Trades

BESOMEBODYFX

BUILDING THE CASE FOR SOME TEMPORARY DOLLAR STRENGTH

I KNOW THE MAJORITY IS DOLLAR BULLISH SO THIS POST WILL BE WELCOMED BY MANY OF YOU…

After we have been Dollar bears for months it’s now time to gradually shift bias heading into the elections, BUT… Only temporarely.

Let me show you what we see:

It all starts with the FOMC meeting last week.

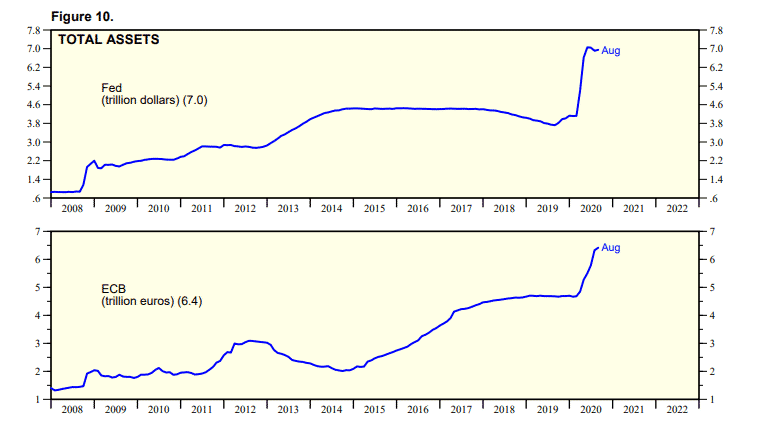

The FED there has not given us Dollar bears anything to get excited about, the only thing that right now in the very short term could further weaken the Dollar is more QE but no signs of that at the moment, the FED story is stale and their balance sheet has not grown since June:

As we can see from the chart above the ECB balance sheet is still growing while the FED one has been stalled since June.

Also, we are probably right at the front edge of where traders (and risk managers) start to worry about the US election.

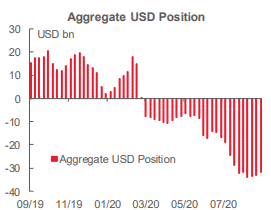

And this is beginning to be very clear looking at the CFTC data:

We can see that asset managers and speculators are slowly beginning to take profit on Dollar shorts heading into the elections and this trend is likely to continue the closer the election day gets.

There is a remarkable tendency for fear to build and volume to rise about 4 to 6 weeks before events, even events that have been on the calendar for years like an election day.

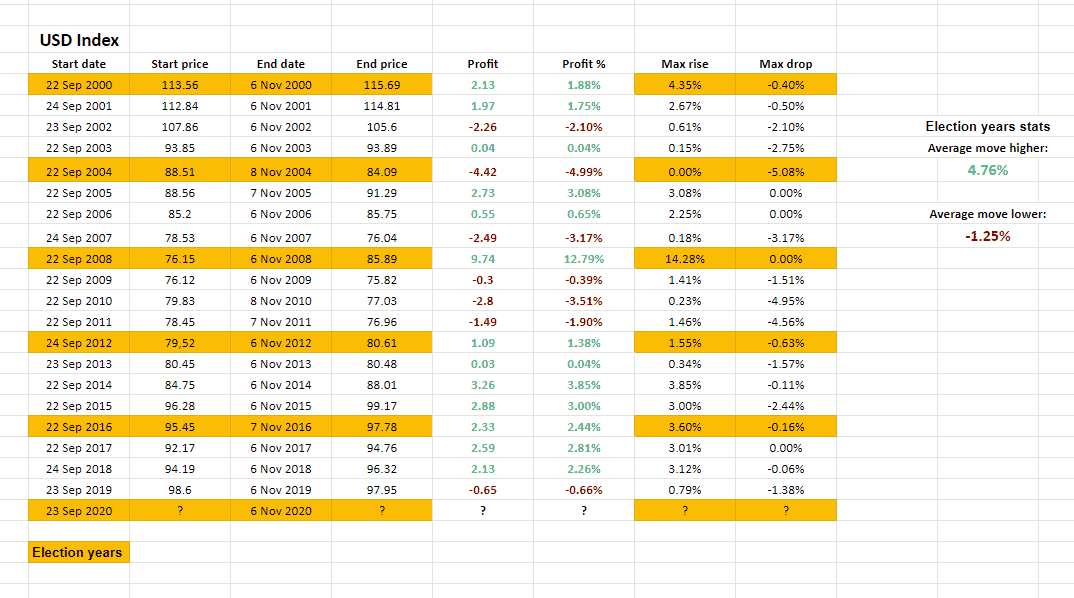

But let’s talk practical, here is how historically the Dollar performs heading into the elections:

So in the image above we can see the Dollar performance from Sept 23 to Nov 6 since the 2000s, and highlighted in yellow are the election years.

All years but one (2004), since the new millennium started have seen Dollar strength heading into the elections.

And…

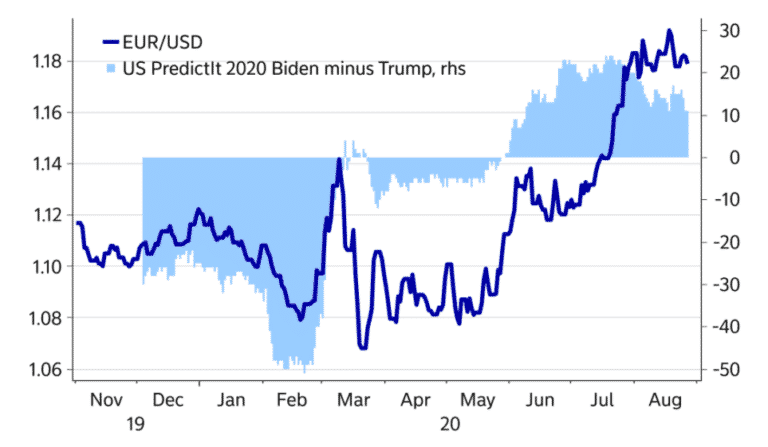

This is an old chart (from early September) but EURUSD is still in the same range and the only thing that has changed here is that Trump has gained more approvals… so we get the picture

So here we begin to see how practically some Dollar relief begins to make sense:

- Shorts are overextended and beginning to take profit

- Usually heading into the elections the Dollar tends to appreciate (likely caused by market hedging)

- The FED in the very short term doesn’t have much else to offer

- FED balance sheet stalled and no more QE until further notice while ECB one still growing

- An ECB that is worried about EURUSD above 1.20 and ready to jawbone it lower

- Trump approvals rising and that’s positively correlated with the Dollar

EURUSD is of course the best expression of straight USD views these days, and EURUSD longs are still out there overstretched, so just some profit taking from asset managers ahead of the elections will push EURUSD lower.

The most important level here I feel it’s the line in the sand put by ECB Lane’s when he said the famous words “EUR matters”, price never came back to that level, and if it does come back there and nothing has changed since this post then we will be there ready to short.

Another important level is the Q3 open price that has been supporting price for a while now and that has worked wonderfully for our longs recently, so a DAILY close below that will be interesting as well.

This is our idea generation process, which is the process where we do our researches to build a trade idea, we now move into the gatekeeping phase which is where we look at the charts to give us the best entry and to confirm our view.

This above is just a small part of what we do, we now begin the process of looking at retail activity, looking at the news flow and more to give us that extra confirmation that we need to deploy capital with confidence.

We send our confirmation and further researches to our Private Network members and as always, on top of that, we send them the exact details of our trades so that they can follow our performance.

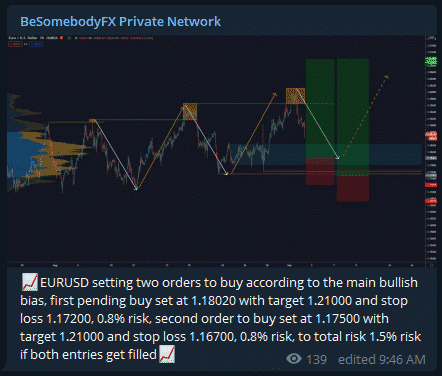

Like this:

That’s how we do it in the Private Network, if you have any question you can hit the chat button on the bottom right or send us a message on telegram, we are ALWAYS available to answer your questions and to help you out.

Have a great day.