Trades

besomebodyfx

WHAT IS THE MOST IMPORTANT TRADING SKILL?

It’s race day!

Traders develop daily rather than in a day, a good trader understands that it takes time to be a good trader, that it’s not something you do or become quickly, it’s not something that you become after you read one book or you buy one course…

Often people come to me after 1 week of being in the private network and they say “I’m so excited, I see everything clearly now, I understand everything”

Nono… Today you are BEGINNING to understand but you are not going to understand the markets just in a week or after you took 2 profitable trades, it takes time, it’s a process…

So as a beginner trader you need to understand that today you are only beginning the journey, what you also need to understand is that it’s a process so it will take time to develop great trader skills

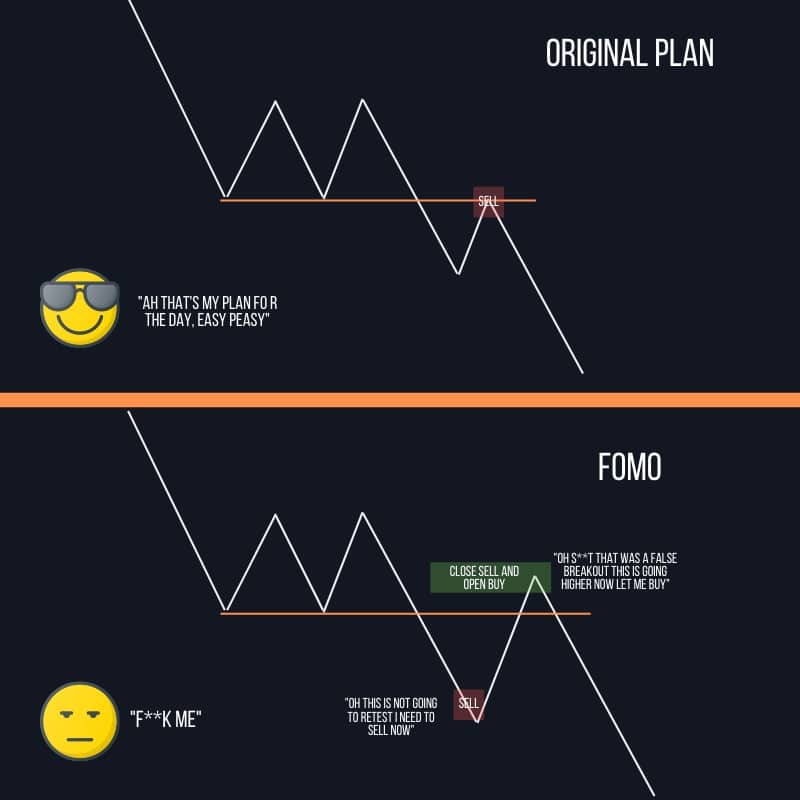

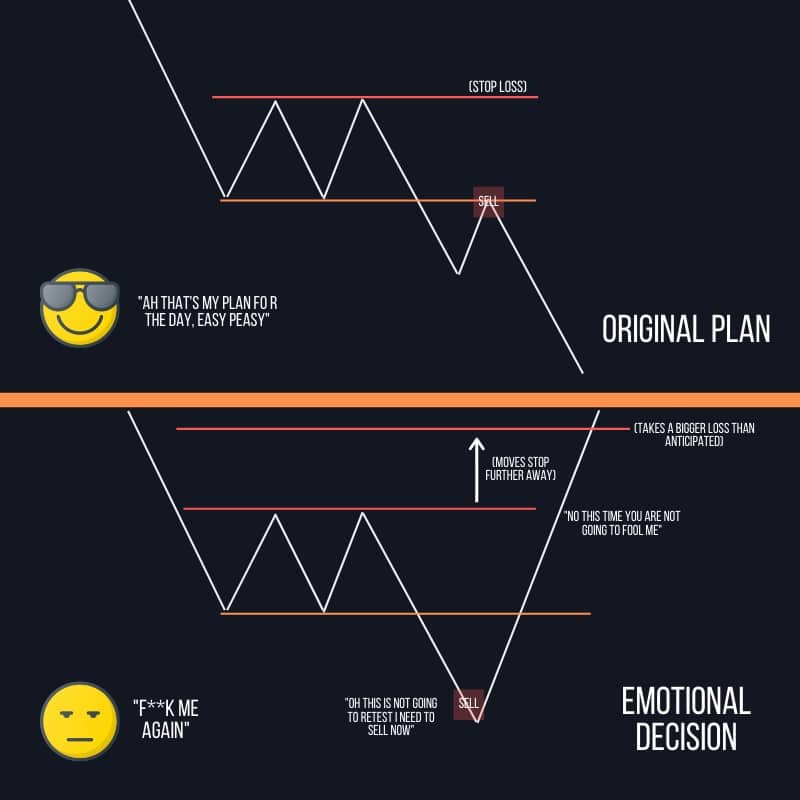

And so the most important skill of a successful trader is discipline:

Read carefully, discipline is much more important than vision, when people think of trading they think of vision, they say “here is what I want” and they see their accounts and plan the amount of money they want to make and the timeframe to reach that and so on…

That’s vision.

Now, vision can be important don’t get me wrong, vision is the fuel for your will but discipline is much more important than vision because discipline is behavior, discipline isn’t what we see (that’s vision), discipline is what we do…

And what we do and how we do it determines where we are going and what our account is going to accomplish.

Now, discipline determines how well you succeed in trading…

let me explain…

If you put your level of discipline on a scale from 1 to 10 so let’s say for instance you are a 5, you are an average level of discipline, well now you need to put your account performance in that same scale from 1 to 10 BUT here is what happens…

There is a law in trading that you can’t perform better than how much you are disciplined, so in simple if you are a level 5 discipline you can’t perform in your trading at a level 10 or at a level 8, your level of discipline will always cap your performance, this is true for everybody in the long term.

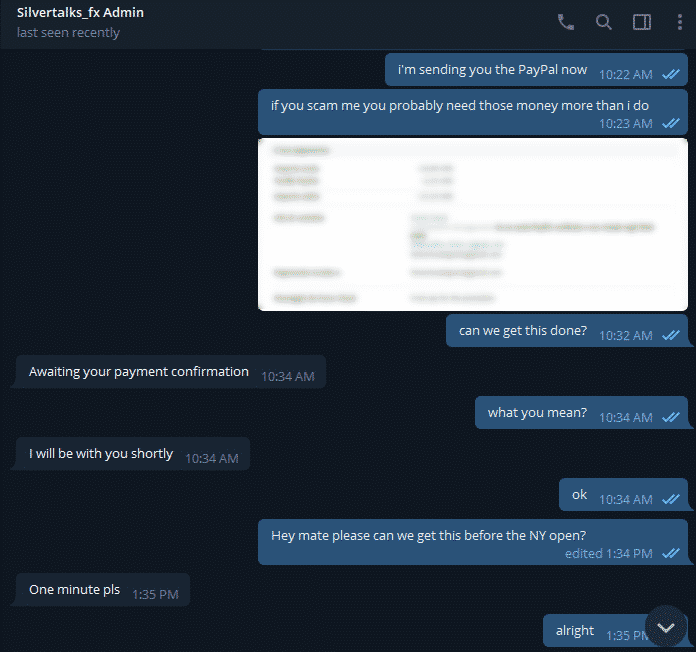

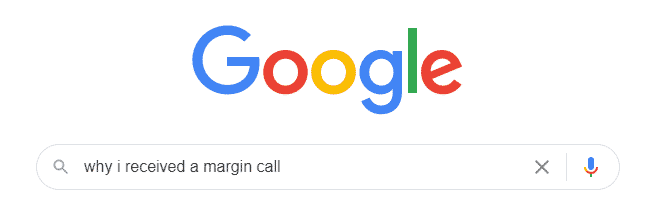

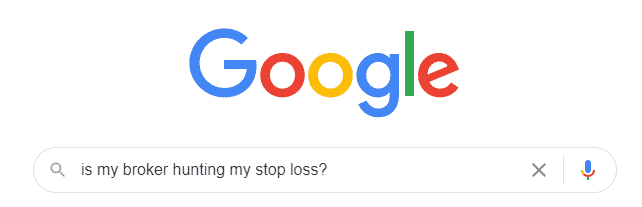

Now, of course you can be undisciplined get lucky and turn 100$ into 1000$ in a week but I can tell you that it’s not sustainable and sooner than later you will search on google:

This rule applies to everybody, over the long term you can’t perform better than your discipline level.

Now here comes the magic, people come to me and ask me:

“How can I grow my trading performance?”

Well, very simple grow your discipline skills, so what that means is that the better we learn to be disciplined the more potential we have of performing better on our trading accounts

The great news that I want to share with you is that you can learn to be more disciplined but I can’t help you with that…

Being in a professional community of traders like the Private Network definitely can help you but you have to work on that by yourself in your daily life too, if you are not disciplined in your life that will reflect in your trading performance.

So if my discipline level on a scale from 1 to 10 is a 5 that means my trading performance is maximum a 5 and it cannot go any higher.

UNLESS…

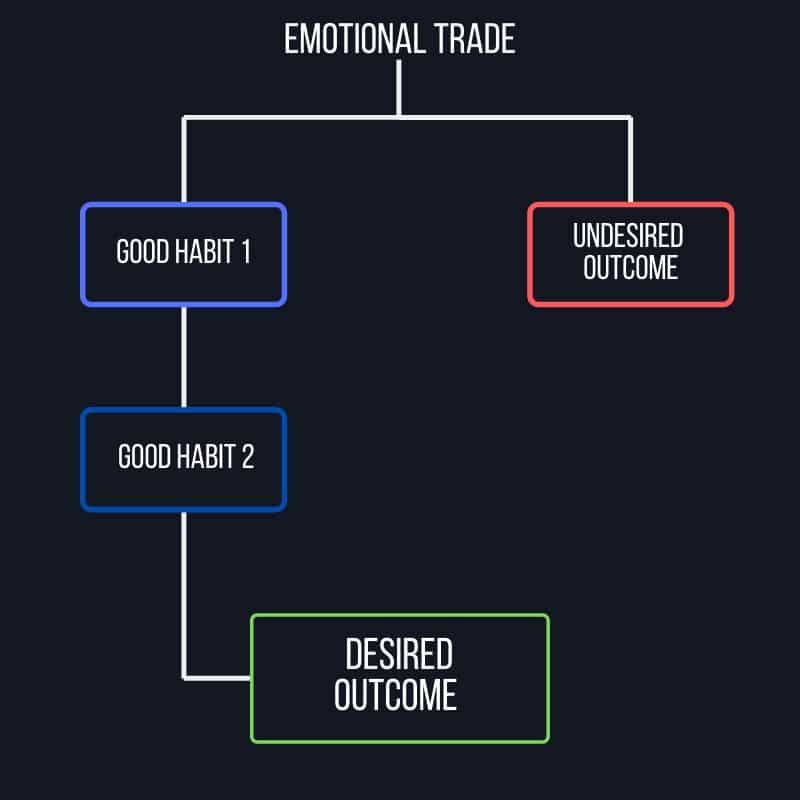

Unless I increase my discipline level, and you can do that, in other words, is possible to take your discipline score to a 5 to a 7 or to a 9, you now have room for your trading performance to grow to an 8 or a 9, once you understand and accept that then things begin to be amazing, you start to see how your daily life behavior and your habits impact your trading, and trust me you don’t have power in controlling the markets but you have all the power in the world to control and change your daily habits.

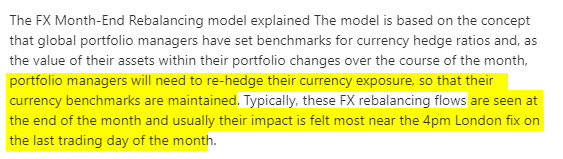

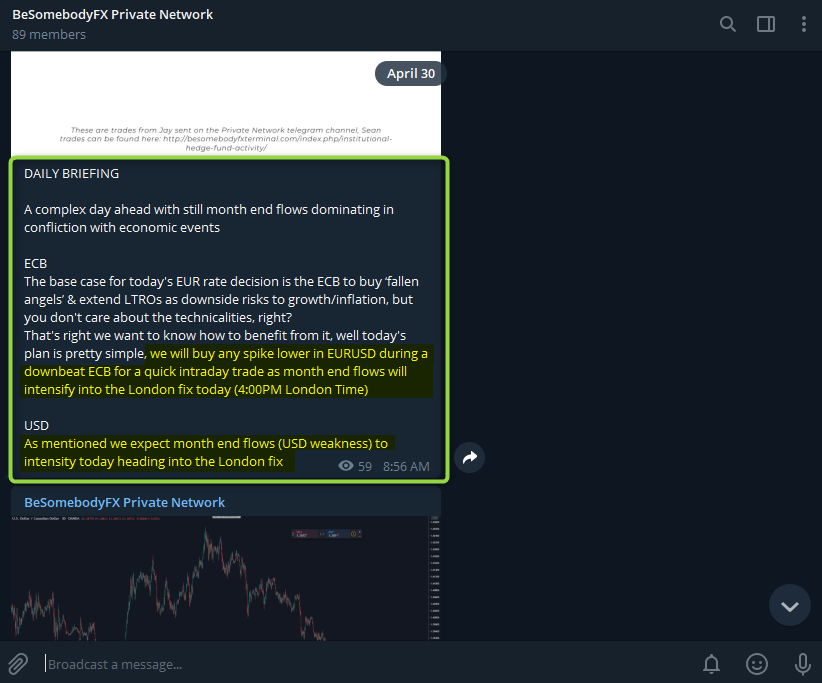

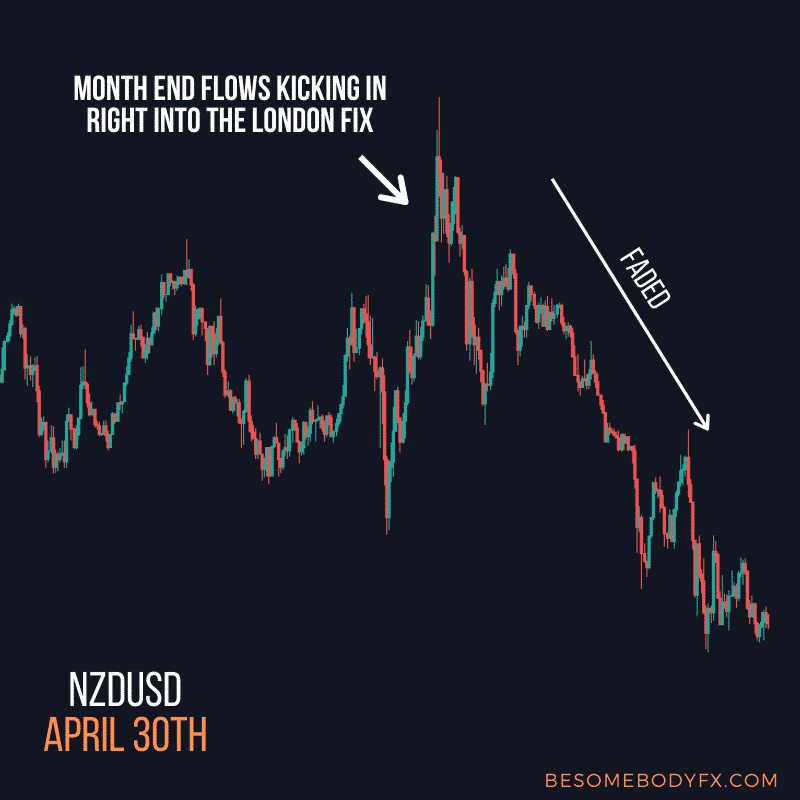

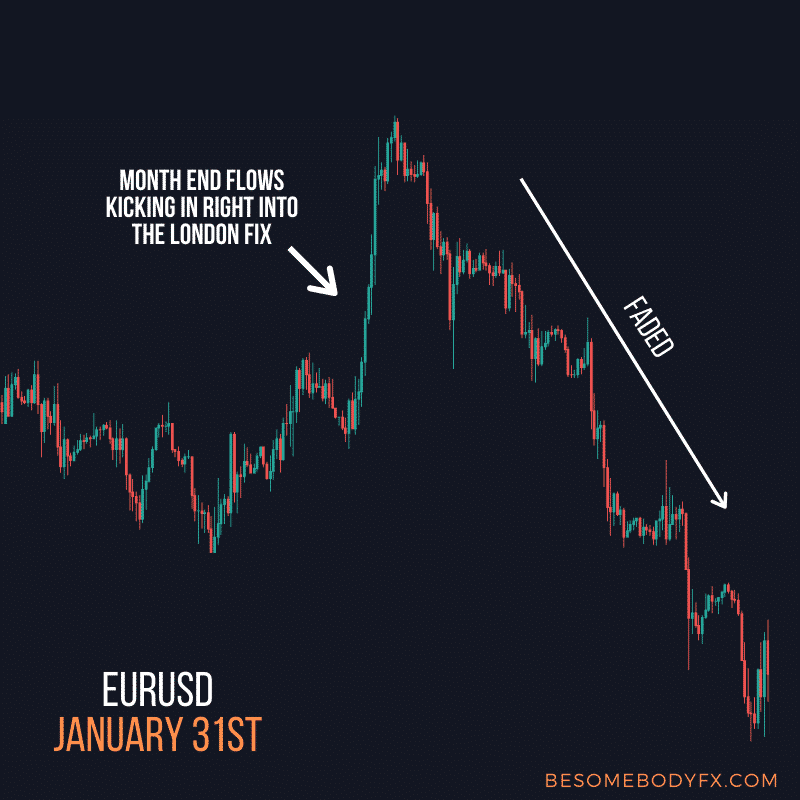

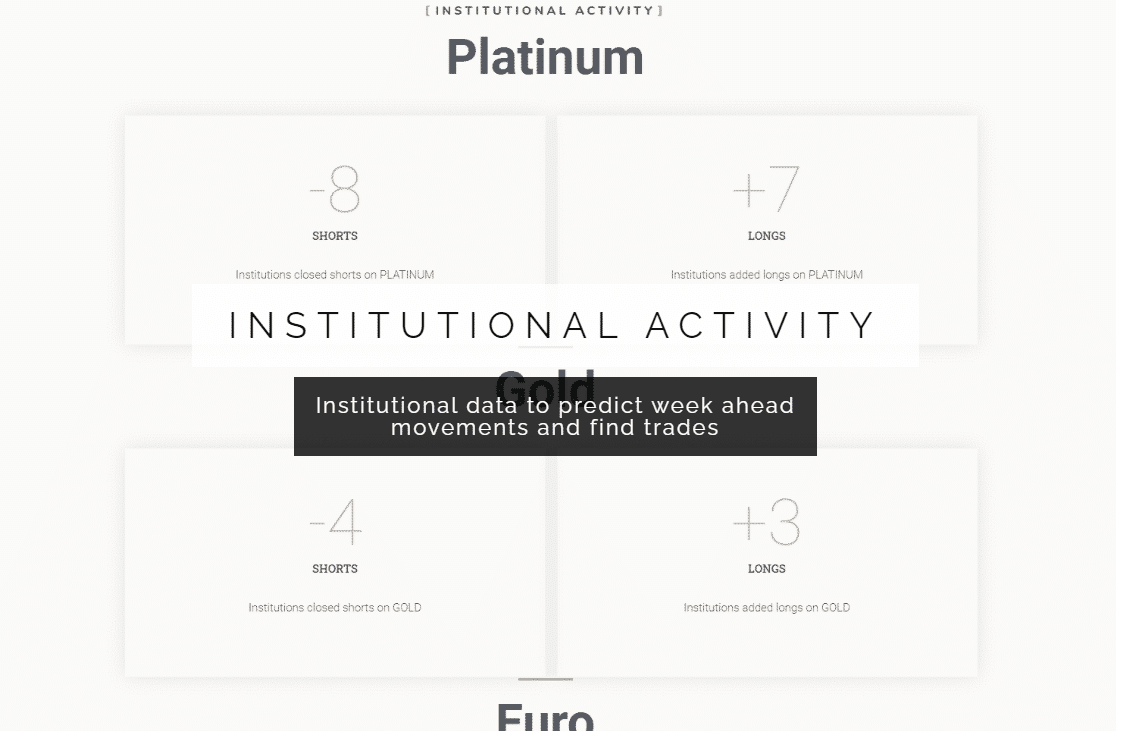

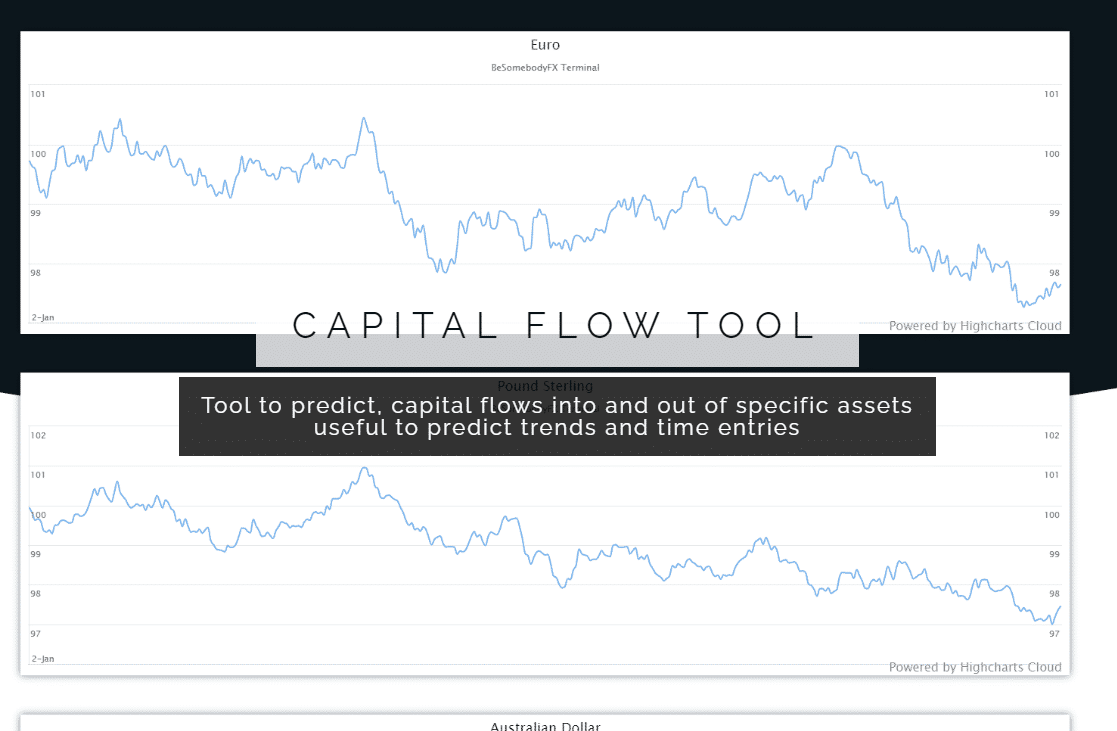

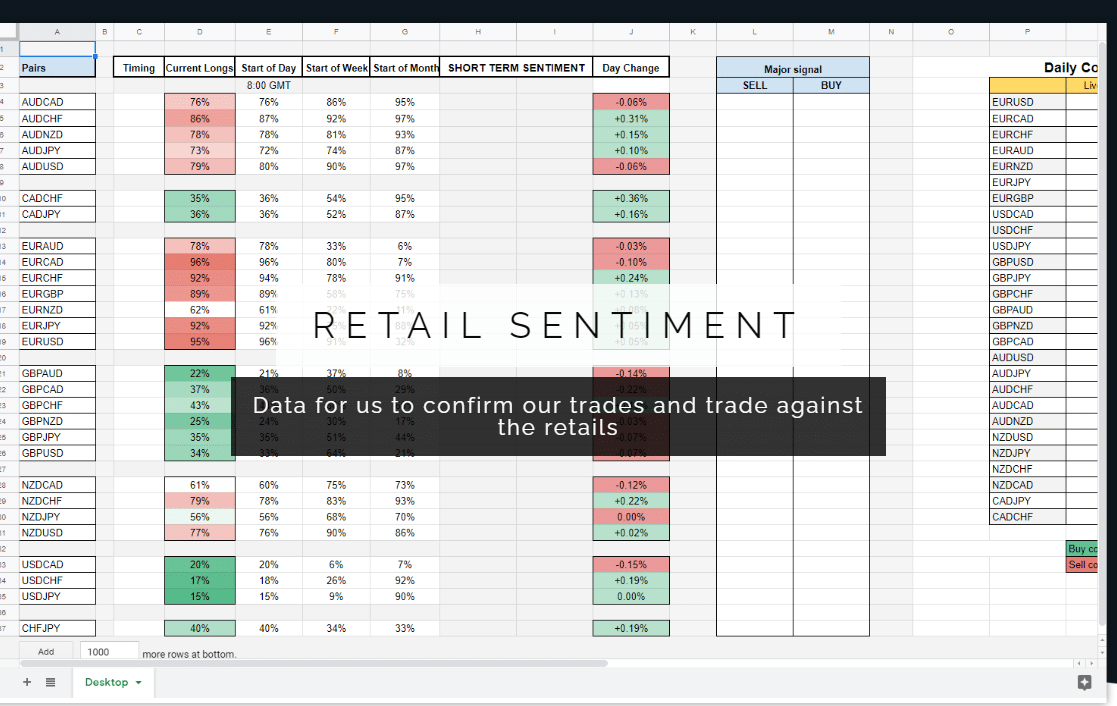

And when you have a whole Network of professional macro fund managers telling you what they are doing with their own money each step of the way, then you are increasing the probability of being successful.

That is what the BeSomebodyFX Private Network offers you, with an emphasis on first protecting your wealth, and positioning your capital to profit.

What does the Network get you?

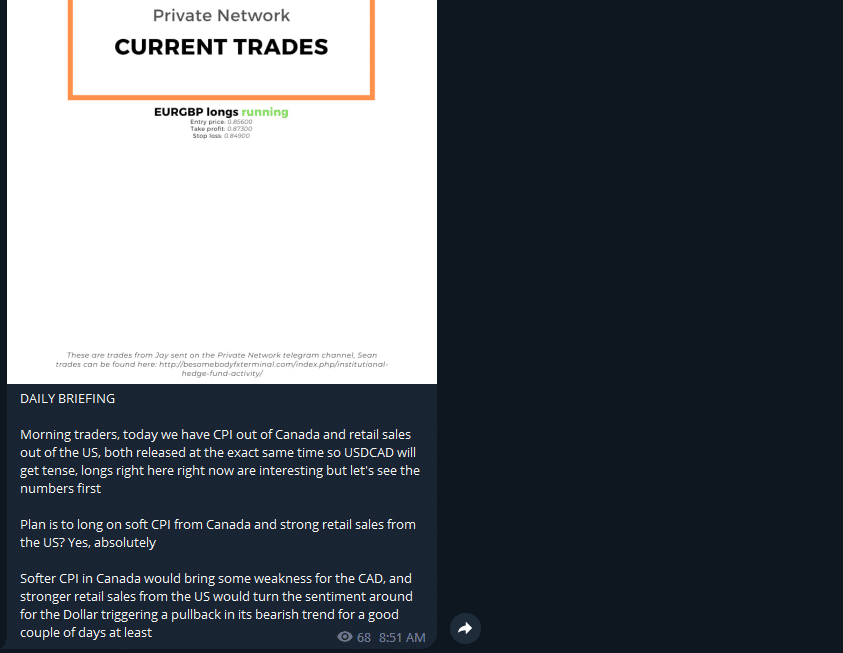

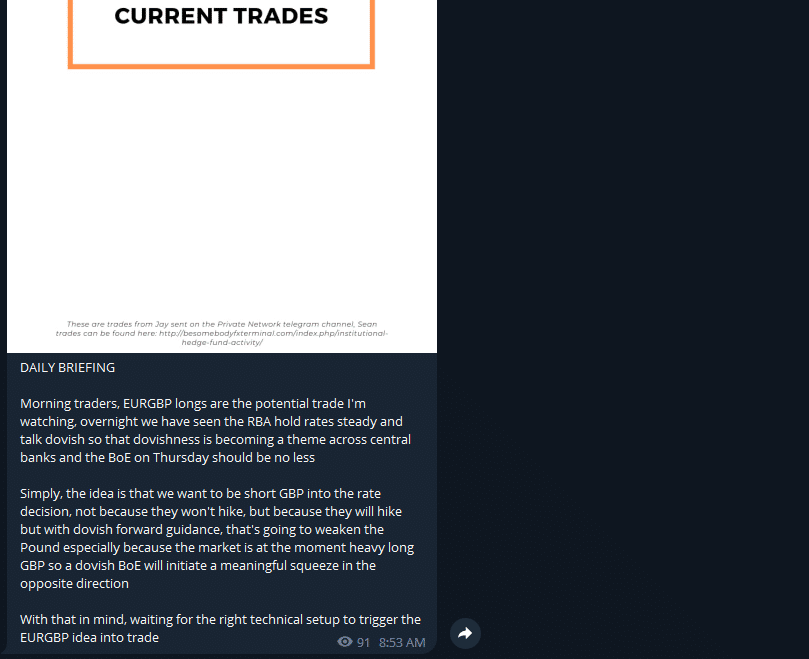

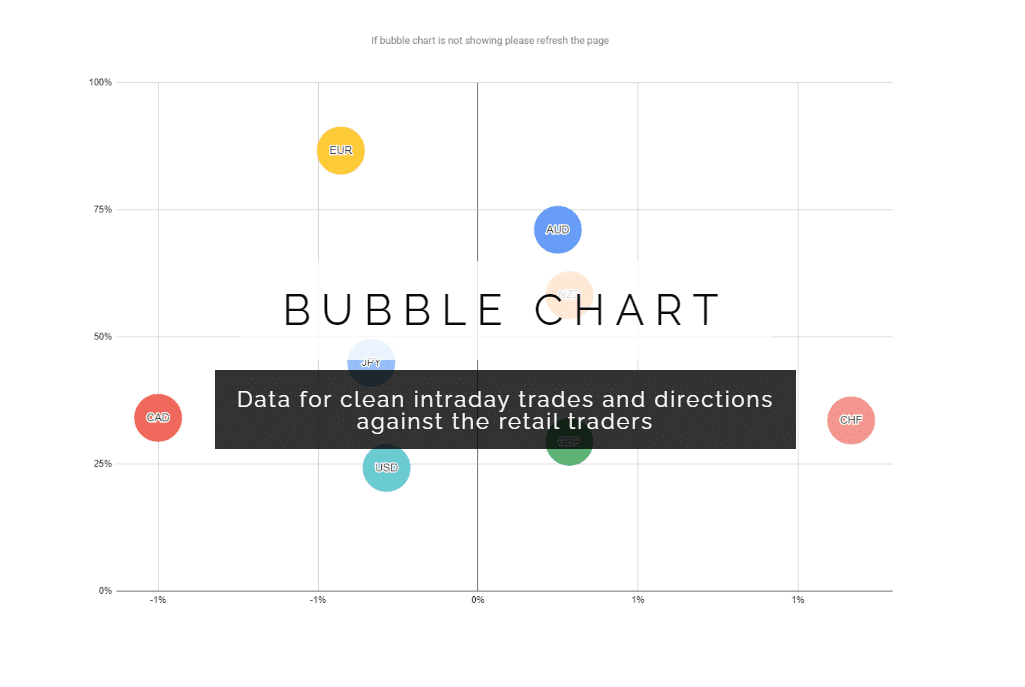

- Access to insights & guidance from top tier traders

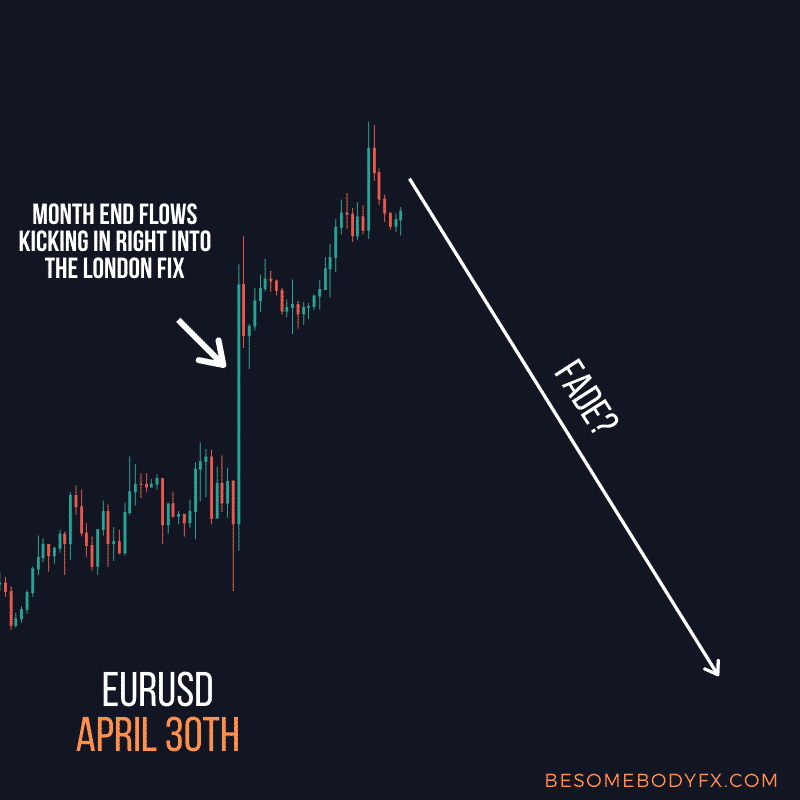

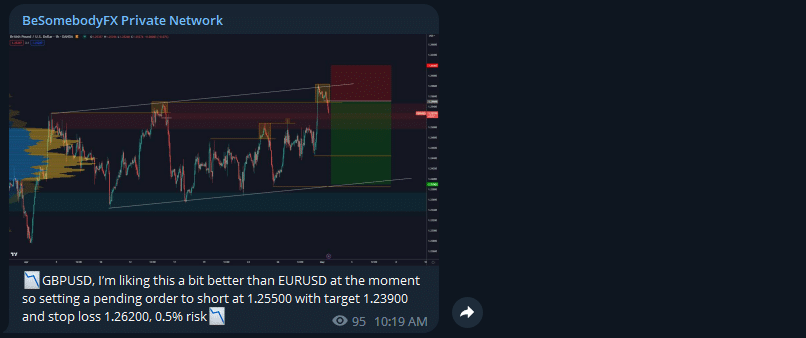

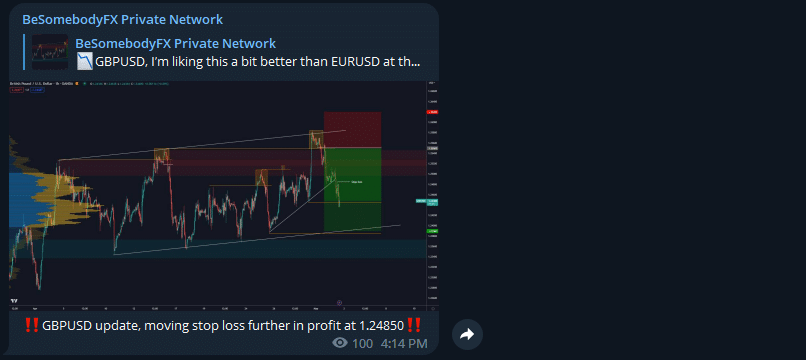

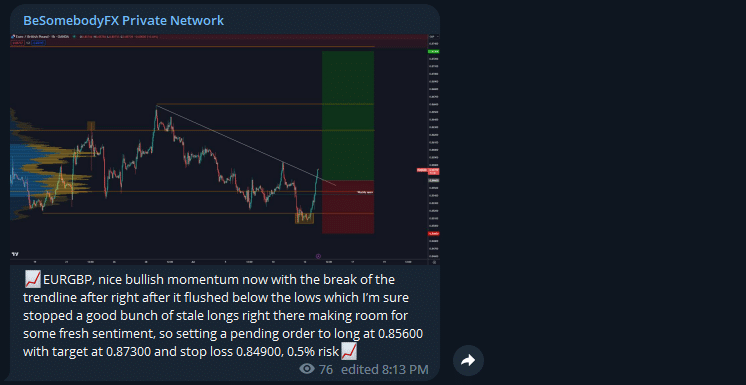

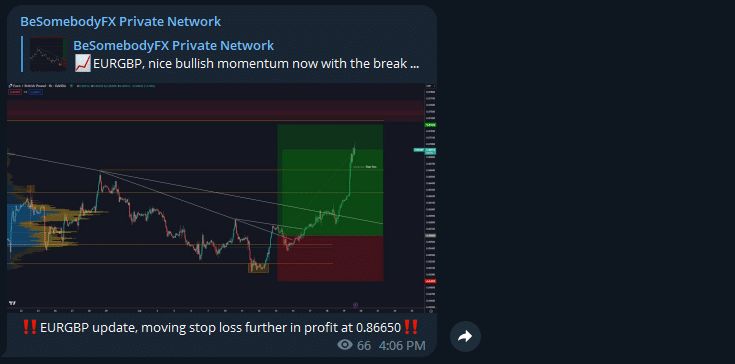

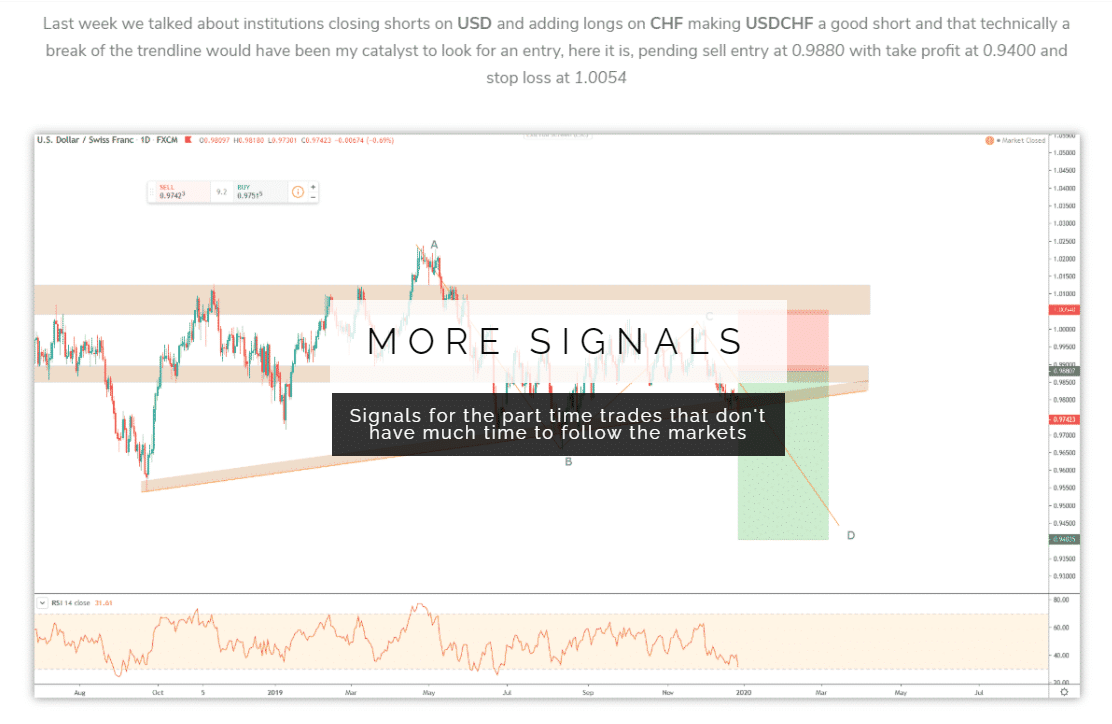

- Access to our live trades, from long term to short term opportunities

- Access to all our researches, info and insights

- Access to a professional helpful community via private chat

…all for less than a daily cup of coffee

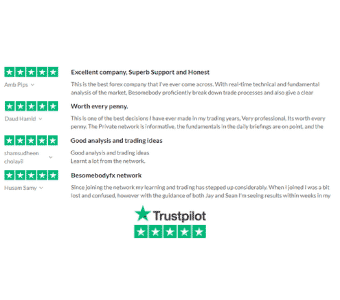

Now i can go ahead all day listing you the features and benefits of the Private Network but i will let our reviews speak for us…

I hope to welcome you in our Private Network soon, so you can start networking with our global member base.

Yes we just opened a few extra seats to join the Network…

This extra enrolment will close in 24h…

Should you have any questions about joining in the meantime, simply send us a message on Telegram @JayRally and i will get your questions answered.