Trades

BESOMEBODYFX

CRYPTO GLOBAL MACRO Q2 2023

THE FED IS SLOWLY BUT FIRMLY PIVOTING to a more dovish stance, from rate hike expectations to now rate cut expectations.

Sentiment changes fast, doesn’t it?

From “interest rates to infinity” to now “CUT interest rates, quick, QUICK”.

You know the drill…

The FED historically hikes interest rates until something breaks.

Well, looks like that thing, whatever it is, has cracked a little.

If you remember in the previous crypto update we talked about two things…

First, how the market could have capitulated lower to 10k before a macro bottom. And second, how a FED pivot would have initiated the mechanisms for the next bull run.

Definitely, there hasn’t been a capitulation to 10k which is an important aspect for the overall context and positionings…

But what really matters right now is that…

The FED is about to PIVOT.

Or actually…

The FED has pivoted.

The macro context:

The trajectory of monetary policy has turned from the aggressive tightening in 2022 to the early phases of easing in 2023.

To put it simply, the FED won’t hike interest rates much further and it is also quietly providing some stimulus again.

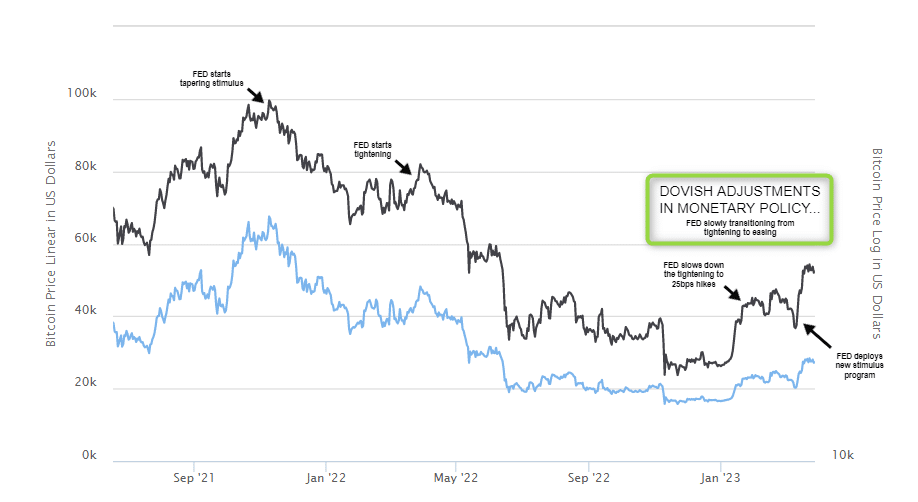

Here are a few fundamental notes with the BTC chart to illustrate this shift in context:

The FED is slowly transitioning from the tightening in 2022 with QT and all the aggressive rate hikes, to what instead will likely be monetary policy easing this year.

Right now it is evident that the FED is about to pause the tightening cycle in what happens to be a firm pivot in their monetary policy.

And that’s obviously a large shift in the macroeconomic context.

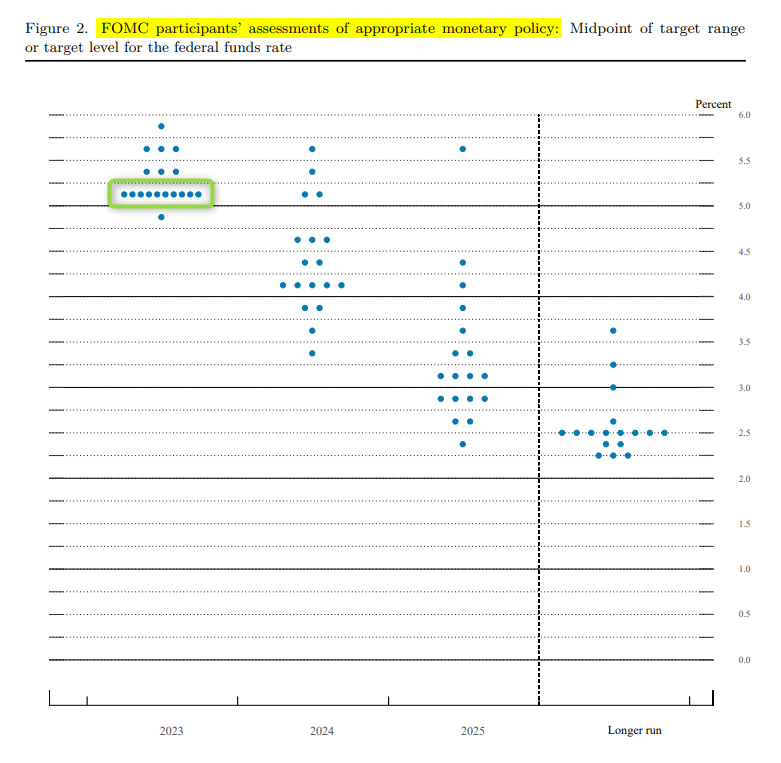

The projections from the latest dot plot published at the March FOMC meeting show just another tiny 25bps hike as consensus and then a pause of the tightening cycle:

Of course, the dot plot is just a theoretical projection the FED makes, it is NOT official forward guidance. But it still gives us a hint of what’s the sentiment and the consensus on what they are planning to do.

With that, it is evident that the FED is getting ready to pause hikes.

That pause in hikes will soon turn into rate cuts, but that’s another story…

So, Bullish or bearish?

I’m sure over the past couple of weeks you have read dozens of tweets and watched hours of content about crypto already.

So certainly you don’t want to consume the same boring piece of content, don’t you?

I know…

Hence I’m going to keep it sweet to the point.

What you need to know is that…

We are bullish BTC and we think the very first signs of the next bull market in crypto have printed.

New bull market? Like, all the way to new highs?

Wait, not too fast…

This is still NOT the perfect macro context to call for a full blown new bull market yet.

Interest rates are still too high and yes the balance sheet is expanding but it’s NOT the classic stimulative QE program.

I Mean, there’s still MORE needed to call a bull market.

But…

the fundamental context is short term BULLISH:

While we don’t think this is the bull run to new highs we can still be positioned for some upside, and we are.

At the moment we are long and bullish because in terms of upside potential we think 35k at least can be reached in the short term.

Then, with a longer term time horizon from around 35k or 40k maybe we can think about a move all the way back to the 20k. But for now that’s just a guess, we will evaluate that when the market is at that 35k.

With the Private Network members we have been buying some already from 23k around late January and we have been adding in early March when the FED pivot became a fact.

Basically, although it was a slightly different story, in early February the conditions started to turn much more favorable for crypto:

With the current softer FED, the cyclical growth boost from China, and the overall still light positionings in risk assets, we think BTC has the potential to squeeze further up to 30k, of course, barring any major upside surprise in CPI next week#BTCUSD #Bitcoin #BTC

— BeSomebodyFX (@BeSomebodyFX) February 8, 2023

That was when a soft landing was still the dominant sentiment…

Obviously that context changed but it changed to an even MORE favorable environment with what was a loud pivot from the FED in early March.

But wait, we are not here to talk about what has happened already.

Let’s talk about what is next…

Market sentiment and positionings:

We usually like to get a sense of whether people are positioned for upside, downside, or neither…

We do that mostly to understand whether a trend is crowded or not.

And right now the sentiment still appears to be pretty balanced as everybody early at the start of the year was waiting for a touch of 10k to load up.

Of course, that touch at 10k never took place so there are plenty of funds still left on the sidelines that have NOT positioned yet.

That could trigger both further momentum above 30k but also be the trigger for the top towards 35k when the bullish sentiment gets too crowded:

For now, sentiment still looks balanced on BTC so we think a bit more upside, but keeping in mind, it would be classic to see most turn bullish on a break above 30k so that’s where we turn more careful, you know how it works#BTCUSD #Bitcoin #BTC

— BeSomebodyFX (@BeSomebodyFX) March 27, 2023

Wait, I don’t mean to say that the market is definitely going to top out above 30k.

No…

But I’m definitely saying that the 35k to 40k zone is where we personally are going to turn much more careful on this trend.

Again, the fundamental context doesn’t suggest a major bull run, at least not yet. So we are NOT trying to aim for anything above 40k.

bullish short term, neutral longer term:

Definitely, there is A LOT that can change and that will definitely change in terms of fundamental context over the next 6 months or so with all the unknowns in the macro landscape.

With that in mind it is REALLY early to call for a full blown major long term bull run to anything higher than 40k.

But short term it’s a different story…

As of right now, you should want to be positioned unleveraged for further upside and eventially add on any large dip.

Large dips… yes.

Keep WELL into consideration that on the way to 35k, as usual, there will be some significant dips.

And I mean the kind of dips where you plan in advance to buy but then it dips so hard and so fast that you turn bearish and go short right before it shoots back up.

You know about those, don’t you?

Quite common in crypto land.

What to keep in mind…

So with everything being said right now what mostly matters is that interest rates have peaked. There is likely going to be just another small 25bps hike, then a pause, and then most likely rate cuts fairly soon.

With this context in mind, we are long and targeting a move to 35k on BTC.

But just a short term view…

Longer term there are way too many variables that can produce many different scenarios so there is no need, nor reason, to make any longer term projection.

In the next update we might have a better long term picture, but for now, we are just positioned for what we think is a tiny bull market that will extend for a little further. You may want to leave us your email down below to get alerted when we publish the next update.