Trades

BESOMEBODYFX

the real fundamental analysis in forex

FUNDAMENTAL ANALYSIS TRADE EXPLAINED AND ILLUSTRATED STEP BY STEP with a real trade example.

I know, there is NO content out there showing you how to PROPERLY trade with fundamental analysis and how to effectively understand fundamentals in Forex.

You can find endless content on technical analysis.

But with fundamentals is different…

Most of the content that you will find will go just as far as giving you a list of all the various economic indicators while giving you basic technical definitions of what they are.

That’s BORING, isn’t it?

Yes, it is.

And other than being boring it’s also NOT enough to understand what fundamental analysis really is about, at all.

So I’m sure you won’t be surprised if I told you that there is a lot more to fundamentals in Forex.

And I mean… a LOT more.

Fundamental forex trades:

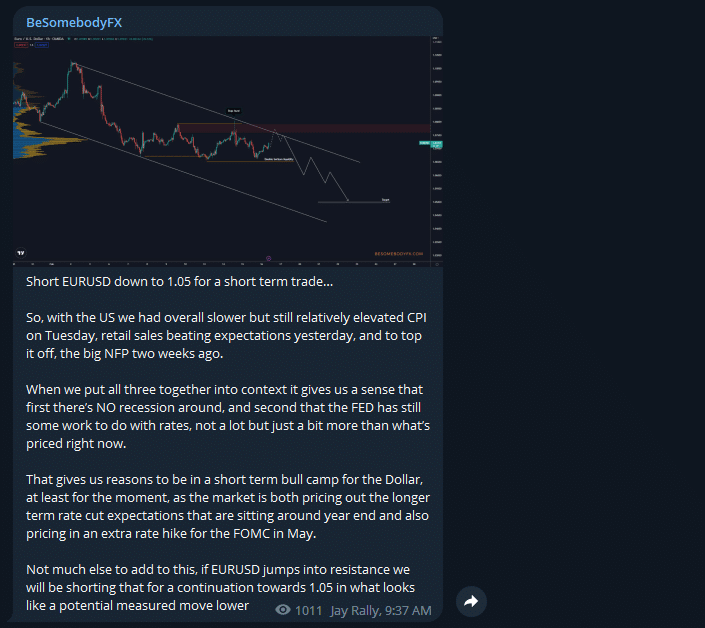

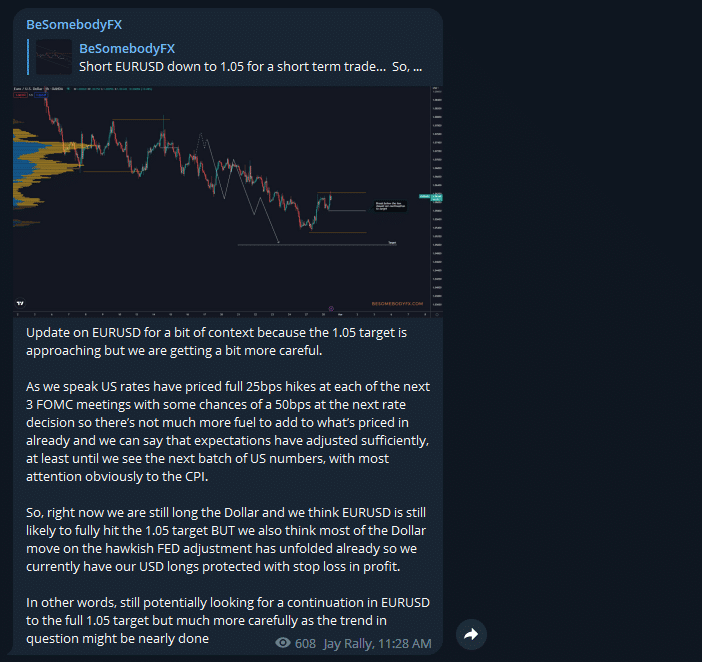

Now, if you follow us regularly on our public Telegram channel you will have noticed this trade:

Don’t worry, this is NOT one of those self promotional articles telling you how great we are and how good that trade was.

No…

This article is an opportunity for you to dive deeper into the thought process of a fundamental trade idea as we explain step by step, detail by detail, the exact context behind the above mentioned trade.

So far it sounds a little bit better than the old classic boring kind of fundamental article, doesn’t it?

Alright, let’s see if it is…

the fundamental context around the trade idea:

When a fundamental idea is generated it usually comes from an understanding of what is the dominant macro narrative, theme, sentiment, or however you prefer to call it.

Because at any given moment in time in the markets if there is a trend there is also a fundamental narrative driving that trend.

And understanding what is the specific fundamental driver of that trend is the FIRST thing that gives you context and awareness of where the market is moving to.

The trade example:

Now, let’s say you are bearish on the Dollar because inflation is slowing down allowing the FED to slow down the size of their rate hikes…

Perfect, the above is an headline that shows the kind of sentiment that was prevailing across markets a couple of weeks prior to the EURUSD trade idea.

With that in mind…

You would be pretty happy to be bearish on the Dollar if inflation continues to slow down, right?

Yes, of course. You absolutely would.

Precisely, the reason for being bearish the USD would be further proven correct if inflation keeps printing below consensus. You would be pretty happy about being positioned for that.

Great. Now here’s the caveat…

What if the data begins to tell a different story in regard to inflation?

What if inflation does NOT slow down as fast as expected?

With that in mind, without a doubt, inflation is something to monitor very carefully in this specific case.

Like… VERY carefully, correct?

Absolutely.

The fundamental data:

So of course traders, economists, central banks, analysts, crypto gurus, you name it, all were watching the CPI releases to see if the trend of slower inflation continued or not, and…

The CPI printed slightly ABOVE expectations highlighting how YES inflation was coming down BUT at a slower pace than what was ideal for the FED.

As you already know, or as you can probably imagine, that was NOT bearish for the Dollar…

Now, here’s the interesting part…

fundamental sentiment and expectations:

At any given moment in time, the market is “expecting”, or more technically, “pricing” a certain scenario or a certain fundamental path to take place.

That expected scenario can be related to monetary policy, politics, or whatever can and does influence market sentiment.

In this particular trade, we are talking specifically about expectations for the path for interest rates in the US.

So whether the FED needed to hike more or less than what was expected.

Or… to use a more technical term, whether the FED needed to hike more or less than what was priced in.

The consensus in markets prior to the CPI trade was expecting a more dovish FED and a peak in interest rates due to inflation slowing down.

But obviously that narrative QUICKLY flipped around as the CPI printed above expectations.

So the market started to price in MORE rate hikes from the FED than what was priced in before the inflation number.

In simple words…

The fundamental sentiment pivoted from expectations of a dovish FED to expectations of a more hawkish one given the higher inflation print.

That became the dominant sentiment across the board.

Which later was also further supported by the FOMC minutes:

This is the most important snippet from the latest FOMC minutes, it’s nothing particularly new but we know that the data has moved in a hawkish direction since the FOMC meeting so undoubtfully the next rate decision might lean more to the hawkish side#USD #DXY #USDOLLAR pic.twitter.com/R8DVoL4lj8

— BeSomebodyFX (@BeSomebodyFX) February 23, 2023

Ok, but let’s not get too much into the little details.

Too many specifics can be confusing so let’s keep it straight to the point.

For now, just understand that the sentiment pivoted from slightly dovish to more hawkish expectations for interest rates in the US.

So, from bearish USD to bullish USD.

That’s all that is needed to know to understand the basic reasoning for the EURUSD trade in question.

The most important part about fundamentals:

When a central bank says something we listen, and we listen VERY carefully…

But when the data starts to question what the central bank says, we listen EVEN MORE carefully.

When there is a shift in fundamentals there is a shift in expectations and a shift in expectations creates a solid trade opportunity.

So if the market is priced for one scenario but the narrative begins to turn, there is a trade to take right there and then.

With the EURUSD example, the stronger US data meant more FED hikes needed to be priced into markets’ expectations which meant the Dollar was about to find some buyers.

Thus, positioning short on EURUSD was a valid option for us…

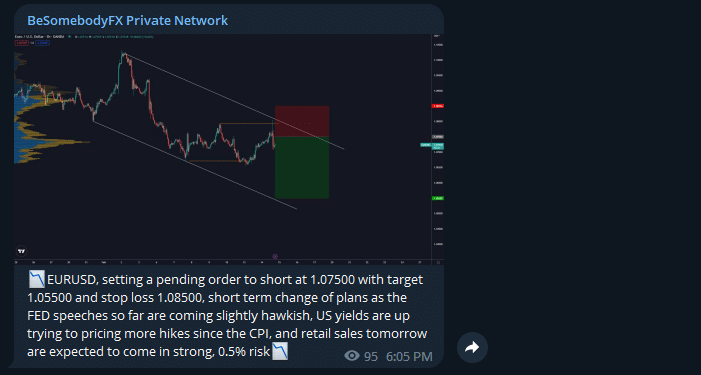

Here is the exact trade that we shared with the Private Network members:

By the way, fun fact…

The trade entry above was missed by about 5 pips.

So we missed the best entry but later we still then managed to find another Dollar long in another pair to ride a tiny bit of the move.

Anyway…

The market was trading one sentiment of bearish USD due to slower FED hikes thanks to slower inflation.

Then, the data started to tell a different story thus the market shifted to the opposite sentiment, one of more rate hikes from the FED.

This shift in sentiment created the conditions for some USD strength.

That’s the juice of it.

the core driver of a fundamental trade in forex:

Now, it may sound way too articulated or complex, but analyze it for a moment…

Think about what is the CORE driver of that trade.

What is it?

A shift in sentiment, or similarly, a shift in expectations.

The core element behind this kind of trade is an understanding of what fundamental story is dominating and simply trading with it.

Easier said than done, but it’s a good base to think about Forex fundamental trading properly.

If you know where the fundamental sentiment is likely to move you know what the trend is likely going to be.

And then what do you do if you know what’s the trend going to be?

You follow the trend, of course.

So you position your trades for what is the expected fundamental direction.

Now, don’t get me wrong, this is just ONE small example and it’s NOT what fundamental analysis is all about in trading.

Still, without a doubt, it is a VERY important one…

And definitely one that can generate plenty of great trade ideas.

Fundamental context and sentiment in Forex:

Remember that when the market is positioned on one side pricing a specific fundamental scenario and the data begins to question such scenario there is a trade to take, a pretty good one.

So if the FED says they are going to hike rates just another 25bps and then pause, the market prepares for that scenario with softer short term US yields and a weaker Dollar…

But, if a couple of weeks later a batch of US numbers comes in SO STRONG that it flips whatever the FED has said, then that whole USD weakness would reverse.

The reason?

Because the market would price out that dovish scenario and would instead price in a hawkish one, one of more rate hikes.

A shift in fundamentals means a shift in sentiment which means a shift in market direction.

With that said…

EURUSD itself came just shy of the full target when the sentiment started to change again.

Feels and looks like markets have repriced rate expectations sufficiently at this point, hard to justify much more hawkishness from here, at least until the next CPI release#USD #DXY #USDOLLAR

— BeSomebodyFX (@BeSomebodyFX) February 28, 2023

Rate hike expectations began to peak but at that point, of course, the stop losses for the Dollar longs were well in profit protecting the positions.

And that is a trade based on fundamental analysis.

Pretty easy, isn’t it?

NO…

Of course NOT.

Learning about fundamental analysis:

If you have never heard about this kind of actionable fundamental analysis it won’t be an easy one to wrap your head around at first.

It takes some raw mental processing to understand the context, but that’s why it is so effective in understanding the direction the market is going to trend.

This is going to sound so obvious but…

If you want to improve your fundamentals you have to eagerly consume this kind of educational content that guides you through the reasons around a trade idea.

That’s an effective way to learn about fundamental analysis.

Study the right content, consume the correct information, and mostly, put everything into practice by trading with the right minds around you.

So, if you like this kind of educational trade analysis drop us your email down below to get notified when we publish another article like this.

Think about fundamental analysis the right way:

Now, there are three main topics that I want you to take away from this article here…

- To know the trend you must know where the sentiment is likely to move.

- You must NOT get stuck in an old and stale narrative. In other words, if the data changes direction, if things take a different shape, you HAVE to adapt to the new sentiment.

- The same applies to the take profit. If the fundamental context changes, if the data changes, you HAVE to adjust and protect the running position. Otherwise you can find your trade back at breakeven in a hurry.

With that said…

Fundamental analysis in Forex trading is an immense topic, IMMENSE.

And obviously, one trade example can only cover a small piece of the whole picture.

But little by little this is the kind of content that will show you the ins and outs of what fundamental trading REALLY is about.

Other than that, if you have managed to read this article all the way to this exact paragraph that means you are already way ahead of the majority of retail traders out there.

Just always remember, follow the right traders that elevate and keep your trading at a professional level. Really, the people you follow influence you in ways that go far beyond what you can imagine.