Trades

BESOMEBODYFX

The fundamentals that matter to trade consistently

YOU WANT TO KNOW MORE ABOUT WHAT FUNDAMENTAL ANALYSIS REALLY IS ABOUT? cool, let me show you something interesting.

Ok, let me throw you into a trading scenario right away.

It’s FOMC rate decision day and Powell is about to get to the microphone…

There’s tension, like always, for what he’s going to say.

The FED hiked interest rates by more than 500bps in the span of a year or so.

Unprecedented.

Historical.

Now once again Powell has all the attention at this meeting…

The market, journalists, investors, traders.

We all want to know if he thinks the FED needs to hike more or not.

So we wait…

Powell is little late…

Not his usual.

The man is always on time.

What’s he doing back there? Is he tweaking his speech right at the very last?

Maybe he didn’t like the market reaction to the rate decision and he’s preparing to address that?

Mh…

Oh wait, hearing the clicks and flashes of the cameras, means he’s here…

Yes, there he is:

Powell takes on the microphone and, as regularly, he goes on with the introductory statement.

There’s something interesting in there but nothing that hasn’t been said on the text release that the FED published 30 minutes earlier.

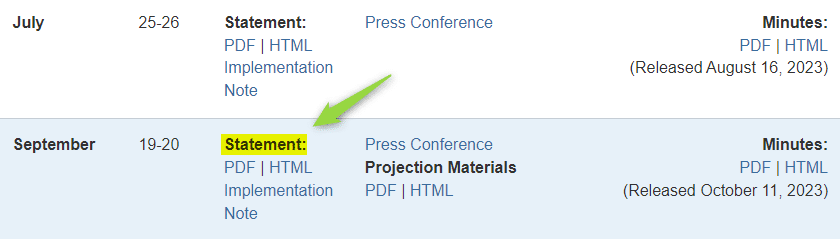

You know, the one attached with the rate decision:

That sometimes can have interesting bits of insights but often the most interesting part is when Powell takes question.

And that comes right after the introductory statement.

And there he is…

Powell is now taking questions from the press…

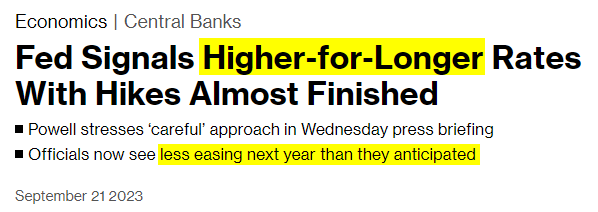

Keywords like “higher for longer” and “fewer rate cuts” dominate in most of his answers.

What do we call that?

Hawkish.

And what does hawkish mean for the Dollar?

Bullish.

Yes.

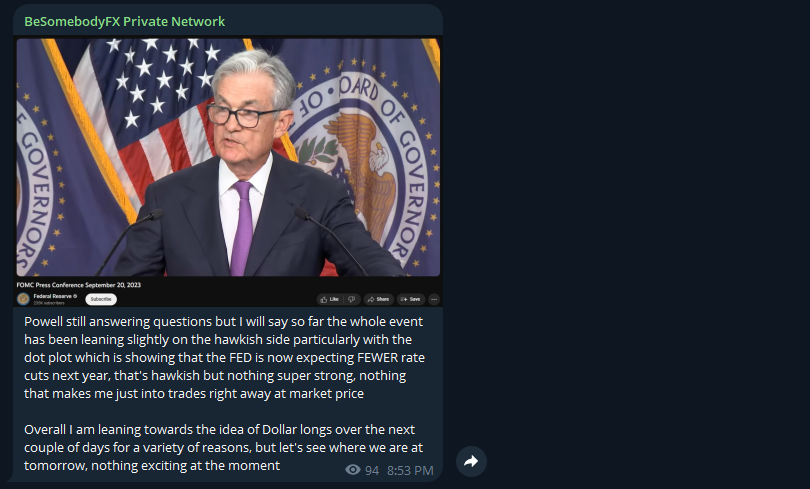

We brief the Private Network with our thoughts on the matter:

Now headlines from the major news outlets are hitting the wires too.

Bloomberg is on the same page…

Hawkish it is.

Powell and the FED are saying that there might be another rate hike ahead and mostly… they want to keep rates high for higher than anticipated.

Alright, what’s the trade?

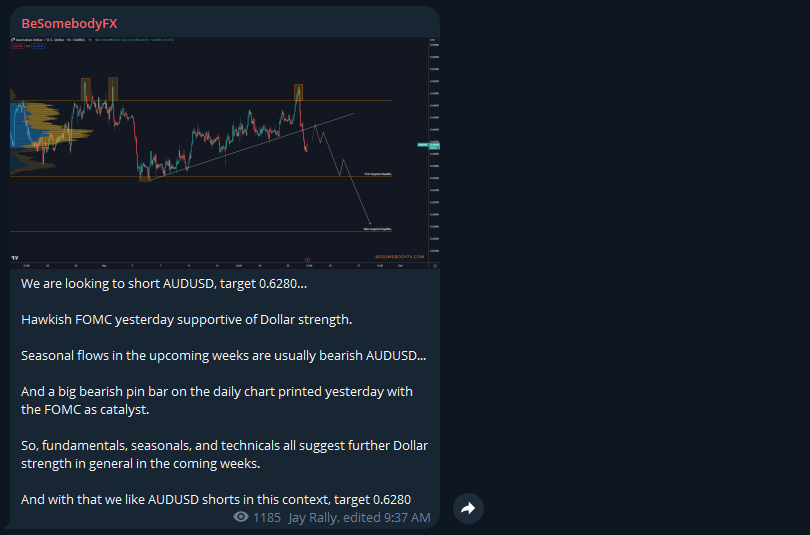

Scanning through the charts to see what Dollar pair gives the best technical setup.

The best technical setup? What do you mean?

Yes, the best price action, the best risk reward.

All that kind of stuff.

We update again the Private Network with a detailed daily briefing with out thoughts and ideas:

So, yes…

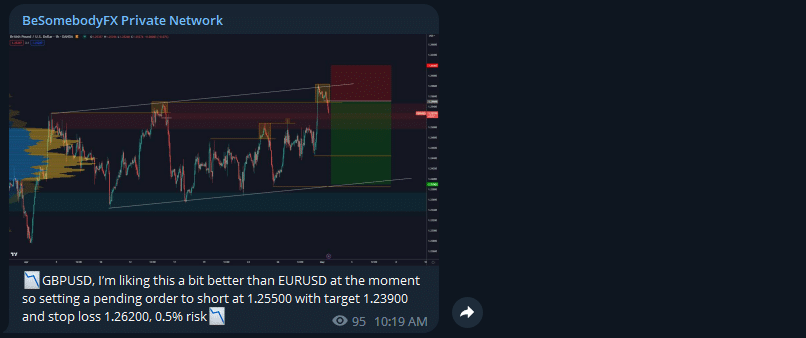

Let’s put the trade on:

Alright?

Perfect.

And now?

And now we wait…

More headlines keep hitting the wires from Bloomberg:

All still hawkish interpretations.

And the price action on the chart so far looks good, nothing crazy going on like random fades and whatnot.

Cool.

Now the next step is to just let the trade play out?

Yes.

It’s to keep track of the fundamentals and let the trade unfold.

The fundamental flows that shape the trend:

What happens after an important FOMC are two things…

First, other macro traders start positioning according to the latest sentiment and forward guidance from the FED.

Which in this specific example is?

Hawkish.

Which for the Dollar means?

Bullish.

And second, the traders that are on the wrong side of that sentiment start closing their positions.

I mean…

What happens to Dollar bears if the context turns bullish?

They have to cover their positions because they are on the wrong side of the sentiment.

Either they hit stop loss or they close their trades manually.

So what happens with these two types of flows?

We have Dollar bulls adding because the fundamentals are in their favor.

And Dollar bears squaring their shorts because they are on the wrong side.

So?

So a trend is created.

A fundamental trend.

We update about the potential trade setup on the public Telegram channel as well:

And there it is…

That’s a real trade based on real fundamentals.

And that’s the kind of fundamental trading in Forex that matters.

So…

What it is REALLY about?

Fundamentals in Forex is about understanding the sentiment:

Yes.

Market sentiment.

Fundamental sentiment.

Fundamental context.

Macro context.

They are all the same thing.

Fundamentals are the sentiment and the sentiment is a product of the fundamental context.

In simple…

If the market is trending that means there is a specific sentiment, and that sentiment is a product of a specific fundamental context.

Read that again if you need to.

Done?

Cool.

With that said…

This is the simple and effective way of thinking about fundamentals.

Sounds easy, right?

Well, maybe.

But it’s NOT something that you can learn overnight just by reading a single article.

No.

It’s something that you have to learn from real trading with real traders.

That’s what builds experience.

So if you like that professional way of doing things that both builds your experience and gives you good trades to follow…

Then check the Private Network.

That’s where you can follow our exact trades and read our thought process to build and grow your fundamental knowledge 😉

And I mean trades like this:

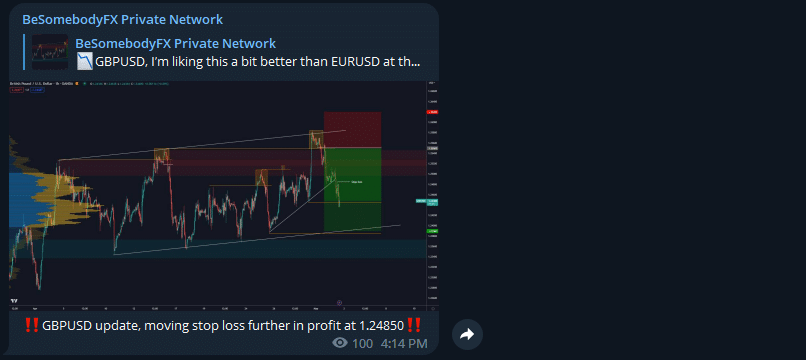

With all the various updates along the way:

Cool?

Cool.

And now with that said.

There’s still one thing to add…

The most important part about Forex fundamentals:

Alright.

Always keep in mind that the quality of your fundamental analysis is directly correlated with the quality of the information that you get.

I mean it.

That is really the most important thing that you can understand about the subject.

So?

So follow the right sources.

The right traders.

The real ones.

That’s what makes the difference.

If you liked this article and you enjoy this kind of straightforward content, leave us your email down below to get updated if we publish another one like this.