BEGINNER FOOLISHNESS

Did you know that forex opened up to private traders a relatively short while ago?

You probably don’t give a damn about it, you just want to make monyyy right?

Well this is exactly the reason why forex is becoming so popular…

MONEY

.

People are attracted by easy money, attracted by the “lifestyle” of the forex trader, they want to become the next wolf of wall street, not even knowing that Jordan had nothing to do with forex…

I want to go straight to the point here, i want to show what’s really possible in this industry and bust some of the “beginner ambitions“

First of all…

What Is A Realistic Return On Investment?

The question about a realistic Return On Investment (ROI) for forex trading is frequently asked, but it does not have a simple answer.

Frequently, in the professional trading field, the number 35%( for annual ROI) comes up.

But although this would not be a bad return on investment at all (the average return on investment on the stock market over a 30 year period is somewhere between 8% and 12% annually) it’s still too low for many of the retail traders looking to double their account in a week…

Annual ROI ― the value an investment yields in a given year ― is dependent on a number of factors, among them the volatility, how much risk is involved per trade and the frequency with which an initial investment is reinvested.

But let’s put the technicalities aside for a minute..

I want to start open the eyes of the average telegram forex trader here, a GOOD average return on investment is 100% a year, i’m pretty sure some of you are already giving up here, 100% a year??? so my 100$ will only get me 100$ at the end of the year?

Yes, if you want to follow strict money management rules, hence risking 2-3% per trade than yes on average it will take around a year to double your account…

BUT, before you leave this page!

Keep reading because what i’m going to tell you at the end of this article can really change your life…

I want to be completely honest with you…

You want to make money trading?

you first need money.

why?

First of all because a professional trader MUST have some premium services that gives him an edge in trading, you can ask any successful trader, they either have a Bloomberg terminal, a livesquawk or pay for some premium service that provides them the info they need to trade.

You can pay $20.000 a year for a Bloomberg terminal or you can subscribe to the BeSomebodyFX Network for 39€ a month 😙 you choice.

.

I was saying that you need money to make money in trading right?

Well yes, as harsh as it may sound it’s the honest truth, if anybody ever comes to you offering you to make big money with only 100$ the run as far as you can, because they just want YOUR money!

Don’t get me wrong here, your 100$ can turn into 1000$ in a week, but it’s the same as going into the casino and betting on the french roulette by following weird colour or number patterns…

If you want to approach forex as a long term business then you HAVE to be realistic with your account, not risking more than MAX 5% on any given trade…

So what is a realistic forex trading account?

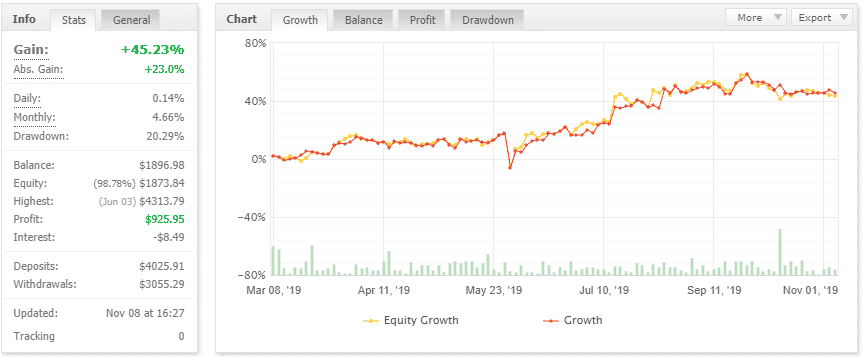

PRIVATE NETWORK TRADES (SHORT/MEDIUM TERM)

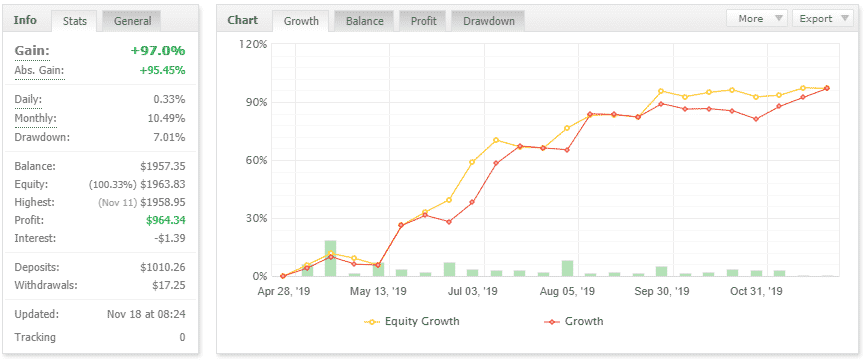

PRIVATE NETWORK TRADES (LONG TERM)

We run 2 accounts for our trades, one long term that is managed once per week, and one for short/medium term trading that we manage daily.

I’m showing you this to let you know how a stable long term trading plan looks like, if you ever come across one of these equity lines.

A real equity line is one showing slow and losing periods, there can be months in your trading where you are not in flow with the market or simply the market is not in the right environment for your style of trading, and those periods are what make the difference…

Why?

In those periods the real traders are formed, if your account holds well and stable into a losing period then you are doing great and you are on a path for a successful trading career.

If instead…

You lose patience and after a few weeks of losing trades or breakeven trades, you start getting annoyed and you begin to trade instinctively, you rise your trading size to recover the losses, you add to losing trades, you reverse trades for no reason, then you need to work on your discipline and the psychology side of trading, because without that you will not succeed.

Trading on the forex is exciting, fun and dynamic, but it’s crucial not to get carried away because of this. Successful traders approach trading like a business, not a hobby.

You use your trading capital to make business decisions; some will make you money, others will cost money, it’s that simple. But as soon as you lose sight of your rationality I promise you that the losses will stack up pretty quickly.

I’m talking about those moments that you do move your stop loss, because you just can’t get yourself to take the hit. Or those moments that you decide to get in right now, even though your trading plan tells you to wait, because you’re so scared to miss the trade, or perhaps you’re just BORED.

.

Those moments that you’re so mad that you lost 10 trades in a row that you start trading with triple your normal risk, taking positions in currency pairs you normally never trade in. Those are the moments you lose in 30 minutes what it took you three weeks to build up.

So what can you do with your 100$?

Let me tell you something that can change your life here...

If you want to make money, you need to be patient, your 100$ will NEVER make you rich, BUT there is something you can do, you can trade those 100$ professionally and build a track record, a REAL track record, meaning with LOW drawdown, at least less than 20%, anything more than 20% is not attractive for investors.

What i’m trying to say here?

I’m saying that your 100$ won’t make you rich BUT your performance might…

You don’t have the capital and maybe you will never have the capital to make a living from trading right?

Then build a solid track record, 1 or 2 years at least and trust me it will be easy to find money to trade with.

When i started i didn’t have the capital to make a living from trading too, after i blew four 100€ accounts, i took some time to learn macroeconomics, monetary policy, i got fortunate to have a GREAT mentor that showed me the right path, i then started again with 1000€, after 2 years i was managing 20.000€ from close friends, 4 years into it and we were 2 traders managing over 100k…

But listen closely, it didn’t take me a month, it didn’t take me a year nor 2 to start being profitable, i studied 3 years, tested and tested and tested to finally found what was my style and what was could have guaranteed me long term profit.

The overnight success is true yes, but it comes from years of HARD WORK.

That’s it…

What i’m trying to say here is don’t try to turn your small capital into big money, but use that small capital to practice and build a long stable track record so that people will then give you the capital to trade with…

It’s all about discipline and patience, discipline and patience…

Learn to handle losing periods and maximize winning ones, that’s what trading is about.