BESOMEBODYFX

BEST FOREX SIGNALS WITH FUNDAMENTAL ANALYSIS

this particular trading approach is often A PROFESSIONAL AND ADVANCED WAY TO TRADE, so HERE ARE THE BEST traders to follow BASED ON this trading style.

When it comes to signal providers there are a ton, but they are all based on classic technicals, so where can you find something different from that?

Well, the best traders that send the best fundamental analysis can be found on Telegram, and we have an excellent recommendation for that:

BeSomebodyFX is always the top recommendation as it’s the most professional and most accurate when it comes to trade recommendations.

But let me tell you more…

What you need to know about fundamentals:

Most of all, is that it’s NOT just about economic indicators, the same way technical analysis is not just about historical price movements and chart patterns.

There’s more to it for both.

You can read more about central banks and monetary policy to get started in the right direction if you want to understand more about the more detailed aspects of this trading approach.

With that said, what you need to know is this type of approach can be more complex and articulated than, for instance, the classic technicals.

That’s to say that, without a doubt, signal providers that share this type of professional insights need to be experienced and highly educated on the matter.

Otherwise, if you follow inexperienced traders, you are just going to get random and useless trade ideas based on the wrong takes.

So, who’s the best to follow?

The best fundamental analysis signal provider:

BeSomebodyFX is the number one for fundamental analysis signals for Forex on Telegram.

And it’s not just about the accuracy of the trades, it’s also about the professionalism and the education in the reccomendations and insights.

For instance, there are numerous traders to follow…

But most of them are more focused on technicals, meaning they operate only based on technical analysis.

And technical traders focus mainly on analyzing the charts, with things like chart patterns, price action, and such.

Which is ok, don’t get me wrong, it’s perfectly ok to approach the markets that way.

It’s alright.

But when you want a more complete and professional approach, fundamental analysis for Forex trading comes into play.

Now, this trading subject is often widely misunderstood.

Right?

Yes.

And I mean…

There’s a lot of content out there, but it’s not necessarily the correct one.

If you make a basic search on Google about the subject you will find mostly just basic information and basic education that just goes as far as explaining what interest rates are and what economic indicators are.

That’s what people teach as fundamentals.

They list the various economic indicators and they teach some basic concepts about interest rates, and that’s all.

But unsurprisingly, there’s a lot more to it.

The basics are great for beginners, of course.

But at one point you have to level up to the more advanced trading concepts.

But let’s define what we are talking about exactly…

What is Fundamental analysis in Forex trading:

As mentioned above, often you see and hear about this topic in the most basic and simplest way.

People talk about interest rates and economic indicators as all there is about it, but again, it’s NOT just about that.

The practical and useful way to think about this kind of approach it is to think about monetary policy and the global macroeconomic context.

It starts with central banks and their monetary policies in the macroeconomic environment.

Wait, it sounds complicated?

Sure, it’s NOT an easy subject.

An effective fundamental trade in Forex is both simple yet articulated at the same time.

And that’s exactly why following professional traders that properly show you how to analyze markets with this type of trading style is important.

And, as already mentioned…

BeSomebodyFX is the best to follow.

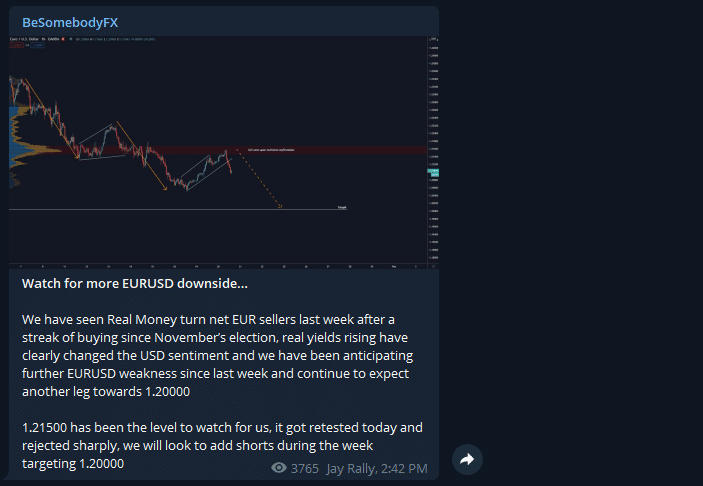

FOR INSTANCE, SEE THIS TRADE EXAMPLE:

What’s highly valuable is the explanations behind the idea.

In other words, the trades have solid research and details attached to explain each position.

It’s not just random signals…

That’s definitely the content that you should value as most useful and insightful for your trading because you can also learn how to trade with fundamental analysis from this kind of insights.

You know, the theory brings you so far, the practice is what really builds your experience and your knowledge.

Sure, it’s a clichè phrase, but it’s true.

So, get yourself around the right traders and start studying what they do and how they do it.

In simple, this is the kind of high quality information that you have to surround yourself with.

And this is the type of professionalism that you should follow if you are looking for high quality trade recommendations.

Makes sense?

Awesome.

And by the way…

Whether you are a swing trader or a short term trader it doesn’t make a difference, let me show you why…

Fundamental analysis and swing trading:

Trades with this type of approach are usually by nature swing trades, why?

Because they involve holding positions for medium to long term time horizons.

So that’s true.

But it’s NOT always true.

Obiously there are some short term positions to take with this type of market analysis that are quite profitable and professional.

A good trader, even if he prefers to take longer term positions, knows when there is a short term opportunity to take.

And if it’s high quality, he often takes it.

Or to put it differently… a good trader is open minded to both short term and longer term opportunities.

Also, an excellent swing trader combines both type of type of approaches to have the most info about a currency pair to make educated decisions with his positions.

In other words…

Swing trading is about medium to long term positions so it’s an approach that is different from intraday trading.

But a good trader knows how to adapt between the two styles together.

And, a more macro approach to trading can generate both intraday and swing opportunities, although the swings are by far the most common.

But let’s not make any confusion…

What you need to know is simply that to make effective swing trades you need both fundamentals and technicals.

Cool?

Alright.

And the point is that the top Forex Telegram channels for signals usually use both the two approaches, which gives greater accuracy and better consistency.

THE DIFFERENCE FROM other types of trading styles:

The difference between technical and fundamental trade reccomendations is simple…

Signals with technical analysis are based purely on the charts and the price action, while there is a lot more around the macro aspect of trading.

Here’s exactly what I mean…

Technicals are mainly about analyzing candlestick patterns, price action, patterns, market structures, and similar styles that are related to the analysis of the chart itself.

Meanwhile, trades with this particular approach are based mainly on macro fundamentals and then in addition they have some technicals too.

Because remember…

Technicals and fundamentals go hand in hand.

So it’s when you combine both that you get the most benefits.

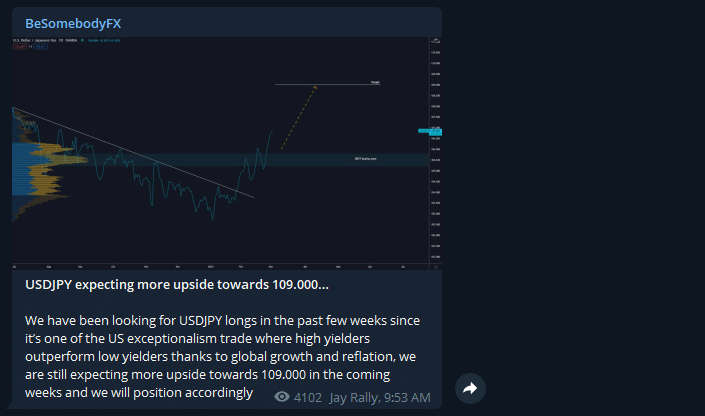

But let’s see a practical example of a trade:

See how it’s not just one type of approach or the other?

There is some technical analysis, but there’s also insightful details attached to it explaining why the currency pair should move in a specific direction.

When you combine both trading styles you find the sweet spot.

That’s the professional way of doing it, combining both styles to have a complete approach to the markets to trade it correctly.

And listen, I know what you may be thinking…

Fundamentals look complicated, right?

Well, not necessarily.

Let me show you what I mean…

How to understand trades with fundamental analysis:

There is one way to understand and learn this approach to trading.

You read, and you research what you don’t understand.

Sounds too simple?

Well, yes, it’s that simple.

But let me show you an example…

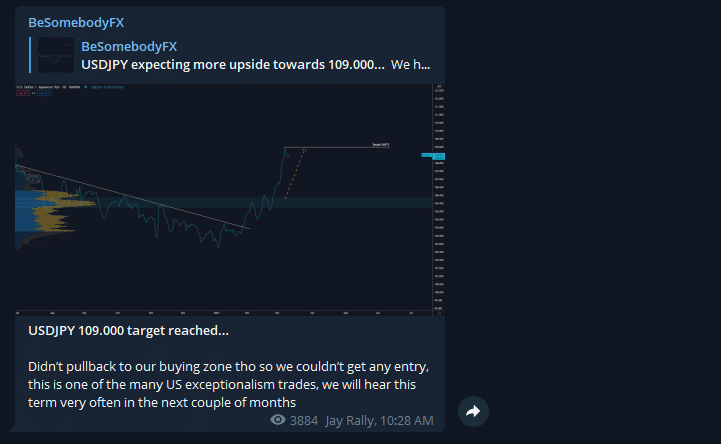

FOR INSTANCE, LET’S TAKE AS AN EXAMPLE THIS INSIGHT:

This one is pretty straightforward and it’s the update of the other trade shared above this one.

You may noticed that, for instance, on the insight attached with the analysis there can be some terms like “yields” or “interest rates” or similars that you don’t know about.

So, what do you do about it?

You get on Google or Youtube and you research the subject to understand it better.

And if still you don’t get it, then ask questions, take notes of what doesn’t make sense to you, and try to find a way to get your head around it.

That’s how you understand this type of trading.

If you are a beginner and you need to build up your knowledge.

Now, let’s get to the next subject…

Where to find Forex signals with fundamentals:

You can get trade reccomendations on many platforms but when we talk about this type of trading style specifically, you have to be more selective.

And as already mentioned…

The majority of signal providers are only focused on technicals.

So?

So if you are looking for price action analysis or technical charts and patterns you have plenty of traders that do that.

Some are more professional and some less.

But…

If you are looking for content that goes deeper into macroeconomics, and I mean the type of content that is accurate and educational, then you have to follow the very best Telegram groups for Forex.

There is average, and there is high quality.

The question now is…

How do you recognize the high quality ones from the rest?

How to find high quality trades:

Well, the rule of thumb is simple…

If a signal provider sends valuable trade ideas that you find useful and that you can use in your trading, that’s a great follow.

Whether it’s intraday or longer term that’s up to you, you know what style you prefer so adjust your following based on that.

For instance, if you are more of a swing trader you shouldn’t follow intraday trades. Simply, focus on a provider that has your preferred trading style.

Now, let’s recap…

What are the best Forex fundamental signals:

The best trades are the profitable ones, simple.

But also the educational and insightful ones.

Because signals are not just about following a random analysis. I mean, trade reccomendations are also about the education and the insightfulness of the idea itself.

That’s the very first differentiation between an average signal provider and one above average, the quality of the insights sent.

And what about professionalism?

Professionalism is also a very important aspect, of course.

On Telegram you have a lot of traders to follow, but few are professional and high quality.

Let me explain why professionalism matters…

It matters because a trader needs to be disciplined in his trading, and also insightful in his communication. When a trade idea is shared it needs to be precise and concise to illustrate the trading opportunity in all its important details.

See, this type of analysis is a bit more nuanced than technicals, thus it takes a bit more experience to be traded in the right way.

With that said, it’s obvious why professionalism matters.

Always, and I repeat, ALWAYS follow experienced and professional traders, it makes all the difference.

Above we have explained what are the best fundamental analysis signals in Forex trading and you also have a great recommendation to follow.

Now it’s time to get focused, remove the noise from the random signal providers, follow the best traders, and value the high quality fundamentals.