Trades

BESOMEBODYFX

HERE'S HOW TO LEARN ABOUT FOREX FUNDAMENTALS

IF YOU ARE LOOKING FOR THE BEST FUNDAMENTAL ANALYSIS EDUCATION THIS ARTICLE WILL EXPLAIN YOU EXACTLY WHERE AND HOW TO LEARN FOREX FUNDAMENTALS the proper way.

There is just ONE way to truly learn Forex fundamental analysis. And that is to follow already successful traders that show you how it’s done.

This is the way, period…

There’s no book, no video, and no educational article that will teach you the ins and outs of Forex fundamentals, the best way to learn about it is to trade the markets and build your experience up.

Don’t get me wrong, the theory is needed. So yes, you should read books, watch videos and consume content about fundamentals. But the real experience is built by trading the markets.

With that said, here’s how really to do it…

Where to learn fundamental analysis for Forex trading:

Simply, Telegram is a great platform to learn about fundamentals because that’s where you can find the best channels for Forex fundamental analysis.

By following professional traders on Telegram you can build your experience. You may be wondering how?

Watch successful traders in action, read their insights, read their content, and study their trades. That’s how you do it.

When you follow the right traders, you will naturally improve your trading experience.

Because you can assimilate all the concepts and nuances that actually make a trade, not just the theory.

Now, let me show you a practical example of what I’m talking about.

How to learn Forex fundamental analysis:

You learn about fundamentals by following traders that share valuable trade ideas and not just random signals.

In other words, learn by trading with the right minds around you while following their fundamental analysis signals. That’s a simple way to put it.

And here’s what I mean…

Look at this Forex signal below, this is the classic example of what is NOT valuable:

What is there to learn from that kind of content?

Nothing, it’s just a random trade signal with no analysis behind it for you to learn from.

What I’m trying to say is that, when you follow a trade, you have to know why that trade makes sense. Like, what’s the logic behind it? And, what’s the analysis for that specific trade?

With those details, you can take notes and study the reasonings for each and every trade and you can build your experience up.

And that’s the reason why you have to follow the top Telegram channels for Forex to truly learn about it.

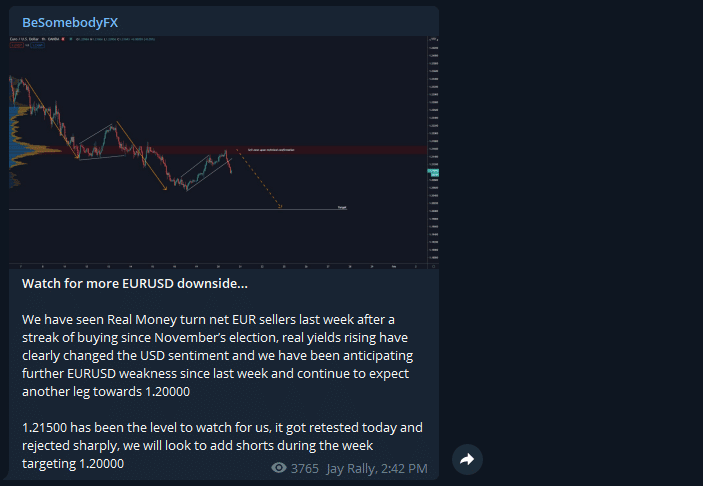

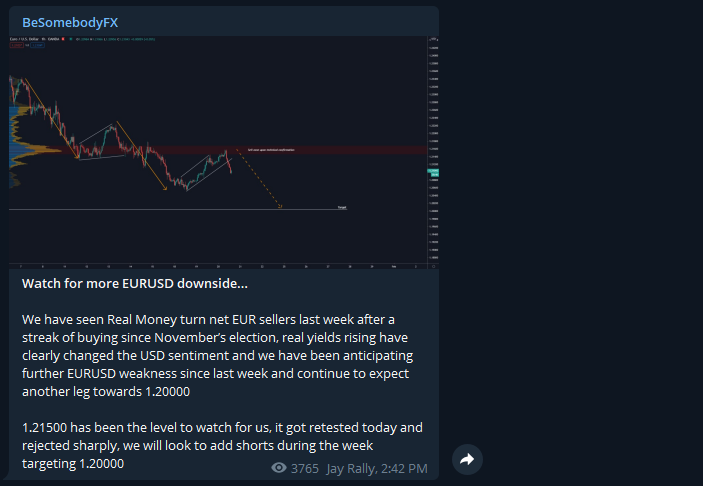

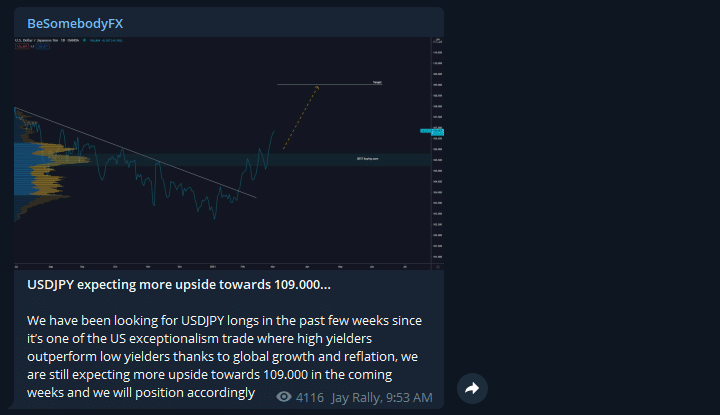

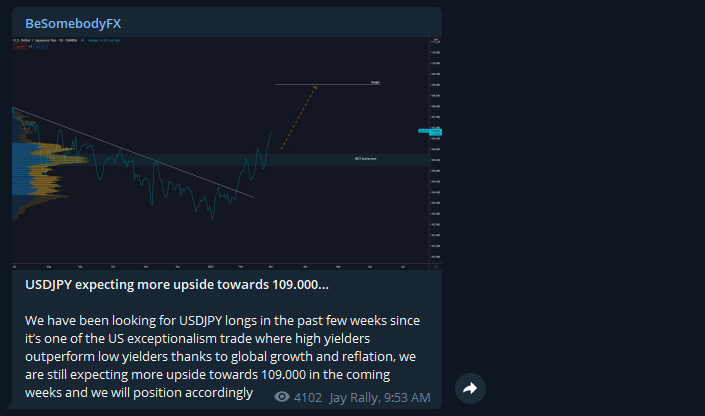

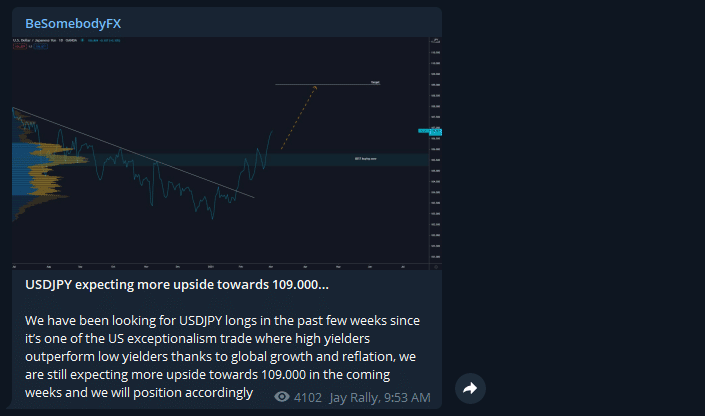

But let me be more specific, here’s an example of what instead is highly valuable and educational content:

Can you spot the difference? Of course, there’s a big difference between the two examples.

And that’s where you have to be smart. Now, let me explain how it works…

HOW WHO YOU FOLLOW MATTERS:

If you follow the random trader providing no value whatsoever you won’t increase your expertise and your knowledge, and thus you won’t learn anything.

But if you follow the insightful trader, you will pick the right ideas and insights to increase your knowledge and learn about fundamental analysis.

And I’m talking about the real fundamentals, not the nonsense that you find out there. Here’s what I mean…

What is fundamental analysis in Forex:

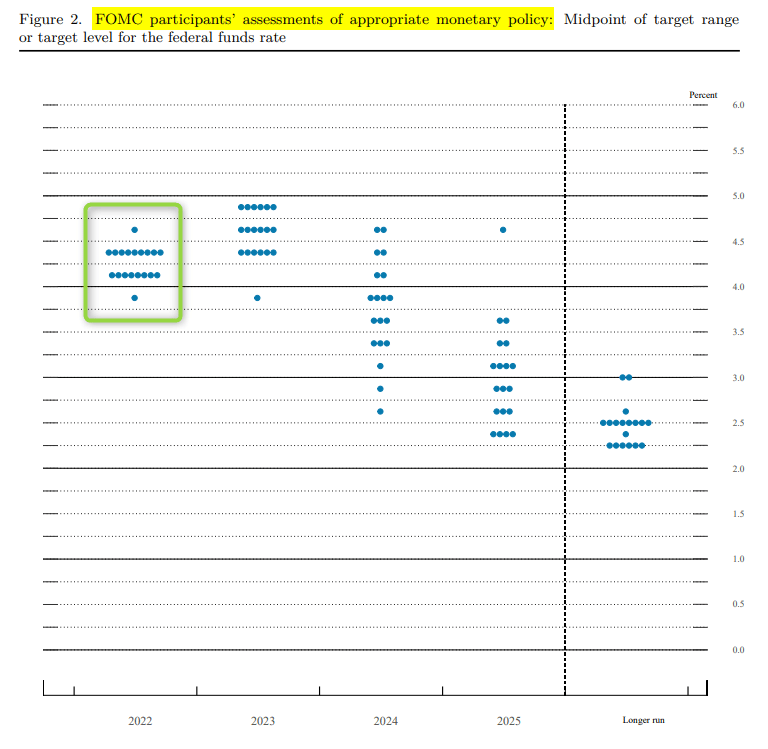

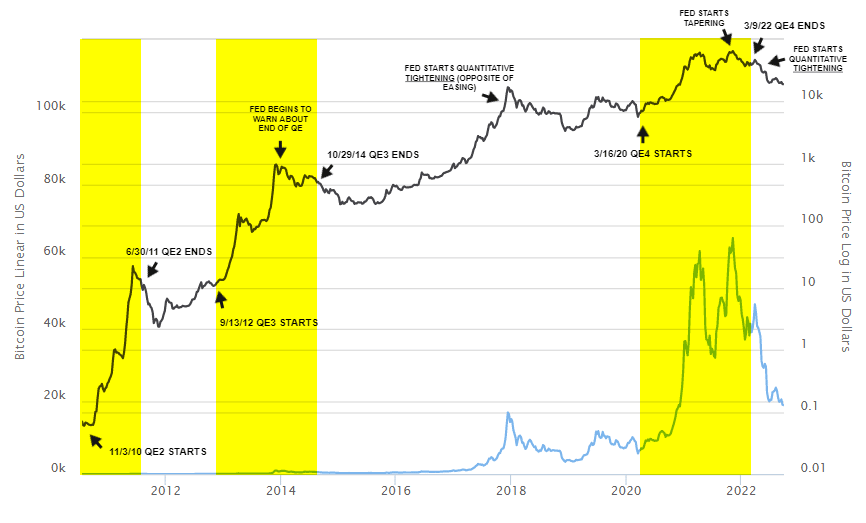

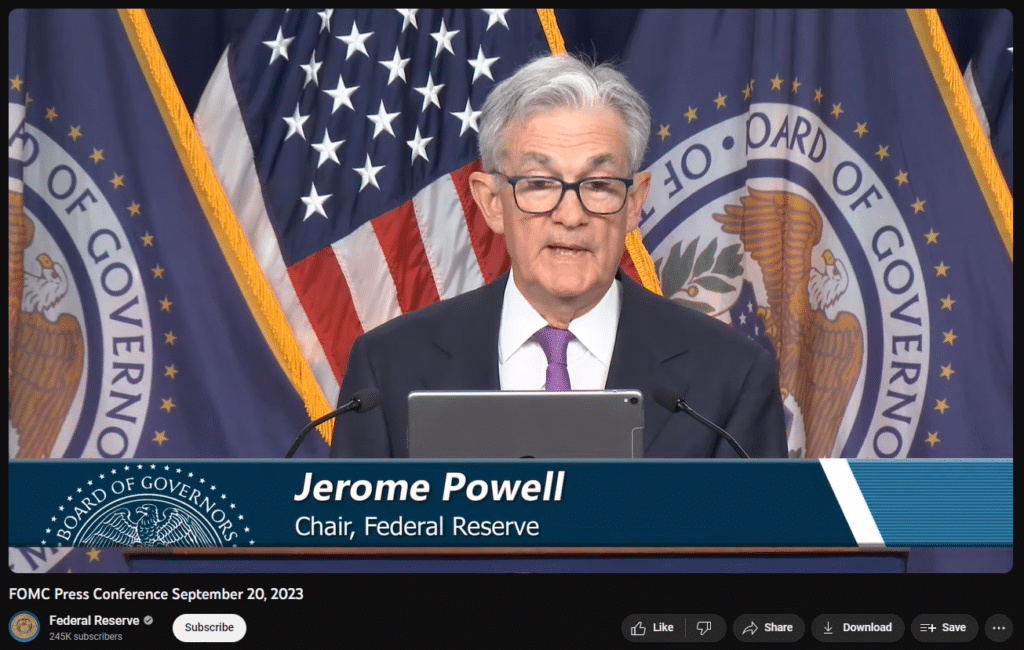

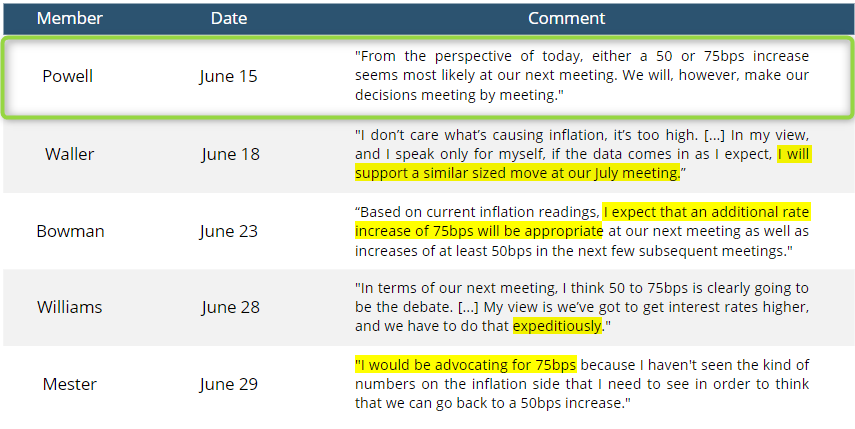

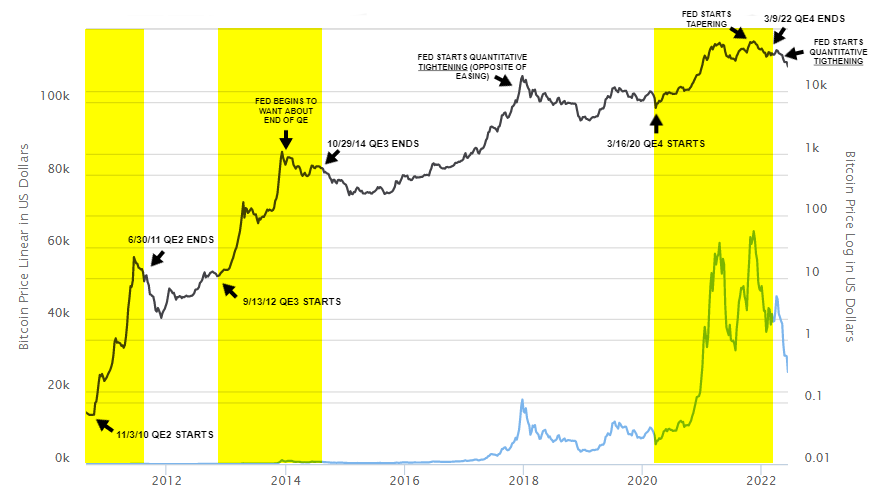

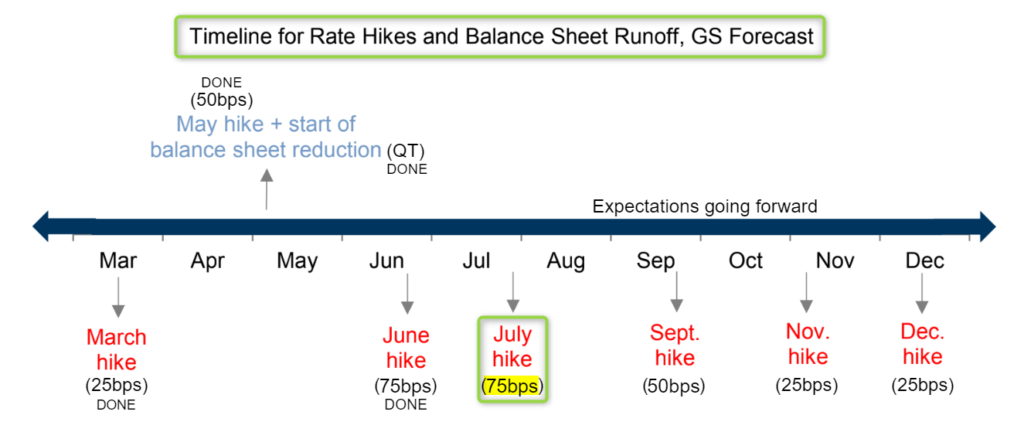

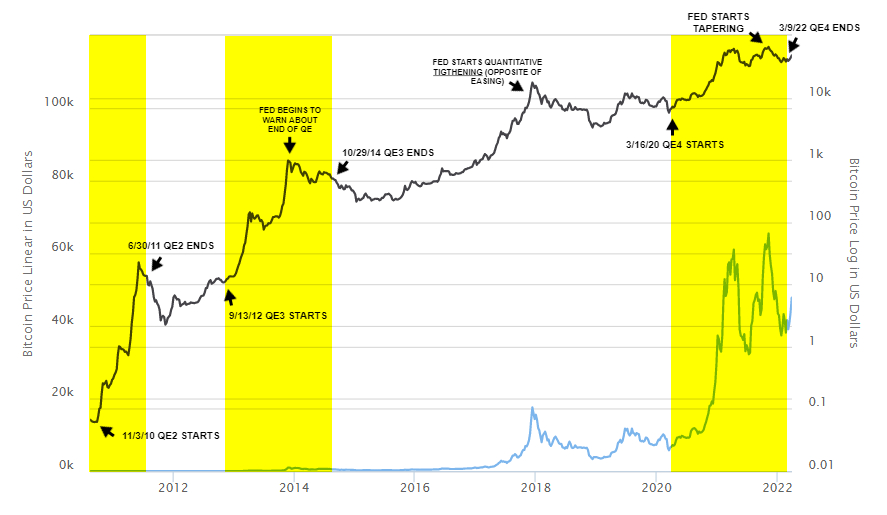

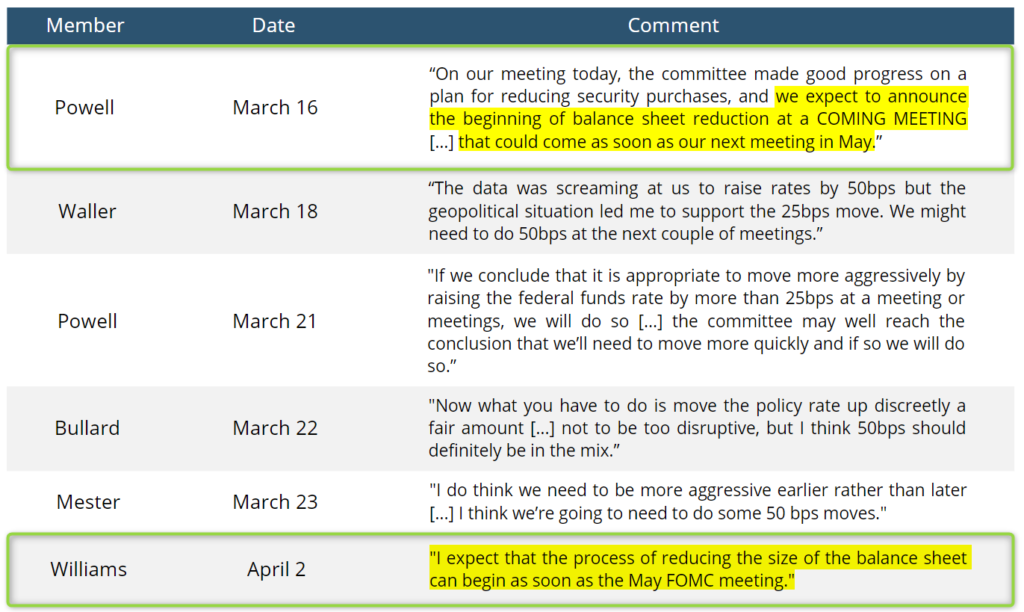

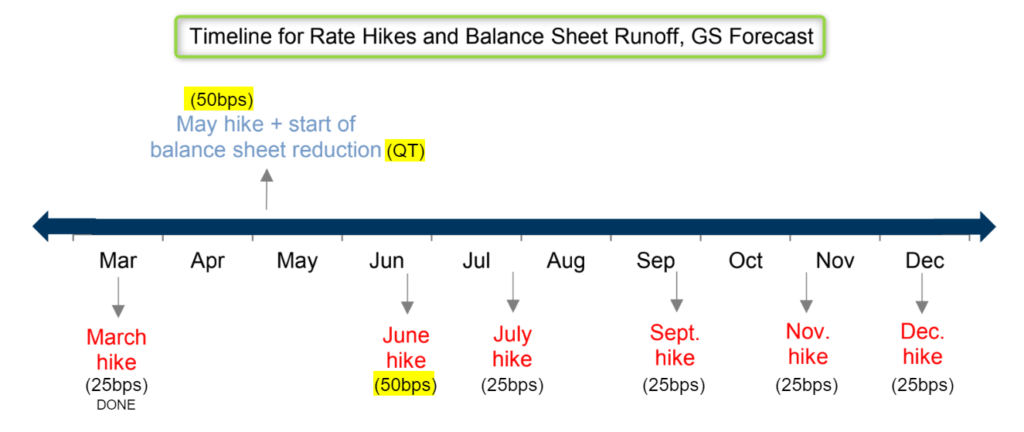

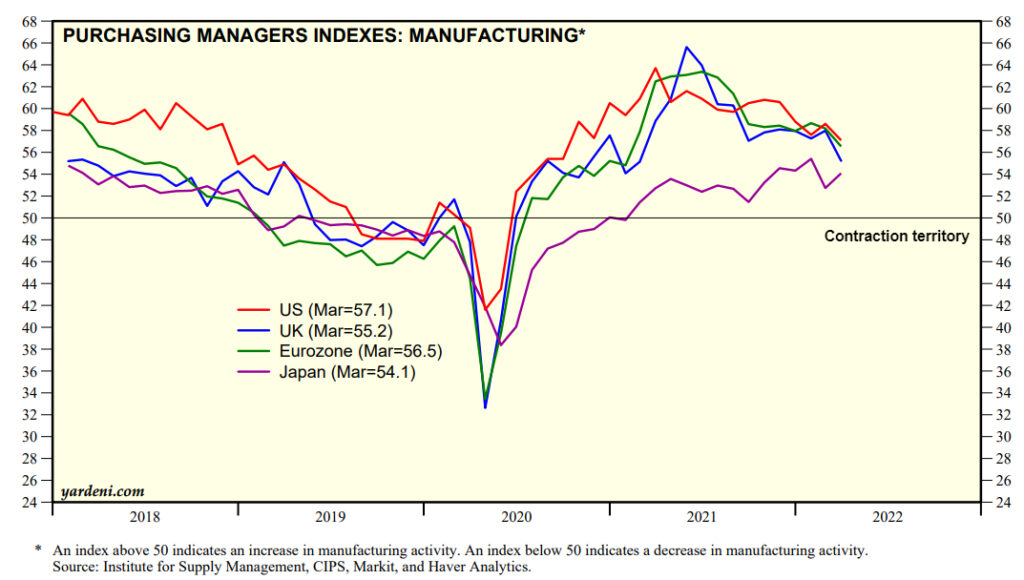

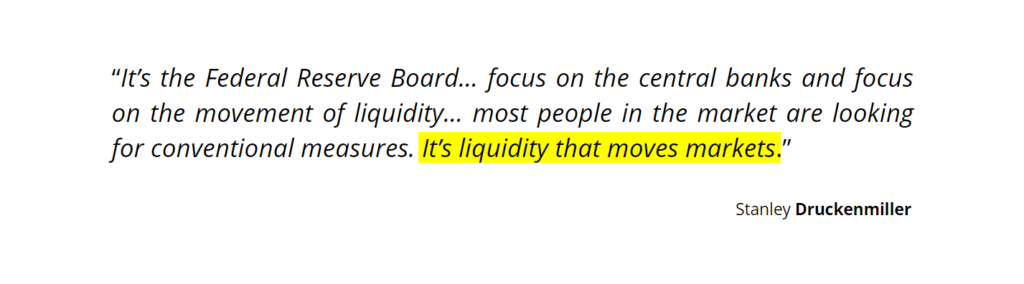

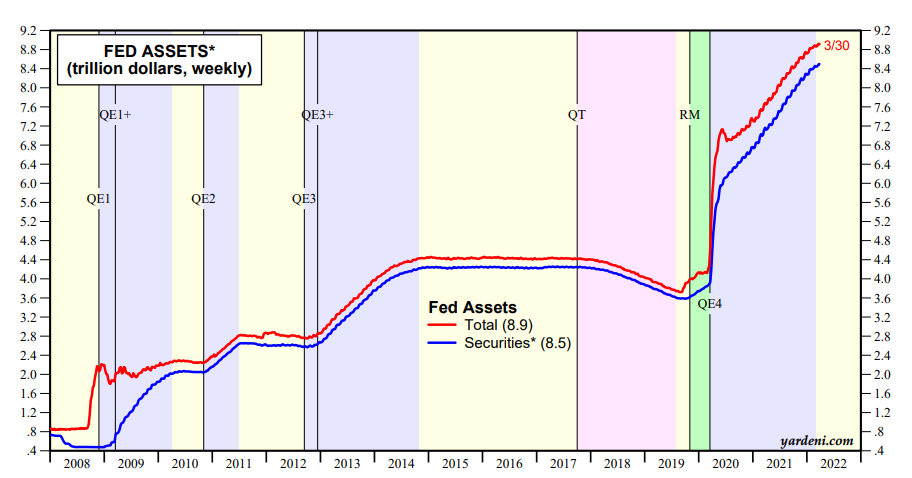

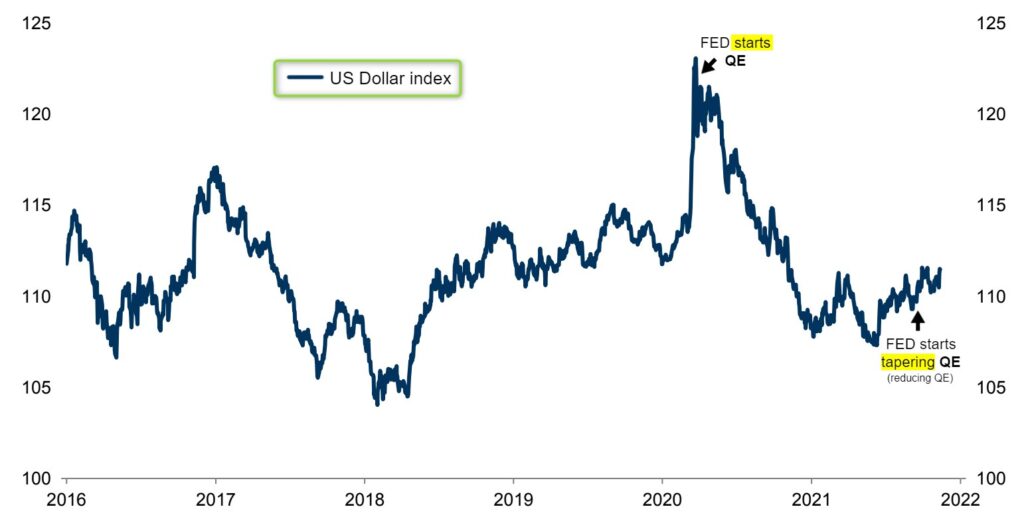

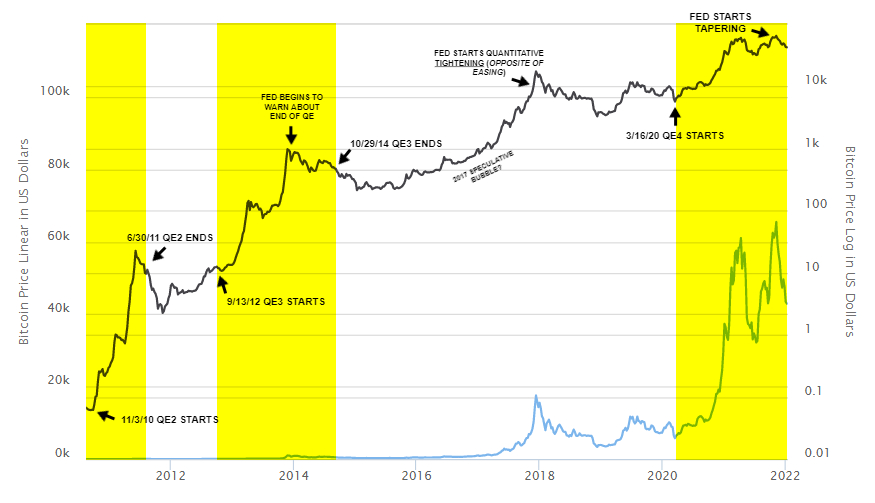

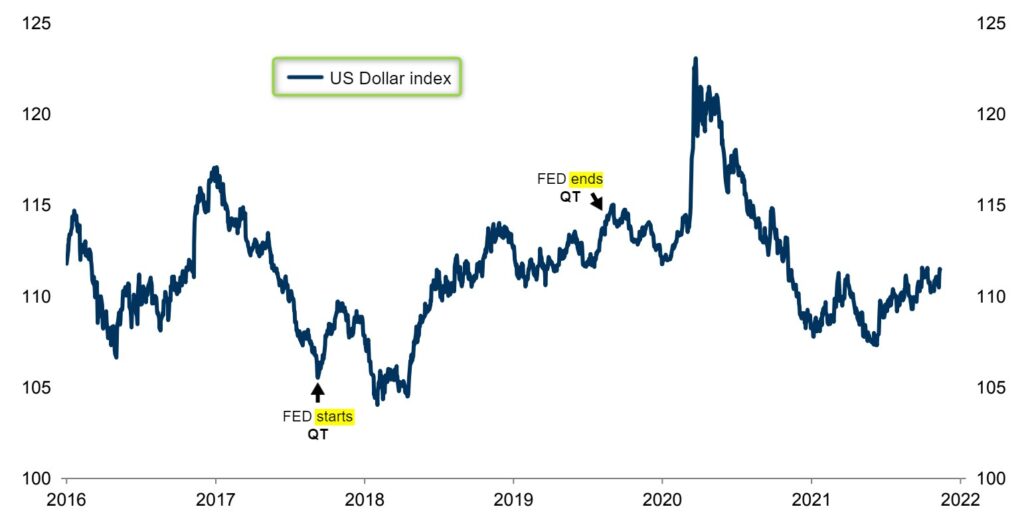

Macro fundamentals are about understanding central banks and monetary policy, and in knowing how to make practical use of it for actual trading.

And “knowing how to make practical use of it” is such an essential part. Because it’s NOT just about knowing the theory, you have to know how to make use of the theory.

I mean, there is a big difference between an analysis and an actual trade.

An analysis just tells you where a currency pair should go, but an actual trade needs to find an entry, a stop loss, and a take profit level.

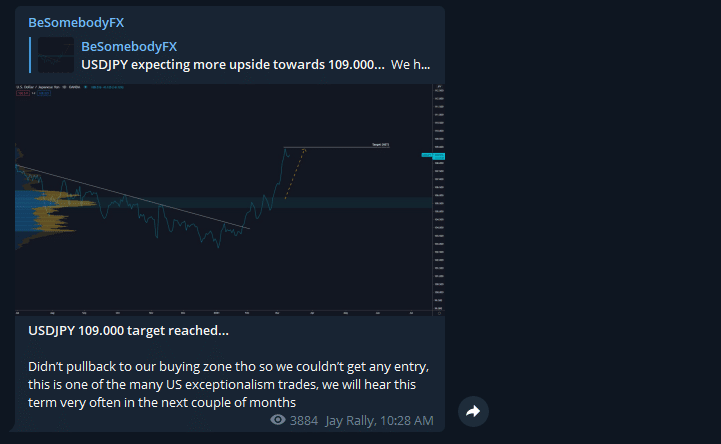

And then, when the trade is running, there is trade management which is another important subject. Once you are in the trade you have to manage it correctly, which means not taking profits early and allowing the trade to run.

Those are all things that you learn by doing. You learn about all these little nuances by actually practicing them and seeing them in action.

it’s the BEST Forex fundamental analysis education that improves your trading:

So, if you want to learn about macro fundamentals trading you have to follow traders that send tradable trade ideas that you can study and learn from.

The “tradable ideas” are insights and trades that you can take. So you can take notes on why a certain trade was taken and then you can also take notes on how it evolves.

Because keep in mind, the most important aspect of the learning process is the notes that you take. It’s the process of studying and learning from the trades.

Make sure that you don’t overlook that part, you learn about fundamentals by studying the process and practicing it. In other words, you learn by doing the trading and taking notes so that you can repeat what works and optimize what doesn’t.

That’s the best way to learn Forex fundamental analysis:

First, you learn the basic theory. Then, you have to start following the right traders and the professional Forex signals to learn more specific details on how to actually trade it.

In simple, you follow successful and professional traders that already have the knowledge that you need, and you study them. That’s the way.

And of course, in the meantime, you also study some theory, you look for Youtube videos about the subject, read some books, and consume content about it.

But always remember that practice is what makes perfect. The theory only brings you so far, you have to trade to build up experience.

And when you follow the right signal providers you can truly learn about fundamentals. And of course, it takes some time, it’s not straightforward, and you definitely have to put in the work, that’s how it works.