Trades

BESOMEBODYFX

CRYPTO GLOBAL MACRO Q1 2023

BULLISH SCENARIO APPEARS ON THE HORIZON BUT DON’T GET TOO EXCITED YET.

With FED policy slowing down, there are some valid arguments to start being bullish on BTC. We are seeing some early indications that the bottom is near…

But DON’T get too excited just yet, because “near” doesn’t mean “right now”.

Let’s say, the bottom is in the process of being created, but we are still quite EARLY in that process and a test of 10k is always well on the table. Let me explain…

Usually, after bear markets and before major bottoms, there’s some sort of capitulation. In other words, a strong flush lower that hits longs in the right spot… to then bottom and start a bull market.

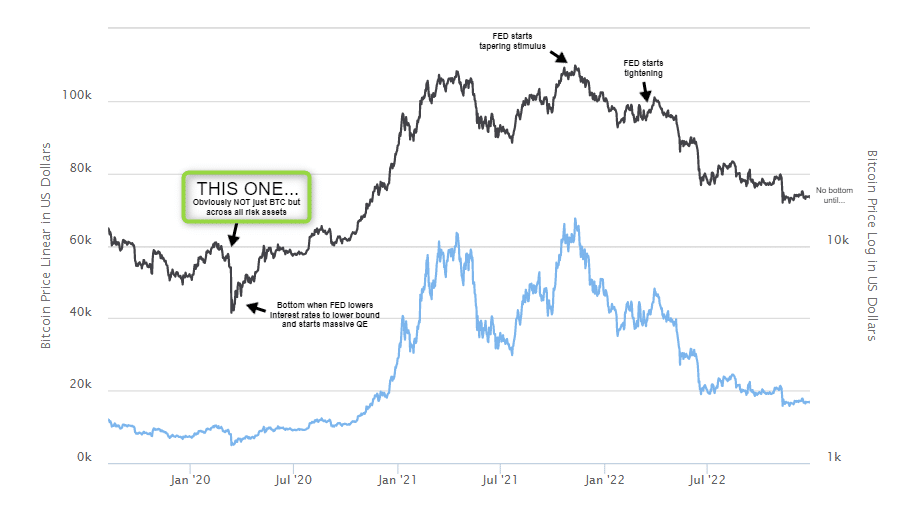

Yes, the early 2020 type of capitulation:

That bearish part of the cycle is usually because of a recession or growth concerns, after a FED tightening cycle.

Did you notice the “after a FED tightening” highlighted?

There’s a reason why it’s highlighted, here’s what you need to know now…

The CURRENT macro story:

On the previous crypto update and basically since the start of 2022 we have been bearish on crypto because of the aggressive monetary policy tightening from the FED and other central banks around the world.

But now the story about the crypto bearishness because of FED tightening has been done already, that’s now old stuff as the FED slowly turns to a more cautious approach with slower rate hikes.

But wait a second…

I know what you thinking… at this point, naturally you are thinking that since the FED is now finally slowing the size of the rate hikes it’s a good time to buy the dip, right?

If so, you would be partially correct BUT fundamentally early…

Let me explain you the reason…

From here, what you must keep in mind is that BTC is a risk asset… an ultra super volatile risk asset, but always a risk asset, like stocks.

BTC is a risk asset, a high beta risk asset, NOT a safe haven, keep that in mind#BTCUSD #Bitcoin #BTC

— BeSomebodyFX (@BeSomebodyFX) December 16, 2022

And risk assets are NOT only driven by monetary policy but by growth expectations too. This means that if a FED pause in rate hikes is followed by a recession, BTC will still struggle to find a bottom.

Yes, you read that right… a pivot in FED’s stance alone is NOT enough to seal a bottom for crypto.

A rebound in economic activity along with the FED pivot is also needed for BTC and crypto to be able to mark a macro bottom, what we call… soft landing.

Think about this way…

A FED pause in rate hikes without a recession, which is what we technically call soft landing, IS bullish crypto.

While a FED pause in rate hikes followed by a recession is NOT bullish crypto. At least not until the FED lowers interest rates enough and starts pumping some more stimulus.

Ok, let’s get to the point…

All this to say that, in a potential recession, DON’T expect crypto to act as a safe haven. The safe haven will be GOLD, not BTC… keep that in mind.

Now, back to the macro context…

What’s next from the FED:

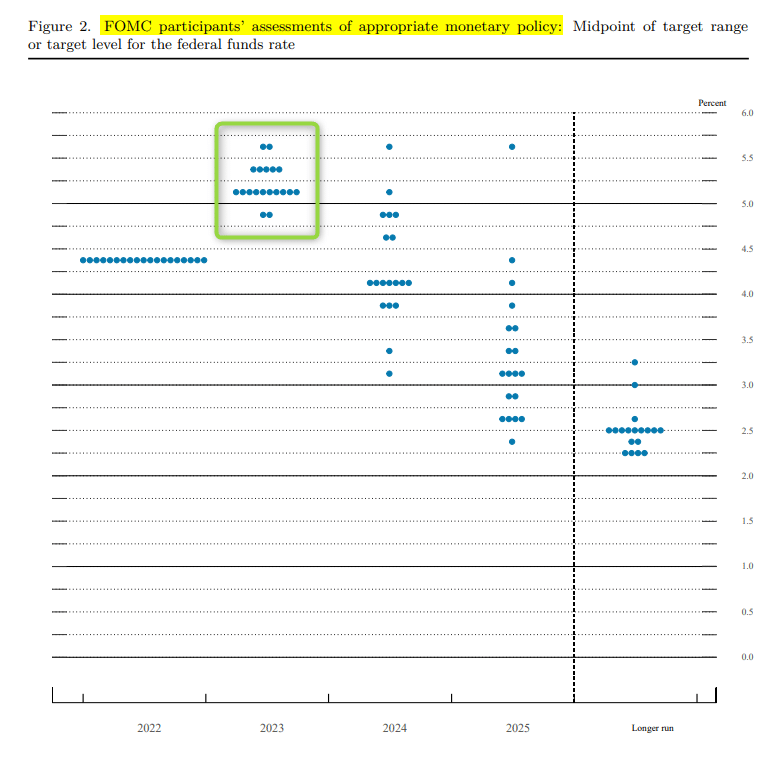

The FED is about to slow down to smaller rate hikes. From their latest dot plot we can see a median consensus for another three but smaller 25bps hikes this year:

The dot plot shows the median sitting at 5.25% interest rate, so at the expected slower pace of 25bps that’s another 3 hikes from current levels.

In simpler words, the FED expects to slow down the tightening path and hike just 3 more times before holding steady.

And I know what you thinking… FED officials can be awful forecasters of where rates will go.

Yes, without a doubt, that’s true…

But we don’t really watch the exact number of hikes they expect. Instead, we take note of whether they expect a slowdown of the tightening pace anytime soon or not.

And at the moment yes, they do…

The latest dot plot median consensus tells us that the FED is ready to go slower, and wants to go slower. That’s the sentiment to take away from it.

slower rate hikes but still not buying dips?

And that BUT is the “soft landing” part of the equation, that’s the unknown.

As discussed above, after a tightening cycle, the matter for risk assets is whether the economy can hold steady without a recession or not. And while we don’t like to anticipate and forecasts recessions we can say that most of the classic leading indicators at the moment are pointing to a global recession.

In other words… in our view, the facts continue to say that it’s still time to stay relatively cautious on crypto and avoid jumping into dip buying, just yet. There will be even better levels to load soon, we are thinking 10k and possibly an overshoot lower than 10k too.

What you should know:

We have been bearish crypto all the way through 2022, we turned bearish at around 45k as the FED started to tighten monetary policy and we have been bearish all the way down to current levels.

And right now we can continue to say that… it’s still NOT time to buy the dip. At least not yet, not with the current macroeconomic conditions.

Yes, without a doubt, we can see that a bullish scenario is forming on the horizon, but before that, there’s likely going to be another leg lower toward 10k.

Remember…

The price you see on your favorite crypto chart it’s NOT a good indication of whether it’s time to buy. Don’t be the one that thinks BTC is “cheap” because of the price its at… It’s NOT the price that says when BTC bottoms, it’s the macroeconomic context.

And that’s why keeping a constant eye on the FED is so important. Monetary policy creates both bull markets and bear ones.

The 2020 and 2021 bull market was caused by low interest rates and QE operations, what it’s called “easy monetary policy“. While the 2022 bear market by the complete opposite policy with higher interest rates and QT operations, what’s called “tight monetary policy“.

Now we are entering an entirely different macro regime for crypto and regular markets. It will be a target rich environment for short term trades and long term macro opportunities, get yourself around the right traders to trade with discipline and confidence.

That’s everything, we will update on our views with a new crypto global macro in the first week of Q2. You may want to leave us your email down below to get alerted when we publish it.