Trades

BESOMEBODYFX

CRYPTO GLOBAL MACRO Q4 2023

NOT SUPER BULLISH BUT ALSO NOT BEARISH. WHAT’S THE OVERALL CONTEXT FOR CRYPTO AND HOW ARE WE POSITIONED?

Alright.

Straight to the point…

Has anything changed in the crypto space?

No.

Not really.

In the previous crypto update we talked about how we were bullish biased for the time being on BTC.

And well…

That hasn’t changed.

The fundamental context with FED’s monetary policy and the overall growth context still suggests higher prices on BTC at the moment, 35k first and then from there we can think about whether 40k is achievable as well or not#BTCUSD #BTC #Bitcoin

— BeSomebodyFX (@BeSomebodyFX) August 14, 2023

And there’s also nothing new to add to what we discussed in the previous update, so…

BORING.

I know.

Crypto right now feels a little… boring.

But hey, boring usually precedes interesting moves so boring is also interesting.

But ok.

Are we still bullish?

Yes.

Let me show you…

The fundamental sentiment around risk assets:

So, first of all…

The recession keeps getting postponed, doesn’t it?

Looks like.

This kind of context over the medium term is supportive for higher risk assets such as the NASDAQ and the S&P500.

But what about crypto?

Like… where is BTC in all this?

Well, some of the models we look at are flashing green for potential upside.

We look at a variety of factors but in this update let me show you one of the most curious.

Which is?

Google trends…

Now this is interesting, there’s a meaningful jump on Google trends for BTC related searches, usually this happens right before or during meaningful upswings in price, you can see in the image below the other most recent instances, interesting behavior#BTCUSD #Bitcoin #BTC pic.twitter.com/TIntNMLSj7

— BeSomebodyFX (@BeSomebodyFX) August 31, 2023

Yes, yes.

I know.

It feels SUPER cringy to look at Google trends to get the sentiment for crypto.

But hey…

It’s not that bad at all.

Most of the upticks in searches have preceeded or matched large upswings in price.

So a cringy, but potentially useful leading indicator.

But ok.

Is that by itself really enough to be bullish?

No.

Of course not.

So let’s get a bit more specific…

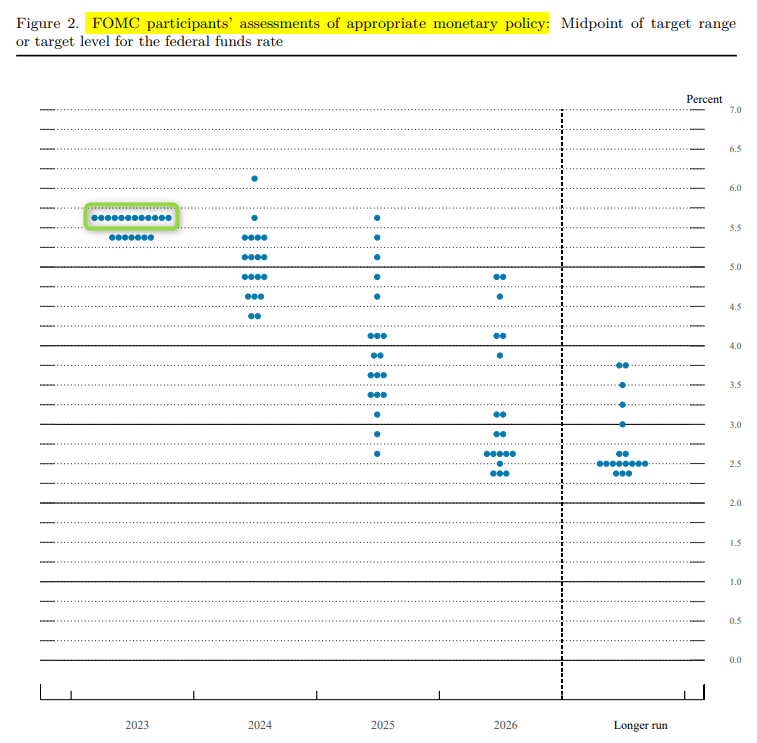

Where monetary policy and the FED are at:

No doubts…

The aggressive tightening cycle is history already.

The FED is essentially done hiking.

And now rates should stabilize at 5.50% for some time…

Which is evident from their latest dot plot:

They see a possibility of another 25bps hike in November.

But after that…

Rates are seen on hold.

So…

Is this bullish? Is this bearish? What is it?

It’s… neither.

The current monetary policy context is faily neutral for the overall sentiment.

Sure, interest rates at 5.25% are NOT bullish.

But the fact that they are NOT going to 6% and that inflation is moderating farily well at the moment IS… bullish.

So?

So let’s recap…

the overall macro context and sentiment:

The monetary policy context is farily neutral but the growth context is fairly bullish.

And that overall makes the context slightly bullish for BTC.

Sure, it’s pretty stale as of right now, but isn’t that what the market does?

Bore traders to dump their holdings because “the market isn’t going anywhere” before taking off?

Fact.

But wait.

Don’t get me wrong.

I’m NOT saying BTC will soon take off to 100k.

I’m saying that slightly higher prices from here are more likely than lower.

More or less.

You get the point.

35k is more likely than 20k for BTC, so to speak.

With that said…

What to keep in mind…

This is STILL fundamentally the moment to be in a “soft” unleveraged dip buying mode for us.

But remember…

The word “soft” in that sentence is VERY important because the context is NOT perfectly bullish, at all.

I mean, this is NO context to be buying dips left and right with leverage.

No, but it’s good enough to have some exposure anyway.

We hold some small unleveraged positions and we just sit on those patiently.

That’s all there’s needed to know right now.

The next update for crypto will be in the first week of 2024 so if you want to get a few more interesting and useful info along the way while also being alerted when we publish the next update you can leave us your email down below.