Trades

besomebodyfx

quiz results and explanations

OK, INTERESTING, VERY INTERESTING RESULTS, IF YOU ARE HERE YOU WANT TO KNOW THE CORRECT ANSWERS RIGHT?

Well that would be $99.99

Joking 🤪

Don’t want to dwell too much today so let’s get straight to the results.

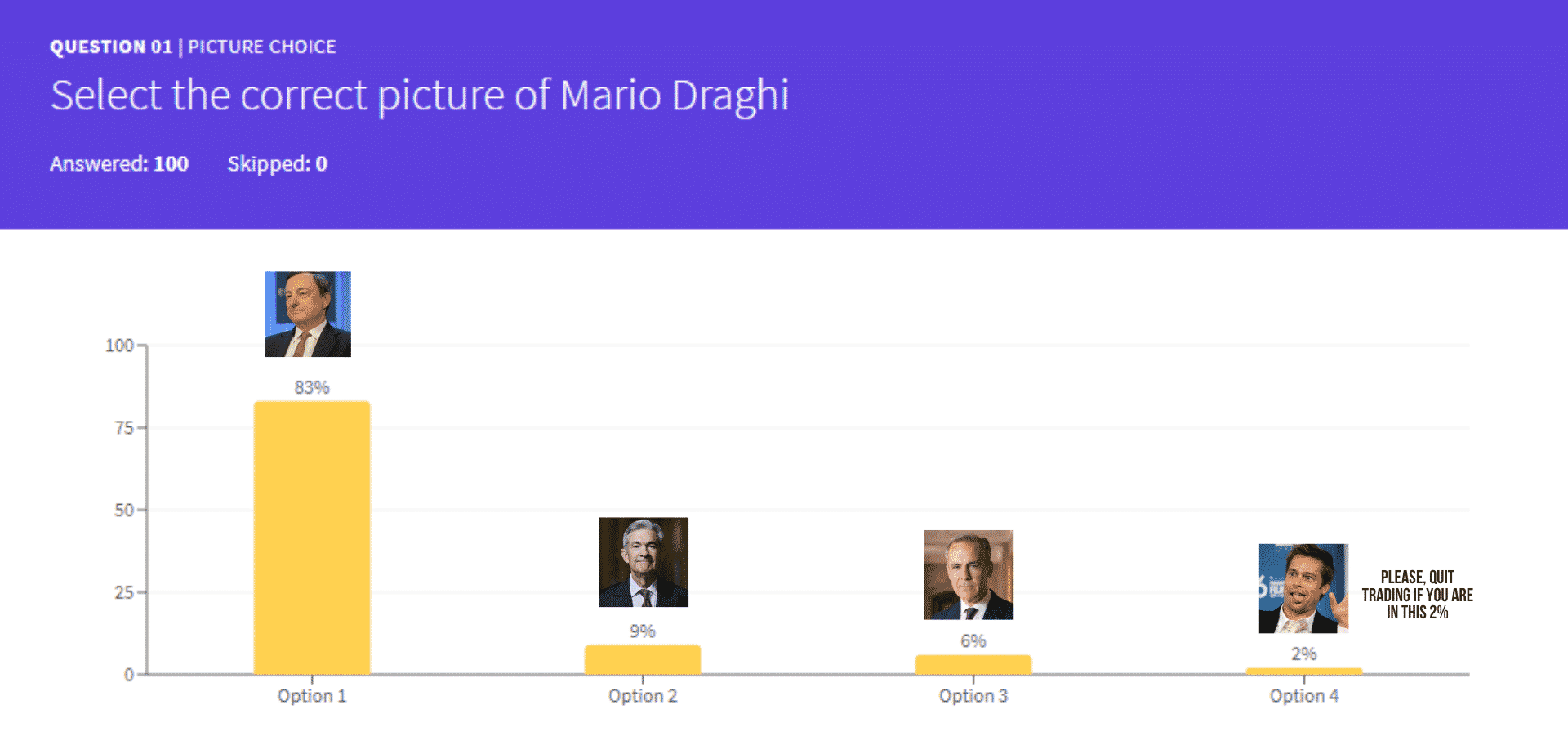

It’s relieving to know that at least 83% of you know who Mario Draghi is, i don’t even want to comment on the others, literally, you could have just googled it… ![]()

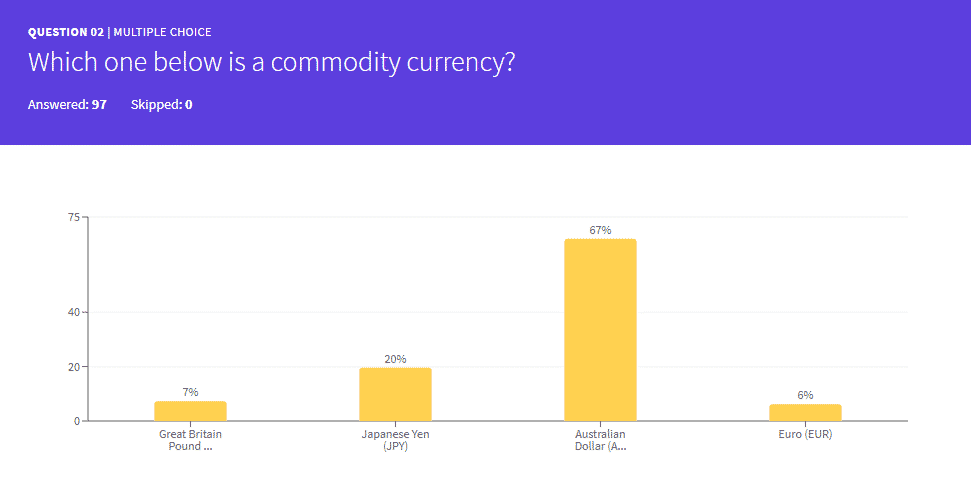

Second question asked you to choose which one of the options was a commodity currency.

67% of you got it right.

What even is a commodity currency and why the AUD is labeled as such?

Google is the answer to all your problems…

So in simple why the AUD is considered a commodity currency?

Australia is a major exporter of GOLD and its economy is highly dependant on that, another example of this is the CAD which is another commodity currency because Canadian economy is highly dependant on OIL exports hence OIL prices, lower OIL prices = CAD negative, higher OIL prices = CAD positive

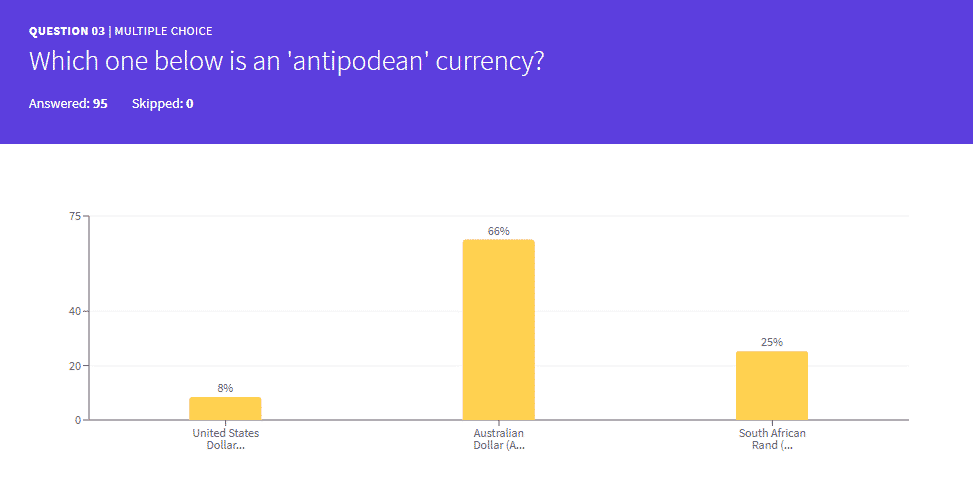

Next question, which one is an antipodean currency?

Antipowhat?

Antipodean is just a technical label for AUD and NZD…

34% of you learned a new word today, good job, don’t forget it because it’s a widely used term in the professional trading world.

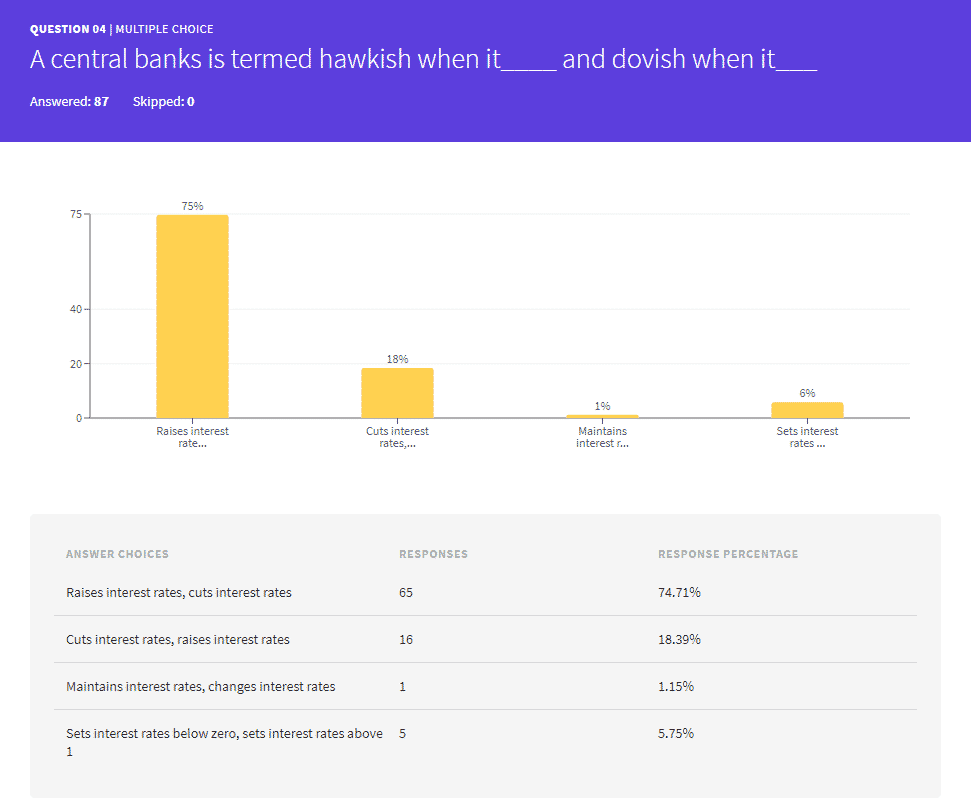

Let get to the next question:

75% of you got it right thanks, this is literally the cornerstone and extremely basic concept of fundamentals trading, knowing what an hawkish central bank is and what a dovish central bank is.

You can stick to selling oversold and buying overbought zones in your stochastic if you don’t want to study the very basics of fundamentals…

A central bank is termed hawkish when it raises interest rates and dovish when it cuts interest rates.

Next…

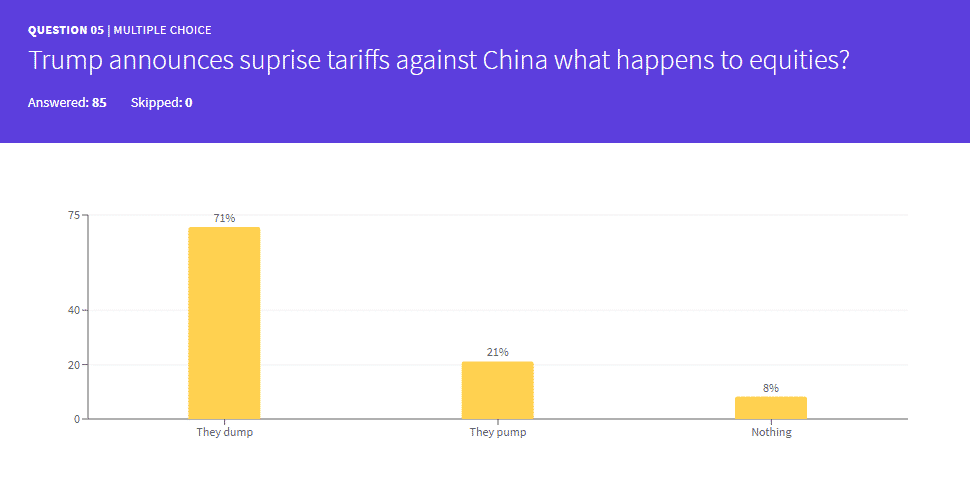

Here we are talking about short term reaction, and the correct answer is of course “they dump” and all the traders with a brain that traded in 2019 should know very well this, if Trump announces tariffs against China then the risk sentiment of the market gets hit hard and investors start to take out money from stocks to put in into safe havens, and don’t forget about algos, the short term reaction it’s all algo trading, they read the headline in milliseconds and start to trade based on the headline sentiment.

So when you see a dump or pump based on a news headline then that move is 99% algo scalping the headline trying to get ahead of everybody else for a few pips of profit, literally it’s algos trying to get ahead of another algo to buy ahead of it to then sell it back to the algo coming late to the party…

Yes high frequency trading it’s that fucked up…

Next…

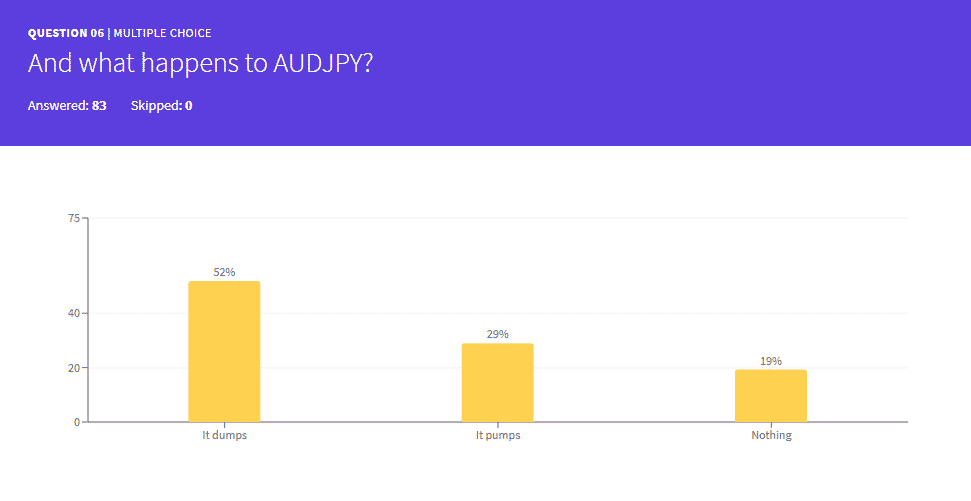

And this confused more traders tho, again, the traders that went through 2019 trade war should well know the logic behind this, Australia is a major trade partner with China, if China is hit with tariffs and their economy slows down then Australia is inevitably hit as well which would force the RBA to step in and lower interest rates hence making the AUD less attractive hence less demand hence AUD weaker…

“Arghhh ![]() this trading thing is much more complex than I thought…”

this trading thing is much more complex than I thought…”

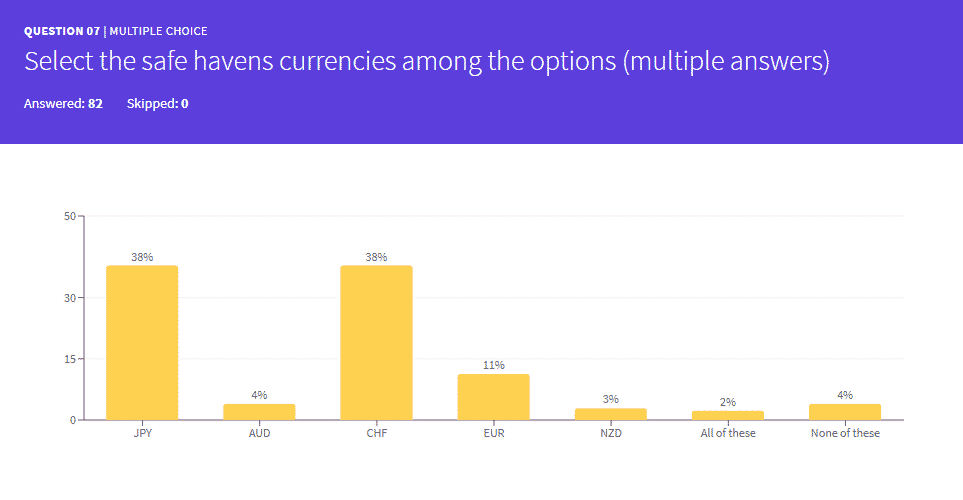

Safe havens… You MUST know what they are, it’s absolutely crucial for your trading success, you must understand it and understand the different shades of market sentiment (risk off/on)

But let’s get to the correct answer here, the JPY and the CHF are he safe havens in this list.

And now the cherry on the cake…

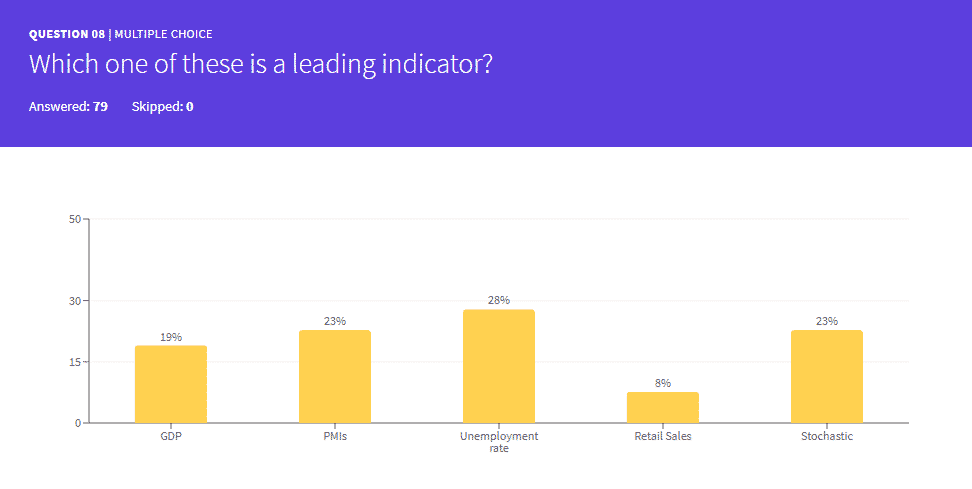

Finally we come to the tricky evil question, what even is a leading indicator you may ask, something that everybody admires as a leader? ![]()

No…

A leading indicator is an economic indicator that anticipates the lagging indicators, so an indicator from which you can anticipate future growth of a country.

And here all the traders that answered Stochastic are facepalming themselves… ![]()

Surely your stochastic doesn’t lead future economic growth right?

It actually doesn’t even lead price on your chart, does it?

So the 23% that answered Stochastic, please reflect on your priorities in your trading analysis… ![]()

The correct answer here are PMIs.

PMIs lead changes in all the lagging indicators such GDP, Employment, CPI and many others, understanding what leading indicators are and what lagging indicators are is extremely important.

The categories are 3:

- Leading (anticipate the future)

- Coincident (just show what’s happening at the moment)

- Lagging (show what already happened)

It’s a broad subject to explain so if you are interested in learning more about it then google is your friend again 😉

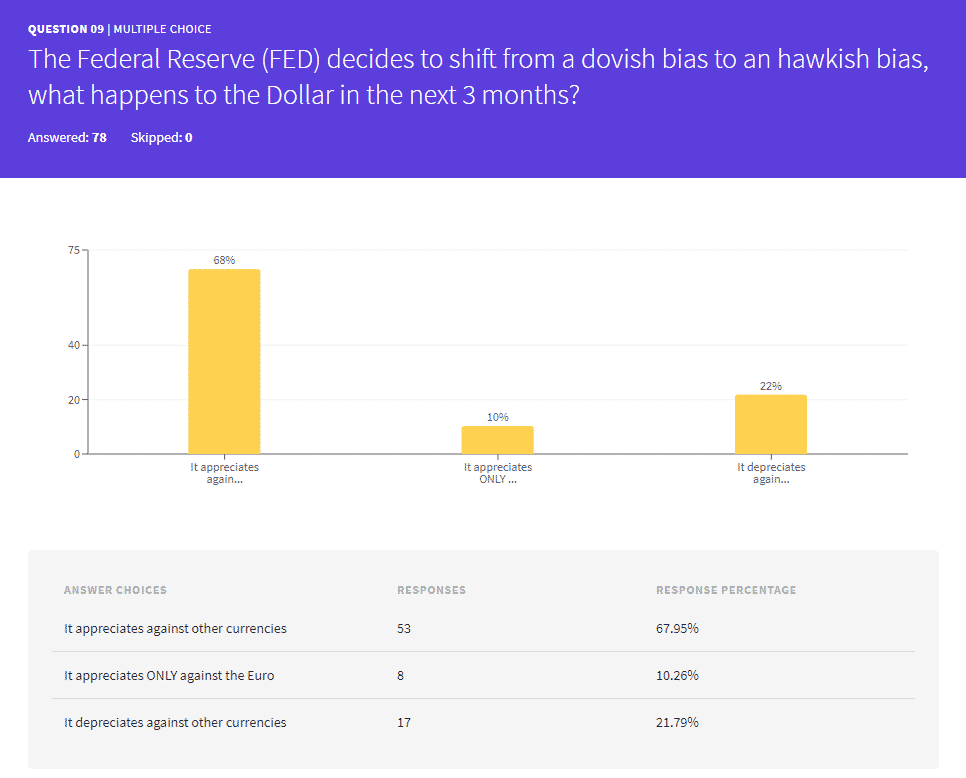

And here we get back to monetary policy basic concepts, what happens to a currency when a central bank shifts from once stance to the other?

And the correct answer is of course “it appreciates against other currencies”

If a central bank shifts from a dovish to an hawkish stance then it means they are now looking to hike interest rates in the future and that’s positive for the domestic currency, the opposite would be true as well of course.

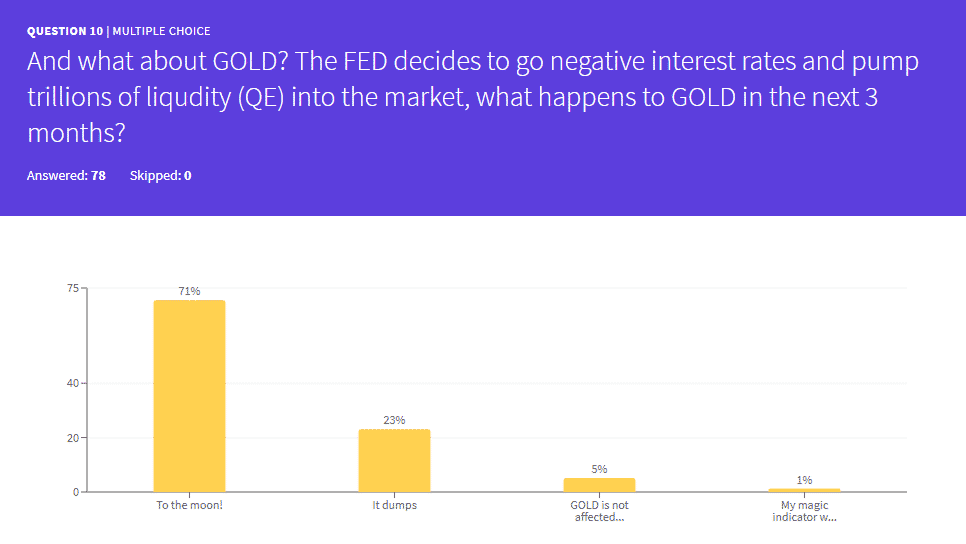

And for the GOLD lovers yes the correct answer is “To the moon!”

why?

Gold, silver, platinum, and palladium provide a safe haven against inflation. When a central bank pumps money into the system, by definition, they are attempting to induce more inflation, precious metals investors view these actions as inflationary and move quickly their savings or investments into these safe haven assets scared about the devaluing of their domestic currency.

So in simple with negative rates and QE a central bank inevitably devalues the domestic currency and increases inflation and would you keep your money into something that is devaluing?

No, hence attractiveness for GOLD increases.

And that’s all, hope you enjoyed taking the quiz and you learned something, and yes you haven’t even scraped the surface of fundamental analysis…

More quizzes to come in the future, this time harder ones, yes this one was easy…