Trades

BESOMEBODYFX

FUNDAMENTALS FOR CONSIsTENT AND ACCURATE TRADES

FOREX FUNDAMENTALs EXPLAINED AND ILLUSTRATED STEP BY STEP in actionable and practical details.

Once you know about fundamental analysis, you need to know what it looks like in action.

I mean…

It’s one thing to know the fundamentals, but it’s another thing to know THE fundamentals.

Wait, whaat?

That sentence doesn’t make sense, doesn’t it?

Well, It doesn’t.

It doesn’t until you get the RIGHT information.

Now…

Do you want to know what’s that all about?

Well, here it is…

Fundamental forex trades:

Context…

Context is the keyword when we talk about fundamentals.

But what’s that exactly?

See, when we look at the theory of funda… wait.

I know you were about to snooze out as soon as I say the words “theory” and “fundamentals” together in the same sentence so let’s change that…

Let me show you something MUCH more enjoyable and practical than some classic textbook technical definitions.

Sounds better?

It sure does.

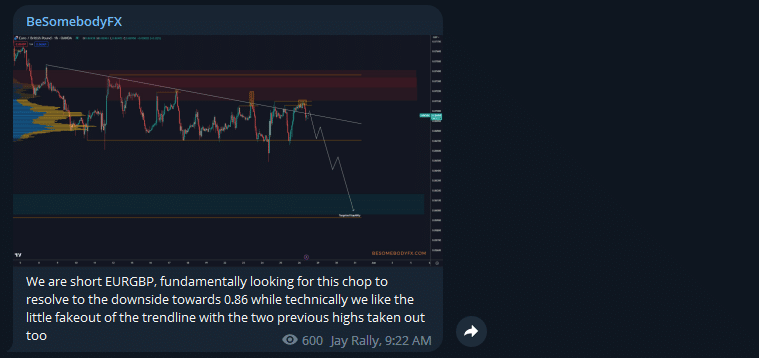

So let’s take a real trade to use as an example for the discussion:

Ok…

First, what stands out from that trade example above?

Notice that: “fundamentally looking for this chop to resolve to the downside”.

Like… what does that even mean?

What does it mean to expect something fundamentally? What’s that about?

Well… let me show you.

Fundamental analysis and market trends:

See, at any moment in time if the market is trending there is a story driving that trend.

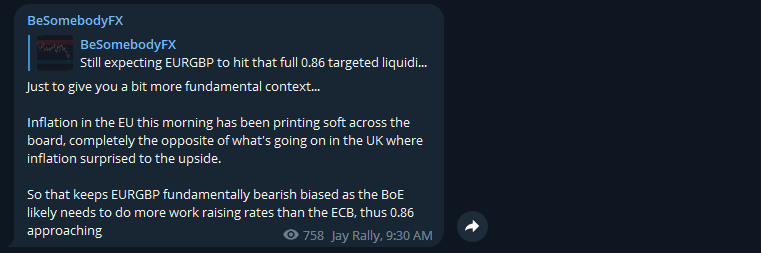

And in this trade in particular there was a narrative that was slowly starting to gain consensus.

Which was?

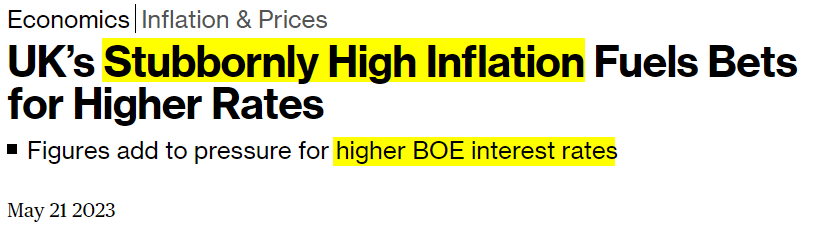

Inflation in the UK that was NOT moving lower fast enough:

That raised expectations for MORE rate hikes from the BoE.

All while inflation in the EU instead was instead slowing down.

Ok.

Now this is the part where we go a bit nerdy and technical into the fundamental aspect of the trade.

Ready?

Perfect.

Think about what that actually means for the respective central banks?

I mean for the ECB and the BoE.

If inflation is slowing down in Europe what does that mean for the ECB policy expectations… and if inflation is instead rising in the UK what does that mean for the BoE?

Simply… or not so simply depending on how much you know about monetary policy.

That means the ECB might NOT need to raise rates much higher while the BoE might instead need to do MORE… right?

Yes, that’s absolutely RIGHT.

And that… THAT was the sentiment growing in the pair, which was making it trend gradually lower.

Are you following so far?

Good, but now let’s get even MORE practical.

The trade:

So the trade was clear, we quickly went bearish on the pair expecting that narrative to continue and…

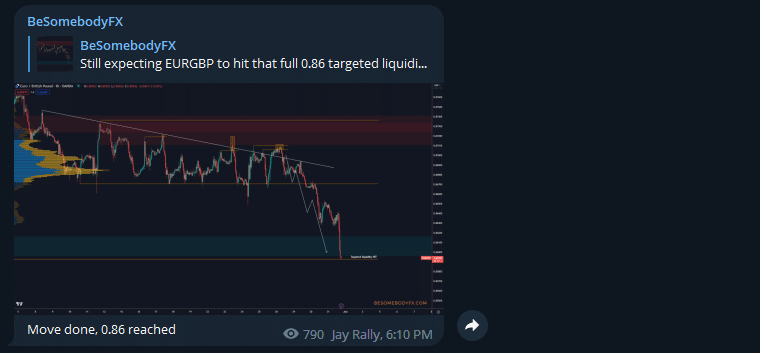

The narrative unfolded pretty nicely, inflation in Europe kept printing soft, and as a result of that the market kept increasing the divergence between the expectations for BoE hikes relative to the ECB.

More hikes from the BoE, less hikes from the ECB.

And that brought the pair to the target:

And this… THIS is a trade based on fundamental analysis.

Cool, but… what else?

I mean…

You want to know MORE, right?

Of course you do. So let’s bring it a step further…

Market sentiment:

Think about what the whole analysis revolves around.

What is it?

Market sentiment…

Right?

Yes. It’s about narrative, it’s about understanding whatever the dominant story is in the markets at any given moment in time.

In other words…

If the market is trending there is always a story and a sentiment driving that trend. And understanding THAT story is what fundamental analysis in Forex is REALLY about.

Ok, that’s interesting but now let me tell you something MORE.

Because we said a lot but we haven’t really said anything yet.

So now let’s get to THE point… the real point that will drive your understanding of all this in the right direction.

WHAT REALLY MATTERS ABOUT FUNDAMENTALS:

Ok, listen VERY closely to this next paragraph because it is the essence of the whole matter… the CORE of what you can practically use in your trading, the single concept that can give you a whole new understanding of fundamentals.

Cool?

Alright.

Here it is.

At any moment in time, when you know and understand the fundamental driver moving the market you can ask yourself…

Should this fundamental sentiment continue? Or is it near exhausting?

A simple question with an amazingly useful and actionable answer.

Yes, because the answer to that question tells you whether you should expect the trend to continue OR… whether you should expect a reversal or a countertrend pullback.

Read that again.

Done?

Good, now let me give you MORE context to make the point clearer…

EXAMPLE OF FUNDAMENTAL THEORY IN ACTION:

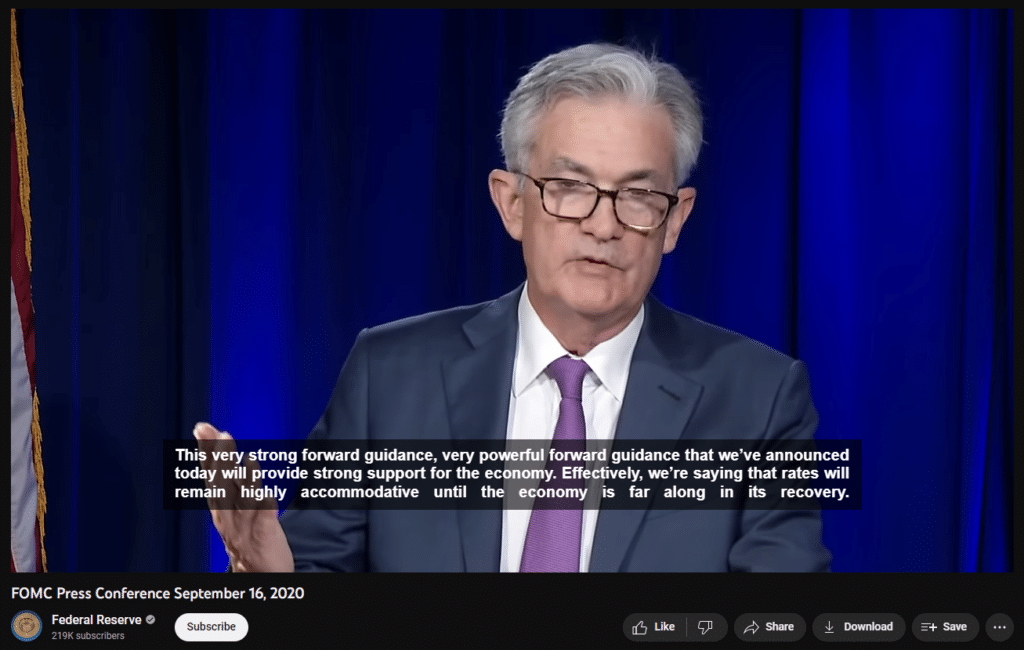

Let’s take a hypothetical example where the FED is keeping interest rates at very low levels with also a large QE program going.

Maybe you know it, maybe you don’t, but either way…

I can tell you that such context is objectively VERY bearish for the Dollar.

You know… monetary policy.

So…

In this specific hypothetical example let’s say the fundamental sentiment is bearish for the Dollar and thus the USD is trending bearish.

Make sense so far?

Yes. You know what’s the dominant fundamental story driving the trend and now you can ask yourself the question…

Is the FED likely to keep on holding rates at very low levels while continuing the QE program, or are they about to change that context?

Or more generally…

Is this fundamental sentiment that is driving the trend right now likely going to continue being the dominant sentiment over the next couple of weeks or whatever time horizon you are looking at?

If the answer is YES, you have a trade to take in the macro direction.

Which in this specific example is? Dollar shorts.

While if instead the answer is NO and you think the sentiment is near its limit, then you WAIT for the right technical confirmation to fade it and trade the reversal.

That’s fundamentals for Forex in the simplest but most actionable and effective form.

Now…

That sounds cool in theory but the practice is so much different, isn’t it?

Yes, but no…

Here’s why.

THE POWER OF UNDERSTANDING THE FUNDAMENTAL STORY BEHIND A TREND:

See, this hypothetical scenario about the FED keeping rates very low and pumping liquidity wasn’t that hypothetical after all.

If you remember in mid to late 2020 that exact narrative was the dominant story across markets…

The FED was committed to keeping interest rates at very low levels and continuing its large QE program to provide ample liquidity to the economy:

So?

So the trend was bearish USD.

And Dollar shorts were the attractive trade across the board.

That’s to say that…

When the market is trending there is ALWAYS a fundamental reason for such trend to exist.

And that’s where fundamental analysis comes into play…

You immediately gain an advantage when you know the logic and rationale behind the narrative driving the trend.

Because you can then know fundamentally if that specific context should continue or not.

Like…

Is the FED likely to keep rates low? Is inflation in the UK likely to stay high compared to the EU? And so and so forth with all the various narratives and stories that you can think of.

And THIS is the whole point of Forex fundamental analysis.

Makes sense?

Understand the context, know the sentiment, and then ask yourself if it has reasons to continue or not.

And there you go, you have done your fundamental analysis to know the direction where a currency pair should move.

- Understand the fundamental sentiment driving the market at any given moment in time

- Ask yourself if that context should continue or not

- Find an entry in that direction.

Ok, now let’s bring this one extra step further…

How many “steps further” did we bring this?

Three, four? I kinda lost count.

TRADE SMART:

Ok… you understand this concept, you understand that markets trend because of a specific macro story, you understand that fundamentals drive trends, you know that you should understand all that but…

But you still can’t wrap your head around how to do that yourself.

Alright.

What I’m about to tell you will sound super obvious but I’m telling you right here right now… that’s THE way.

Ready?

Leverage the experience of others.

Yes.

That’s kinda boring textbook advice, isn’t it? I know, it’s the kind of advice that you read in the average book about productivity or in the average Youtube video.

You probably heard that many times already. But listen…

However obvious it sounds…

That’s THE way.

But what do I even mean?

Literally… if you just can’t wrap your head around something, find the expert at it and listen to him.

Think about this…

You have amazing experts in monetary policy, technical analysis, fundamentals, and any other subject that you can think of.

You DON’T have to exhaust yourself by trying to do everything. USE the experts to your advantage to TRADE SMART.

But ok, wait a second…

Am I just flexing about the Private Network and how the members have the benefit of reading insights and following trades from other professional traders?

Well…

I am.

And that’s the point.

Because… that’s THE way to trade consistently.

Your mental energy in trading is an EXTREMELY important resource because it helps with your mental clarity which overall helps you make better decisions and thus better trades.

Logical.

But are you taking good care of that aspect of your trading?

I mean…

Do you have professional traders giving you actionable insights and exact trade ideas, which allows you to ease some of the trading pressure off of your shoulders?

That’s the point.

How to trade smart:

And by the way, I follow this exact advice myself.

Politics, I like politics, but I have NO idea how that stuff works from the inside.

So around elections and around important political events, I try to NOT make up random opinions on how they will influence the market.

Instead…

I reach out to the people I know are the top in the subject and get briefed on all I need to know.

Simple questions like…

Hey, what does this and this mean for such and such currency? What do you think of such and such? What’s your opinion on such and such and how should it impact the currency?

And so on, and so forth.

And that’s THE way to be an expert at everything you want.

Cool, I just gave you the best advice for your trading right HERE right NOW…

Use other professional traders to compensate for what you don’t know or understand.

In other words… work smart, not hard.

Such a clichè phrase isn’t it?

I agree… but it’s also so true.

keep these points in mind:

Ok, this article is probably getting a little too long but if you managed to reach this paragraph you are probably enjoying it… right? RIGHT?

Well… if you are, you can leave us your email down below to get updated if we publish something else like this.

With that said…

There are three things that I want you to take away from this article.

- Fundamental analysis is about understanding the logic and narrative driving a trend and then analyzing whether that context should continue or not.

- You don’t have to be an expert to trade fundamentals. You can just use already experienced traders to your advantage to listen to what they have to say.

- Work smart, not hard. That’s how you effortlessly improving your trading efficiency.

Alright, that’s all there is to say…

Get your fundamentals straight by understanding what it’s really about, follow smart traders to make your trading easier, and trade consistently, period.

Other than that…

If you have managed to read this article all the way to this exact paragraph you are on the right track.

Really, you have the curiosity that is necessary to learn and move consistently in the right direction, good job.