Trades

BESOMEBODYFX

The right way to keep track of fundamentals in forex trading

the most effective ways to stay well updated with the important macro developments in the markets.

Undoubtedly, staying up to date with all the news flow and market developments is essential to trade fundamentals appropriately.

Logical, right?

Yes.

So how do you actually do it in a way that is simple and straightforward?

I mean…

How do you stay up to date with everything going on in the markets without driving yourself crazy?

And even more than that…

How do you filter out the noise and the useless information to get ONLY what really matters for your trading?

Those are some pretty good and important questions.

So…

Let me give you the RIGHT answers.

Use the right platforms:

Wait.

I get it.

“Use the right platforms” is as boring of a subheading as it gets.

But, bear with me a second…

Because we are going to start with some boring, but essential stuff, to then lead into the more original insights.

Sounds cool?

Alright.

So…

WHAT ARE THE BEST PLATFORMS TO STAY UPDATED WITH FOREX FUNDAMENTAL ANALYSIS?

Which is?

Twitter.

Or X.

Not sure exactly what to call it nowadays.

Either way, you get the one I’m talking about.

Twitter is an amazing source of information BUT…

It’s also where traders just shout random useless fluff.

And I mean really, REALLY useless fluff.

But that’s nothing new, isn’t it?

Yes. I know you know how Twitter works so let me give you something MORE interesting and way better organized than that.

Twitter for a trader is cool, but Tweetdeck is… COOLER.

What’s that?

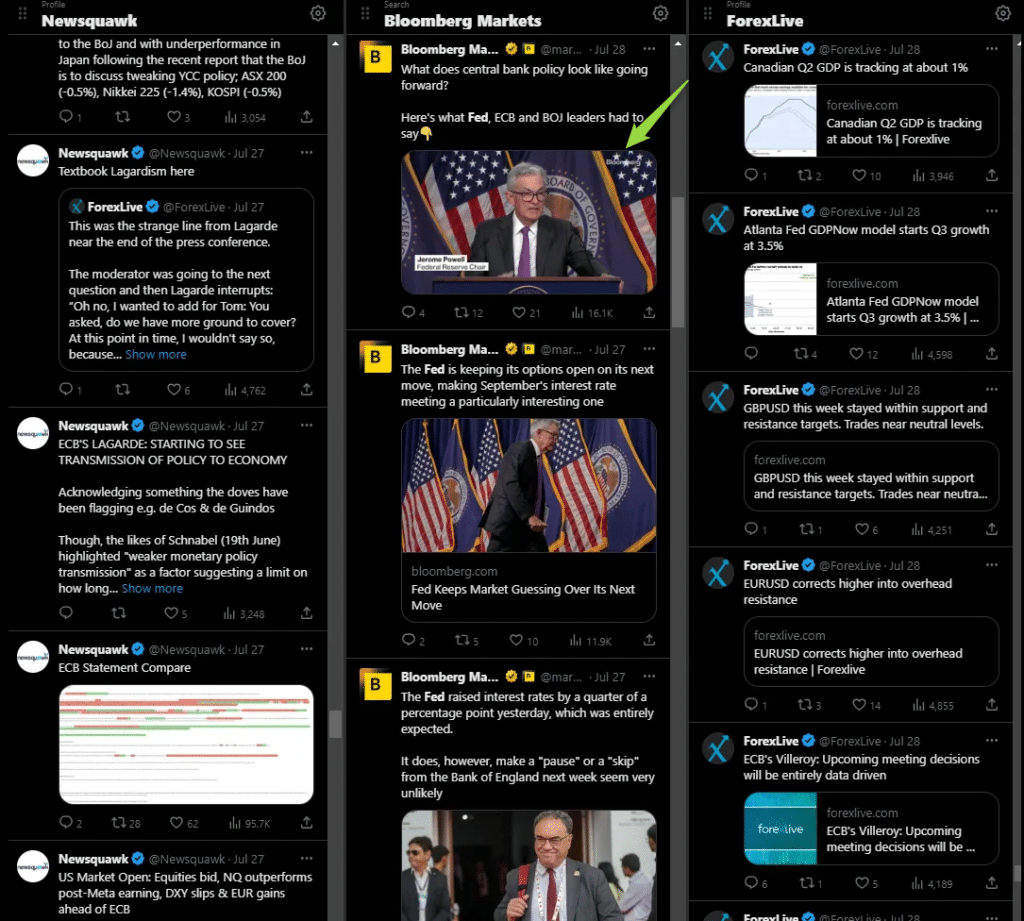

Here’s a Tweetdeck:

It’s basically Twitter but with a more organized feel to it.

Yes because you get to cherry pick who gets in there and the Tweetdeck streams all of the tweets from the sources you decide to add.

And it does so in real time.

Cool stuff, right?

Yes, especially because you can get profiles that share important fundamental articles so you can have your specific column for the news flow and various economic releases.

Something like this with Bloomberg:

You can really get creative with this.

But remember…

Twitter, whether it’s a Tweetdeck or the original, is as distracting as it gets.

I mean…

The line between useful and just annoyingly distracting is very VERY thin.

You MUST make it a priority to follow ONLY high quality profiles that deliver VALUE and that DON’T spam you with useless content.

Keep that well in mind or you will drive yourself crazy trying to follow random stuff left and right.

I can’t stress this enough.

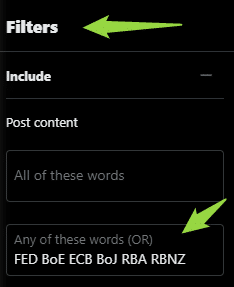

So for instance, learn how to use the “filters” to narrow down only to certain keywords like:

These are the exact filters in the Bloomberg column that you see in the previous image.

As you can see it’s narrowed down to the major central banks, that way it filters out all the irrelevant articles while focusing only on the ones that are actionable and market related.

And by the way…

Make sure to follow our Twitter too.

We keep it super related to useful market insights with no fluff whatsoever…

This is the most important snippet from the latest FOMC minutes, it’s nothing particularly new but we know that the data has moved in a hawkish direction since the FOMC meeting so undoubtfully the next rate decision might lean more to the hawkish side#USD #DXY #USDOLLAR pic.twitter.com/R8DVoL4lj8

— BeSomebodyFX (@BeSomebodyFX) February 23, 2023

Ok, now…

What else is there to keep track of fundamentals?

Well…

What about the good old Bloomberg itself?

That’s a great one, obviously.

But, there’s also another interesting alternative to that…

ForexLive.

Fundamental headlines and market sentiment:

It’s nothing new and super original I know.

Bloomberg and ForexLive are two classic places to get high quality articles and headlines to stay well up to date on everything going on in the markets from a fundamental point of view.

But wait a second.

Because there is an important detail that makes a big difference.

And I mean a really BIG difference.

Curious?

So, when you head to ForexLive the homepage basically has posts like this:

That’s ok, nothing wrong with that.

But in reality, you DON’T need all of that generic market commentary.

We as traders need content that is more targeted, more niched down to what actually matters for the market, right?

That’s right.

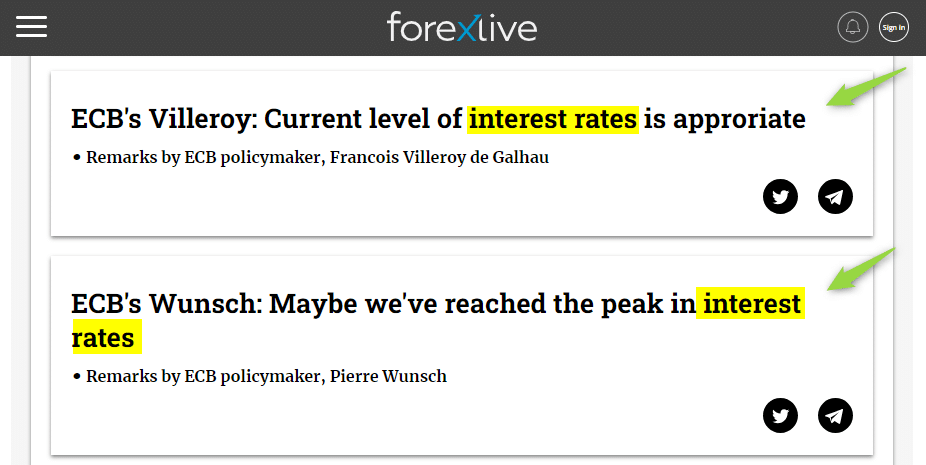

So, one way to do that is to head to more useful sections.

Like the central banks’ section…

And that will filter down to articles that are more related to currencies and stuff that matters for currencies…

You know, monetary policy and central banks?

Pretty important stuff in Forex trading.

Now what about Bloomberg?

On Bloomberg it’s a similar thing.

But there’s something extra that you will love.

LONG FORM MARKET UPDATES…

Yes, because on top of the classic insightful articles, Bloomberg has a lot of live shows and video content to follow to stay up to date with the markets.

There’s plenty every single day for all market sessions.

And you can find them on Bloomberg itself:

Or on Youtube:

But wait…

Two or more hours of content per show?

I mean, is it even useful?

Well… kinda.

They have plenty of awesome experts and professionals on there that talk markets that are well worth a listen.

But there’s a caveat.

They cover A LOT of stuff.

And I mean also stuff that is NOT really relevant for trading purposes.

So it’s great for staying updated overall.

But…

Let’s do better.

We want to get MORE specific.

More targeted to articles that are actually highly relevant and useful to Forex trading.

More effective, so to speak.

So is there a way to do that?

Yes, there is.

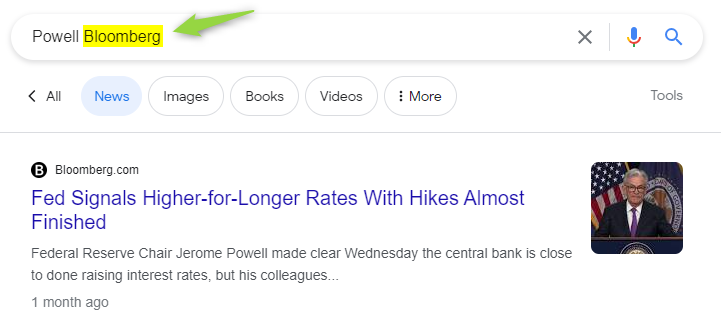

How to get even MORE precise and targeted fundamental articles:

So here is a fantastic piece of advice that will make you way more effective at this.

Ready?

On Google, just search for whatever you are looking for plus the keyword “Bloomberg” and head to the news section.

Like this:

With this you have all the latest articles from Bloomberg on that specific topic.

Literally, you can target everything you need at any time you want.

For instance…

An important FOMC meeting just got done?

Cool, search for “FOMC Bloomberg” and you get all the related articles.

And of course…

You can do this with whatever source you prefer.

I like Bloomberg so I’m using that for this example.

There are many other alternatives, but in terms of straightforwardness, I will say…

Bloomberg is there at the top.

Their headlines are often enough to grasp the sentiment of the whole article for a quick sentiment check.

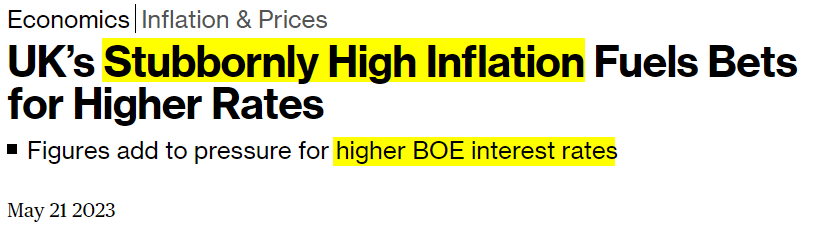

Look at this one for instance:

See?

The headline and the first two paragraphs often tell you all you need to know.

You get the point.

Ok.

Now wait a second tho.

Like…

Are these the absolute best ways to do it or is there something else?

Well, that’s a VERY good question.

How to be effective in your fundamental analysis:

These two are some basic methods to keep an eye on what’s fundamentally going on in the market.

And they are great, but…

But what?

But they are NOT the most practical and effective methods.

Facts.

Because when you read an article on Bloomberg or when you scroll through Twitter you MUST have an incredible ability in filtering out all the noise and random chatter that is NOT actionable for your trading.

And on top of that, you also need to interpret, understand, and apply correctly what you are reading.

Otherwise, you just get thrown off track into the wrong trades.

So… easier said than done, right?

True.

Just by having these two methods mentioned above you won’t suddenly understand fundamental analysis better.

At all.

You still need that experience to put into action correctly what you read around.

And that’s where the famous “work smart, not hard” comes into play.

What do I mean?

I mean that you can be smart simply by following other professional traders to use their expertise to have a good guide and picture of everything that’s going on in the markets.

Almost like delegating the complex task.

Literally, you let someone else do the complex work for you.

Sounds quite an advantage, right?

It is.

So how can you do that properly?

I mean…

How can you follow more experienced traders to guide you and give you the correct fundamental context you need for your trading?

Well, time for the self promotional bit now 😉.

The Private Network is the place for that.

That’s where you can follow our fundamental insights, guidance, and exact trades.

And I mean trades with exact entry and exit details.

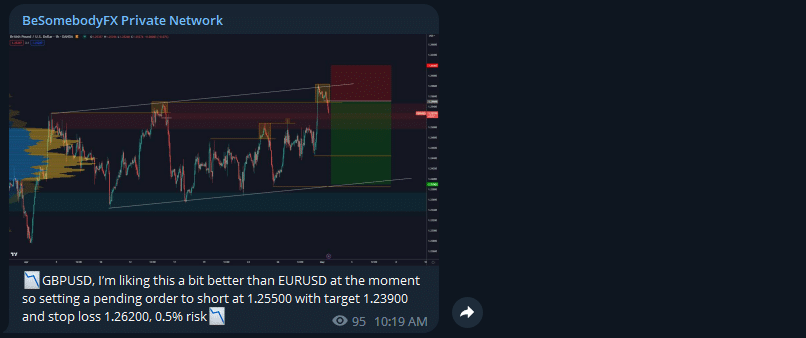

Like this:

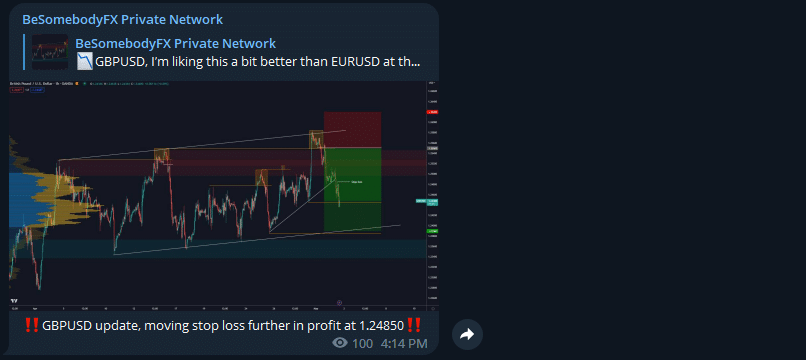

With then all the various updates to the trade along the way:

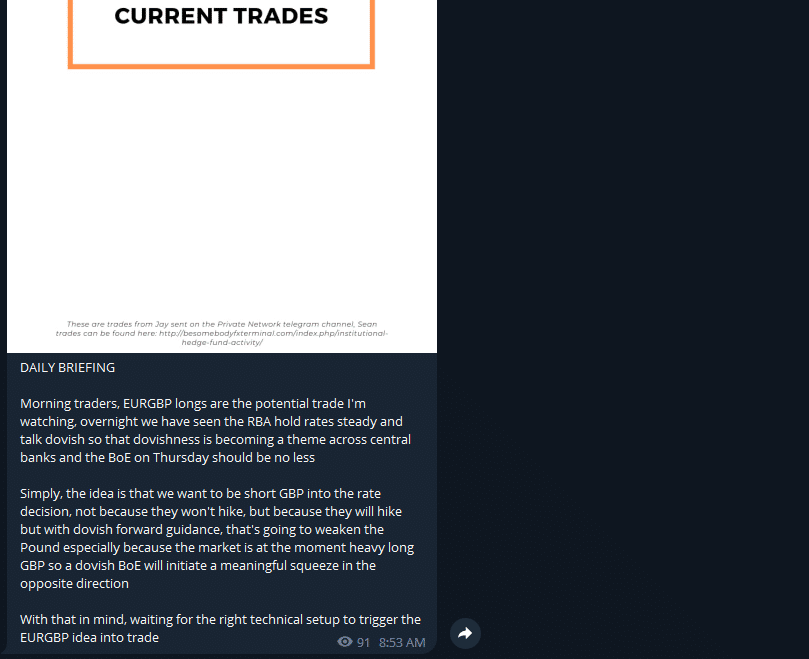

And with insightful daily briefings like the one below that keep you always up to date with what matters across the markets:

Really.

All the good stuff to keep you on top of all you need to know in a straightforward format so that you don’t have to waste time and energy every day trying to catch up with all the fundamental developments across markets.

In other words…

The complex trading tasks, done for you.

Pretty good, isn’t it?

I know.

Ok, with that said.

Is there anything there anything else to add to this article to complete it?

Yes.

But first…

If you like this kind of educational articles you can leave us your email down below to get updated when we publish something else like this.

And now with that said…

Three points I want you to take away from this article…

So keep these in mind:

- Twitter is a VERY useful tool for traders but you have to be super disciplined and skilled at ignoring the fluff and distractions, a Tweetdeck can help you with that.

- Bloomberg and ForexLive are a great method to get a grasp of the sentiment around important market events. Specifically, Bloomberg’s headlines are quite precise and useful for that.

- You don’t have to do all the heavy lifting yourself, be smart, and get yourself around other professional traders who do it for you, and do it better.

Alright, that’s all there is to say…

And I guess that’s all there’s to say on this, these are the right ways to always be on top of everything going on across the markets fundamentally.