Trades

besomebodyfx

WHAT are month end flows and how to benefit from it?

Don’t worry we won’t into the complex technical details of the flows as it would get too complicated and basically useless for real trading…

What instead we want to teach you with this article is how to benefit from these month end flows, and read until the end to see a trading opportunity that you can capitalize on as soon as next week starts…

So let’s get into it

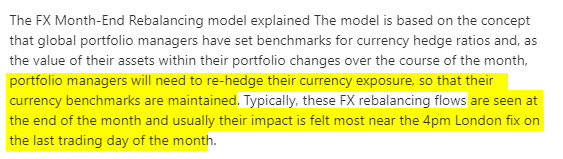

Don’t worry i said we will not get too complicated and indeed we won’t, the key takeaway from this definition that you need to understand is simple, at the end of the month there are portfolio managers and funds that need to rebalance their portfolio exposure before the London session ends hence why the biggest impact of this is seen at 4PM London time of the last day of the month which is called the London Fix.

So you may be asking yourself…

How the heck do i know what these portfolio manages have to hedge so that i can ride these month end flows?

Well you can’t…

Or better, you can’t without proper tools or the right contacts tipping you ahead of the move, hence why we have the Private Network so that we can send the members these type of tips thanks to out tools and contacts 😙

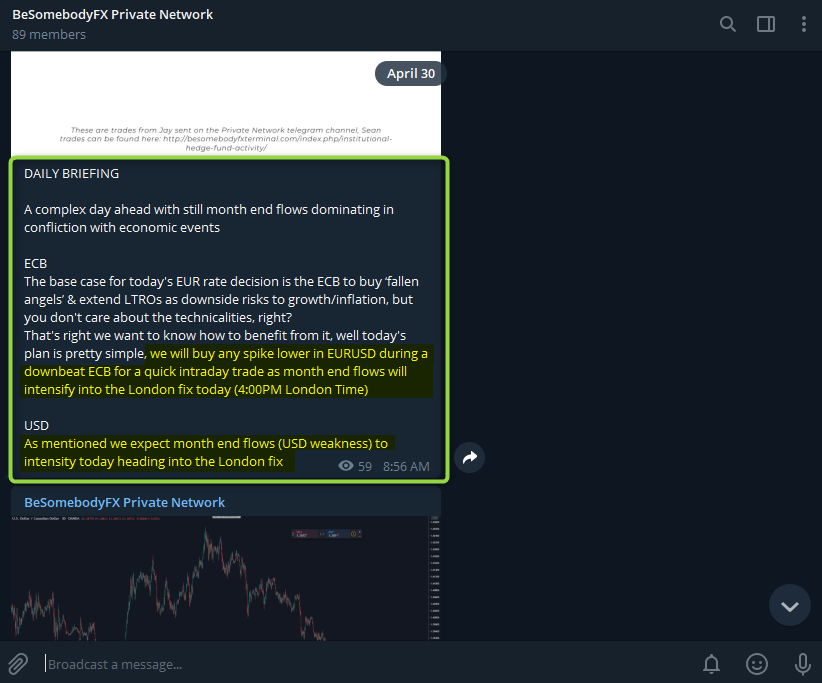

We knew exactly that month end flows for April would have been USD selling hence USD weakness so we tipped the members at the London open.

How did we know this?

First an extremely useful tool that we use to predict these month end flows is the Capital Flow Tool from the BeSomebodyFX Terminal

That tool gives us clear direction on where money are moving across assets, but we are not here to flex about our tools and services…

You should already know by now that being a Private Network member gives you the edge in the market 🤪

But let’s get to the point of this article before you leave thinking “i will never be profitable if i’m not a Private Network member“

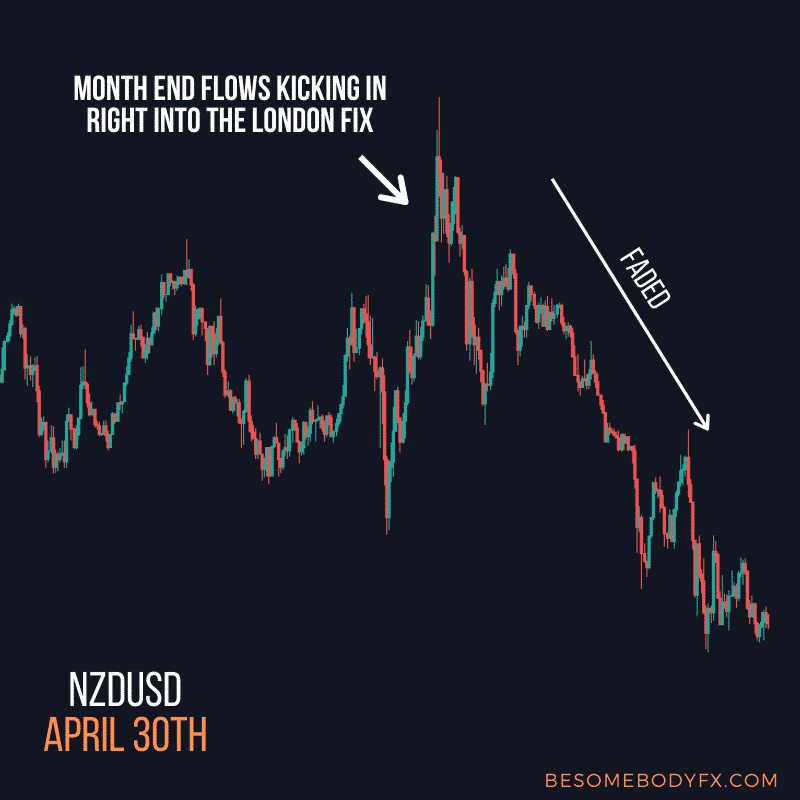

The month end flows are not only useful to ride when they happen but they are extremely profitable to FADE once the month ends…

Yes because think about it, there is no fundamental or real catalyst for that move and the market moves pricing in geopolitical factors, interest rates, macroeconomic, central banks policies etc, so what happens if the market rallies 200 pips for no reason right at the London Fix at the end of the month?

Easy, the market needs to reprice back to his original value, that 200 pip move has no reason to be there it was just caused by a technical rebalancing in the portfolio managers book, it wasn’t cause by a shift in fundamentals, hence it’s a GREAT fade.

And this is exactly what happened with the April month end flows too, we saw USD weakness on many pairs to then reverse completely the move on May 1st

Oh and same happened with JPY pairs, the Yen saw a massive spike of weakness right into the London fix to then reverse on May 1st

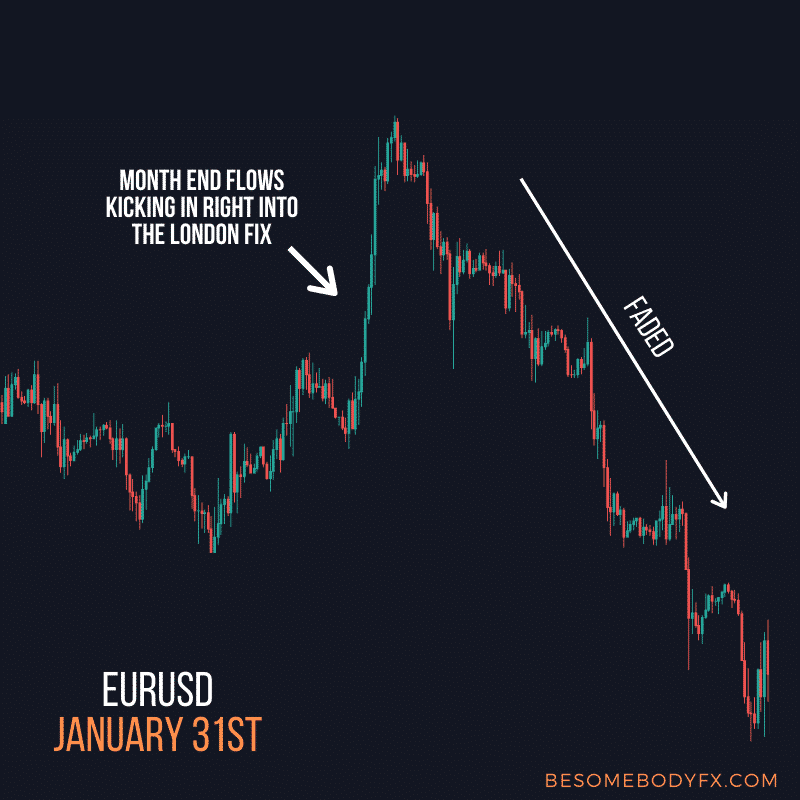

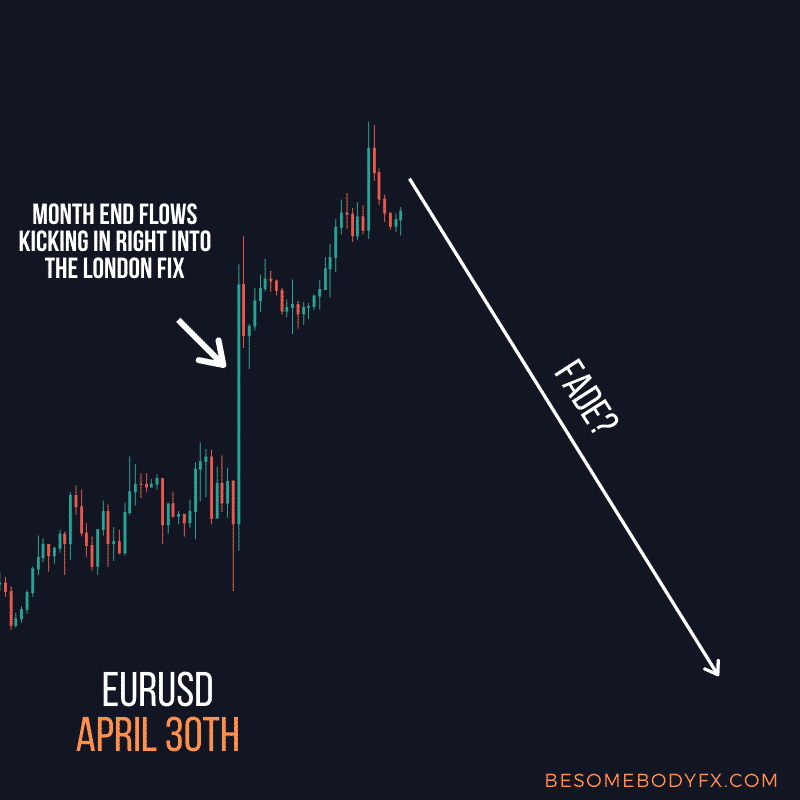

Now these type of flows DON’T happen every single month, you need to be good in recognizing when it’s real month end rebalancing or when it’s only a normal market movement, here is another example from EURUSD for January month end flows.

Do you see where the opportunity lies?

If you see a crazy move in the last day of the month which is not being driven by economic news or events and it’s extremely impulsive with little to no retracements that’s your trade right there, you can fade it once the next month begins…

And now here is a bonus 😉

As you can see EURUSD still has to retrace April month end flows.

Can this be an exception where the flows are not retraced?

Yes it can of course, but the edge to take the trade for us is there, if we are proven wrong this time no big deal we don’t take it personally and we move on to another idea.

So can you short EURUSD?

I’m not going to tell you if you can short it or not, the article is self explanatory but I can tell you that we in the Private Network are short with an extremely small position so manage your risk well if you want to give it a shot 😉