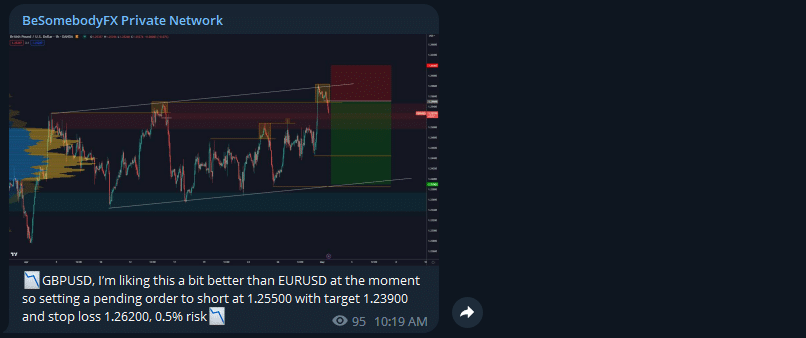

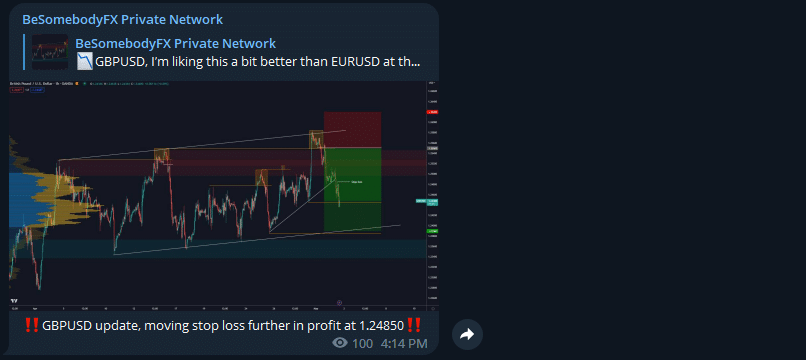

Trades

BESOMEBODYFX

CRYPTO GLOBAL MACRO Q2 2025

MIXED STUFF…

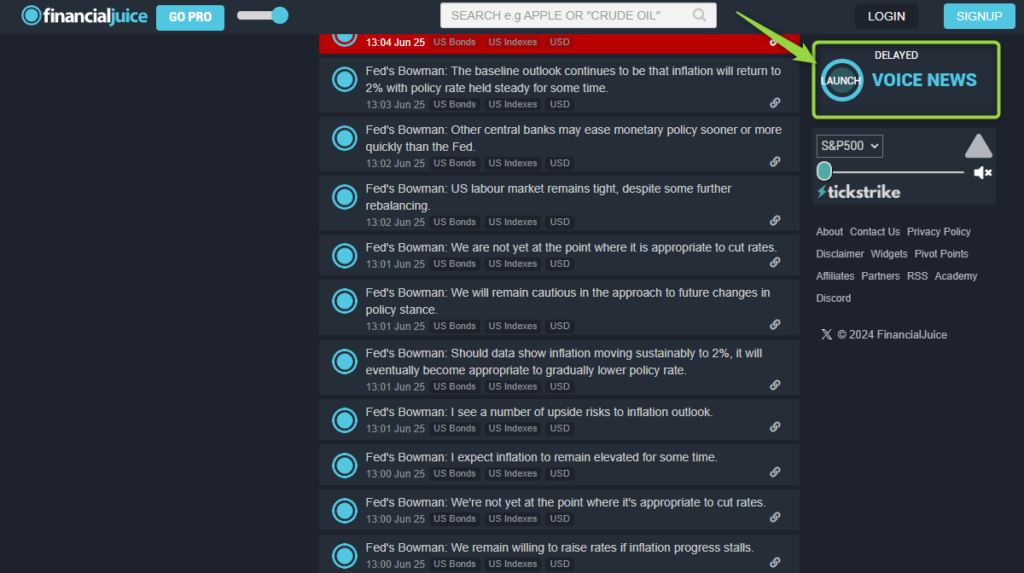

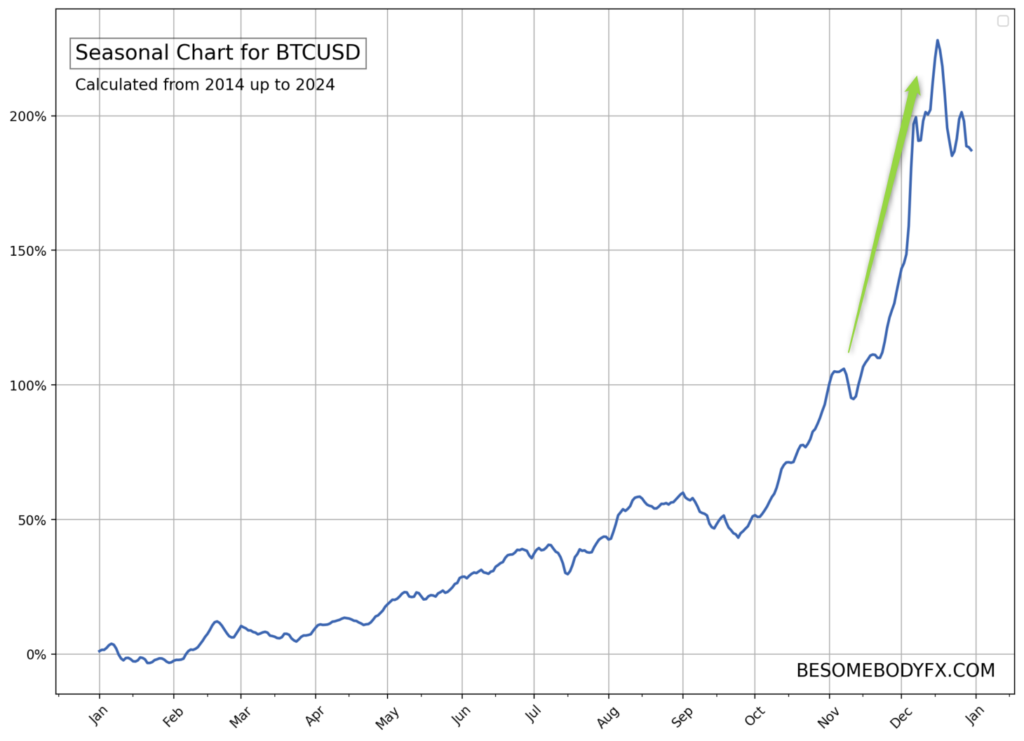

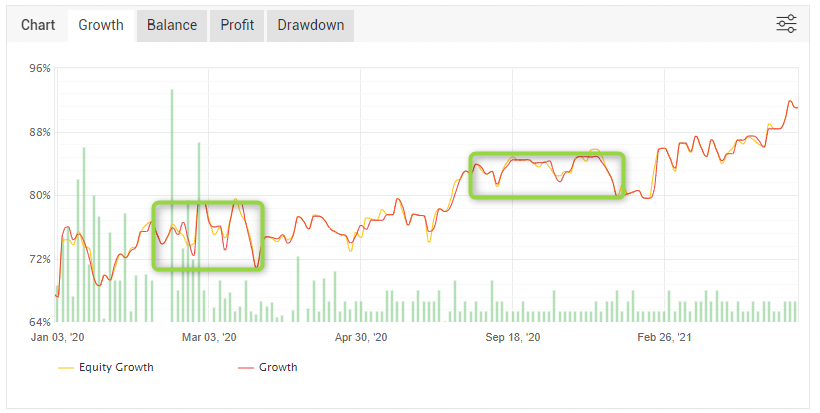

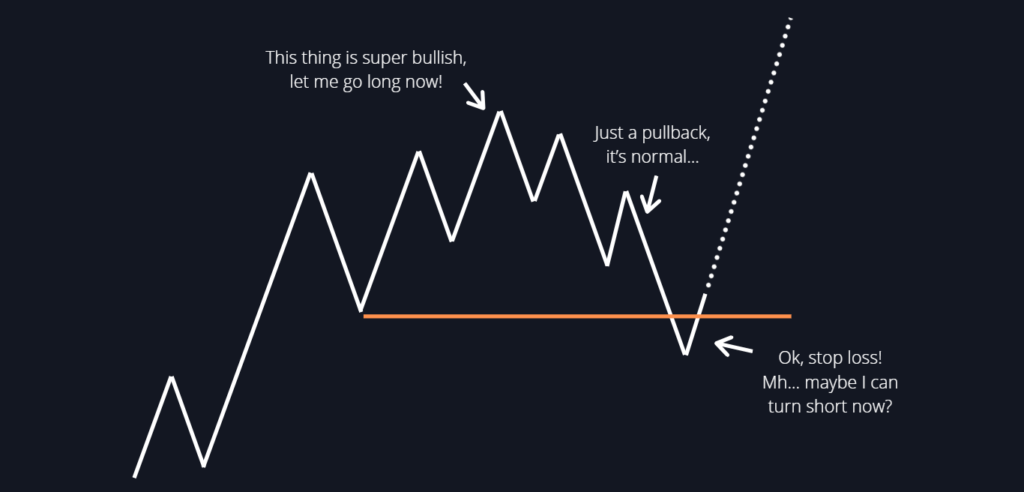

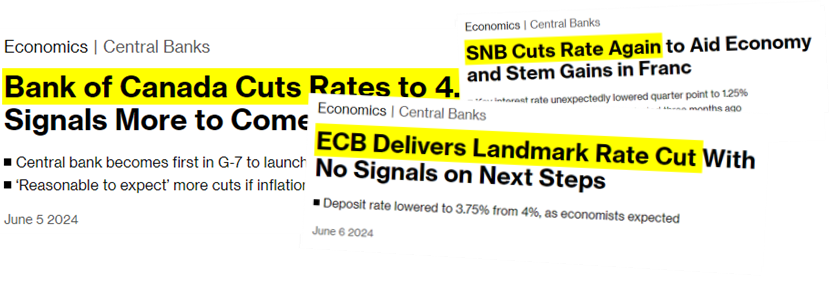

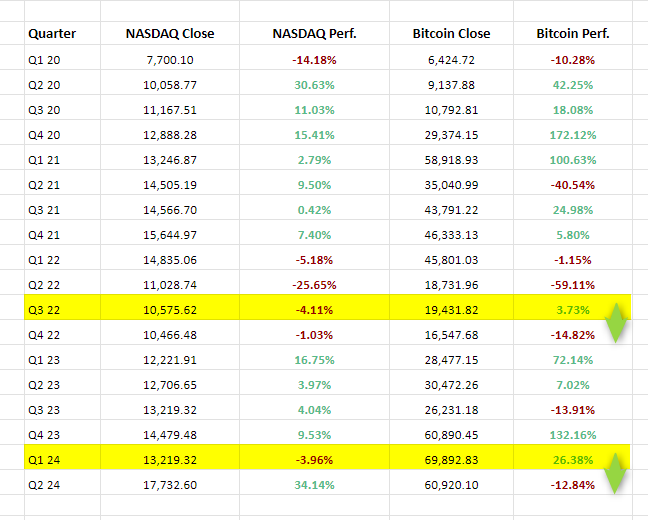

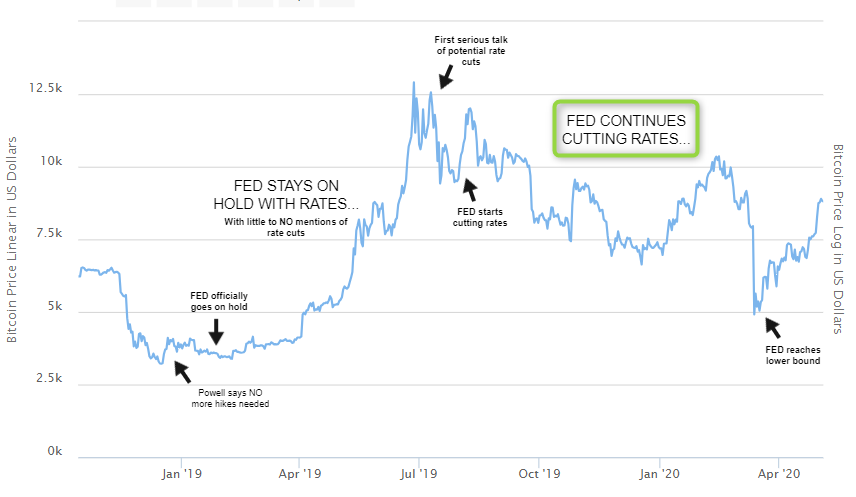

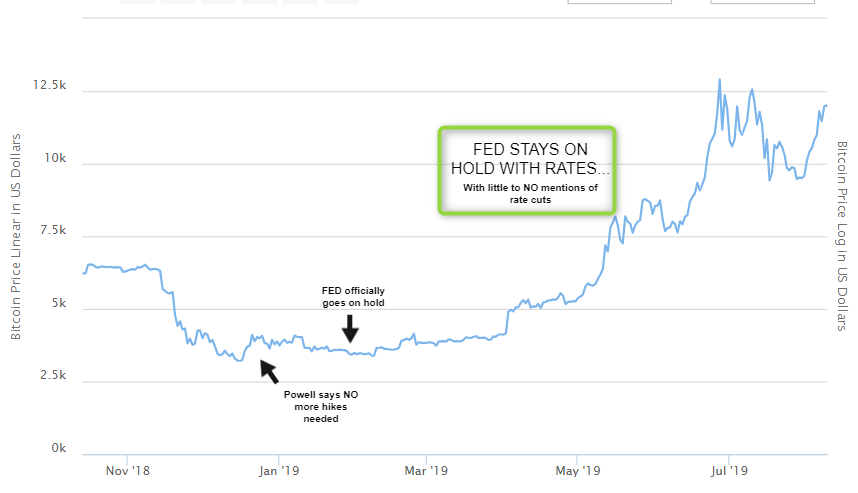

If you follow our quarterly updates on crypto you will remember the chart below from the previous macro update.

This is the chart that Bitcoin bulls conveniently ignore. Just beware of it.

- BeSomebodyFX

Read on SubstackOk.

Now what?

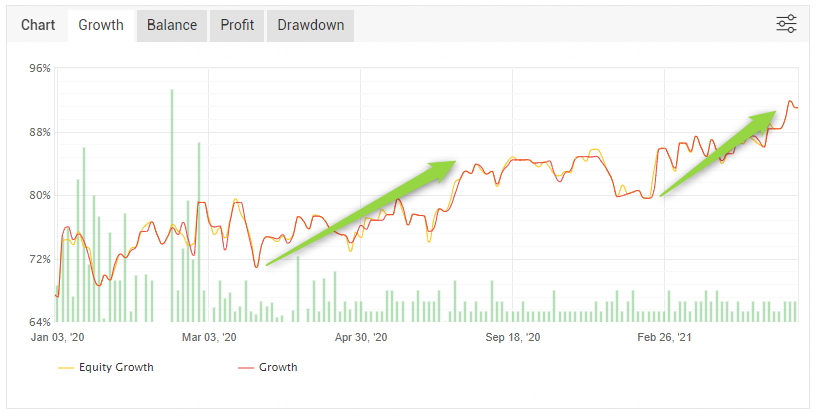

Now here’s how that same overlay (Bitcoin with global liquidity) is looking:

Kinda bullish?

Yes.

But hold on, not too fast!

We are NOT super bullish here.

We are just a tiny bit bullish while also FULLY aware that there are A LOT of downside risks building up that could weigh on price for a while.

What are those risks?

The risk variables ahead:

Namely two…

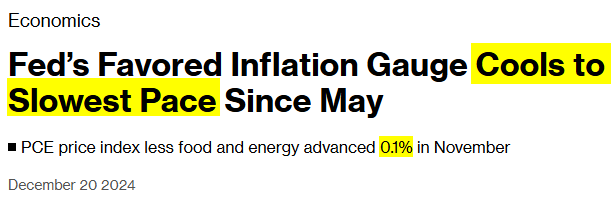

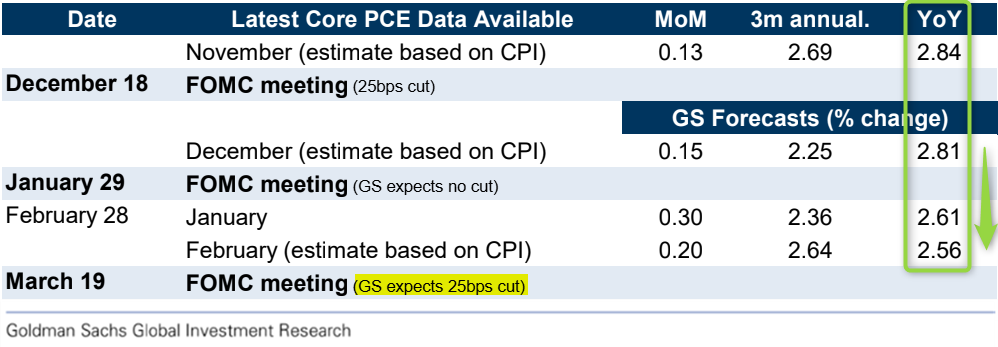

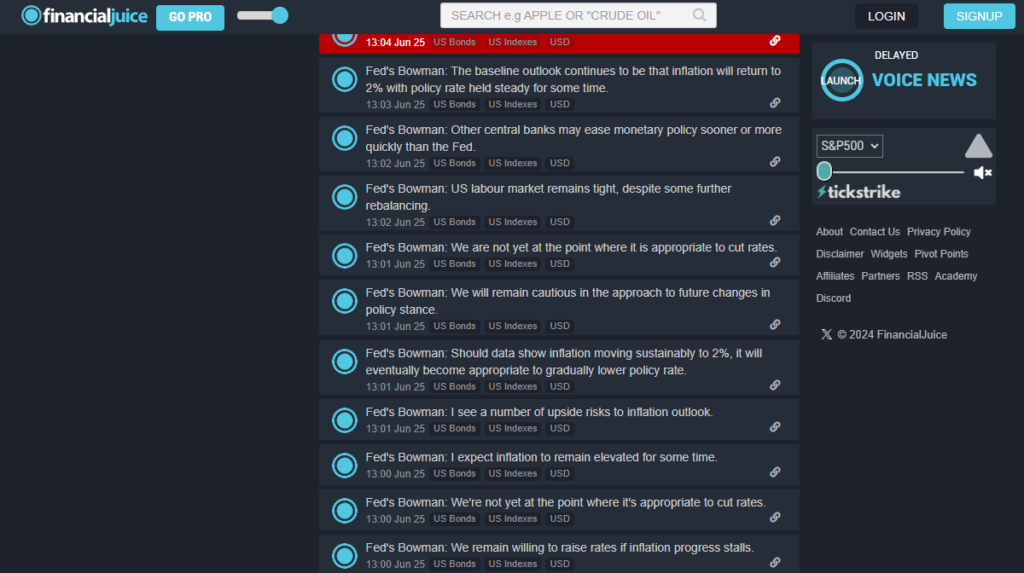

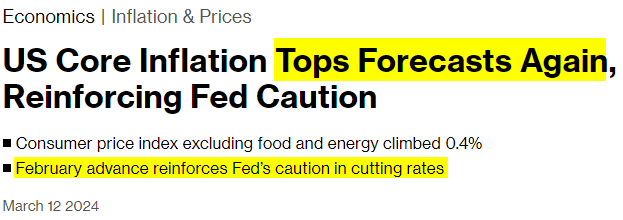

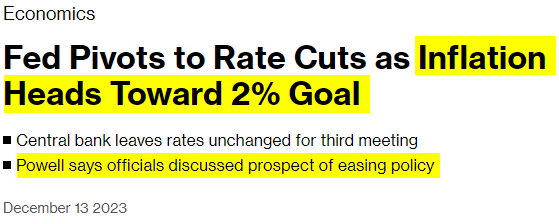

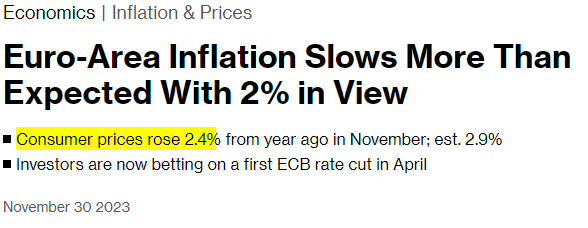

Trump’s tariff.

And inflation (again).

And both are sort of related there.

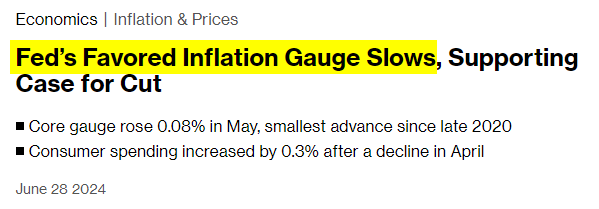

Inflation is at risk of bumping higher again because of Trump’s tariffs, and that’s bearish for risk assets.

And Trump’s tariff also threaten global growth, potentially a short term quick recession, and that’s also bearish risk assets.

And as you know (or as you should know) Bitcoin is a risk asset!

So it does well in risk on, and it doesn’t in risk off.

Makes sense?

If it doesn’t, watch this video that explains what risk sentiment is all about.

With that in mind…

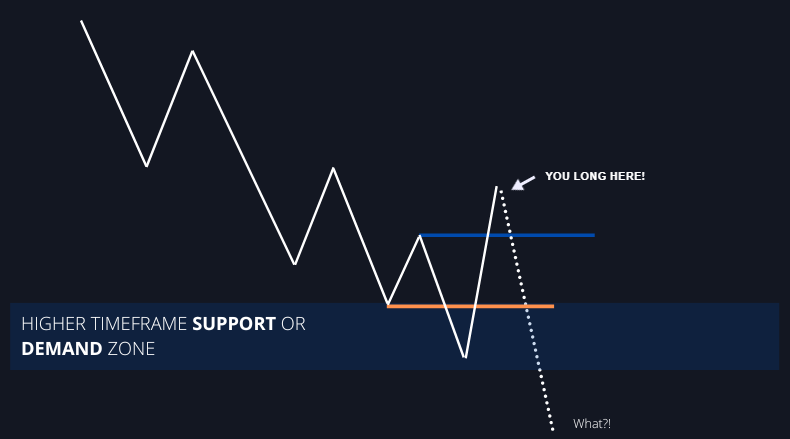

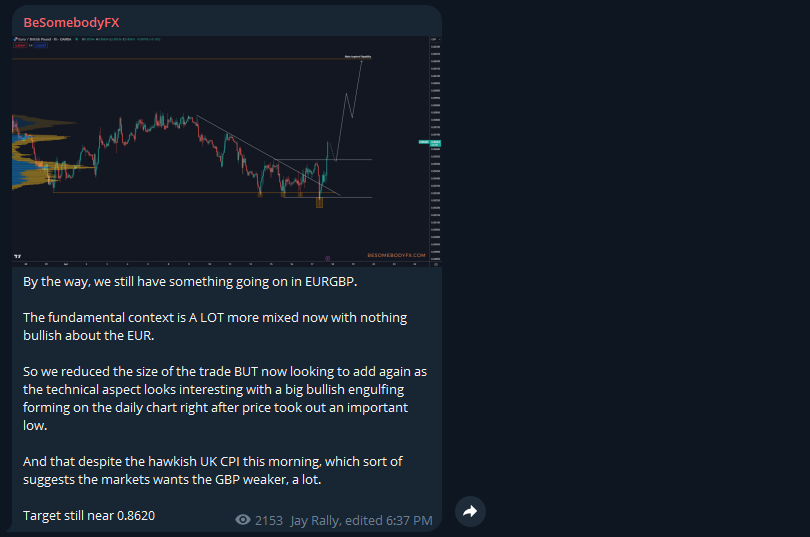

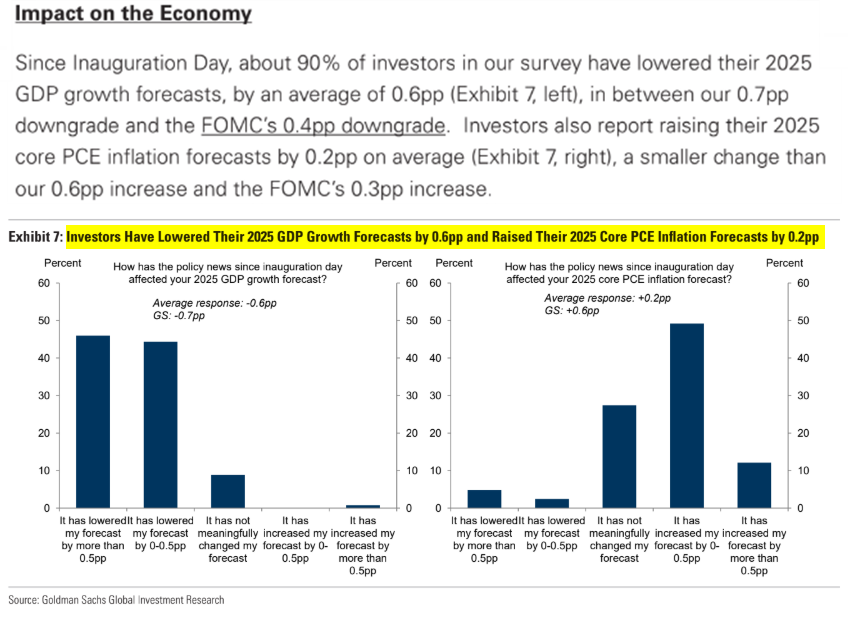

Here’s what Goldmans institutional investors are expecting:

As you can see, lower growth, higher inflation.

Stagflation?

Kinda, I mean stagflation is when inflation is A LOT higher and growth A LOT lower, and that’s NOT the case here.

But nonetheless, the direction of travel moves toward stagflation, and that’s a risk.

And that’s also why GOLD (the safe havens of safe havens in a stagflationary enviroinment) is doing wonders:

But I’m sure you noticed 😉

WITH THAT SAID…

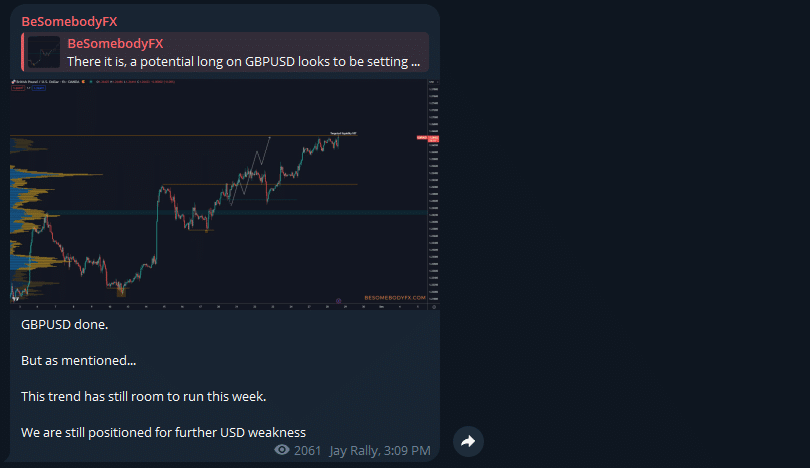

The moral of the story here is that we don’t have a clear bias at the moment.

We are slightly bullish (because of global liquidity) but things can change at any minute with Trump.

That’s how it is right now.

Be flexible.

If you want to get alerted when we publish the next update you can leave us your email down below.