Trades

BESOMEBODYFX

CRYPTO GLOBAL MACRO Q4 2022

BEARISH IT WAS AND BEARISH IT REMAINS, FROM A MACRO PERSPERCTIVE THERE’S NO BOTTOM FOR CRYPTO on the horizon, YEt.

There’s just ONE key comment from Powell that you need to keep in mind in order to understand the current macroeconomic context:

“Will keep at it until we are confident the job is done.”

The “will keep at it” means they will continue to hike rates aggressively, and the “until we are confident the job is done” means until inflation shows meaningful signs that it’s slowing down.

It’s a pretty straightforward message from Powell to say that even if growth continues to slow down, they will keep on tighten monetary policy aggressively until they are confident the “job is done” against inflation.

In other words, for the time being, you can keep ignoring the “up only” crypto gurus out there.

The macros story remains bearish:

As we have been repeating in the previous crypto update and in the one before as well when BTC was around 45k, the macro context is that…

There’s no bottom in crypto until the FED turns. There’s no technical support that will hold until the FED turns. And there’s no level to load positions until the FED turns.

Powell’s current guidance does NOT leave any room yet for that “FED pivot” that can seal a bottom in crypto.

Thus… if you want to start buying for the next major bull run, this is still NOT the right macro environment YET.

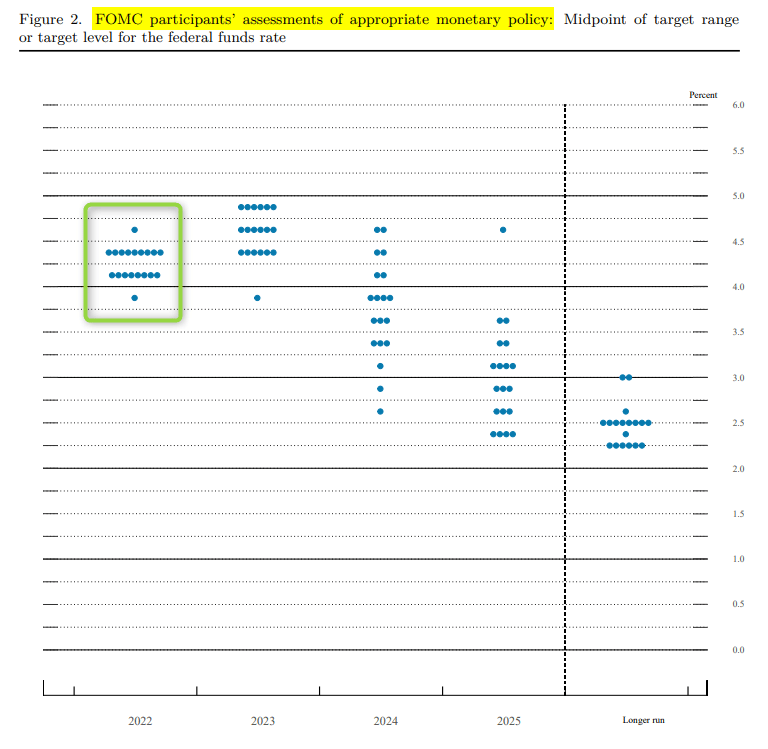

The “path of least resistance” for crypto remains lower, and based on September’s dot plot from the FED we see that the board expects another 125bps worth of hikes over the next two FOMCs.

Which means they want to hike another 75bps at the November’s FOMC, and then possibly MAYBE slow down to 50bps in December.

In case you don’t know… The dot plot is an illustration of the personal expectation from each FED official of where the FED fund rate should be at specific points in time, and each dot represents each FED official’s expectations.

It is NOT a reliable indication of where interest rates will be. But it still allows us to know what the FED’s board consensus is.

And with the dot plot in mind, it’s evident, the FED is highly committed to keeping policy tight for as long as needed with large hikes and QT operations to reduce the size of their balance sheet.

In other words, another 75bps hike in November is another BIG interest rate hike, and 50bps in December is still big too. And all this while QT operations are now ongoing at full size:

QT pace is doubling…

— BeSomebodyFX (@BeSomebodyFX) September 1, 2022

As per schedule, the FED started it back in June and now it ramps up in size from September. Does it matter? Yes…#Bitcoin #DXY #USDOLLAR

If you want to understand more about Quantitative Tightening and its impact on markets we have written about that already.

All this aggressive tightening is NOT going to help crypto bulls, at all:

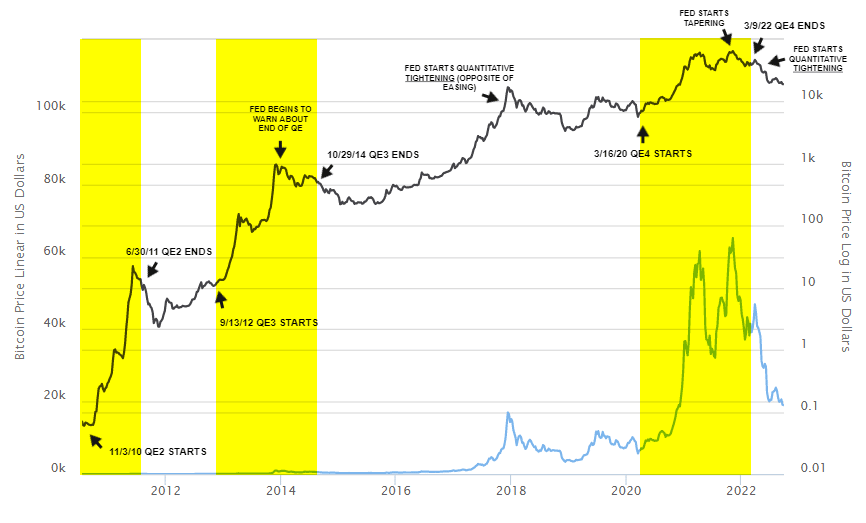

Cryptocurrencies are simply high beta assets, and like any other asset they fluctuate based on monetary policy and the macroeconomic context…

The bottom at 3k back in 2020 was not random…

The top at 60k was not random, and the whole move lower back to 20k neither…

Shifts in FED’s monetary policy, and specifically balance sheet adjustments, are always behind tops and bottoms across the crypto market:

All this to simply say that those same macro reasons that brought BTC from 60k to 20k are still there rocking…

The QT operations to reduce the size of the balance sheet are ongoing at a rapid pace. Inflation has NOT shown easing signs yet. The FED will deliver another 75bps hike in November, and the world is grinding into a recession.

That’s all bearish…

Does this mean that we can see BTC below 10k again?

Yes, for how the macroeconomic context looks right now, it’s a highly likely possibility.

As long the FED keeps going with their aggressive monetary policy tightening, BTC won’t bottom, and there’s no dip to buy, YET.

In simple, any downside target is possible as long as the FED keeps tightening monetary policy aggressively.

For BTC and the whole crypto market to bottom, inflation needs to show meaningful signs of slowing down, which would result in the FED slowing down to smaller 25bps hike.

I repeat…

There IS a scenario where BTC bottoms this quarter, but it involves inflation cooling down meaningfully and the FED slowing their tightening to smaller 25bps hikes.

IF that happens, BTC can bottom…

But at the moment, it’s NOT a likely scenario as inflation is still too high and the FED is expected to deliver another large 75bps hike in November, and 50bps in December.

Remember…

The price you see on your favorite crypto chart it’s NOT a good indication of whether it’s time to buy. Don’t be the one that thinks BTC is “cheap” because it’s back at 20k…

It’s NOT the price that says when BTC bottoms, it’s the macroeconomic context. And that says it’s still NO time to buy dips. There will be pullbacks higher, yes, but the trend will remain bearish.

That’s everything, we will update on our views with a new crypto global macro in the first week of 2023. You may want to leave us your email down below to get alerted when we publish it.