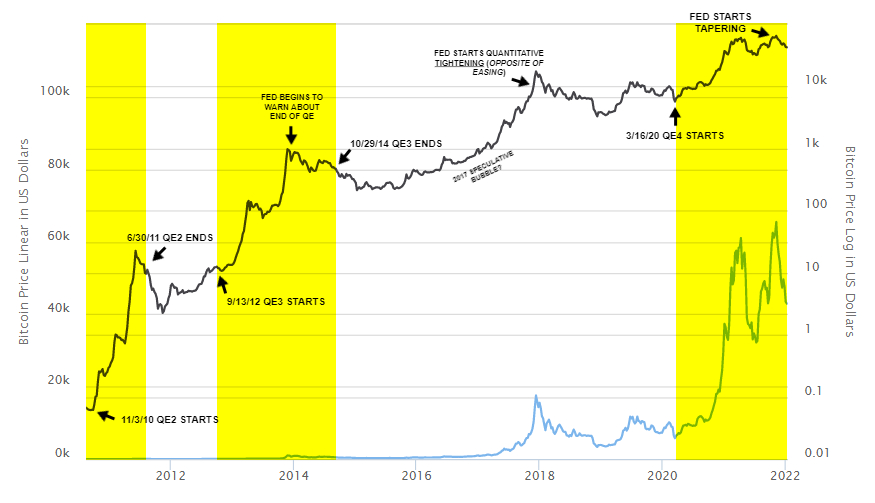

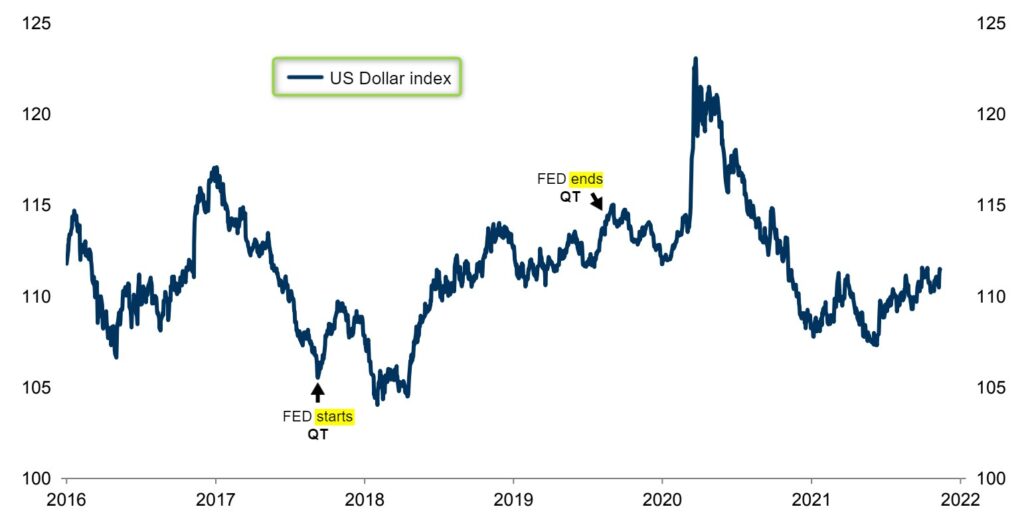

Ask who didn’t take some profit in 2017 when the FED started quantitative tightening.

Or ask who didn’t take some profit in November 2021 when the FED started tapering.

Your crypto portfolio can do much better if you follow the macro environment.

With that said, let’s talk some crypto…

And you probably guessed it already, this is a bit of a bearish note here.

But let me explain…

The FED is about to hike rates by 50bps in May, announce the reduction of liquidity from the financial system (quantitative tightening) at the same FOMC and is also likely going to deliver another 50bps hike in June.

So, are we bearish crypto?

We should, but we don’t like to be bearish crypto…

We like to be dip buyers, and the point we are trying to make here is that there will be (most likely) better levels to do so going forward.

This doesn’t mean BTC can’t have some bounces here and there.

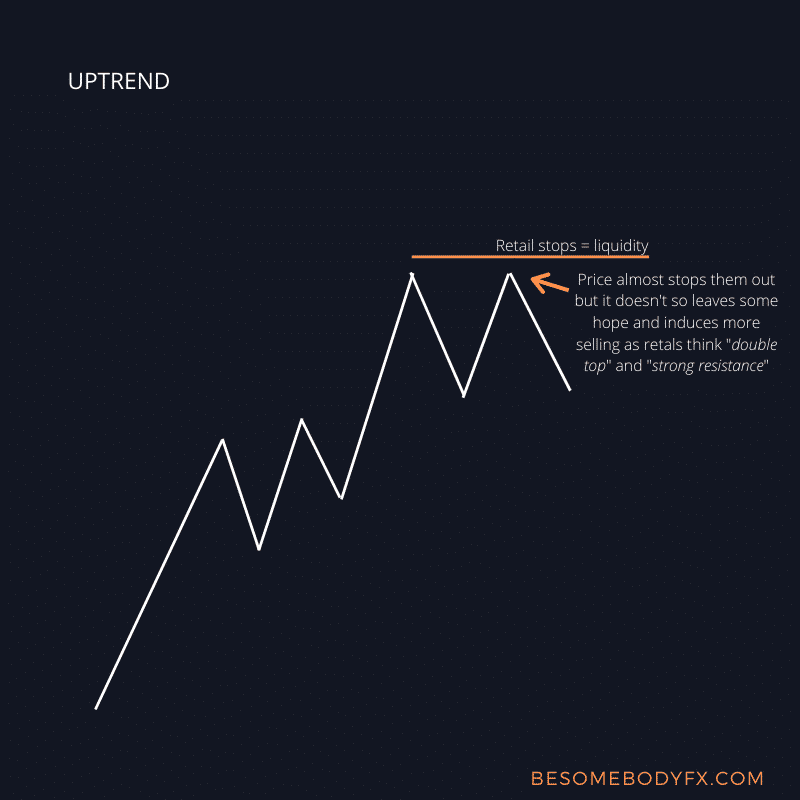

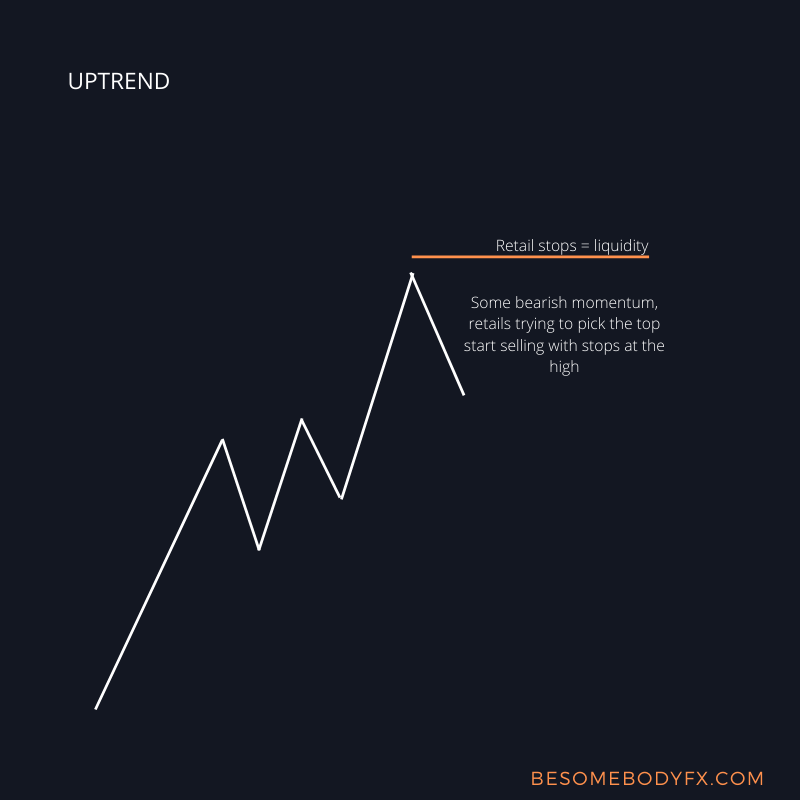

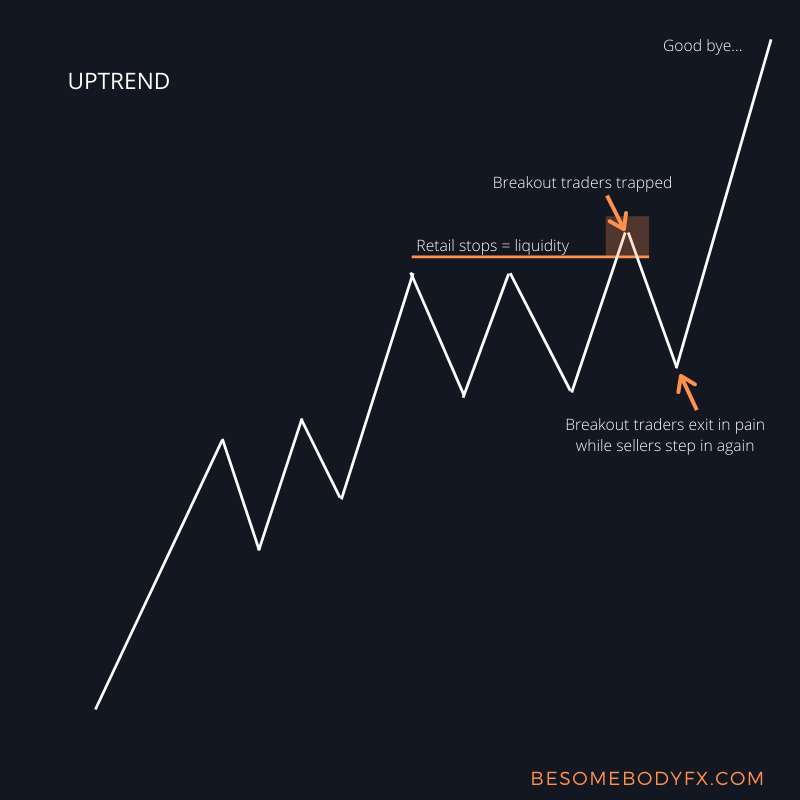

In the short term we expect a tactical push towards 50k…

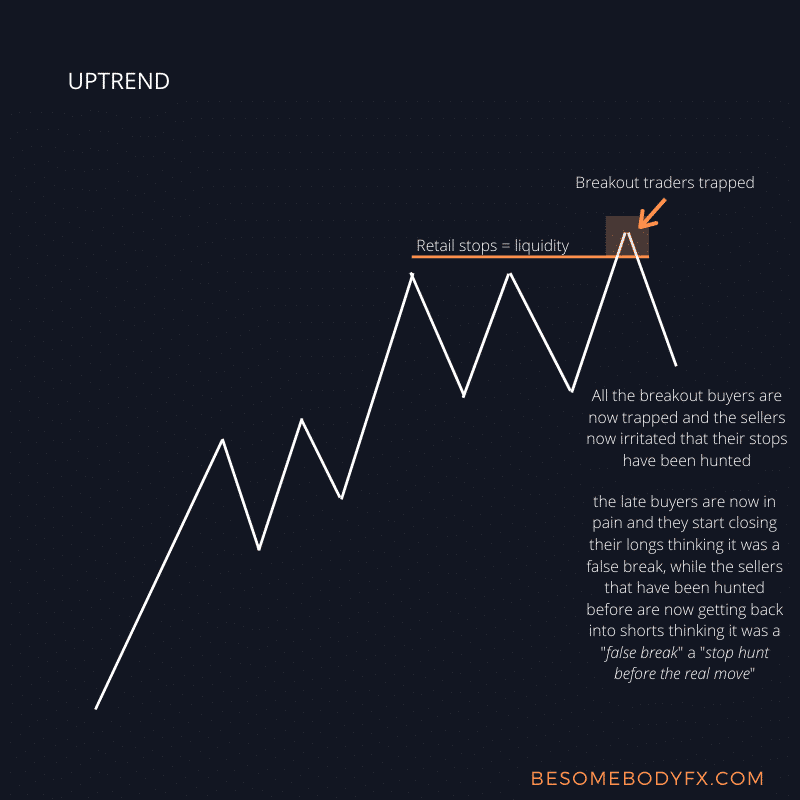

But those types of rallies are likely to be met with strong sellers at one point or another, and dips WON’T be met with strong buyers UNTIL the macro conditions become favorable again.

That is to say…

Bounces will happen, yes… but the next major bull run to 100k and beyond needs the macro conditions to be favorable to truly start.

The “volatility” is FAR from over and ATHs will be hard to achieve with a quantitative tightening regime starting in May.

Here are THE points to keep in mind:

The real growth slowdown has YET to start, all we have seen so far is just a glimpse of volatility…

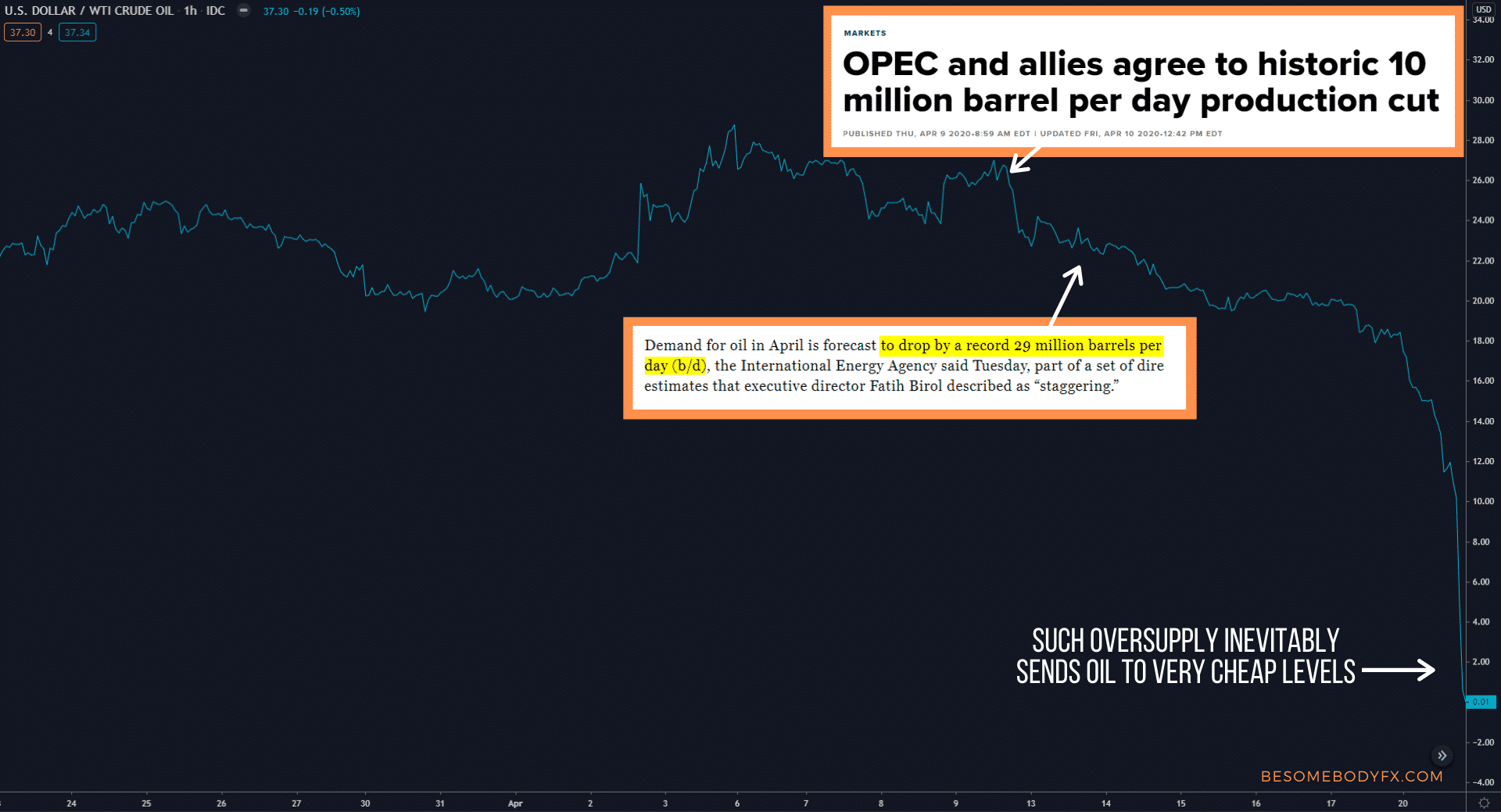

The impact of the recent geopolitical developments in energy prices has YET to hit the economy, and crypto is NOT a safe haven.

The CPI and the economic numbers we are seeing right now are NOT representatives of the huge surge in energy and commodity prices post Ukraine invasion.

Meaning the FED will be faced with even higher inflation numbers that will persuade them to go ahead with aggressive tightening with 50bps hikes and QT operations starting from May.

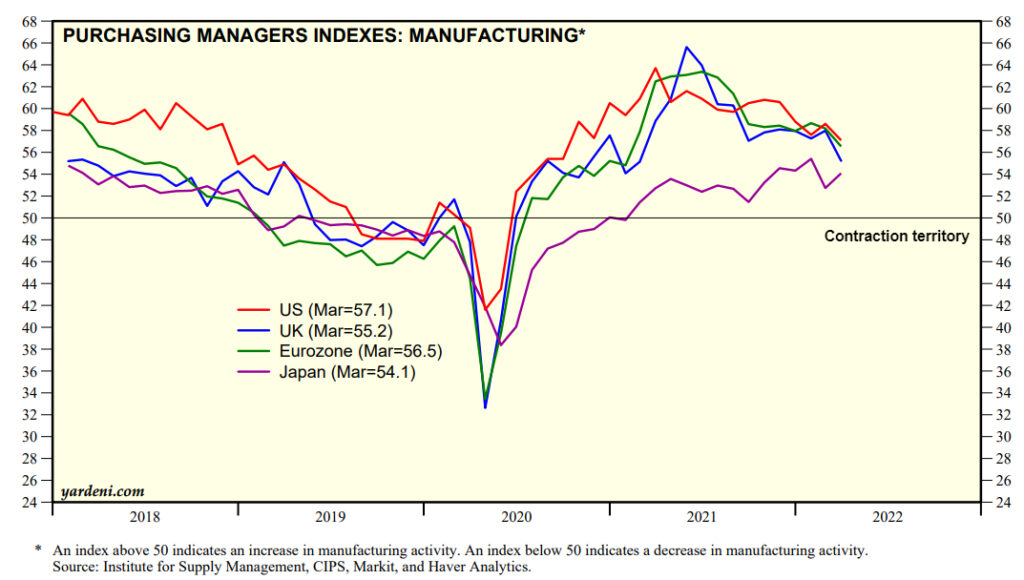

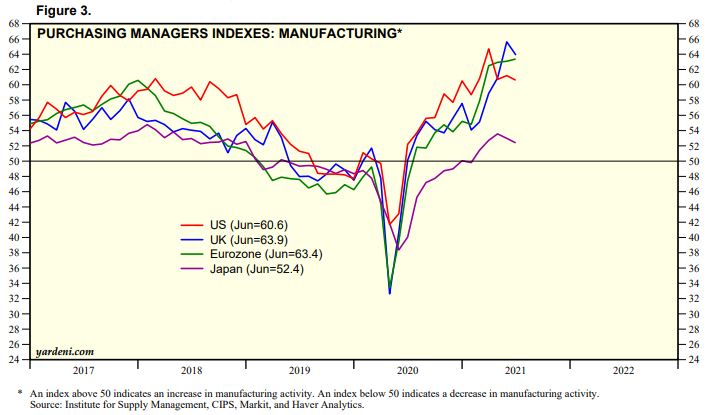

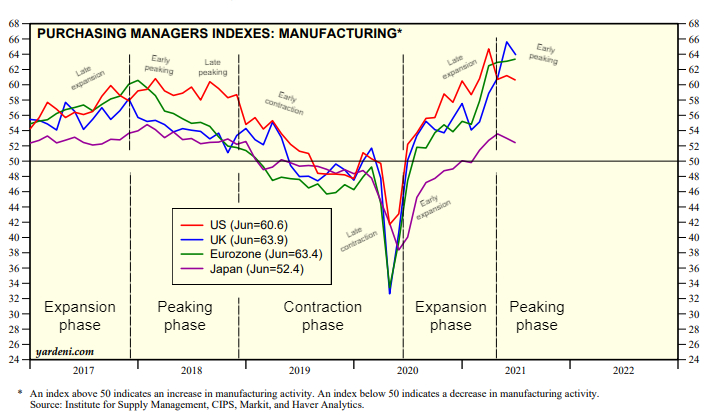

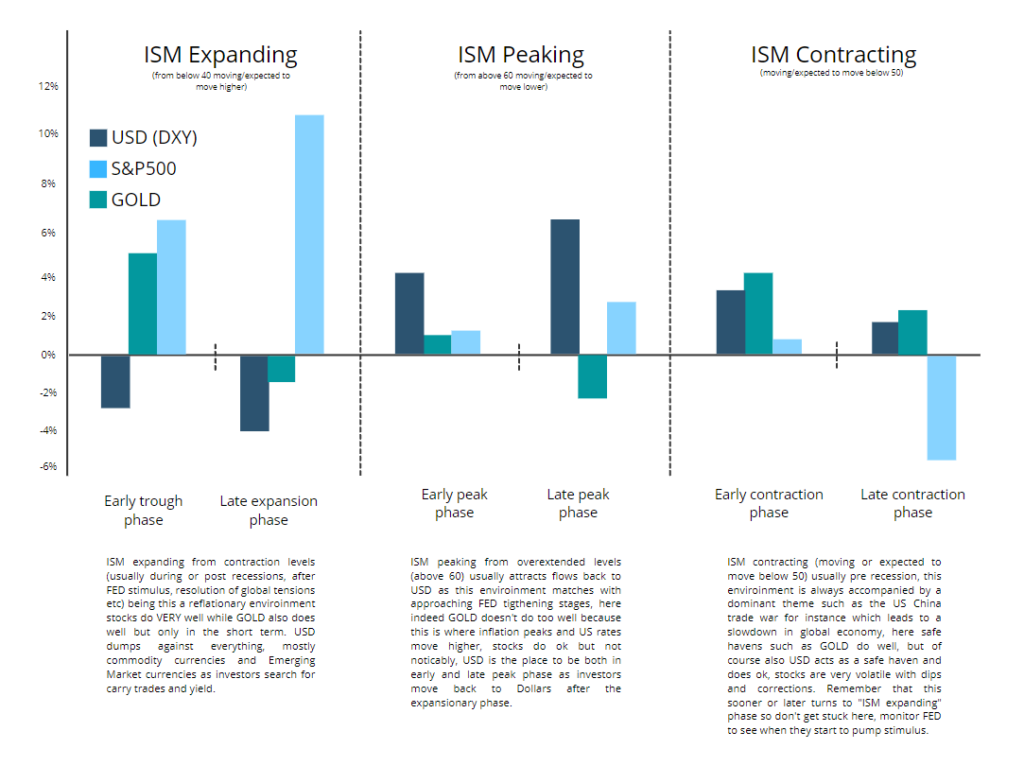

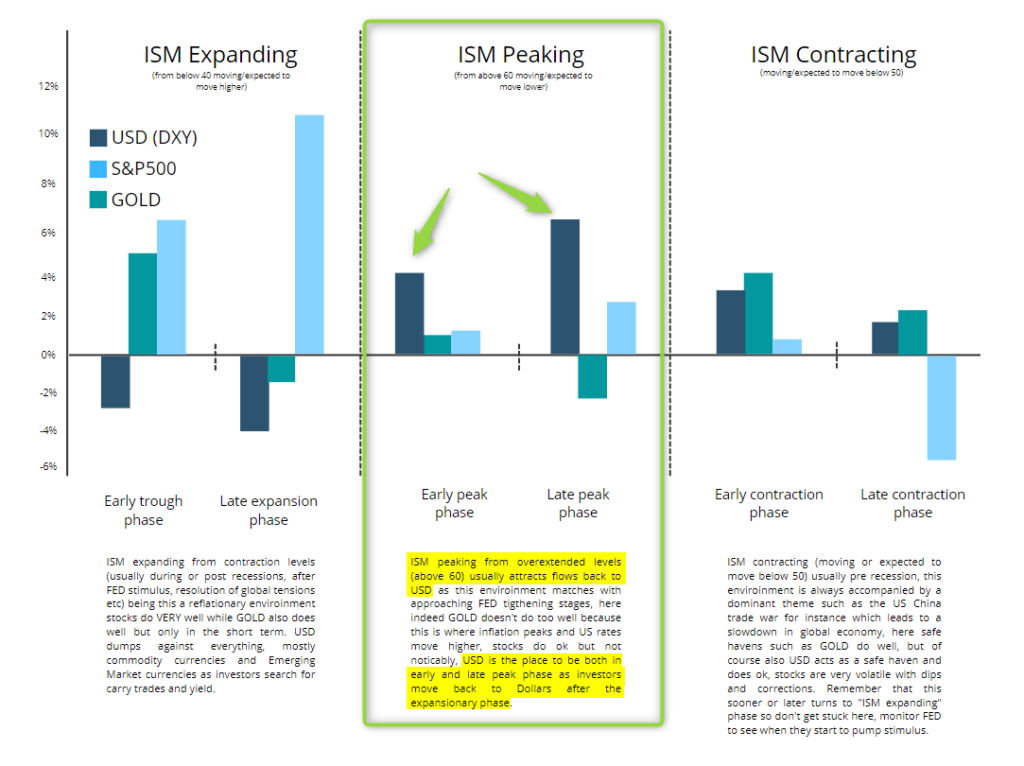

And in all this, Global PMIs (one of our favorite leading indicators) over the next couple of Quarters are likely to head into contraction territory.

In it itself this wouldn’t be bearish crypto, but the aggressive tightening from the FED coupled with global growth slowing is a recipe for OUTFLOWS from risk assets such as crypto.

So, here’s the conclusion and the key takeaway you should bring home from this crypto global macro update:

The REAL buying opportunity across the board in crypto has YET to come.

So far the FED is in bulldozer mode, ready to smash everything in order to bring inflation back to “acceptable” levels.

Let that be, don’t fight the FED…

Then, when the committee decides to… stop tightening, then, at that point, the boat can be loaded with crypto for the next bull run to 100k and beyond.

That’s all there’s to say, the KEY takeaway?

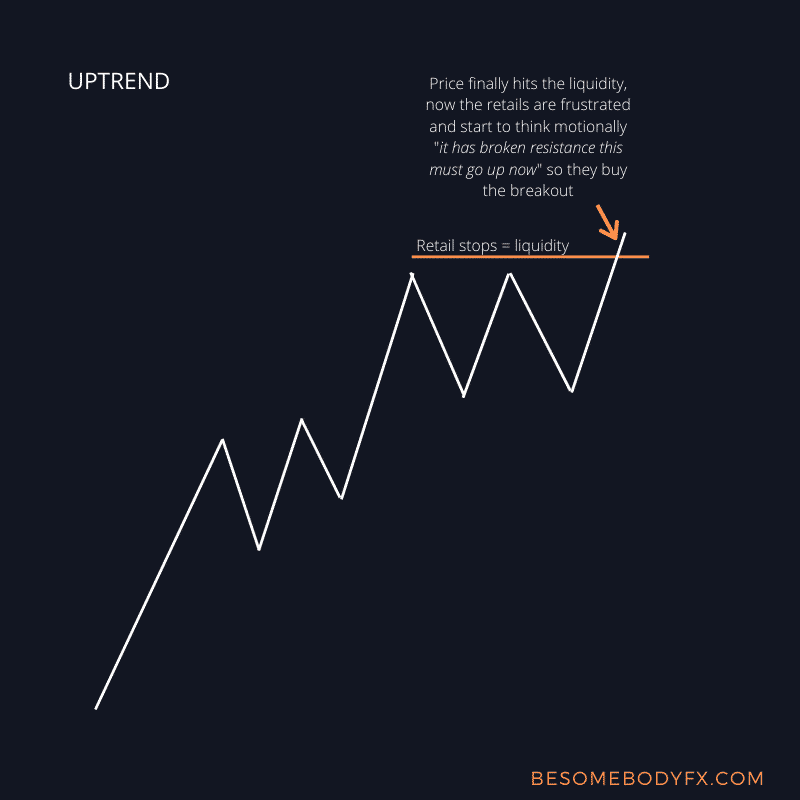

Don’t buy the dip too early, don’t FOMO at resistance, there will be new lows made in crypto before new ATHs, watch the FED.

I hope you found this a valuable read, and if you didn’t… that probably means you bought BTC at 60k.

Nothing wrong with that as long as you have a wide enough time horizon…

The time for BTC and the whole crypto market to break to new highs will come, there’s no question about it.

But purely based on the current and upcoming global macro conditions, it’s NOT that time yet.

We will update it with a new crypto global macro in the first week of Q3. You may want to leave us your email down below to get alerted when we publish it.

Cheers,

Jay from the BeSomebodyFX Team

.

.