Trades

BESOMEBODYFX

ONE SIMPLE TIP TO IMPROVE YOUR TRADING NOW...

SOUNDS TOO GOOD?

It is too good, in some cases, but let me get straight to the point…

I’m in a good mood this weekend (F1 race weekend) so you know when i’m in a good mood i like to share stuff for you guys…

The whole point of this article is retail emotions…

The point here is that the crowd is impulsive and trades emotionally…

They get irritated easily so when a trade is in drawdown they take it personally, and sometimes their irritation will even make them switch position for no reason…

Don’t lie, you are guilty of that aren’t you?

And knowing this can give us an advantage in our trading.

Really?

Yes, and let me explain…

So for instance, the average Joe is seeing price breaking out of major resistance, he is telling himself “I can’t miss this buy, this is going to flyyyy” he buys at market price right at the break of the resistance, and you guessed it, right when he buys price starts to squeeze him out of the trade, it keeps squeezing and squeezing and Joe is telling himself “ah this was a false break now it’s time to sell let me reverse my position“…

You guessed it, when he reverses his position the market continues in the originally intended position, so Joe (sorry Joe) turned what was a good idea, so the long position, into two losers against what could have been 1 winner…

Let’s see exactly what i mean…

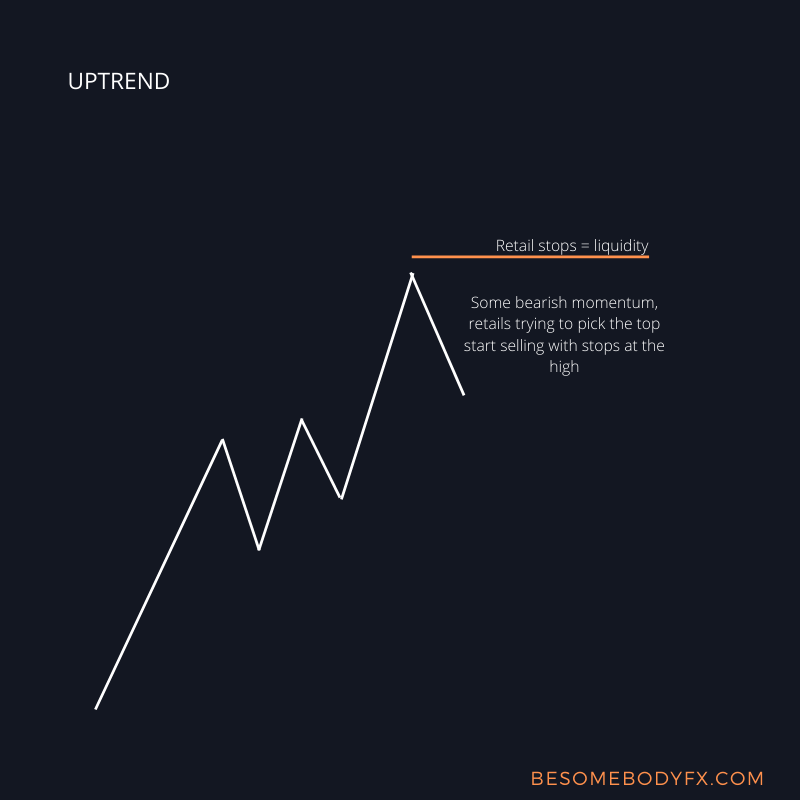

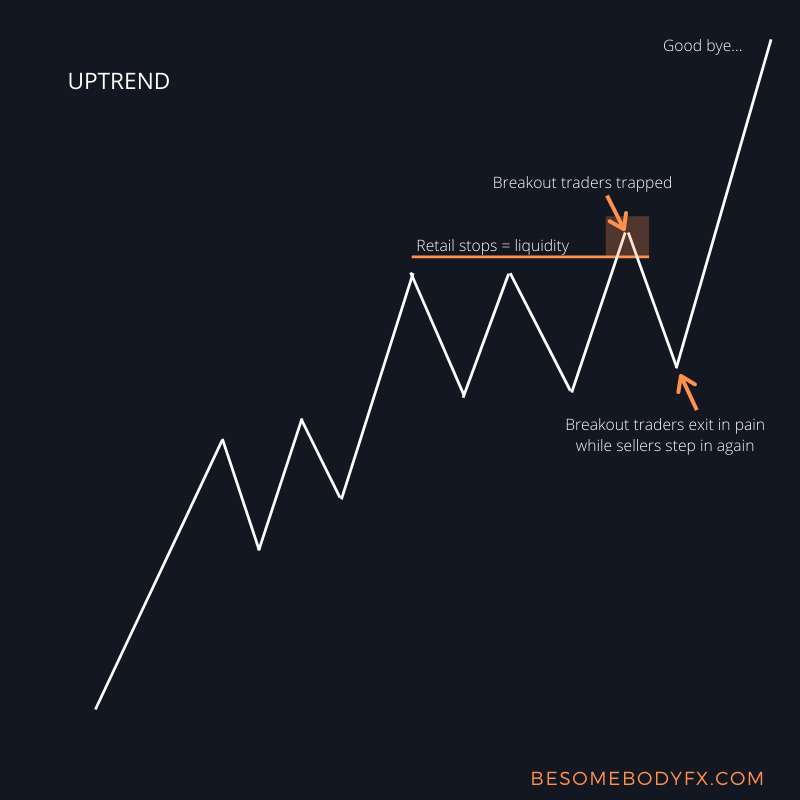

As you can see in the image above we have an uptrend where if we look at the retail sentiment I’m sure we see retails selling because they are always trying to pick the top in a trending market, so let’s suppose for the sake of the example that retails are selling this market.

We get a small bearish move that attracts further bears to step in and set their stop losses above the high.

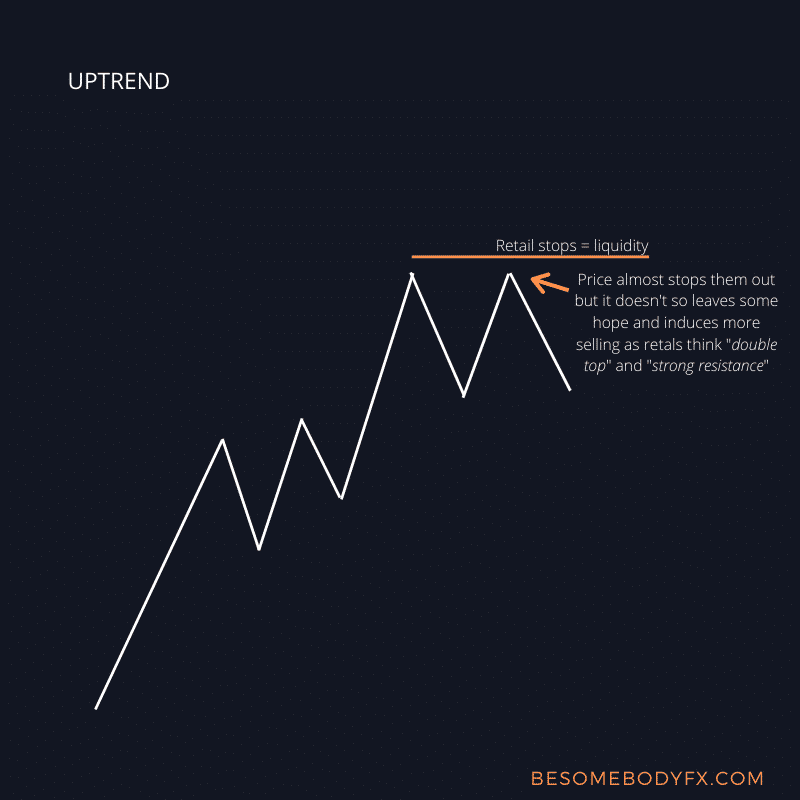

Here comes the fun part because as you can see in the image above price comes close to their stop loss but it doesn’t hit it.

Why?

Because it wants to build more liquidity above, it wants to induce more sellers that will now jump in thinking of this as a double top or strong proven resistance.

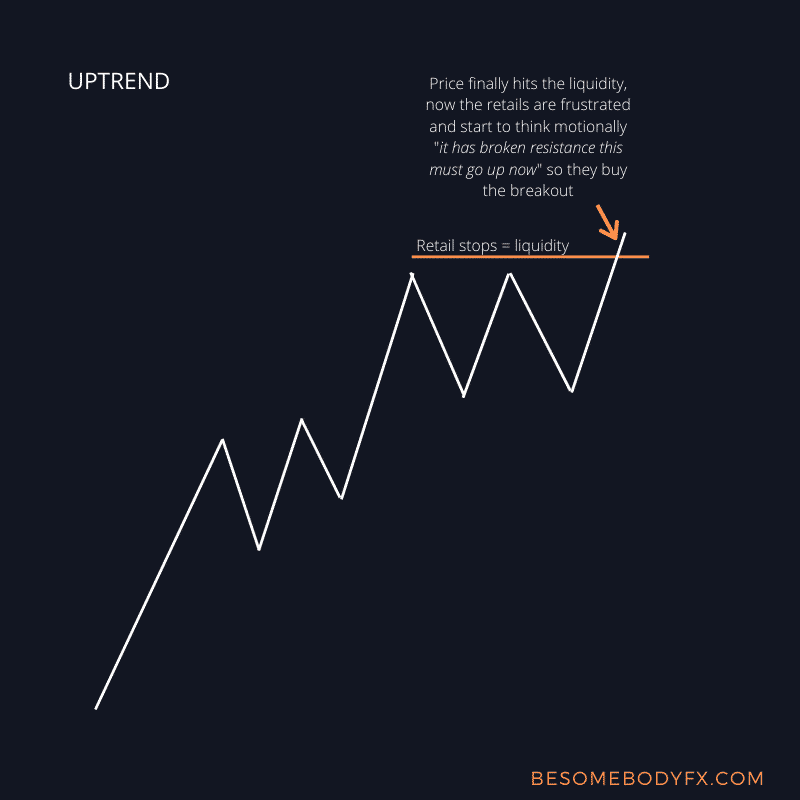

So in the image above price finally hits the liquidity level, now we know there are either breakout buyers waiting to buy that break or the same retails that were short now frustrated and emotionally irritated reverse their position and buy the breakout giving themselves all the excuses in the world “this is going to fly now” “there is huge momentum to the upside” and so on…

The best part…

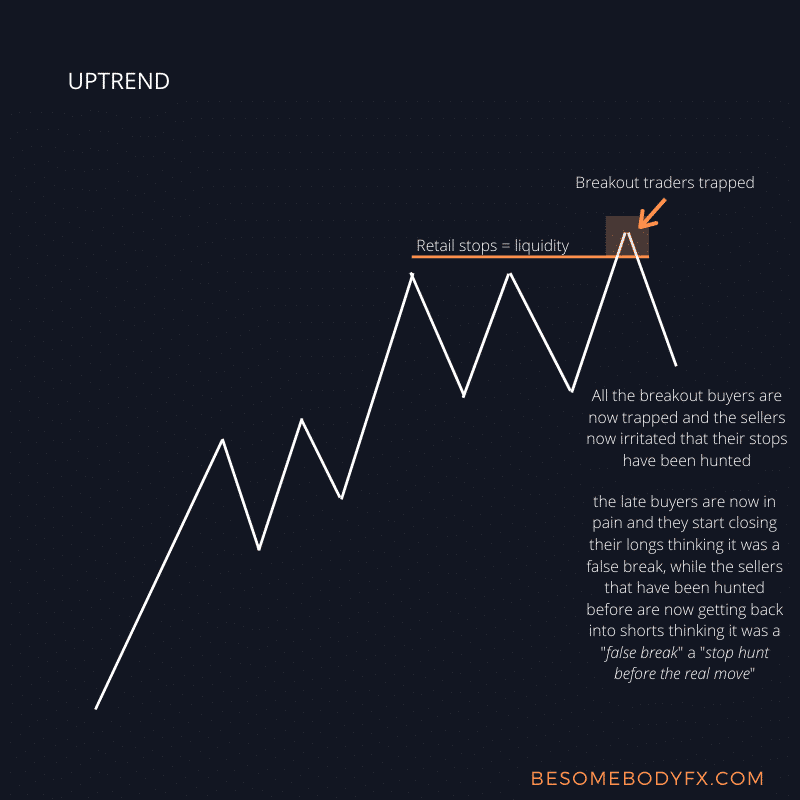

So now the market here is causing real pain (which is what it likes to do) because it’s now squeezing the late breakout buyers and inducing all kinds of self destructive thoughts for who was short and got stopped earlier “why i didn’t have my stop loss a few pips higher?” “why are they targeting my stop losses?” “should i add more when my stop loss gets hit?“, while the late breakout buyers are gradually all closing their positions in pain and probably reversing trade thinking it was a false break while all the previous seller and now getting back in (likely increasing position size as well… Human nature…) thinking the real bearish move is now about to happen after that “stop hunt“

The image above is self explanatory, this is by far one of the most useful psychological pattern in the markets that helps you first in not getting trapped, second in recognizing that this is indeed happening and to not fall trap and finally in exploiting this to your favour so that you can get the best entry after a breakout instead of FOMOing in the market.

And sure there will be the times the market breaks the resistance and just flies away with big momentum but if you want to have a healthy and long trading career then chasing that momentum won’t give you that, professional traders let the market come to them, they never chase it.

Quick and useful tip that can help your trading career…

We are writing a full “research paper” on all this stuff where various patterns similar to this will be listed with details, explanations, studies and so on, we are just a few pages in so it’s going to take some time to organize everything…

Of course it’s going to be available only to our Private Network members 😉

The example above is the representation of the perfect pattern but the real market is different, you will get perfect setups here and there but most of the time you will get various degrees of the same thing with slight variations, which is why it’s important to metabolize the core concept of liquidity and retail emotions in the market and not the pattern itself, the pattern is simply a representation of what’s happening in the retail mind.

So for the time being make sure you study the pattern shared above and next time you want to buy or sell a breakout right away think twice because there are tons of retails doing the same.

If you want to delve deeper in our trading style, check the BeSomebodyFX Private Network, you will have professional macro traders telling you exactly what they are doing with their own money each step of the way, so that you are increasing the probability of being successful and so that you can learn along the way.

We won’t accept any new member when the market opens and it’s limited to 5 new members, (3 already booked) so 2 seats left, the next enrolling will be only in September, or October, or next year? ![]()

If you have any question hit the chat button on the bottom right or send me a message on Telegram and i get your questions answered quickly.