Trades

BESOMEBODYFX

WHERE TO FIND HIGH QUALITY SWING TRADES?

LET’S BE REAL…

Consistent profits in trading are not that common.

I mean, there’s not a lot of consistent traders out there.

So naturally it’s hard to find signal providers that are… consistent.

I get it!

But you know what?

There are.

So let me show you one of those…

Alright, let’s get to the point:

You want to take great swing trades.

The type of trades that you can set and just let them run without having to stare at the screen for all day.

And more importantly…

The type of trades that are consistent and profitable.

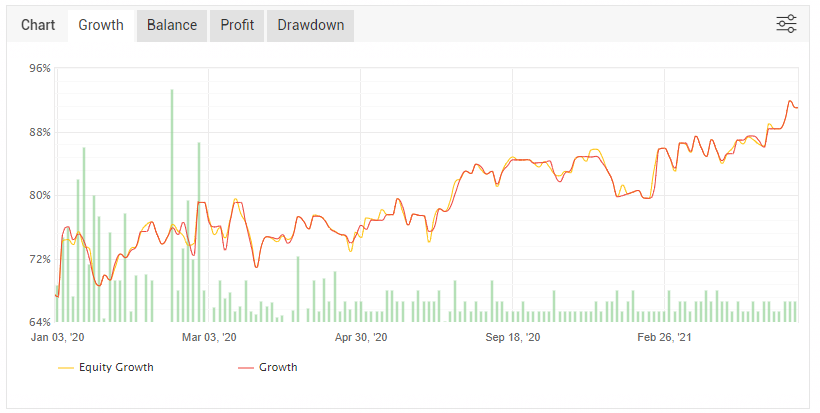

Consistent enough to get your equity line to look like this:

Because otherwise… what’s the point?

True.

So…

Where to get the best swing trades?

Well, the best place to get high quality swing signals is BeSomebodyFX.

You can follow the public Telegram channel here:

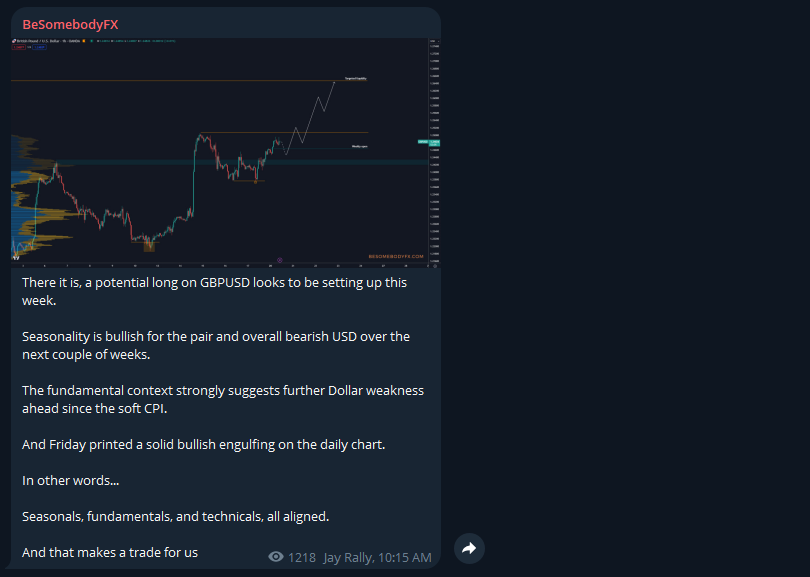

That’s where we send insights like this:

That turn out like this:

Useful, right?

Yes.

These aren’t just random trades thrown at you.

No.

It’s smart, indepth, well timed, and precise swing trades that can help you in your trading.

But hold on a second!

I know you already got what you wanted.

But there’s more to it.

Because this goes way beyond just signals.

I mean…

What sets the best signal providers apart:

Profitability?

Sure.

That’s a big one.

But it doesn’t just stop there.

Because you shouldn’t be following traders just for the profits.

What do I mean?

The educational value of swing trading signals:

Let’s talk about the best aspect in my opinion.

Because our Telegram channel doesn’t just tell you buy here sell there and that’s all.

No!

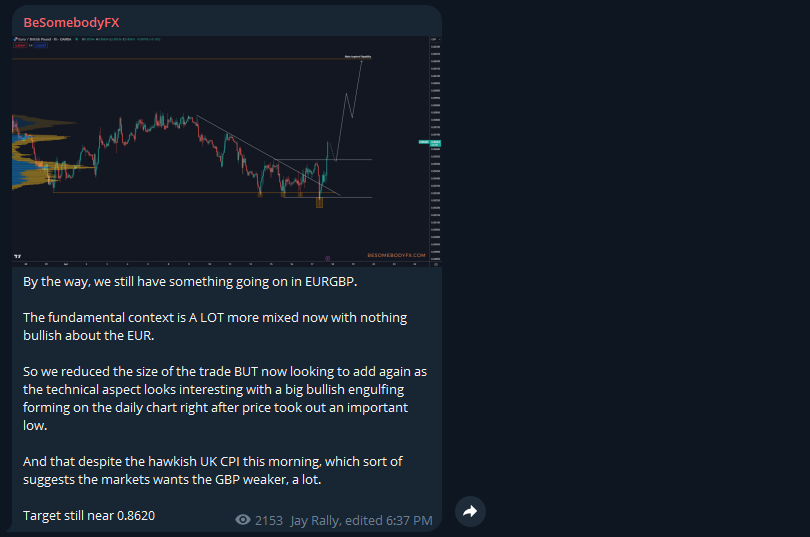

Every trade is a mini lesson in market dynamics, fundamental analysis, technical analysis, and market strategy.

Think about it.

Each trade is filled with indepth context around the idea.

Like this:

You can see the rationale behind the idea, the technical patterns used, and the fundamental context. It’s like having a trading mentor explain their every move.

Cool, right?

And if you want to delve even deeper, there are tons of videos on YouTube that explain the strategies used in these trades. Here’s our Youtube channel:

As you can see it’s a combination of both technicals and fundamentals.

What’s that about?

Well, the videos above go well into the details.

The point is that you have content covering everything from basic concepts to advanced swing trading strategies.

You can explore topics at your own pace, steadily improving and advancing your knowledge over time.

Oh and by the way…

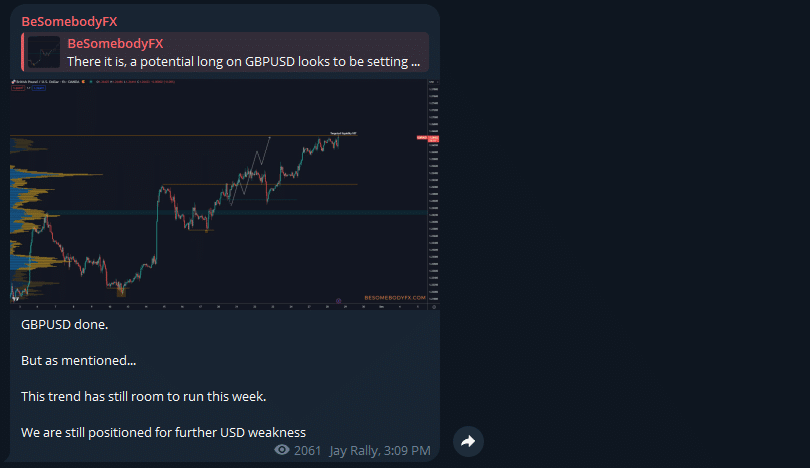

How did that EURGBP trade turn out?

Well, here it is:

But wait a second!

Don’t think that every trade you’ll get will hit take profit perfectly.

No.

That’s NOT how it works.

Stop losses are part of the process.

There’s no way around that.

The key is in just hitting those stops and moving to the next trade.

Here’s for instance a position that hit the stop loss:

Notice how there’s NO doubling down.

NO moving the stop loss further and further trying to avoid it.

And NO hiding of the losing trade altogether.

Again, that’s part of the process…

And that’s what creates this type of performance:

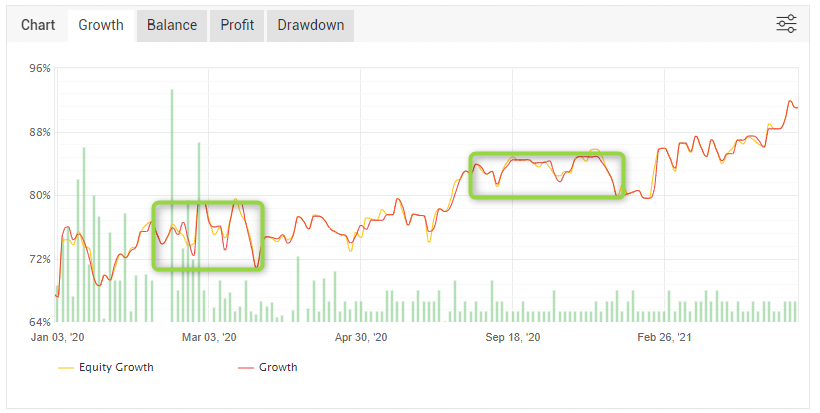

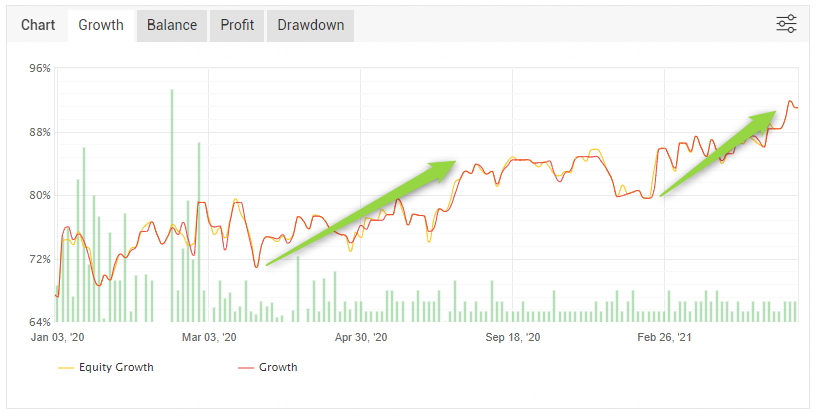

Now…

See those choppy periods?

Those are times when some trades hit the stop loss, some hit breakeven, and overall, the equity flattens out for a while until the market shifts back in the right direction:

That’s professional swing trading.

It’s not all wins.

But it’s consistent overall gains in the right direction with some choppiness here and there that requires a bit of patience and discipline.

Ok.

Does that sound like something you can follow?

I think so.

Let’s analyze what makes a swing trade signal effective:

It’s not just about getting an alert to buy or sell randomly.

No. There’s a meticulous process behind each position, meaning that every trade idea is backed by solid analysis and research.

Where does that start?

With the fundamental context.

Which opens up a whole different debate that touches on monetary policy, risk sentiment, interest rates, economic data.

It’s wide subject and if you are interested in that we have a book guide called The Real Fundamental Analysis that goes into all the details you need to know about:

And then…

The fundamental context is complemented with the technical context too.

Because you know…

“Being right” and “profitable trade” are not always synonyms in trading.

I mean, you can be right and get stopped out because of a wrong entry point.

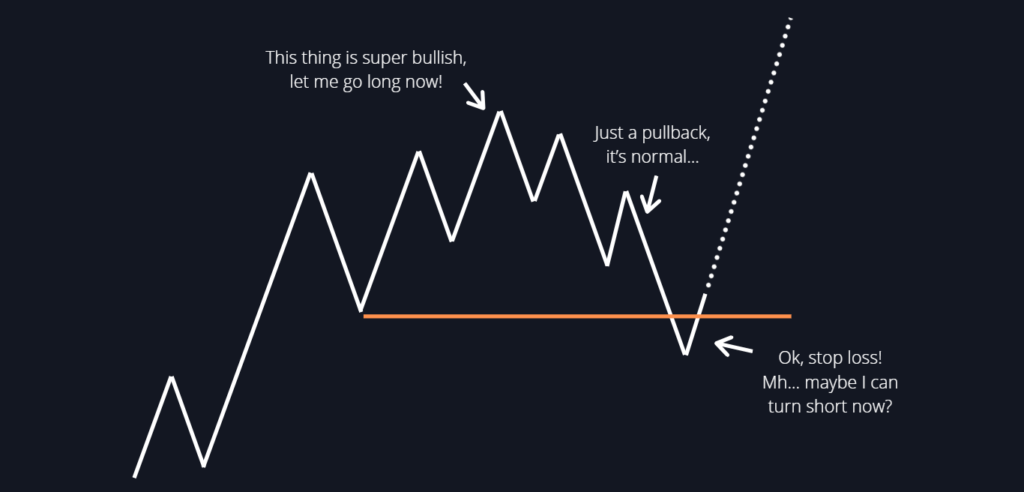

You enter a trend trade.

The market starts to pull back against your position.

You stop the position out.

And the market just turns in your expected direction.

Like this:

Look, that’s nothing new.

The market does that!

And so to do that you need some technical analysis to time the trades correctly.

The point?

The point is that a solid trade idea is not just technicals, it’s not just fundamentals, it’s… both.

For instance, let me show you a position we took on NZDCAD that shows this very well.

Here it is:

Notice how yes we have the bullish fundamental bias, but at the same time we have the price action and technical confirmation on the chart.

Makes sense?

Awesome.

That ended up being a great trade…

And that’s the point.

When fundamentals and technicals are aligned that’s where it interesting.

And you know…

I can go on and on with examples but the point is simple.

Fundamentals are great.

Technicals are great.

But neither of those alone in isolation are enough to be consistent.

It’s when you combine both together that you get those high quality, high conviction trades to follow.

Those that you are comfortable taking, holding, and just letting them run.

That’s the difference.

And that’s what you need to know:

In other words…

The BeSomebodyFX public Telegram channel allows you to follow great trades, learn from it, and make you a better trader.

You get the trades, the rationale behind them, and the educational content to back it up.

Solid, right?

It sure is.