Trades

BESOMEBODYFX

CENTRAL BANKS AND THEIR MONETARY POLICieS

CENTRAL BANKS AND THEIR MONETARY POLICIES ARE CORE DRIVERS OF FX AND ALL ASSETS TRENDS, LET’S SEE HOW

The best way to start a discussion about central banks and monetary policy is with this quote from the legendary Stanley Druckenmiller:

It’s liquidity that moves markets…

That’s a solid starting point, now let’s get more technical:

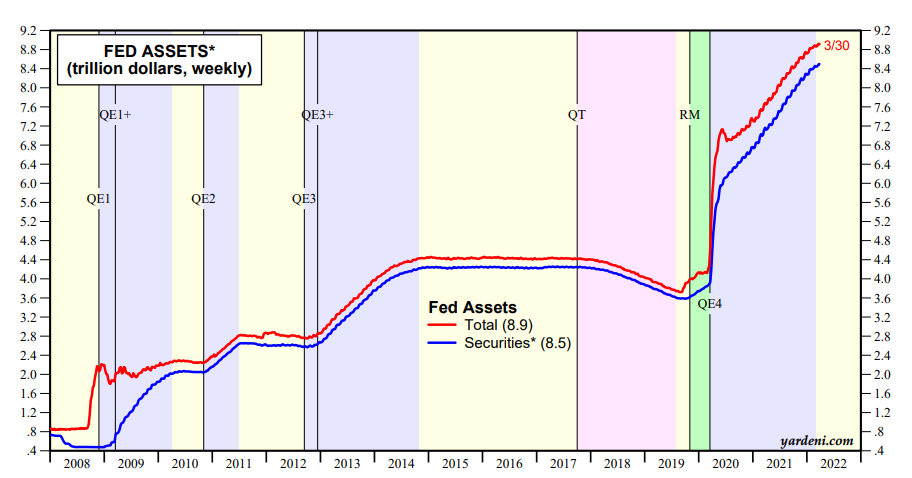

The FED adjusts “liquidity” with… monetary policy, or more specifically, the balance sheet:

Now, a central bank can add or reduce liquidity…

The injection of liquidity into markets is the so called Quantitative Easing (QE) while the reduction of it is the so called Quantitative Tightening (QT).

QE is done to stimulate the economy, stimulate inflation…

While QT is done to do the exact opposite, to start putting a cap on what could be an “overheating” economy.

But enough theory, let’s see how practically this applies to markets and FX specifically.

Let’s start with Quantitative Easing (QE) first…

QUANTITATIVE EASING:

The FED implements QE when they need to stimulate inflation and economic growth. In simple QE is literally the injection of liquidity into the economy, the so called “money printing”.

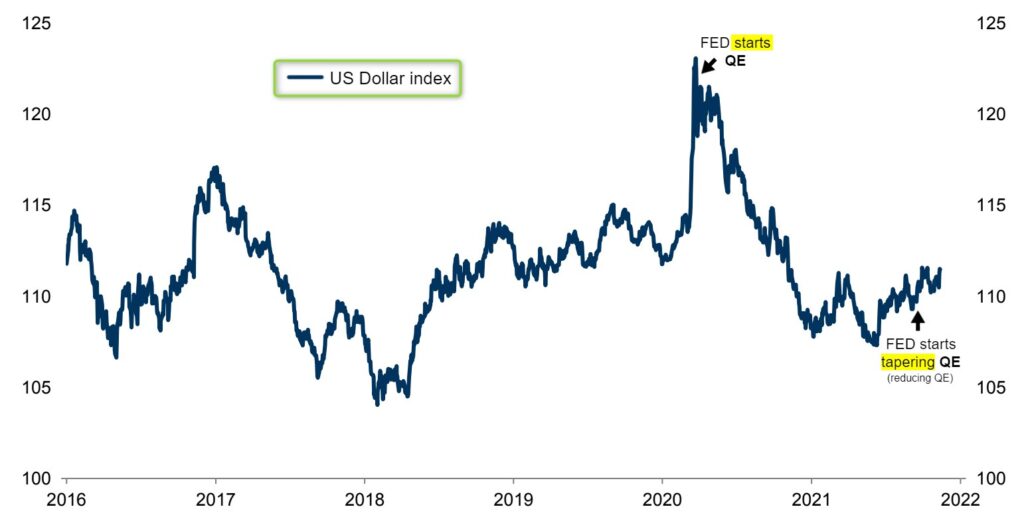

What happens to the domestic currency when a central bank prints more of it?

Basic economics 101 here… it devaluates.

Here’s the us dollar index during qe4:

That is the FX impact, USD weakness… but obviously, this goes way beyond that.

Because QE programs create some of the best bull market opportunities.

All risk assets rise, as economic growth is stimulated PMIs bottom (see here what it means) and reflationary themes pick up steam. We are talking about higher commodity prices, higher GOLD, and all those good stuff.

And by the way, just to be precise…

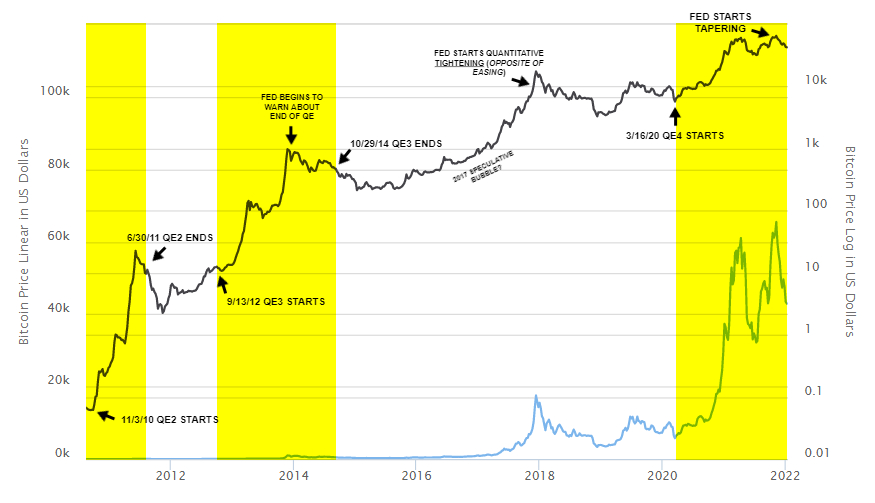

The FED runs the party in crypto too:

Central banks with monetary policy dictate most of the crypto cycles as well, something to have well in mind.

Anything that moves and that can be traded… is influenced by central banks’ monetary policy, particularly the FED.

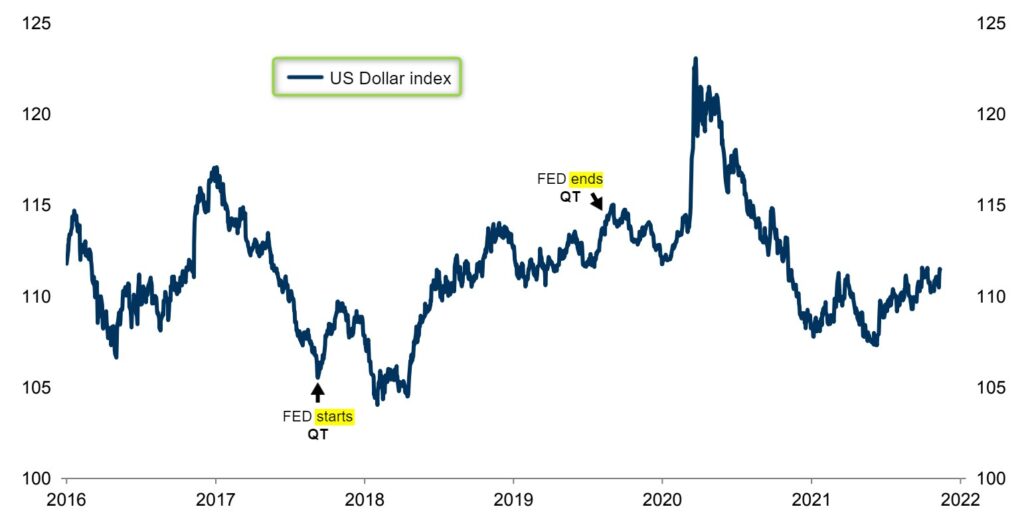

Quantitative Tigthening:

So… we have stimulated economic growth and inflation enough with QE and low interest rates… now how do we halt and lower inflation?

By tightening financial conditions, lowering asset prices, and increasing the value of the domestic currency, in other words, engineering a growth slowdown to restart the cycle.

How? Quantitative Tightening (QT) and rate hikes are your tools…

While QE is the injection of liquidity into the markets, QT is the exact opposite and as a result, the exact opposite effect is created with the strengthening of the domestic currency:

Good, we have covered some basics here…

Understanding the FED’s balance sheet and the various monetary policy regimes is quite useful, NOT only for longer term trades, but for shorter term ones too.

When you know the longer term “path of least resistance” according to the macro bias, you get more accuracy and harmony in your shorter term trades by going with the flow, rather than against it.

In other words… “don’t fight the FED” long term, nor short term.

But… for longer term trades, does this mean you just go in and sell USD when QE starts and buy USD when QT starts?

You could…

But NO… that’s just one piece of the puzzle, read THIS to get a grasp of what composes a complete institutional trading framework.

To conclude, remember Druckenmiller’s quote:

“It’s liquidity that moves markets.”

Obviously, the central banks’ discussion goes above and beyond just QE and QT. There are rate hikes, rate cuts, and other monetary policy tools to be discussed.

But that becomes more complex and articulated to discuss in a simple blog post, the best way to learn about everything, as we always repeat, is to actually experience it with the right minds around you, make sure you are around professional traders, and take notes.

Cheers,

Jay from the BeSomebodyFX Team