Trades

besomebodyfx

HOW TO MANAGE YOUR FOMO

With the recent volatility in the market, it’s time for every trader to start managing their emotions and most of all their FOMO (Fear of missing out)

I’m writing this post down to teach you a process useful in your trading to help you avoid poor decisions, because most of a trader losses are due to bad decision taken emotionally and instinctively…

You see a sharp move in the markets…

Maybe you even predicted that move...

But you didn’t execute your order, now the pair is moving and you don’t want to miss it out, you want to jump into the train not realizing tho that it’s arriving to the station hence it’s too late, your risk reward is now awful and you take a poor trade that’s maybe going in your favour for a few pips but then reverses, squeezes you out of it and then resumes in the original direction…

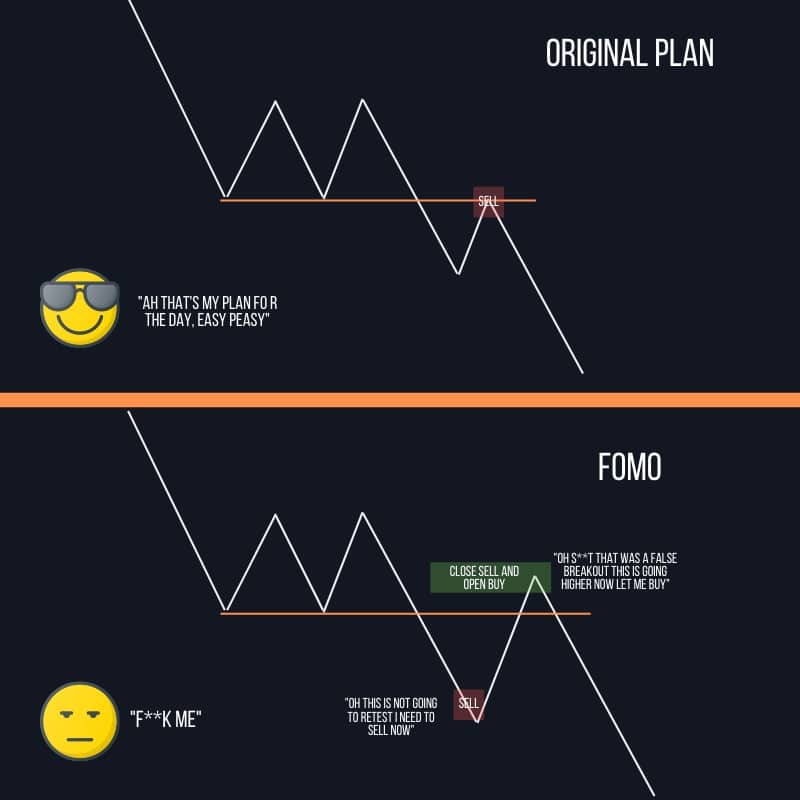

The image below is the perfect representation of that:

You may think:

“well this happens once and then you learn from it”

Well no, many never learn from this and they keep repeating the same mistake.

Why?

Because the markets are good at fooling people, it is literally what it does every day, and it evolves day after day to always stay ahead of your game so that you can be fooled over and over again.

So how can you solve this problem and never fall for it again?

This is what we are going to speak about in this post so sit back, take a notepad and write down some notes…

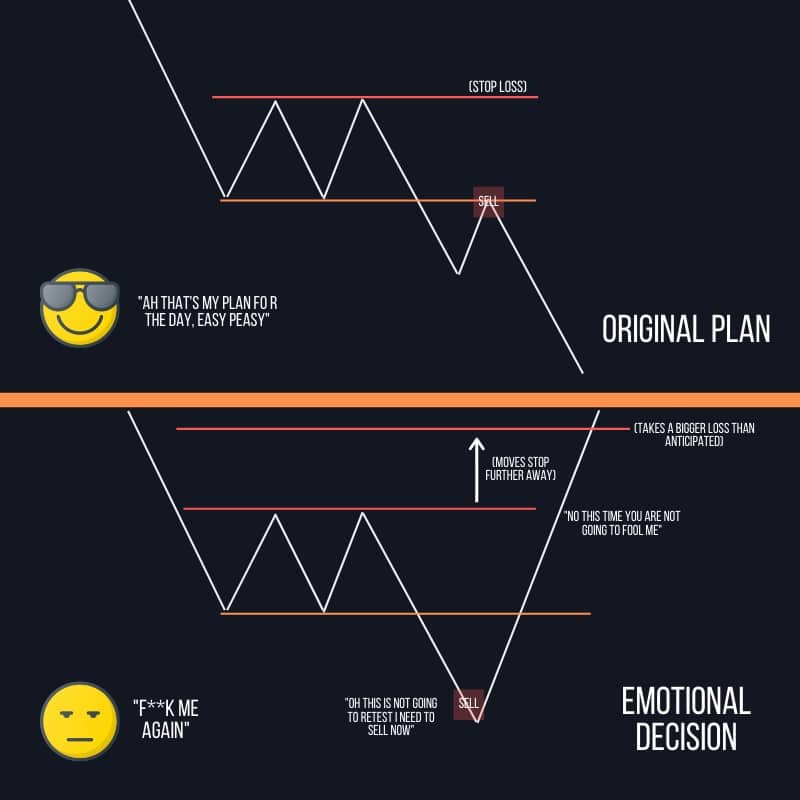

First, its important to understand that the fear of missing out is not a once and done type of thing, it’s a process that sparks a series of poor decisions, because when you take a loss or you get trapped by the marked to then see it unfold in the direction you predicted but this time without you, that sparks a sentiment of frustration that can be extremely damaging for your trading, because in the next few trades you can jeopardize your account because you don’t want to get “fooled” again by the market like the last time.

Think about it, did you ever hold into a trade moving you stop loss just because the last one stop hunted you to the pip?

So what’s the solution to this?

The solution to not jeopardize your trade while open is “simple”, have a plan, set an entry, set a stop loss, set a target and DON’T touch anything once you are into the trade, if your plan is good enough in advance you don’t need to do anything when you are in the trade.

If you entered it in the first place there must be a solid reason to, right?

So why you need to watch it every 2 seconds?

BUT HOW TO AVOID STUPID TRADES?

Before you enter the trade you need to go trough a few steps to avoid an emotional decison…

I want you to manage your behavior better, to create a set of good habits, so let me give you a set of good rules.

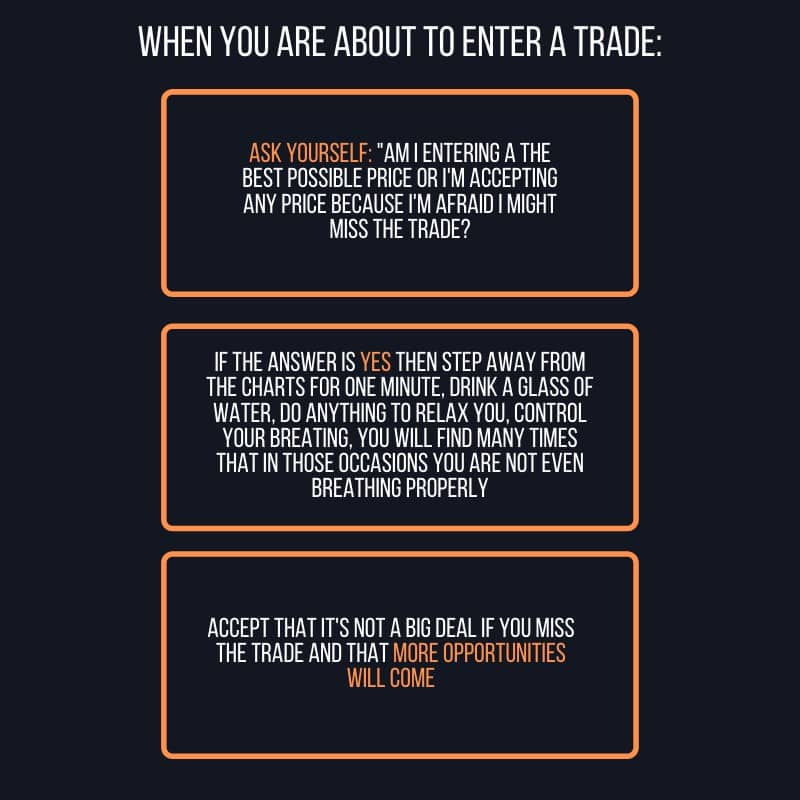

First, when you are entering a trade:

Print this image and stick it on your desk, every time you are about to enter a trade you need to ask yourself:

“Am I getting FOMO, am I getting at the best price for this trade; can I get trapped by the volatility here and lose control, is it a rational trade driven by solid reasons or I’m just trying to make up a lost trade?”

If any of these is a yes then, take a breath, count to 10, control your breathing and you can even get up and move away from the chart.

It’s NOT EASY to do, but it’s a habit, once you have carved it into your daily trading you will bring this with yourself forever, you must work on it tho, so you must do it every single time you take a trade.

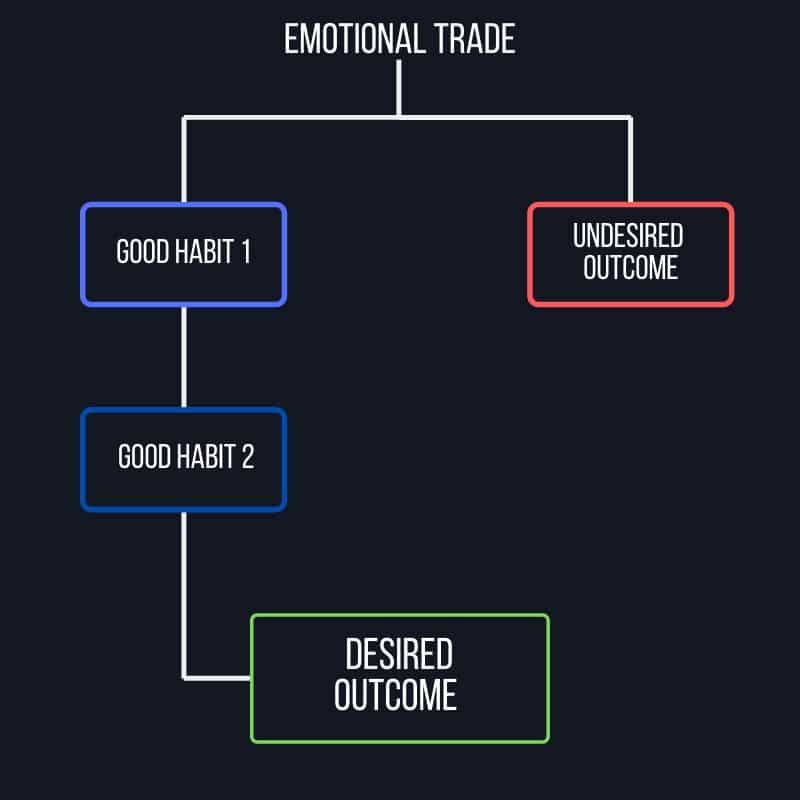

THE EMOTIONAL TRADE

Understand that an emotional trade will quickly bring you an undesired outcome (a loss) sometimes even bigger than what you wanted because you don’t set a stop loss or you move that stop loss further away or you take too many random trades in a state of complete panic and confusion trying to cover the losses.

While instead, an emotional trade can turn into a desired outcome too (a profit) if put through a set of good habits, so, for instance, controlling your breathing, stepping away from the charts for a few minutes, drinking some water, anything that can help you in your decision making…

So every time you take a trade, go trough a set of habits that you prefer to make sure you are not entering into an emotional trade.

But now let me honestly tell you, emotions are not only what’s stopping you from making more profits, If you are finding that you are getting chopped out a lot in these markets and you are questioning your approach, well traders usually are are not taking into account enough fundamental information, geopolitical news, they are not aware of what the average retail trader is doing, where they are positioning themselves vs the hedge funds and the institutions, it’s really important to be aware of this and be aware of market sentiment, trade flow, cycles, seasonality and understand how to apply everything together, that’s what will give you the edge in the markets, so if you are missing one of these and you would like to join a community of successful traders and learn a research driven approach, you have the opportunity to do so, as a member of the BeSomebodyFX Private Network you get access to our exclusive trading tools, real time trading signals (both long and short term), trading researches and market insights, private academy section, support from experienced professional traders, daily briefings, weekly briefings etc…

And last but not least, access to a community of institutional traders to help you remain focused and disciplined.

Click on the link below to join the private network now…