Trades

BESOMEBODYFX

A PRACTICAL GUIDE TO FOREX FUNDAMENTALS

WHAT’S THE BEST BOOK ABOUT TRADING WITH FUNDAMENTAL ANALYSIS?

I hear that question A LOT.

Traders need a SOLID textbook resource to understand fundamentals.

I get it.

And so I did it.

We have condensed all the fundamental knowledge you need in about 128 pages.

A book guide of 128 pages that teaches you the REAL fundamental analysis, NOT the average type of stuff that you can find anywhere else.

Real, practical, actionable fundamentals.

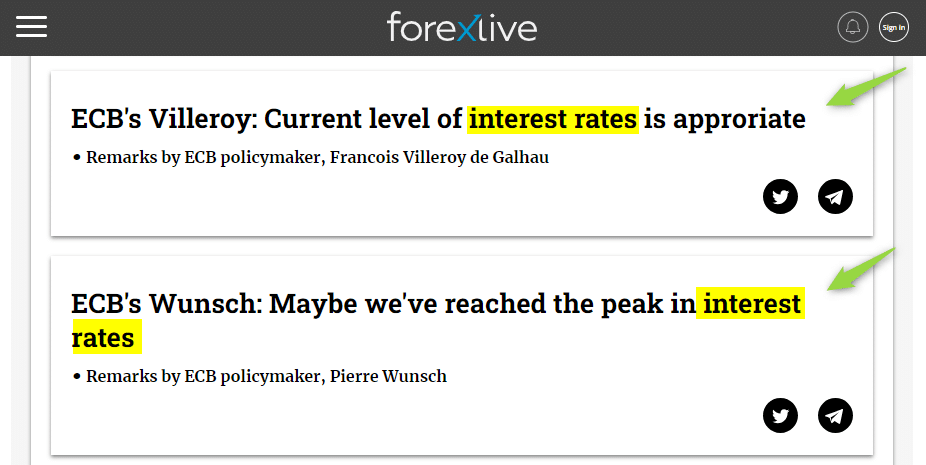

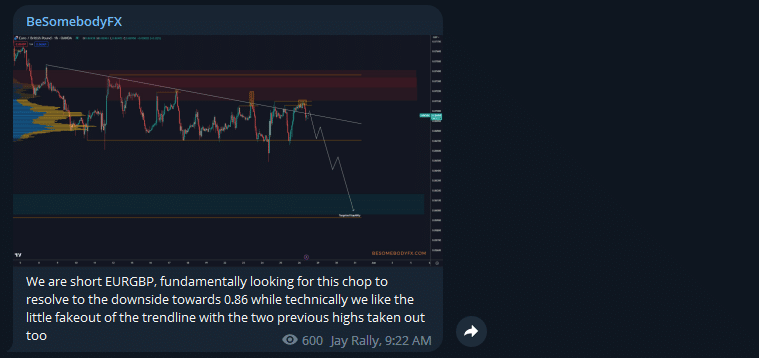

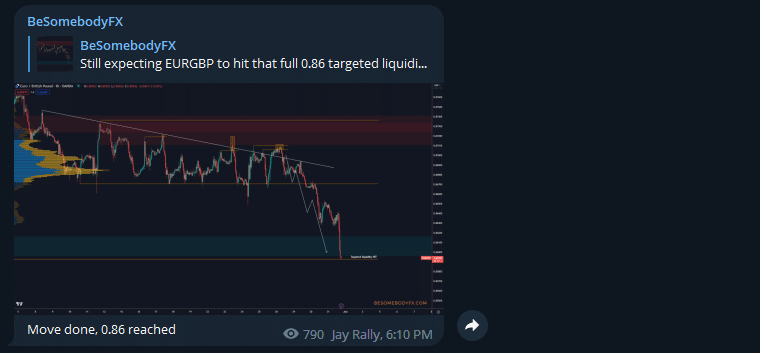

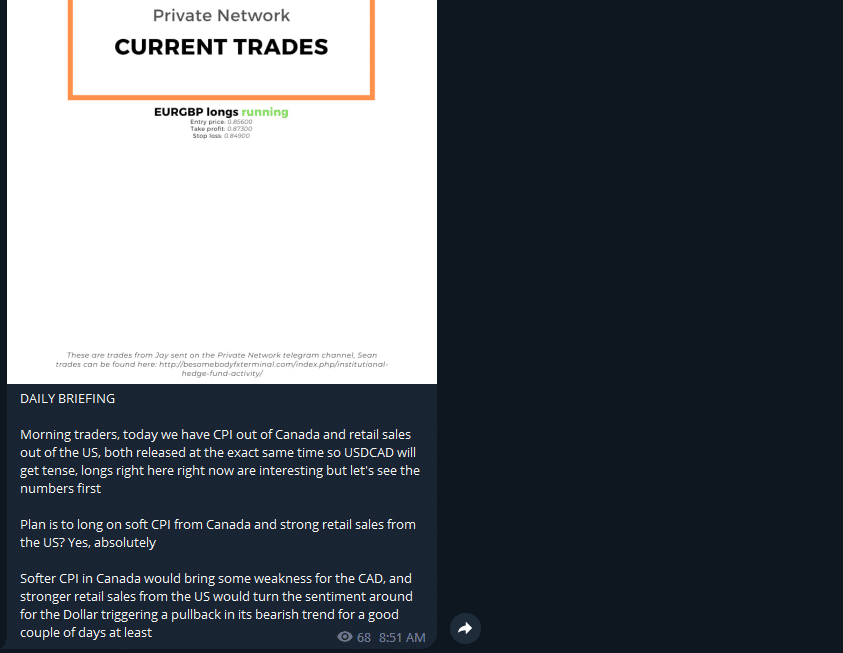

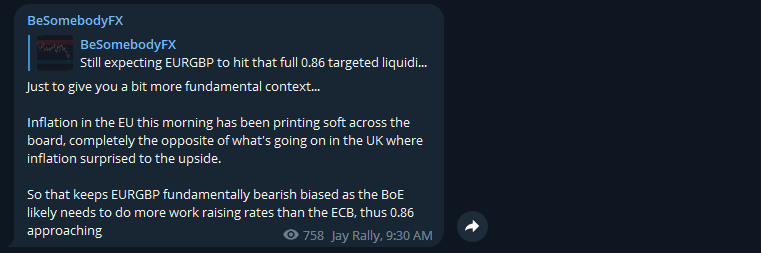

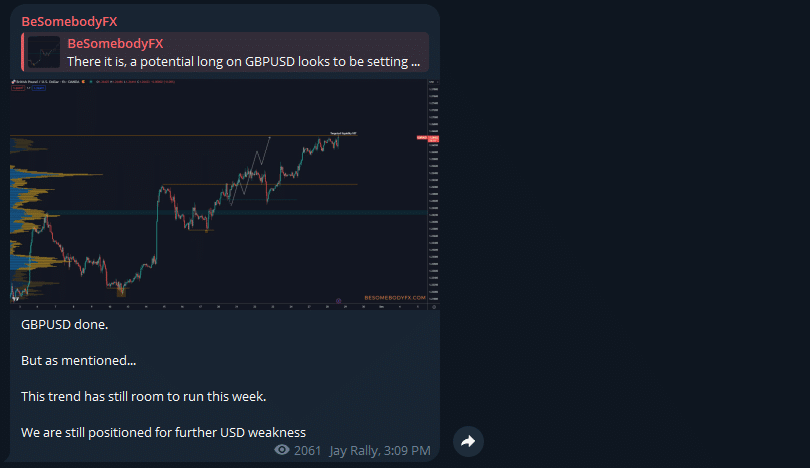

The ones we trade in our public Telegram channel to get trades like this:

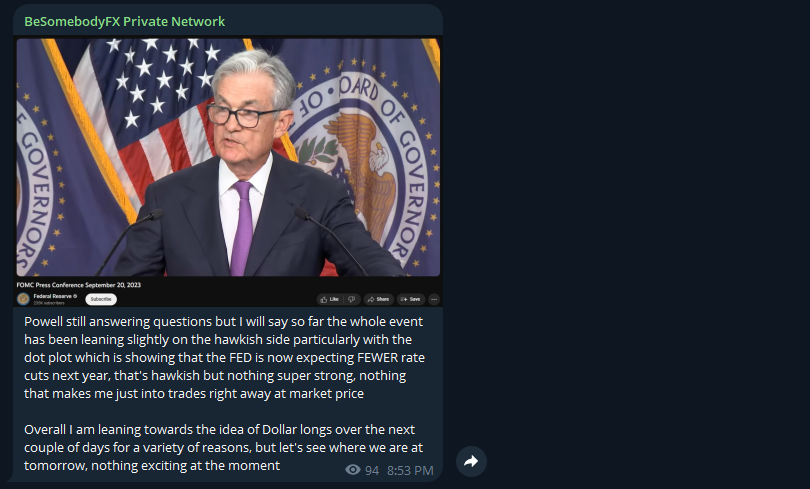

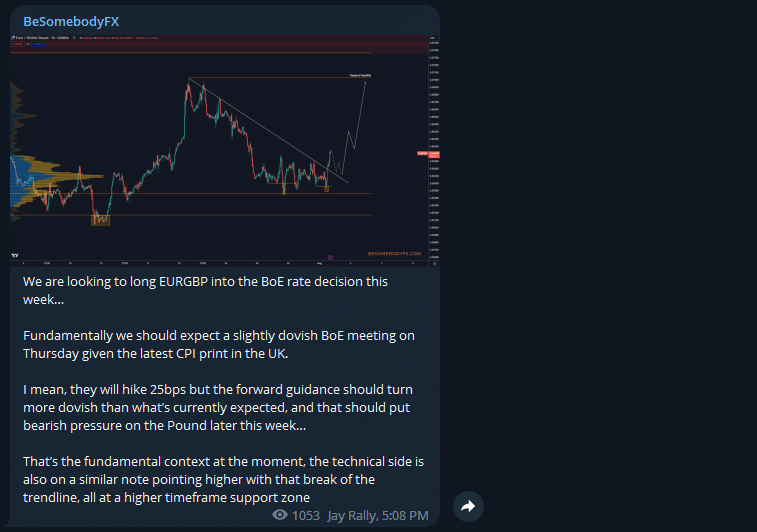

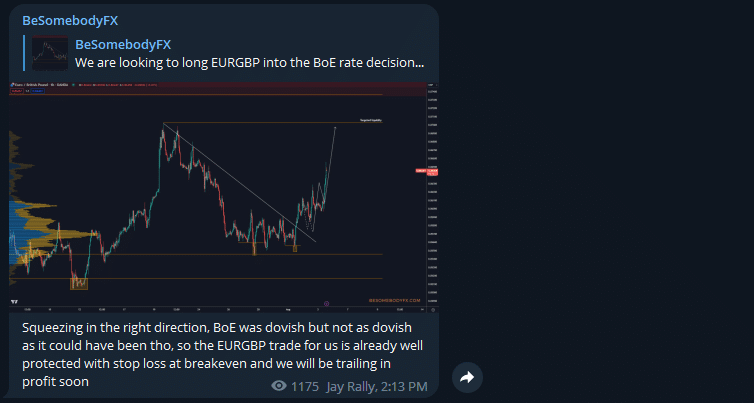

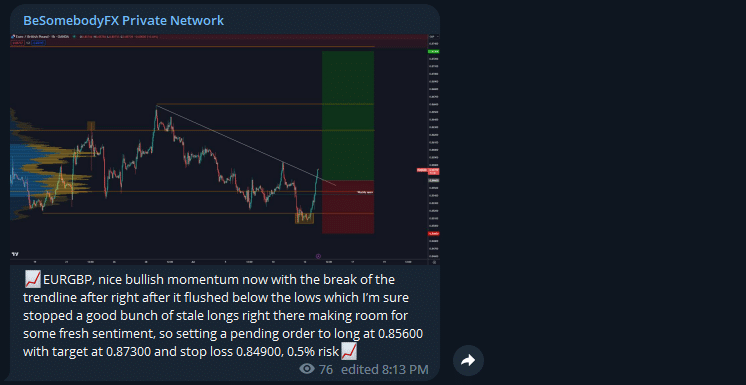

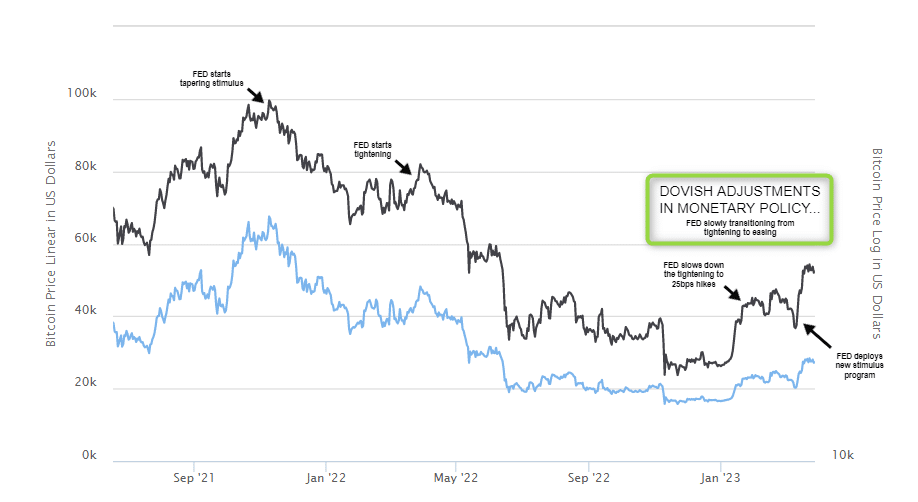

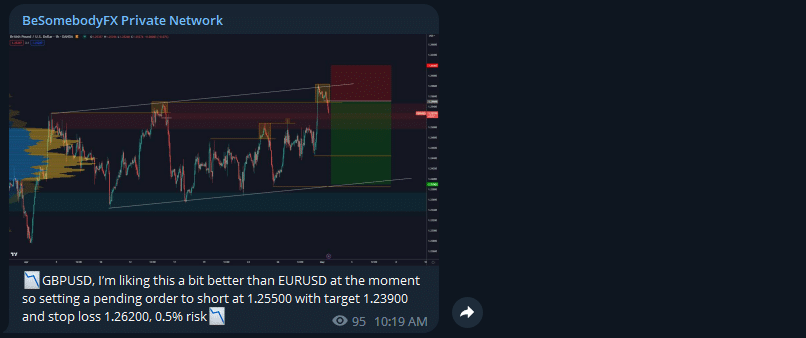

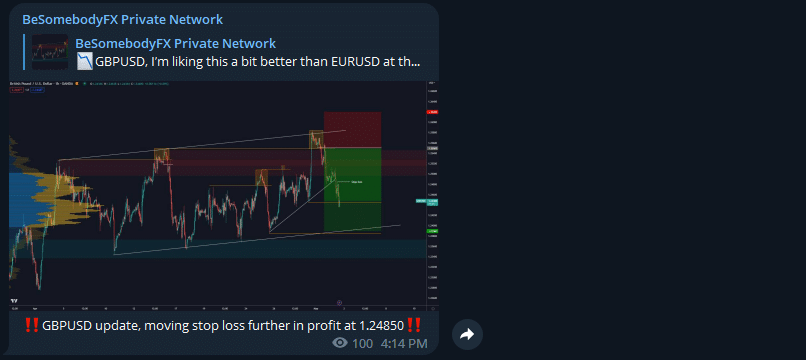

And also in the Private Network to get trades like this:

And I can go on and on with examples.

But the point is…

We have condensed all that knowledge at the price of just a regular book.

Literally, in about 128 pages you will get MORE than what you would find in any overpriced course out there.

For real.

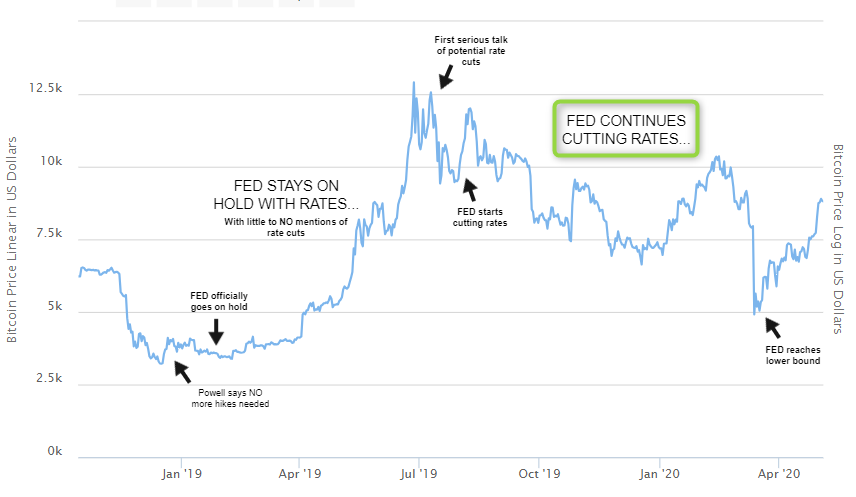

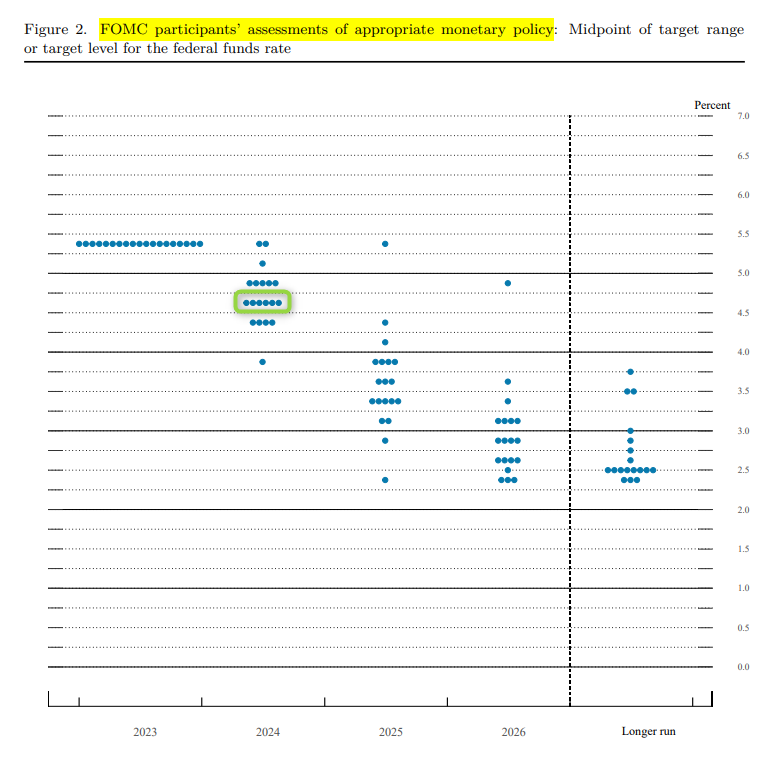

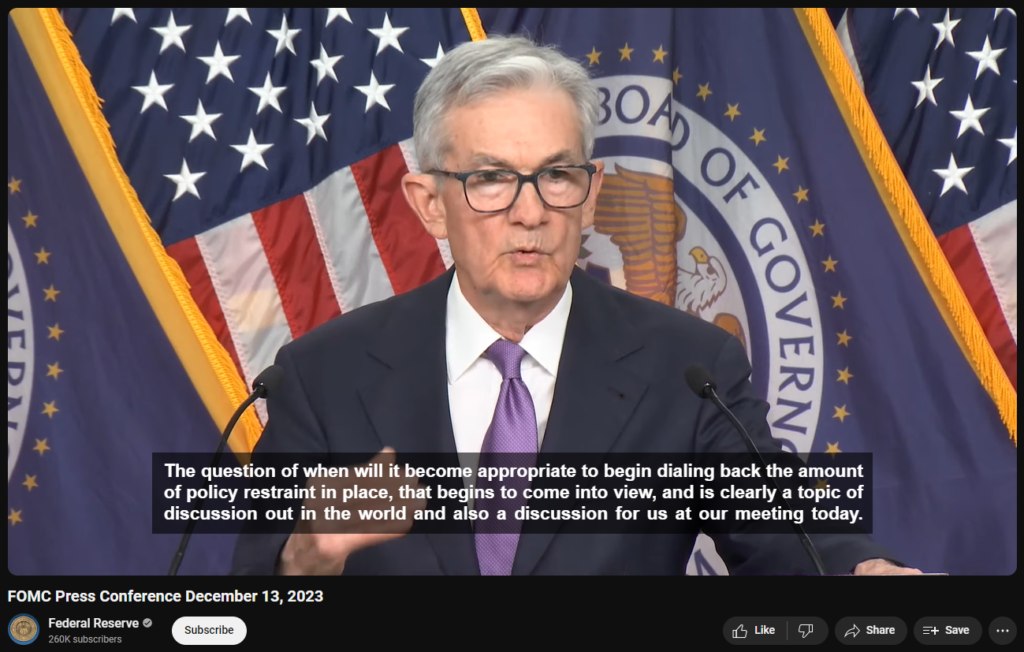

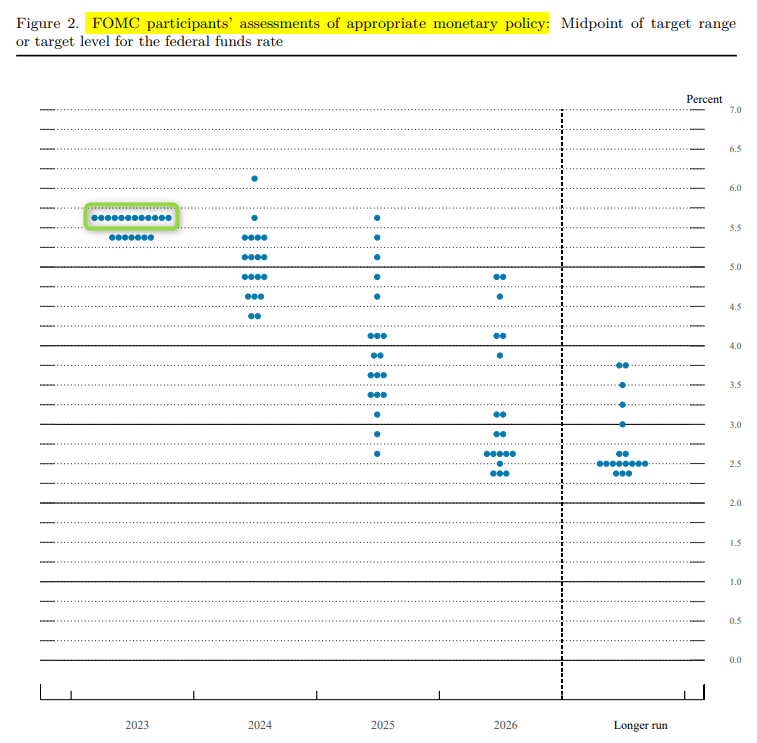

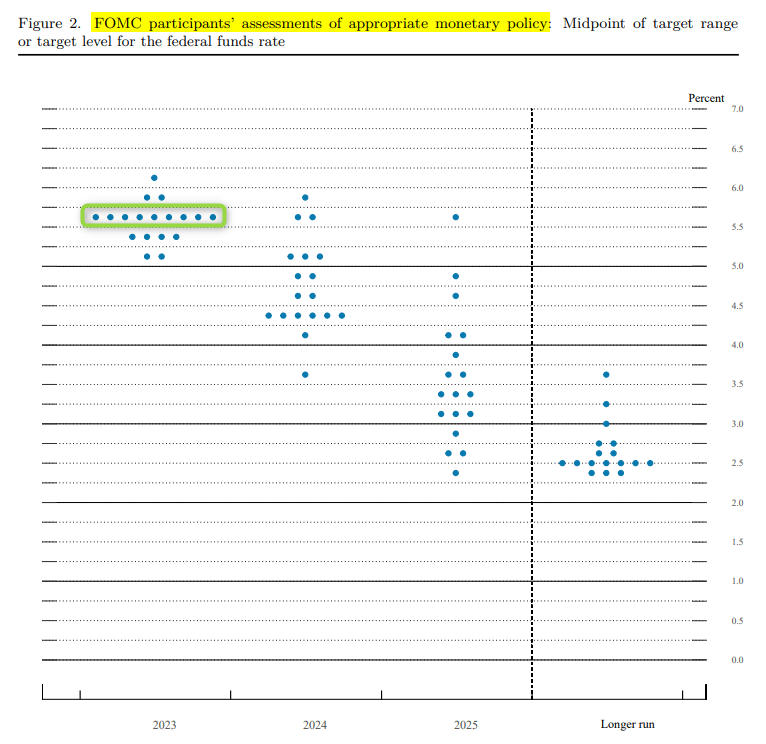

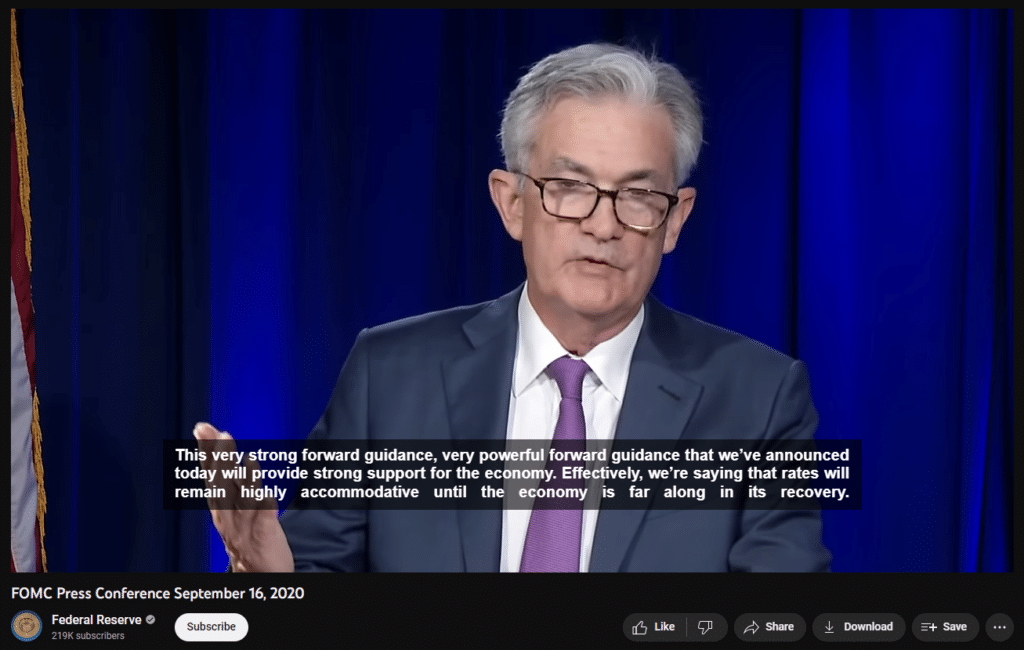

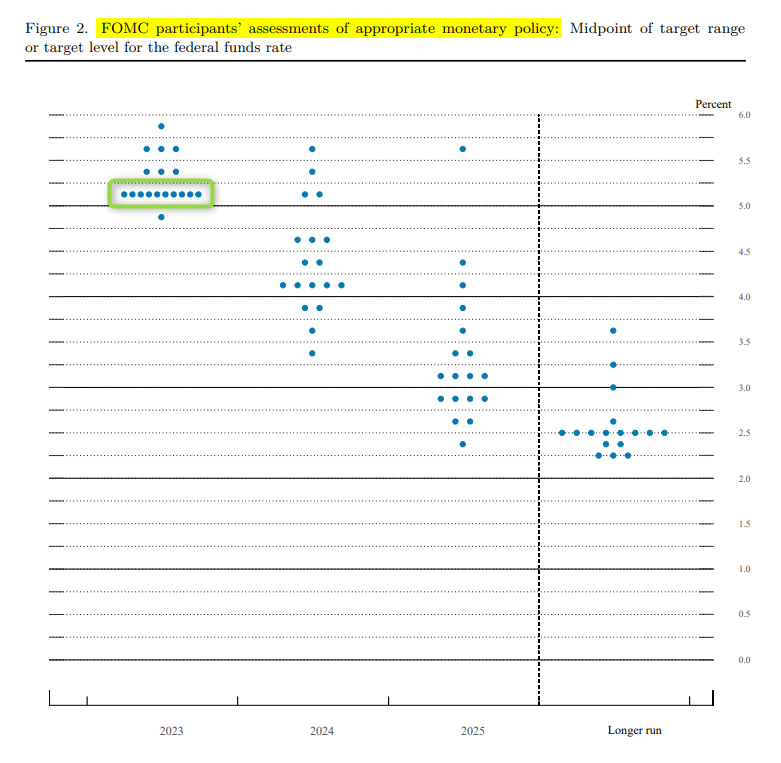

From the basics of understanding the Federal Reserve and its monetary policy.

To more advanced subjects like bonds and yields.

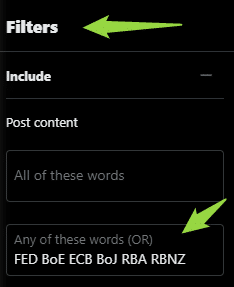

To practical applications like knowing how to keep track of it all efficiently.

And of course, a LOT more.

In other words…

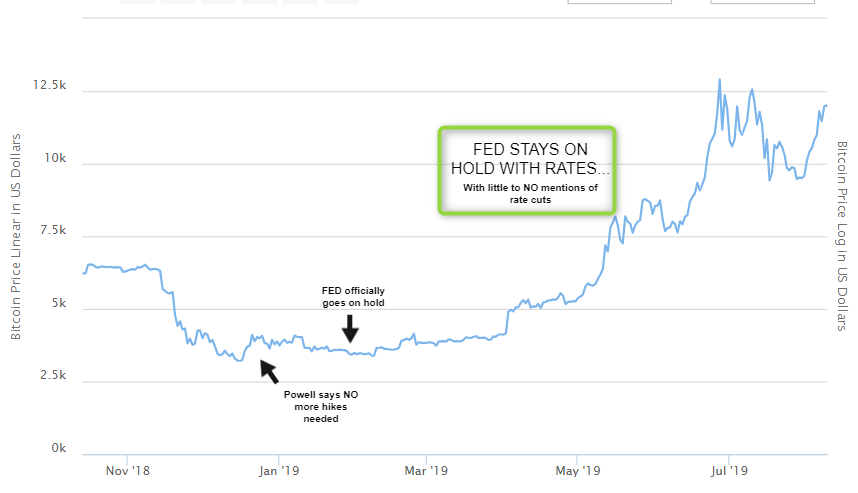

This book guide is NOT just about the theory.

It’s about the REAL fundamentals, the ones that you can REALLY use to improve, refine, and optimize your trading to be more consistent.

Now, don’t get me wrong.

Will you instantly become an expert at fundamentals after reading it?

No. That’s NOT how it works.

But…

Will you be able to finally understand the subject in a way that is applicable to your trading to have a SOLID foundation from where you can improve and fine tune your strategy to include both technicals and fundamentals EFFICIENTLY?

Yes, without a doubt.

So…

Where to get it?

If all what we mentioned here sounds like a good suit for you.

You can download the full guide from Gumroad’s marketplace…

You will also find a preview of the first 9 pages there 😉

With that also said…

If you need more information, tap the chat at the bottom right and reach out with your questions.

We reply fairly quickly, usually.