Trades

BESOMEBODYFX

CRYPTO GLOBAL MACRO Q3 2022

Inflation is ramping, the FED will deliver another 75bps hike at the next FOMC, and QT is ongoing, again, don’t listen to the “up only” crypto guru, listen to the macro environment

BTC was at 60k earlier this year and it’s now more than halved down at 20k is that enough of a reason to long?

Obviously NOT, that’s how the average “up only” crypto guru thinks. You are smarter than that, right?

RIGHT…

Thank you for all the great feedback that we received on the previous Crypto global macro. If that has helped you make some intelligent decisions with your crypto portfolio and kept you away from reckless uneducated dip buying, that was a great success.

Now it’s time for another crypto update…

BTC was at 44k when we published the previous note, and it’s now at 20k, so the question to ask is…

HAS ANYTHING CHANGED TO SAY IT’S OK TO TURN BULLISH?

Short answer… No.

Longer answer… Absolutely not.

If we look at the FED’s current monetary policy, but more importantly, forward looking monetary policy expectations.

We still see an extremely hawkish FED committed to raising rates and tightening markets’ liquidity with ongoing Quantitative Tightening.

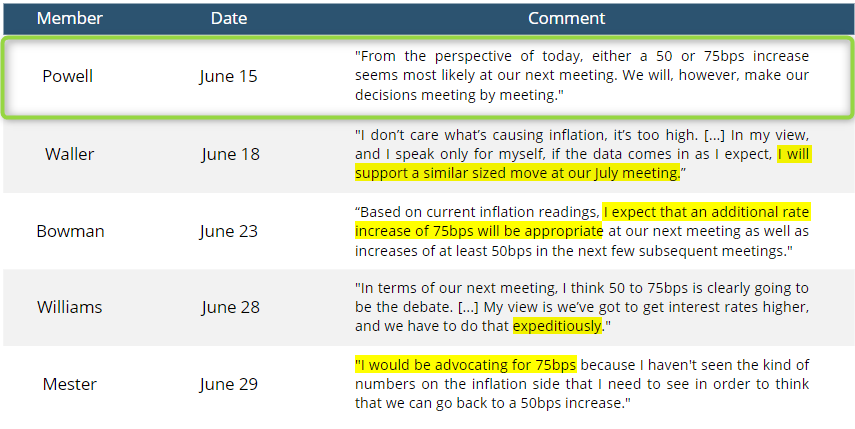

Below you can find the most recent comments from FED officials, and the consensus is clear, bring inflation down…

That keeps crypto in a bearish regime…

And as we mentioned already in the previous update, and also as you should have realized by now, the FED’s monetary policy actions DO matter for cryptocurrencies too.

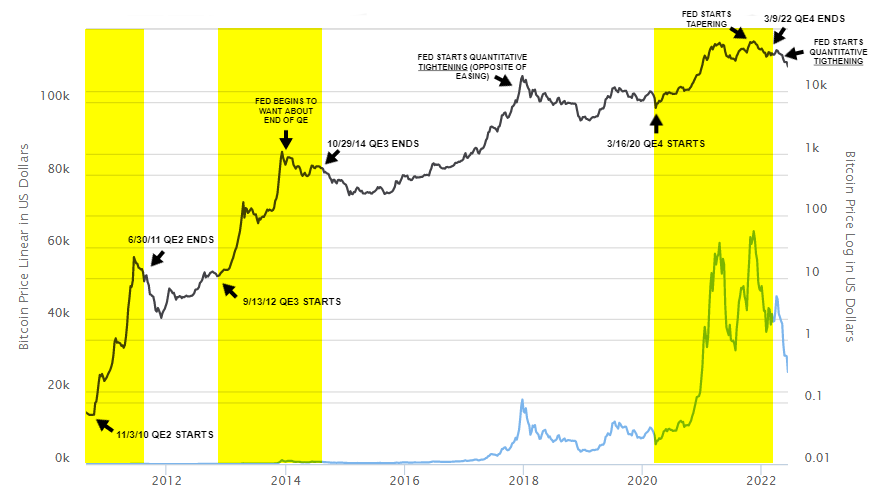

Below you can see a BTC chart with annotated the various monetary policy regimes…

BTC and your favorite crypto in terms of price fluctuations are just extremely high beta assets, tied to global liquidity conditions and thus monetary policy.

If you want to know more about the FED’s balance sheet and monetary policy influence on global markets, check this.

THE POINT IS…

We understand the FED and how its monetary policies affect global markets, crypto included.

And we know that, for the time being, the FED is still early in its tightening path, and they have no intentions to pivot until inflation pivots lower.

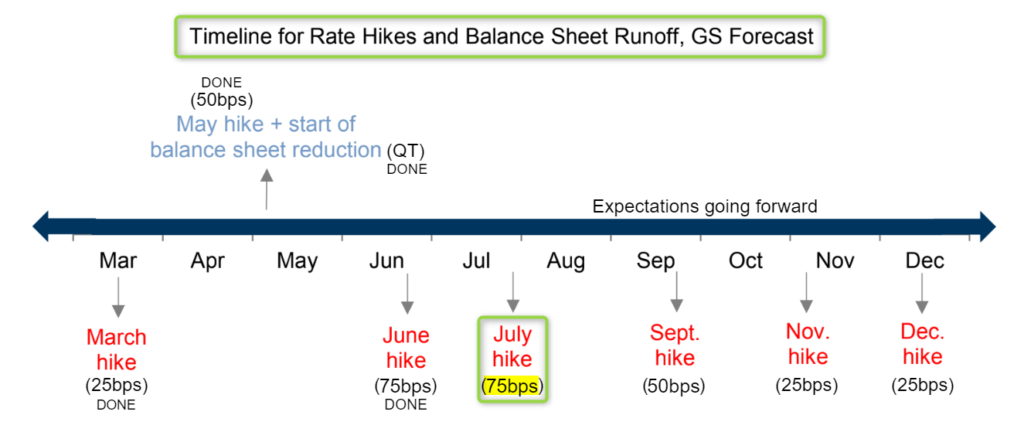

Here’s the current expected monetary policy path based on the recent forward guidance…

Another 75bps hike at the next FOMC, then 50bps, and only then, maybe back to 25bps…

This is aggressive tightening, and can easily can more aggressive if inflation keeps surprising expectations.

For that exact reason, in the previous update, we talked about the expectation for lower prices across the crypto market.

The context of an aggressive tightening from the FED, the elevated sticky inflation, and the shaky global conditions, was all one needed to know that global markets were losing support, crypto included.

Now, has anything changed?

Yes, but not in a bullish sense.

Inflation is proving to be even stickier than expected at the moment, as a result, the FED is proving to be even more aggressive than expected with 75bps hikes now regular activity. And the “global recession” words beginning to get popular.

That means there are two important macro points that you need to keep in mind for the quarter:

- Bitcoin is a risk asset with many unique properties. But it’s still a risk asset, NOT a safe haven… so a global recession will be first bearish crypto and then bullish ONLY… and I highlight, ONLY when the FED steps in to support markets.

- The FED for the time being has NO intention to support markets even in a recession scenario. Inflation is their top priority and they need lower asset prices to lower it. You can’t support asset prices and fight sticky inflation at the same time.

Is that a straightforward enough picture?

Inflation at the moment dictates the FED’s decisions.

And if inflation does NOT move lower substantially, the FED will relentlessly keep pushing with continuous large (50bps and 75bps) rate hikes and QT operations.

The point is…

We follow the FED, we understand the macro regime, and the FED is still nowhere near pivoting for the time being.

The FED has just recently started tightening, there are two more 50bps hikes approaching, 75bps if needed, and in all this, QT begins to ramp up in June...

— BeSomebodyFX (@BeSomebodyFX) May 12, 2022

The “dovish pivot” is not on the horizon yet, don’t be stubborn#Bitcoin #BTCUSD #BTC

We are still in the early phases of the FED tightening path.

And while there could be some bounces here and there, the overall context won’t change until inflation fades meaningfully.

So if you are looking to buy dips, remember that in this environment the “path of least resistance” remains lower.

And it’s NOT about WHERE to buy the dip, it’s about WHEN to buy the dip.

In other words…

It’s NOT about at what support level to buy the dip, it’s about at what time the macro conditions will become favorable to buy the dip.

Price is NOT an indication of where your favorite cryptocurrency should bottom. Sure, you can look at technical structures and find support zones…

But think about how many supports you thought were going to hold have been breached one after the other?

There is NO support that will hold while the FED continues to tighten monetary policy aggressively.

I’m telling you…

If you want to nail the crypto bottom, don’t think about the chart and its technical details. But rather think about macro fundamentals (mainly FED’s monetary policy) and their implications for global markets.

Because when you see crypto bouncing and you feel the FOMO to go long, the KEY question to ask is…

Has anything changed fundamentally to start a bull run, a sustained, prolonged, and meaningful bull run?

Add that “macro fundamentals” thinking to your decision making, and you will be better and smarter than the average crypto guru out there.

That’s everything, it’s NOT time to buy dips yet, we will update on our views with a new crypto global macro in the first week of Q4. You may want to leave us your email down below to get alerted when we publish it.

Cheers,

Jay from the BeSomebodyFX Team