Trades

BESOMEBODYFX

CRYPTO GLOBAL MACRO Q3 2023

Bullish it is, there is one particular narrative that is and will continue to support price.

Alright, bear with me for a second.

In the previous crypto update we explained how and why we were bullish and long from 24k and 26k.

Great.

31k and something printed, at that point we ended up taking profit at 29.5k and turned defensive…

Turning defensive on BTC at the moment and looking for a fair bit of downside before the next leg higher, the short term fundamental context is simply slowly turning a tiny bit bearish#BTCUSD #BTC #Bitcoin

— BeSomebodyFX (@BeSomebodyFX) May 4, 2023

After that, BTC printed a low near 24k and staged a massive run back above 30k in what? Two days?

That was a fast one.

A little too fast.

But ok.

Now what?

Bullish from here? Bearish from here? What’s next?

Well, here’s what you MUST know…

The current fundamental sentiment:

As usual, I will try not to bore you with too much detailed fundamental analysis so let’s get straight to the matter, sounds good?

Alright, to put it simply…

We are now in dip buying mode on BTC.

The reason?

Well, there is a narrative that is and will continue to provide some support to sentiment for risk assets, crypto included.

What’s that?

The AI boost…

Yes.

What’s happening with AI is boosting growth and productivity leading to lower recession probabilities, higher growth expectations, and higher margins and earnings for large tech companies.

All good stuff for something like the NASDAQ, right?

Yes, but BTC isn’t the NASDAQ…

Or is it?

Well, what’s good for stocks in general tends to be good for crypto too.

A boost to growth expectations is overall bullish for all risk assets, and BTC as you know is on that pretty list.

But with that said…

Where is the FED in all this?

Literally… can we make a complete macro update on crypto without talking about the FED and monetary policy?

No way.

The macro context in more details:

So, this is where it gets a little more complex because interest rates are a little too high, aren’t they?

Yes, but the tightening is slowing down.

From here there are officially just two more 25bps hikes expected.

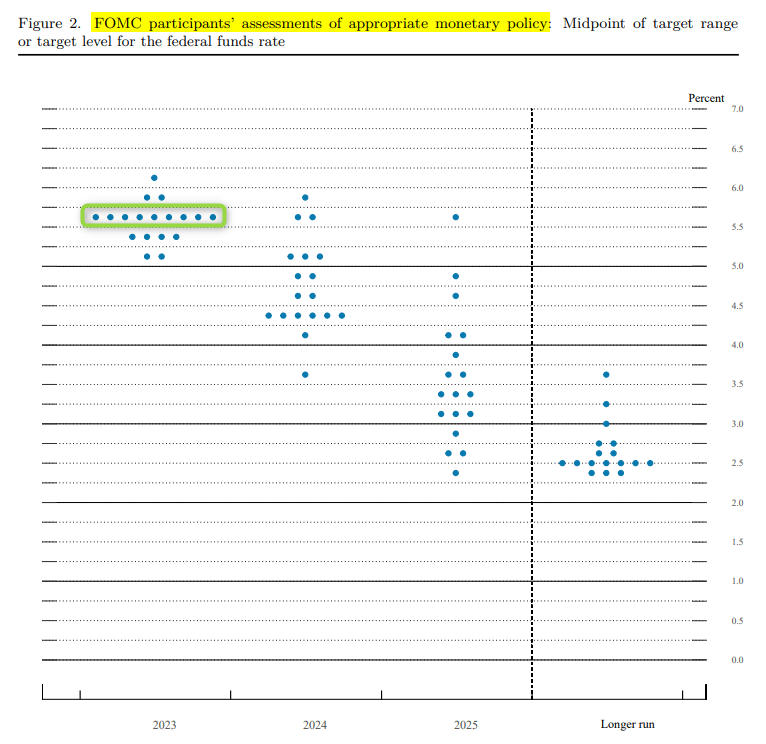

Here’s the latest dot plot published from the FED:

See all those dots stacked at 5.6% for the year?

That’s the majority at the FED expecting two more hikes from current levels.

Is that bullish?

No, not at all.

So is that bearish?

No, not at all either.

It’s kind of… neutral.

Monetary policy is now in this spot where it’s a bit bearish but also a bit bullish.

Like… rates are above 5% and that’s too high which is slightly bearish.

But, the FED is slowing down and near pausing which is slightly bullish.

Mixed, right?

Yes.

Now, what matters is that as long as the FED doesn’t go off script and sticks to what’s projected then the market can focus on something else.

Something else like what?

Like the bullish narrative with the growth boost from the AI story?

Yes.

But waait a second…

Isn’t this whole AI thing like the early phase of a bubble?

The AI bubble?

Sure, could be.

I mean, historically that’s how all significant innovations started, right?

Yes, and this is EXACTLY the point.

Bubbles can inflate assets for much longer than anyone can think of.

Literally, waiting for one to pop or even worse trying to catch the top is… NOT the right strategy.

So intead… what is the right strategy?

Riding it?

Yes.

Riding it in its early phases and then turning VERY cautious and defensive when it becomes too obvious.

Easier said than done, but it can be done. And it is much better than trying to pick its top.

Sound cool?

Alright.

Bullish and positioned:

That’s all there is to know about crypto at the moment.

In simple words…

This is fundamentally the context to be in a “soft” dip buying mode.

Alright, time for some dip buying on BTC from here, soft dip buying mode but still dip buying anyway, for now thinking 40k as potential but will keep it VERY flexible, could be just 35k, could be higher#BTCUSD #BTC #Bitcoin

— BeSomebodyFX (@BeSomebodyFX) June 28, 2023

Soft? Why soft?

Well, if we really want to be precise NOT all boxes are ticked for a perfect bull run.

Obviously, monetary policy is NOT where it should be to go full clip on the long side, plain and simple.

But…

But, the AI narrative is enough to get some exposure to more upside.

And thus we are in dip buying mode on BTC at the moment.

Actually…

We are already long.

Not on BTC itself but on something else.

It’s a fresh position opened very recently, I can say that.

If you want to follow our exact trades and moves you should check the Private Network. That’s where we alert on every position we take with all the related details and updates.

With that said…

What to keep in mind…

Right now what you need to know from this update on crypto is that we are bullish and positioned while also ready to add size on dips on BTC.

I mean…

Don’t go full size at these prices, use a dip buying approach to build a better entry in case the market pulls back a bit from here, which is obviously a possible scenario.

So, we will keep an eye on how the context further develops during the quarter to add on dips and adjust accordingly where needed. If you want to get alerted when we publish the next update you can leave us your email down below.